After we published Ray Dalio’s latest LinkedIn commentary, in which the founder of the world’s largest hedge fund ominously warned that central banks are on the verge of losing control of the global economy as their ammunition is now virtually non-existent in a world where interest rates are the lowest on record, and explicitly compared the current period to the one just preceding World War II, stating that he would “recommend that you understand the workings of the 1935-45 period closely, which is the last time similar forces were at work to produce a similar dynamic“, many immediately suggested that Dalio was merely talking his book.

As it now turns out, a hypocritical take of Dalio’s recent media appearances and write ups appears appropriate, because as Bloomberg reports today, the losing ways at Bridgewater’s Pure Alpha fund – which we first noted last month had “suffered one of its worst first-half performances in two decades after being whipsawed and wrong-footed by rebounding markets” – continued, and this time it was due to the fund’s Treasury shorts.

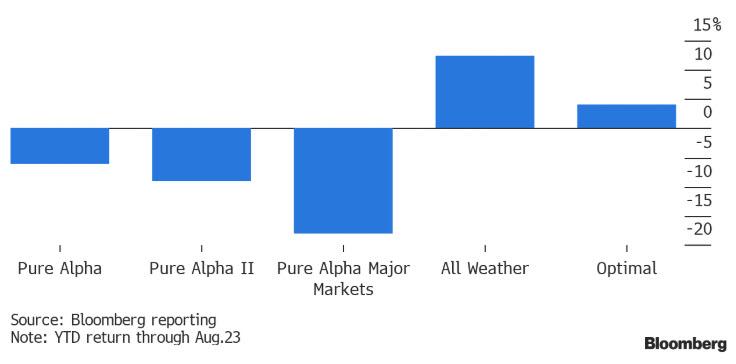

As a result of its paradoxical Treasury short – “paradoxical”, because if Dalio really believed that central bankers were on the verge of losing control, i.e., the ability to stoke inflation, he would be buying not selling bonds – Pure Alpha was down 6% through Aug. 23, and a more levered version of the fund, Pure Alpha II, was down 9% YTD. The pain was not limited to just the fund’s biggest discretionary fund: Bridgewater’s Pure Alpha Major Markets fund, which invests in a subset of the markets traded by the broader strategy, was down 18% through Aug. 23. It manages about $16 billion and since its 1991 inception has gained an annualized 12.5%.

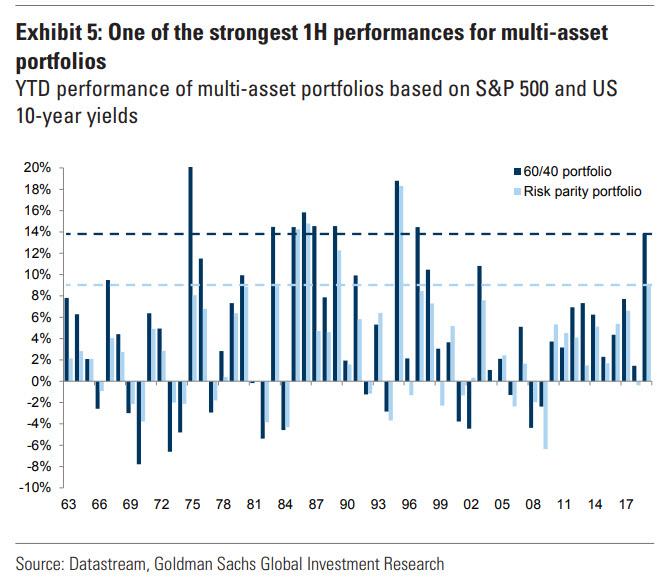

Not every Bridegwater fund is suffering. Offsetting much of the Pure Alpha embarrassment, Bridgewater’s passively managed All-Weather fund, which unlike Pure Alpha is immune from macro-economic shifts and is instead a risk-parity, “balanced” fund, returned 12.5% YTD, which was to be expected in a year where both stocks and bonds have soared, resulting in the best returns for risk parity funds in over two decades.

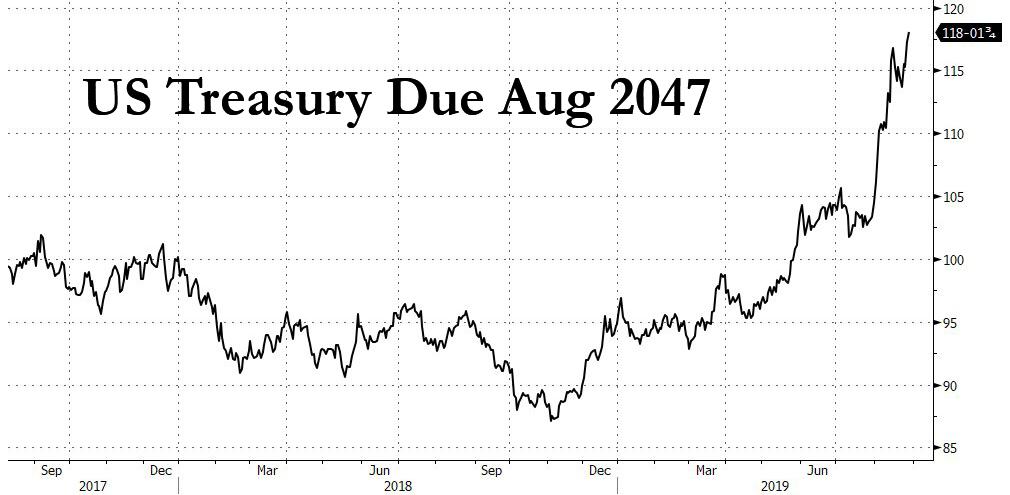

As Bloomberg notes, Pure Alpha’s performance contrast to many peers who unlike Dalio, instead of writing long essays about this or that, simply bought bonds and collected what may be record annual profits as the following chart of the 30Y TSY price shows.

While macro funds have gained 4.7% this year through July, the performance of many managers has been limited due to continue bets that bond yields would rise. Of course, this has been a terrible trade as Treasury yields across the world have never been lower.

Meanwhile, with the latest CFTC Commitment of Traders report showing the Ultra-Long Treasury futures net spec positions are just shy of all time shorts, one thing is certain: the next move in 30Y Treasury yields will not be higher.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com