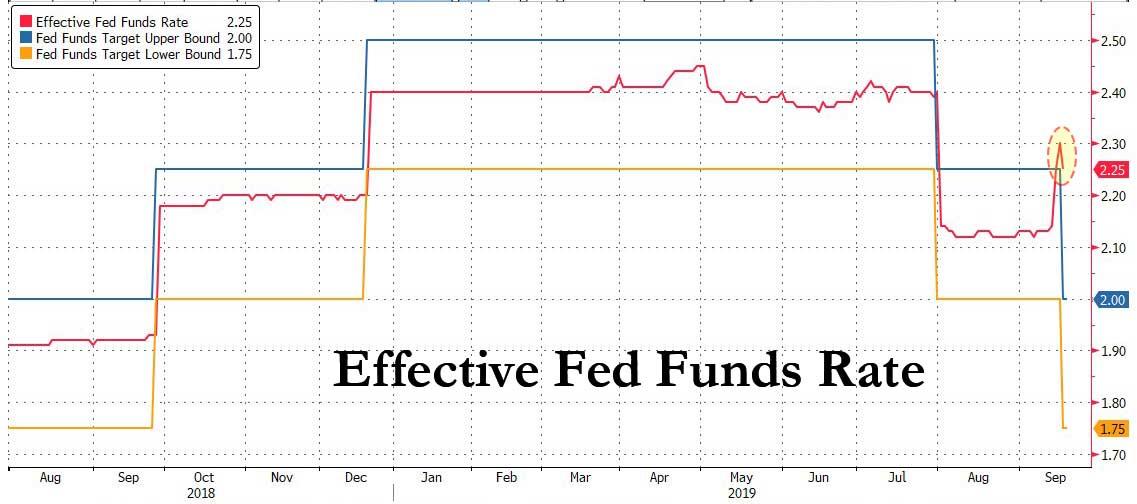

Fed Funds Prints 2.25%, Breaching Target Range, As IOER Spread Explodes

With the Fed’s repo operation oversubscribed for the second day in a row, as $9BN in liquidity requests remained unfulfilled by the $75BN operation, it is perhaps not a surprise that as the funding shortage persists, today’s effective fed funds rate printed at 2.25%, which while down from 2.30% yesterday, was for the second day in a row above the top end of the range, in this case by 25bps above the top of the Fed’s new rate corridor of 1.75% – 2.00% (when accounting for yesterday’s 25bps rate cut).

Furthermore, now that the Fed’s Interest on Excess Reserves was cut by 30bps on Wednesday to 1.80%, it means that the effective Fed Funds rate is now a record 45bps above the IOER.

As a reminder, EFF should trade inside of, or at worst, on top of the IOER rate, confirming once again that the Fed’s attempts to normalize the market plumbing are failing as the market demands a far more aggressive reserve injection, one in the form of POMO (i.e. QE).

Tyler Durden

Thu, 09/19/2019 – 09:17

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com