Fed’s Term Repo 2x Oversubscribed As Banks Brace For Quarter End Funding Shortage

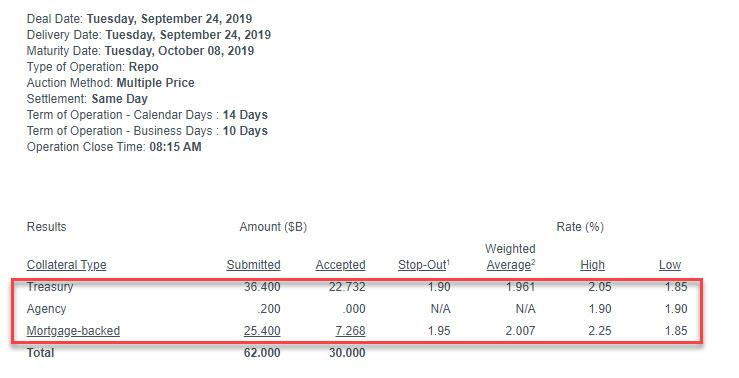

The NY Fed’s first term repo operation in over a decade, which has a 14 day term and thus captures the liquidity-draining quarter end period, has just concluded, and it confirmed that banks are hunkering down ahead of quarter-end, by tendering some $62BN in securities for the $30BN operation, making it more than 2x oversubscribed.

And while we await the details of the regular, overnight repo to be printed, which is being held again today, and every day into October, here are some more details on today’s term repo:

- The NY Fed accepted $22.7BN of Treasuries at a stop-out rate of 1.90%, with a weighted average rate was 1.961%, both well above IOER and confirming that there was indeed quite a bit more demand than supply.

- And while the Fed did not accept agency debt, it accepted $7.27BN of mortgage-backed debt at 1.95%, with a weighted average rate of 2.007%

To be sure, the Fed’s term-repo was always expected to be heavily used, which is also why there are at least two more $30BN term repos this week, which assuming there was just $32BN in additional submissions that did not get access to the Fed’s facility, should be more than met with little need for the third and final term repo. Alternatively, some banks may be simply waiting to get closer to the quarter end before tipping their cards: after all, just like the Discount Window, the repo operation has become the modern “stigmatizing” equivalent, and if reporters or clients get a whiff that a bank is in a dire liquidity state, the consequences could be dramatic.

Furthermore, the closer we get to quarter end, the tighter liquidity will get, and as a result, the overnight general collateral repo rate rose on Tuesday after trading within the Federal Reserve’s target range late last week: according to ICAP GC repo opened at 2.10%/2%, before drifting lower to 2.05%/2.03%; meanwhile term repo rates continue to be in the mid-2% range.

Commenting on the upcoming cash crunch, Wrightson ICAP expected weekly Treasury bill settlements and the “early liquidity- chilling effects” of approaching quarter-end statement date to “start to move repo rates back up this morning”, and that’s precisely what happened.

Tyler Durden

Tue, 09/24/2019 – 08:33

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com