Ken Fisher Redemptions Blow Past $2.7 Billion As Los Angeles, Goldman Pull Out

It is becoming a full on, four-alarm redemption stampede at Ken Fisher’s firm, Fisher Investments.

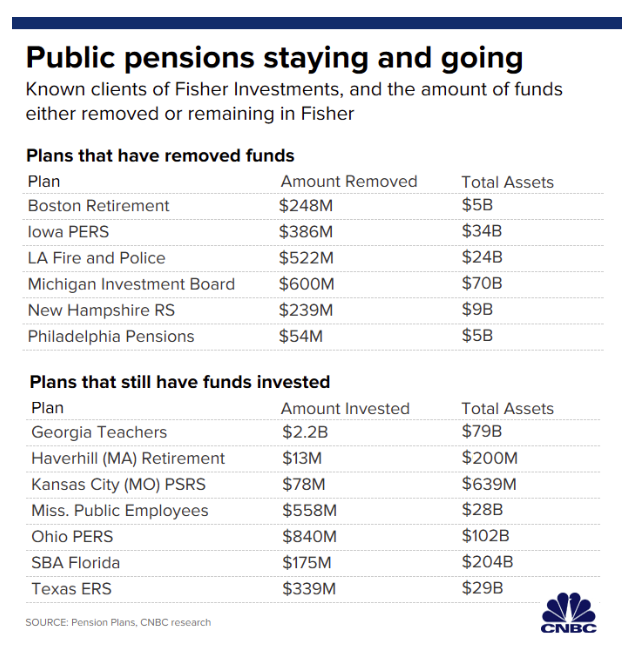

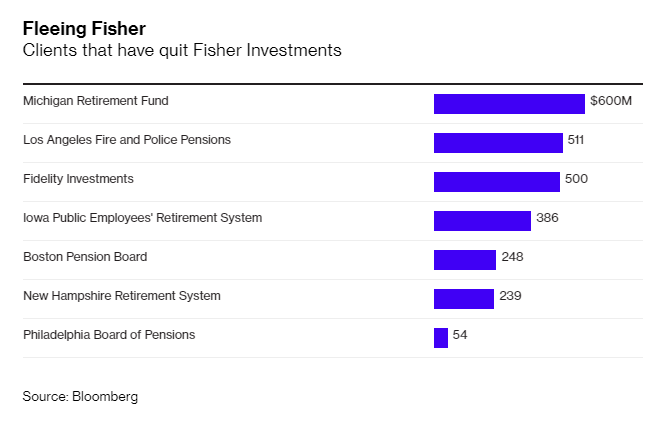

Both the city of Los Angeles and Goldman Sachs have now joined the ranks of Fidelity, the Michigan Retirement Fund, the Iowa Public Employees Retirement System, the New Hampshire Retirement System and the Philadelphia Board of Pensions in pulling their money out of Fisher’s firm, according to Bloomberg.

The LA pension board called a special meeting on Thursday to discuss their contract with Fisher and L.A. pension commissioner Brian Pendleton said: “Fisher’s words reach millions and only do damage. Other pension funds are going to come to the same conclusion and we shouldn’t be the last ones to turn the lights off.”

Fisher Investments CEO Damian Ornani apologized to the LA pension board, stating: “I really apologize sincerely. He does too. He understands what he did. This will not happen again. This is not who Fisher Investments is. This is not who Ken Fisher is.”

The irony, of course, is that Fisher is hardly alone: in fact, the more an investor protests, the more likely they have one or more men who say the same, if not worse, as Fisher. And yet, with the magic of virtue signaling, if one pulls their money it is somehow seen – internally at least – as redemption for their sins.

Hypocrisy aside, LA commissioner Kenneth Buzzell responded: “Talk is cheap. I’d like to find out what if anything you’re going to do to attempt to right as best you can what’s been done” while board president Adam Nathanson took exception with the fact that Fisher himself didn’t attend the meeting. He stated: “It’s telling that he’s not here. He’s the one who said the comments. The accountability lies with Mr. Fisher.”

When they were told Fisher was too important to the firm to resign, and that the firm was a “great place to work”, L.A. commissioners responded by “saying they have heard that Fisher’s comments are part of a pattern of inappropriate behavior and no one at the firm can hold the founder accountable for his actions.”

Meanwhile, arguably the biggest abuser of chauvinistic harsh language – anyone who has been in the middle of the Goldman trading floor during the mid/late 2000s knows precisely what we mean – Goldman Sachs, is now pulling out $234 billion from Fisher, according to CNBC. One source commented that the final sum withdrawn from Fisher Investments could wind up being “even greater”.

About 3 days ago, we reported that Fidelity had pulled $500 million from Fisher’s firm. Days prior to that, we reported that Iowa had pulled out $386 million from the firm. This was only hours after we reported that the city of Boston had also pulled out of Fisher Investments to the tune of $248 million.

Shawna Lode, spokeswoman for the IPERS, had said: “IPERS staff has taken time to evaluate this situation, and it is our opinion that Mr. Fisher’s comments have damaged the credibility of the firm and its leadership. As a result, the risk to IPERS is that the firm could lose investment talent, and/or it may be unable to recruit high caliber talent in the future.”

“Furthermore, the negative publicity will probably continue to be a major distraction to Fisher Investment personnel,” she correctly prognosticated.

Several weeks prior, Lode had commented that the IPERS was reviewing their relationship with Fisher Investments: “Fisher’s remarks are obviously concerning,” she said at the time. “Although our investment management contracts do not include a conduct policy, we hold our partners to the highest standards and reserve the right to amend or sever any contract at our discretion.”

Recall, just days after the $70 billion state of Michigan retirement fund pulled its assets from Fisher Investments, the city of Boston also did the same.

Fisher managed $600 million in retirement funds for Michigan and the state’s exit ends a 15 year relationship with Fisher’s firm.

Boston Mayor Martin Walsh said at the time: “Boston will not invest in companies led by people who treat women like commodities. Reports of Ken Fisher’s comments and poor judgment are incredibly disturbing.”

Michigan’s chief investment officer, Jon Braeutigam, notified the state investment board of the termination on October 10. In his letter, he said that Fisher’s comments were “unacceptable” and that although employees at his fund hadn’t witnessed similar comments, “history does not outweigh the inappropriateness of the comments.”

Fisher was managing about $10.9 billion on behalf of 36 state or municipal government entities at the end of 2018, down from $13.2 billion at the end of 2017. That number will likely be sizeably lower at the end of 2019.

For those confused what caused all of this, recall that three weeks ago we reported that at a conference in San Francisco, Fisher – whose firm manages more than $100 billion – “shocked” attendees when he compared gaining a client’s trust to “trying to get into a girl’s pants.” Fisher also said at the same conference that executives who were “not comfortable talking about genitalia should not be in the financial industry.”

Tyler Durden

Fri, 10/25/2019 – 10:59

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com