As Bonds Tumble, Treasury Sells 30Y Paper In Dismal Auction With Lowest Ever Dealer Takedown

After two impressive coupon auctions, when both the 3 and 10 year auctions stopped through the When Issued, moments ago the Treasury concluded the last coupon auction for the week, when it sold $19 billion in 30Y paper in what was a decidedly weaker market.

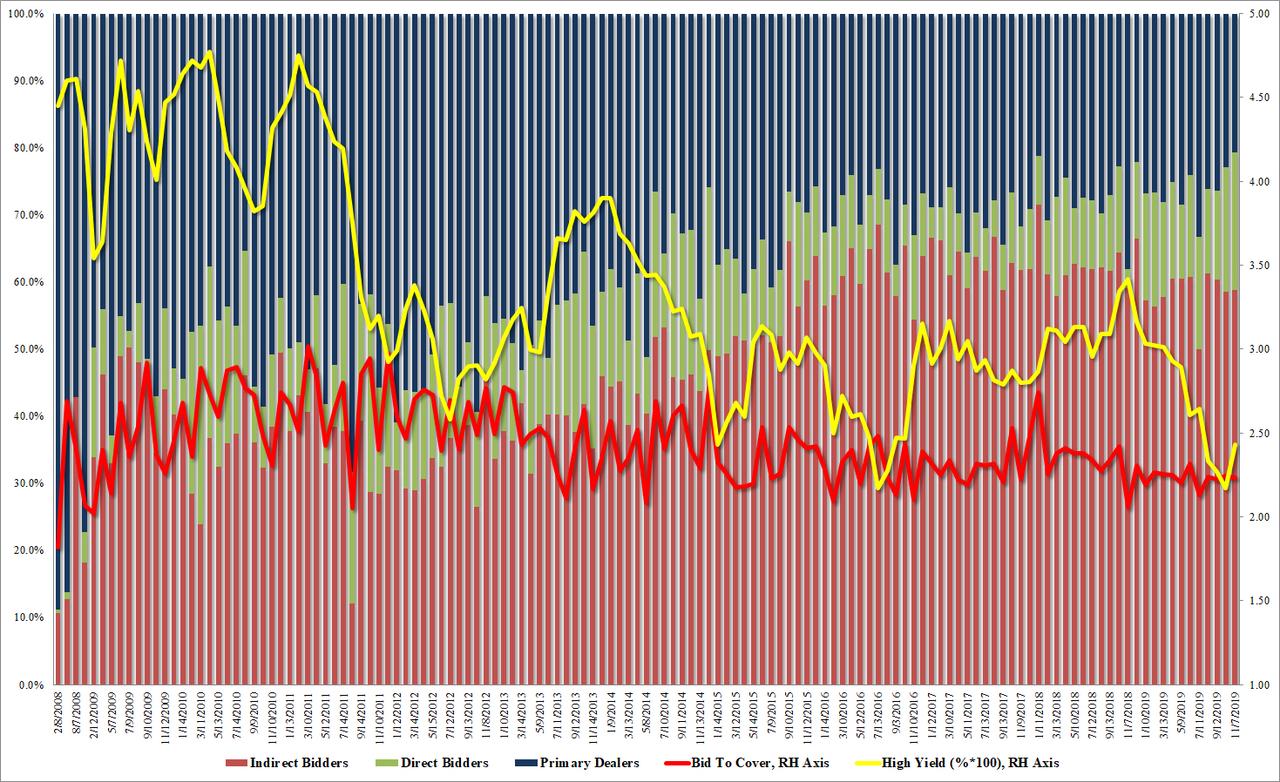

Whether it was due to the sharp selloff in rates today, which saw the 10Y rise from 1.80% to just shy of 2.00%, demand for 30Y paper was sloppy at best, with the high yield of 2.43% – the highest since July – tailing the When Issued 2.424% by 0.6bps, the 5th consecutive tail since June.

The bid to cover of 2.23 was just lower than the 2.25 in October, and right on top of the six auction average. As the chart below shows, the trendline is clear: after peaking in 2011, the BTC has been declining for almost a decade.

Finally, the internals were concerning, with Indirects taking down 58.8%, also in line with the recent average of 58.6%, and while Directs jumped to 20.5%, the highest since December 2014, it was Dealers that surprised with a takedown of just 20.7%, this was the lowest Dealer takedown on record.

What is notable about today’s auction is that it took place just as the bond market was shitting the bed, with rates getting slammed across the curve. Ironically, the 30Y auction while ugly, could have been even uglier according to the market, and as a result, it appears to have marked the bottom for rates (and high for yields) so far today.

Of course, should there really be a “trade deal”, watch as the 10Y steamrolls right above 2.00% and the Fed scrambles to start hiking rates all over again.

Tyler Durden

Thu, 11/07/2019 – 13:21

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com