S&P Futs Hit New All Time High As Tsunami Of Central Bank Liquidity Pushes Everything Higher

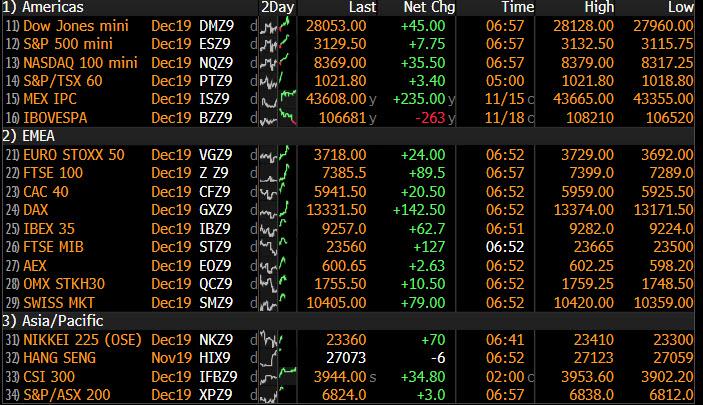

It was not very easy to glean from the disjointed overnight headlines and comments if the prevailing trader mood was one of “optimism” or “not so much optimism” when it comes to the daily US-China trade deal barometer, but one look at stocks which are a sea of green this morning…

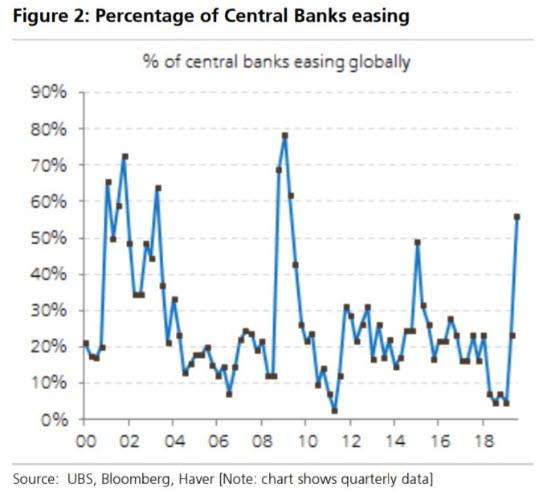

… the narrative quickly becomes one of smooth sailing between Washington and Beijing, even though in fact none of that matters, and it’s all been a diagonal line since the start of QE4, pardon, “NOT QE” on Oct. 14.

Meanwhile, Reuters did not disappoint with its regurgitated, stock explanation for the market move, noting that “world shares touched their highest in nearly two years on Tuesday as investors maintained bets that the United States and China can reach a deal to end their damaging trade war.”

It gets better: confirming what we said at the top, Reuters then goes on to state that “A lack of clear news on the progress of talks has not deterred investors emboldened by a growing sense that risks of a recession, a specter through the year, have receded. Looser monetary policy from major central banks like China has also helped bolster expectations for equities.”

In other words, there was no actual news, but because a record burst of central bank liquidity since the financial crisis has pushed risk assets higher, the goalseeked explanation is that, somehow, a deal must be closer. And there you have reflexivity in all its fallacious glory.

So amid this liquidity barrage, it’s hardly a surprise that the MSCI world equity index gained 0.1% to touch its highest since January last year.

European shares stocks rallied again from the open led by miners, autos and financial services in the absence of fresh news or economic data, with the broad Euro STOXX 600 adding 0.4% to move to its highest since July 2015. Indexes in Frankfurt and London gained 0.4% and 0.5% respectively. DAX rose 1% to outperform peers, while S&P futures breached Monday’s highs above 3,130, and not even dismal results from Home Depot or Kohl’s could derail this train.

Earlier in the session, MSCI’s index of Asia-Pacific shares ex-Japan rose 0.6%, with Shanghai blue chips gaining 1% and Hong Kong’s Hang Seng up 1.6% as Hong Kong equities extended a rebound to recoup some of last week’s losses, shrugging off another night of chaos as a university siege continued, following another major reverse-repo liquidity injection to the tune of 120BN yuan by the PBOC. India’s Sensex rose, but many stocks fell as investors mulled a health check of the nation’s shadow banks that pointed to prolonged distress. Outside of Hong Kong, Asia was quiet as investors awaited signs of progress in U.S.-China trade negotiations. Trading volume was below average in markets including Japan, China and India. While the MSCI Asia Pacific Index has gained more than 6% since the rally began less than six weeks ago, it hasn’t had a price swing greater than 1 percentage point. It’s the longest such stretch in a year and a half.

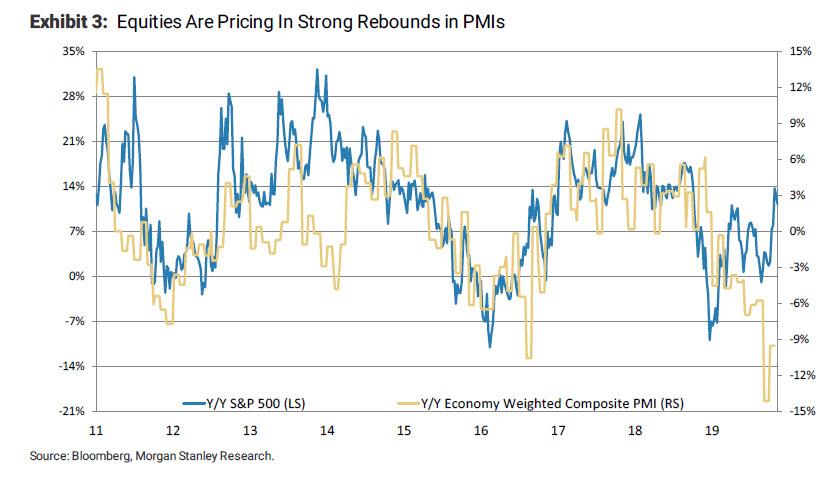

Going back to the ‘imminent’ US-China trade deal, investors said assumptions that an initial trade deal would be reached had outweighed any creeping doubts on progress in talks that stemmed from a lack of clear news, with a growing sense of positive economic fundamentals ahead. “Consensus is assuming that there will be a cyclical upturn,” Stéphane Barbier de la Serre, a strategist at Makor Capital Markets. “It’s like the market lowered its guard on the big risk metrics — and that has triggered a reweighting of funds from bonds to equities.”

Ironically, on Monday markets barely moved, after dipping initially as CNBC reported the mood in Beijing was pessimistic about prospects of sealing a trade agreement with the United States, buffeting the dollar. But signs that suggested growing detente between the sides clouded the picture: a new extension granted by Washington to let U.S. companies keep doing business with Chinese telecoms giant Huawei suggested a possible olive branch.

Still, that lack of clarity did unnerve some investors: “The longer we go on, the more concerns will arise. The reality is the clock is ticking,” said Michael McCarthy, chief market strategist at brokerage CMC Markets in Sydney.

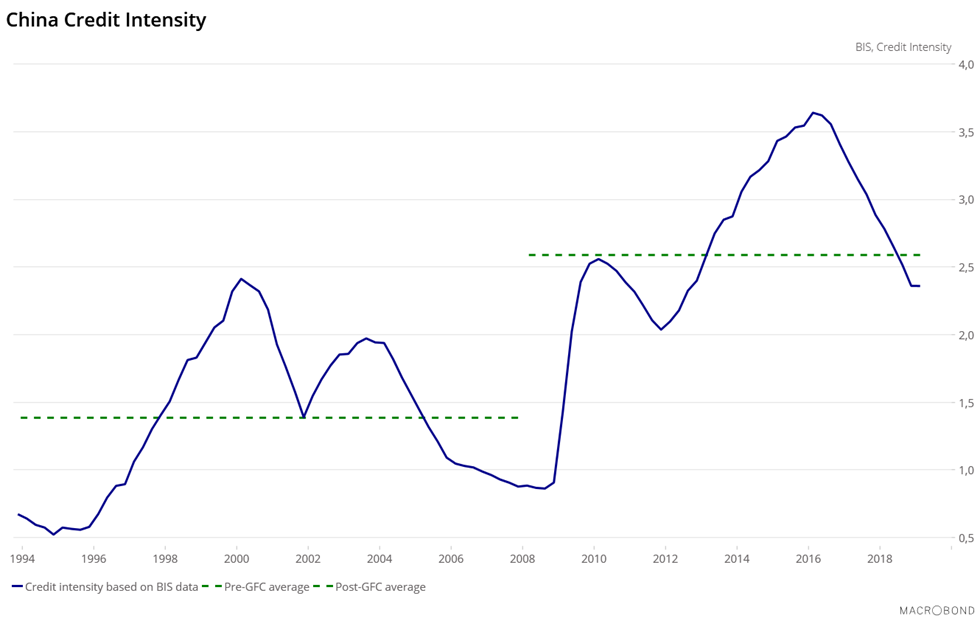

As usual, much of the optimism relied on hopes that Beijing will deliver some economic stimulus in addition to Monday’s surprise cut to a closely watched lending rate provided a boost to sentiment in Asian markets. Alas, as we showed yesterday, that won’t happen, setting up markets for another major disappointment once the Fed’s NOT QE fizzles.

Meanwhile, as we also noted yesterday, a full-blown economic recovery is now fully priced in by the S&P.

In rates, bunds fell, underperforming Treasuries which were unchanged at 1.815% amid lighter-than-average trading volumes as stocks extend gains to fresh highs. The bund curve steepens, with 10-year bond underperforming Treasuries by 0.5bps; bund futures trading volumes are running at around 70% of the 10-day average. BTPs are little changed with futures trading volumes about 55% of the 10-day average. Gilts traded steady, while curve flattens; 2041 gilt linker size is set at GBP2.25b, with final orderbook over GBP17.5b; compares with orders of GBP20.5b for the prior reopening in October 2018.

In FX, the dollar halted a three-day decline while the yen and the Swiss franc came under pressure as risk appetite gained some traction after the London open. “Trade headlines are dominating sentiment but in terms of the key event risk, the release of the Fed minutes will be a big one for market participants,” said Nordea FX strategist Morten Lund.

The EUR/USD traded in a narrow range, with the 21-DMA seemingly capping the upside. The pound slipped as hedge funds took profit on short-term long positions, ahead of the first election debate between the two main party leaders due later Tuesday. Australia’s dollar recovered from an earlier decline that came after the latest minutes from the central bank suggested it was considering another rate cut in November.

In commodities, Brent crude fell, losing 0.2% to $62.29 a barrel, with a combination of jitters over trade and expectations of a rise in U.S. inventories jangling nerves.

Looking at the day ahead, politics is expected to dominate the agenda as the US impeachment inquiry continues and we have the first head-to-head TV debate ahead of the UK election. Today’s data highlights from Europe include September’s Euro Area construction output, Italian industrial sales and orders, and UK industrial trends survey from the CBI. In the US there is October’s building permits and housing starts data, and we’ll also get Canada’s manufacturing sales for September. From central banks, New York Fed President Williams will be speaking, while Home Depot will be releasing earnings.

Market Snapshot

- S&P 500 futures up 0.2% to 3,128.75

- STOXX Europe 600 up 0.6% to 408.29

- MXAP up 0.2% to 165.44

- MXAPJ up 0.6% to 530.80

- Nikkei down 0.5% to 23,292.65

- Topix down 0.2% to 1,696.73

- Hang Seng Index up 1.6% to 27,093.80

- Shanghai Composite up 0.9% to 2,933.99

- Sensex up 0.4% to 40,430.46

- Australia S&P/ASX 200 up 0.7% to 6,814.22

- Kospi down 0.3% to 2,153.24

- German 10Y yield rose 0.4 bps to -0.332%

- Euro down 0.05% to $1.1066

- Brent Futures down 0.8% to $61.95/bbl

- Italian 10Y yield fell 2.4 bps to 0.862%

- Spanish 10Y yield fell 0.8 bps to 0.406%

- Gold spot down 0.3% to $1,467.67

- U.S. Dollar Index up 0.09% to 97.88

Top Overnight News

- Federal Reserve Chairman Jerome Powell met with President Donald Trump and Treasury Secretary Steven Mnuchin Monday to discuss the economy, marking a second face-to-face sit-down this year amid relentless White House criticism of the U.S. central bank. President Donald Trump said he “protested” U.S. interest rates that he considers too high relative to other developed countries

- Boris Johnson and Jeremy Corbyn are preparing for their first head-to-head election debate as the Labour leader seeks to reverse the prime minister’s double-digit lead in the polls. The premier wrote an open letter to Corbyn accusing him of “dither” over Brexit, while Labour said Tories are more committed to the billionaires who fund the party

- A U.S. chipmaker’s attempt to acquire a peer with a valuable Chinese affiliate has spurred concern in Beijing, as tensions between the world’s two biggest economies threaten to disrupt the global tech supply chain.

- Options traders are the most bullish on the euro’s short- term prospects in a month, as expectations for further policy easing by the European Central Bank fade and with euro-area yields off their cycle lows

- Fixed-income investors have lagged in incorporating environmental, social and governance (ESG) factors into their strategies, but BlackRock Inc. says they now have more tools — including benchmark indexes — to bring sustainable debt into their portfolios

- Australia’s central bank considered cutting interest rates at its latest meeting, but decided instead to hold steady and monitor the impact of earlier easing amid concern that households were being spooked by very low borrowing costs

- Caught between a Brexit they don’t want and a firebrand socialist they fear, business executives were not impressed after the leading candidates in Britain’s upcoming general election tried to win their support

- Bank of Japan Governor Haruhiko Kuroda said the bank would consider additional easing including cutting interest rates if risks were to rise

- Hong Kong leader Carrie Lam has called for a peaceful resolution to a university siege that has transfixed the city and raised fears of a crackdown on scores of protesters who remain trapped in a campus surrounded by police. Lam said she had instructed police to try and resolve the situation at Hong Kong Polytechnic University peacefully

- Oil dropped for a second day on indications U.S. crude stockpiles and shale output will continue expanding, while investors wait for news on a breakthrough to the prolonged trade war

- Japan remained the top foreign holder of U.S. Treasuries in September even after reducing its government securities holdings by the most since at least 2000.

Asian equity markets eventually traded mostly higher but with gains capped after an initial lack of commitment due to the ongoing US-China uncertainty triggered by contrasting trade headlines, including reports of a pessimistic mood in Beijing about a deal being passed. ASX 200 (+0.7%) and Nikkei 225 (-0.5%) were mixed with Australia lifted as gains in the defensive sectors and recovery in financials superseded the heavy losses in tech, while Tokyo sentiment was snagged by detrimental currency flows and with SoftBank pressured by further WeWork troubles as the New York Attorney General was said to be investigating the embattled workspace company. Elsewhere, Hang Seng (+1.5%) and Shanghai Comp. (+0.9%) began indecisively but gradually improved as reports of Beijing trade pessimism was offset by a 90-day license extension for US firms to continue doing business with Huawei, while the PBoC also continued its liquidity efforts with another firm injection of CNY 120bln through 7-Day Reverse Repos. Finally, 10yr JGBs were mildly higher as they tracked recent upside in T-notes and amid weakness in Japanese stocks, while demand was also supported by the BoJ’s presence in the market for over JPY 1.1tln of JGBs in 1yr-10yr maturities.

Top Asian News

- Chain Hated by Hong Kong Protesters Sees Double Digit Drop

- Alibaba’s H.K. Share Sale Multiple Times Subscribed: DJ

- China’s State Grid Chooses JD.com to Smarten Up Electric Meters

Major European bourses (Euro Stoxx 50 +0.7%) are on the front foot in another day of quiet trade, following on from a broadly positive APAC handover. A decent liquidity injection from the PBoC, a lack of fresh negative US/China trade negatives (the 90-day Huawei waiver appears to have mostly offset negativity regarding reported pessimism on deal in China), plus a lack of looming risk events appear to be enabling the recent trend in global equities to continue, i.e. a persistent grind higher. Also, possibly acting in support are reports that US President Trump’s Section 232 auto tariff authority (which he could have used to put tariffs on European auto imports) has run out of time, meaning he may have to find other means if he wants to pursue auto tariffs on Europe/Japan, legal experts said. As a reminder, Trump last Thursday took no action to impose or delay national security tariffs on auto imports, despite a deadline to do so by that date. Regardless, US index futures made YTD highs again this morning, with the ES Dec’19 contract reaching highs of 3129, while back in Europe, the Euro Stoxx 50 broke out of last week’s range to make new highs around 3720, with ATHs seemingly now within reach at 3769. In terms of the sectors, things are mostly in the green, with underperformance being seen in the more defensive Utilities (-0.1%), Consumer Stapes (+0.1%) and Health Care (+0.3%) sectors, while Telecoms (unch.) have also been on the back foot, with the news that France’s 5G auction has been delayed until March 2020 doing little to help. Risk sensitive sectors, including Consumer Discretionary (+1.1%) and Financials (+1.1%) are amongst the outperformers. In terms of the standout movers; Halma (+12.0%) tops the Stoxx 600 performance chart, where the Co. posted decent gains in pre-tax profit and increased its interim dividend. Propping up the Stoxx 600 table is SES (-19.4%), after the US FCC chairman voiced support for a public auction to free up space for 5G – SES had been lobbying for a private auction. EasyJet (+3.6%) is higher after the Co. posted earnings which beat on top and bottom line expectations and said bookings are “slightly ahead” of last year. Looking at flow data from EPFR, they show that European equities received inflows averaging USD 9.6bln for a third straight, compared to an average USD 5bln weekly outflow since December last year. Morgan Stanley cited the return of flows as part of the reason why they are overweight European equities, adding that the region has room for a further price-to-earnings re-rating, citing reduced Brexit risk, possible shift from monetary to fiscal stimulus, and tighter peripheral and credit spreads as other catalysts.

Top European News

- Swiss Watch Exports Stagnate as Shipments to Hong Kong Slump

- Private Equity Muscles Into Britain’s Booming Pension Market

- Labour Attacks Tory Billionaires Before TV Showdown: U.K. Votes

In FX, the broad Dollar and Index have rebounded off APAC lows after the latter found a base at the 97.75 mark. DXY resides near the top end of today’s 97.75-88 parameter ahead of another quiet session in terms of scheduled events and with sights still locked on US-Sino trade developments. Meanwhile, USD/CNH trades little changed on the day having earlier tested its 21 DMA to the upside at 7.0320 (vs. intraday low of 7.0230) ahead of its 100 DMA at 7.0415

- GBP, EUR – Both intially moved sideways and within tight ranges against the Buck amid a lack of fresh catalysts and with eyes on the tonight’s Johnson/Corbyn showdown debate commencing at 2000GMT and the latest YouGov polling at 2100GMT. Upside in Sterling remains somewhat capped in light of comments from EU Trade Chief Weyand who warned of a “bare bones” or no trade deal from Brussels next year, however traders need to steer through domestic political landscape first with election day drawing closer. GBP/USD remains drifted from the 1.2950 mark to around 1.2925, whilst the upside includes reported barriers at 1.3000 and reported stops at 1.3030. EUR/USD resides just north of 1.1050 having earlier tested its 21 DMA at 1.1081 and with eyes on its 100 DMA at 1.1091.

- AUD, NZD – The antipodeans are flat in early European trade with AUD/USD and NZD/USD around 0.6800 and 0.6400 respectively, but off overnight lows. The pairs were initially pressured (albeit modestly) upon the release of the RBA minutes which noted that a case could be made for a cut at the November meeting and reiterated that the Board is prepared to ease further if needed. However, analysts at Westpac believe that the case for a December cut is heavily downplayed in the minutes and the dismal Aussie labour force figures from last week may not be sufficient enough for a move from its current “monitoring” approach, and thus Westpac maintains its forecast for a 25bps February cut. AUD/USD rebounded from its overnight post-RBA base of 0.6785 back above 0.6800 ahead of its 50 DMA at 0.6814. Similarly, its Kiwi counterpart reclaimed 0.6400+ status from an APAC low of 0.6383 (21 DMA) with the next level to the upside its 50 DMA at 0.6435.

- JPY, CHF – Little action on the safe-heaven front thus far although prices seem to have a downside bias against the USD, potentially on the latter’s recovery from its APAC trough. Participants will again be eyeing developments on the US-Sino trade front amid mixed/contrasting recent reports. Meanwhile, the situation in Hong Kong seems to feel some reprieve (for now at least) after the number of protesters trapped inside the Polytechnic University fell from around 700 to between 100-200, however sources cite by the SCMP noted of over 8000 petrol bombs at the Chinese University ready for use. USD/JPY tested and resides around 108.75 (21 DMA) ahead of potential resistance at 108.83 (Tenkan line) with a barrage of options expiring with USD 1bln between 108.50-55 and a further USD 1bln between 108.90-109.00. The Franc also awaits further risk-driven action as USD/CHF meanders around 0.9900 in early EU trade and eyes its 21 DMA at 0.9911.

- RBA Minutes from November meeting stated the board is prepared to ease further if needed and agreed a case could be made for a rate cut at the meeting but decided rates should be held steady. RBA board recognized negative effects of lower rates on savers and confidence as rate cuts could have a different impact on confidence than in the past, while it saw a case to wait and assess impact of its prior substantial stimulus and agreed an extended period of low rates is needed to achieve targets.

In commodities, crude markets are lower, with the complex trading heavy despite this morning’s rally in the equity market and a lack of fresh fundamental catalysts. WTI Dec’ 19 futures fell to lows of USD 56.48/bbl, while Brent Jan’ 19 futures fell as low as USD 61.74/bbl, before losses were somewhat pared. In terms of crude specific news of note; Norwegian oil production stood at 1.519mln bpd in October (prelim) vs. Prev. 1.312mln BPD in September, according to the Norwegian Petroleum Directorate. As a reminder, this Thursday sees the release of the Norwegian oil investment survey, with Q3 oil and gas pipeline/extraction investment seen coming in at NOK 181bln, as estimated by the prior release. Elsewhere, and on the docket today, traders will be eyeing tonight’s API Inventory figure which last week printed a draw of 0.54mln barrels. Finally, gold prices slid back beneath the USD 1470/oz mark and copper has been moving higher, assisted by advancing equity prices with eyes remaining on US-China trade developments.

US Event Calendar

- 8:30am: Housing Starts, est. 1.32m, prior 1.26m; Housing Starts MoM, est. 5.1%, prior -9.4%

- 8:30am: Building Permits MoM, est. -0.43%, prior -2.7%; Building Permits, est. 1.39m, prior 1.39m

- 9am: Fed’s Williams Speaks at Capital Markets Conference

DB’s Jim Reid concludes the overnight wrap

Yesterday I mentioned how twin Eddie locked himself in the toilet for nearly 30 mins on Sunday and became hysterical before eventually calming down and realising he could unlock the same door. Well yesterday twin Jamie apparently got in such a rage that he broke his car seat in a violent protest at not getting a rice cake. That’s what I go home to every day.

In comparison markets were relatively calm yesterday but trade sentiment again drove some volatility, with major indexes bouncing between gains and losses as news dripped out of Beijing and Washington. A reminder from our survey (link here ) last week that only 14% thought the trade war would get worse over the next 12 months. So the vast majority think it will de-escalate in election year. However, things are getting a little tense ahead of the ”phase one” signing. The first catalyst that sent equities lower yesterday was a tweet from CNBC’s Beijing Bureau Chief, who said that the mood in Beijing “is pessimistic”. She also said that China was “troubled after Trump said no tariff rollback” and said “Strategy now to talk but wait due to impeachment, US election. Also prioritize China economic support.” The tweet came before the US open, but the impact in Europe was clear, with the STOXX 600 falling from its intraday high of +0.28% to drop as low as -0.33%. However, it rebounded to end flat (-0.01%) after the newsflow shifted in a more optimistic direction. Fox Business reported that the US will extend its licenses, which allow firms to continue doing business with Huawei for another 90 days, which was better than the two-week extension reported earlier. That apparent olive branch from the US administration to China helped equities rebound, with the S&P 500 (+0.04%), NASDAQ (+0.11%), and DOW (+0.11%) all edging to fresh all-time highs. Energy stocks were the worst hit on both sides of the Atlantic though thanks to the decline in oil prices, with Brent crude oil down -1.39% and the S&P 500 energy group ending the session down -1.33%.

This morning in Asia markets are mixed with the Hang Seng (+1.03%) and Shanghai Comp (+0.46%) up while the Nikkei (-0.41%) and Kospi (-0.46%) are down. Elsewhere, futures on the S&P 500 are up +0.07%.

In other news, Hong Kong Chief Executive Carrie Lam said that she very much wants to resolve the PolyU situation peacefully, after it has been taken over by protestors for the past two days, but she can’t guarantee that would happen. She also said that minors at PolyU would be treated in a “humanitarian” way and stressed the special arrangements being made so that they would not be immediately arrested while adding that, “right now” the city’s government is confident it can handle the unrest without the army’s help. Meanwhile, US Senate Majority Leader Mitch McConnell urged President Trump to speak out on behalf of the protesters as he said, “The world should hear from him directly that the United States stands with these brave women and men”. Further to this, Senator Marco Rubio’s bipartisan bill supporting Hong Kong protestors could pass as soon as today.

10yr USTs are -1bp lower overnight following a firm day yesterday as treasuries rallied even if bunds traded flat. 10-year yields in the US were -1.7bps lower, while other European bonds also gained with OATs and BTPs rallying -0.8bps and -2.3bps. Yield curves flattened, with the US 2s10s -0.3bps to 21.6bps and the German 2s10s also flattening by -0.7bps. Gold also recovered, having been down -0.80% before the initial trade headlines to end the session +0.19%.

Moving away from trade, we got the news yesterday that Fed Chair Powell had a meeting with both President Trump and Treasury Secretary Mnuchin at the White House. In a statement from the Federal Reserve, it said that Powell “did not discuss his expectations for monetary policy, except to stress that the path of policy will depend entirely on incoming information that bears on the outlook for the economy.” Afterwards, President Trump tweeted that he’d “finished a very good & cordial meeting at the White House with Jay Powell of the Federal Reserve”, and that the issues discussed included interest rates and trade with China. A few hours later there was another tweet from Mr Trump saying that “At my meeting with Jay Powell this morning, I protested fact that our Fed Rate is set too high relative to the interest rates of other competitor countries. In fact, our rates should be lower than all others (we are the U.S.). Too strong a Dollar hurting manufacturers & growth!’. So tensions still high between the two. The market has made up its mind which way the Fed are going to go for now though as they’ve removed any pricing of another cut until mid-2020, with the odds for a December cut now around zero.

Other Fed speakers included Cleveland’s Mester and Boston’s Rosengren. Mester said that policy is in a good spot, but that she will be “watchfully waiting,” while Rosengren justified his dissent against the most recent rate cut by saying that he is concerned about having available policy space before the next downturn. He also suggested that a future downturn will necessitate a greater role for fiscal policy to provide support. In Europe, the only central bank communication came from ECB Chief Economist Philip Lane, who said that rates are not at their limit and that their current negative levels are “not particularly a super loose policy. If it were super loose, inflation would be higher.” He also suggested that negative rates have been successful in driving corporates to increase their levels of capital spending.

From the UK yesterday, we got the significant announcement from Prime Minister Johnson that planned corporation tax cuts due to take place in April would be scrapped to help fund the NHS. The rate had been due to fall from 19% at present to 17%. This chimes with our Corporate Bank note out last week, An inflection point in global corporate tax? (link here ), where we wrote how 2020 could see the end of a 40 year race to the bottom on corporate tax. Governments have got precarious finances at a time when corporates are in good health. It doesn’t seem politically viable to see this trend continue with the risks that it reverses if certain politicians get elected. The OECD global taxation plan – set to move on to the next stage early next year – is also key.

In terms of the upcoming U.K. election, attention will turn to tonight’s head-to-head debate between Prime Minister Johnson and Labour leader Corbyn. The Lib Dems and the SNP had challenged their exclusion, but two High Court judges dismissed the attempt yesterday, so it’ll just be the Conservative and Labour leaders on stage tonight. Corbyn has to make these events count with Johnson if he wants to catch up so expect a full on attack from the challenger.

In FX markets, sterling was actually the best-performing G10 currency yesterday, up +0.45% against the dollar and to 6+ month highs against the EUR. The pound looks to have benefited from some strong weekend polls (with more of the same yesterday/last night) for the Conservatives, with the logic being that a Conservative majority in the House of Commons will allow for a smooth ratification of the Withdrawal Agreement through Parliament. Finally, we got the news from Prime Minister Johnson that he would keep Sajid Javid as Chancellor of the Exchequer.

There was very little data of note to report on yesterday, though we did see the NAHB housing market index from the US fall to 70 (vs. 71 expected) in November, a slight decline from its 20-month high back in October.

To the day ahead now, and politics is expected to dominate the agenda as the US impeachment inquiry continues and we have the first head-to-head TV debate ahead of the UK election. Today’s data highlights from Europe include September’s Euro Area construction output, Italian industrial sales and orders, while here in the UK we’ll have this month’s industrial trends survey from the CBI. From the US there’ll be October’s building permits and housing starts data, and we’ll also get Canada’s manufacturing sales for September. From central banks, New York Fed President Williams will be speaking, while Home Depot will be releasing earnings.

Tyler Durden

Tue, 11/19/2019 – 07:40![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com