Charlie McElligott: “The Bull Market In Bonds Is Back On”

Ever the contrarian, Nomura’s cross-asset strategist Charlie McElligott declared LAST Wednesday during an interview on the MacroVoices podcast that the bond market’s latest “correction” – the “powerful” flattening that shaved 40 bp off the 10-year yield – is over, and the multi-decade bull market in bonds is back on.

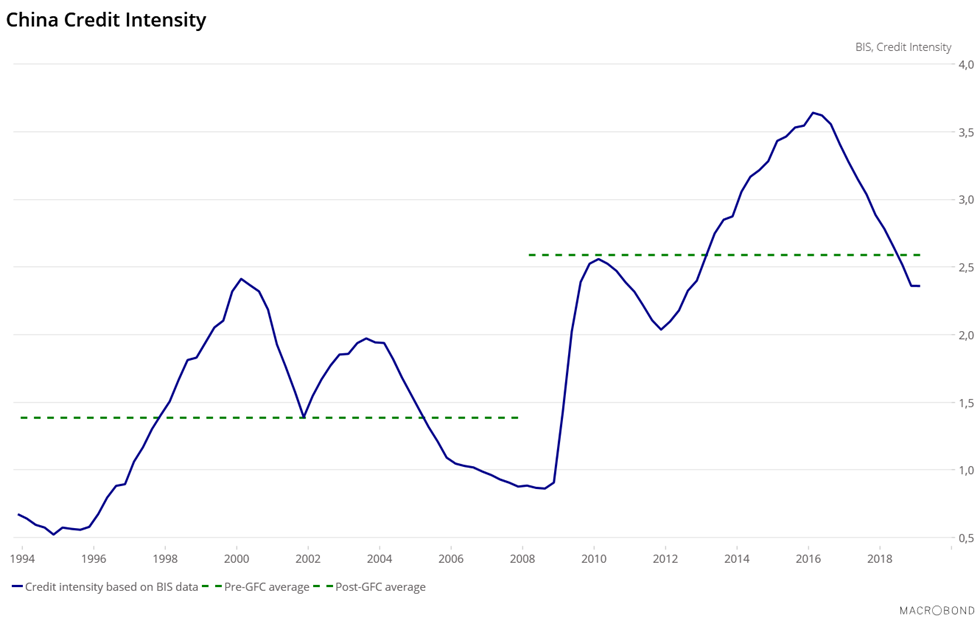

With Jerome Powell insisting that the Fed is done with rate cuts (for now, at least), bonds are ready to blast higher as yields sink. These moves will be abetted by what McElligott fears will be a triggered by a sharp pullback in economic data (something we hinted at last week when we said that that key catalyst for a global recovery, China, is nowhere to be seen this time around), followed by another, even more acute curve-flattening.

As McElligott explains (and as we have repeatedly harped on), while the flat curve is bad, it is the subsequent re-steepening that kills and is the precursor to a sharp market pullback. And at this point, trading activity starts to taper off. Typically, a flat curve is associated with slow growth, low inflation, or what McElligott describes as a “muddle-through of the last umpteen years of what it feels like in a post-crisis period, which is this 2%-ish, 1-1/2% to 2% GDP growth, sub-2% core CPI, which has grown this very crowded and of everything duration trade over the last few years.”

Taking a few minutes to gloat, McElligott brags about a few of his calls from the past year that likely made money for Nomura’s clients.

The thing that started happening last year was that the curve began to steepen because the market began sniffing the slowdown. And the market sniffs the slowdown, then you price in that Fed action.

We got all that. That steepener call that we made last year, and then the catalyst for some of this momentum unwind that comes with that, and then the momentum unwind of trend trades has very much been the theme of the past year. You know, these very stark sharp kind of shock-down periods where prior carry-type trade, prior momentum trades really, really come unglued.

Now we are at this point again where – in the last two months specifically – where I’ve been talking about the implications of the bond market rally over the course of 2019 having overshot. That people were potentially misinterpreting that absolute level in interest rates as this kind of signal of imminent recession.

But looking forward, it appears the entire market, in McElligott’s estimation, is wrong-footed in its hope for a decline in bond-proxy value/momentum stocks and a surge in value/cyclicals, i.e. the “Great Rotation”.

Generally speaking, you’re long the bond proxies, which is everything from typical minimum volatility defensive sectors – you know, the way that Utes and REITs and staples have really been the best-performing S&P sectors over the past year, in addition to those secular growth names like the high-flying SAT software types of names, the FAANG tech type stuff, which actually acts like a bond because of valuation – it benefits from the lower yields justify the expensive valuations.

And they return – they grow earnings, they grow as in this world of low yield and low growth. On the flip side, people have been short cyclicals.

Toward the end of the interview, Townsend asked McElligott about his views on gold, prompting a somewhat cryptic explanation. Gold, McElligott explained, is “the ultimate shapeshifter” when it comes to markets. Traders, especially inexperienced traders, often mistake gold for a pure risk-off play. But that’s not exactly accurate, McElligott explained.

So the trick then, to me, is that gold began to trade off of lower real yields. It began to move higher opposite – correlated, right? So indirectly correlated to lower real yields.

Now I think that markets have seen this dynamic where you’re instead looking at a normalization of yields over the last two months. Gold has given back. Yields – it wasn’t this end-of-days scenario. It wasn’t this imminent recession scenario. So, with that, I think that was pretty important because you ended up seeing gold get pretty hard hit.

Gold more accurately reflects movements in short-dated bonds: When short-dated yields climb, gold falls, and vice versa. But now that real yields (nominal yields – inflation) have swung lower once again, McElligott believes the bond rally is poised to continue.

And as yields sink, expect the price of gold to climb.

So I think now the trick is that – my view here going forward is that the bond rally can actually continue. We’ve washed out that excess positioning. We had that big 40-plus basis point selloff in 10-years.

I think now that, as we pivot towards the more likely deterioration in the China trade story – again, as we look past this Phase 1 and into the tougher Phase 2 – that bonds can rally again. And bonds rallying again means lower real yields means higher gold.

Ultimately, McElligott’s medium-term market view isn’t all that different from Bridgewater founder Ray Dalio’s: As the 2020 election approaches, McElligott believes yields will sink, gold prices will climb, and stocks will slide.

Read the transcript of McElligott’s interview below:

Don’t have time to read the whole thing? Pop in the podcast and go for a jog. Find the link below:

Tyler Durden

Sat, 11/23/2019 – 18:00![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com