As Africa Drowns In Debt To China, IMF Sounds The Alarm

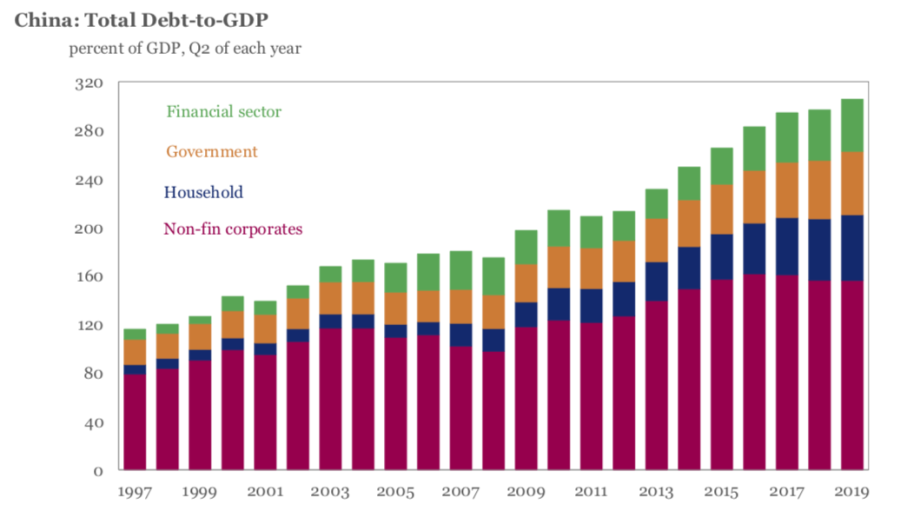

With China’s total debt most recently clocking in at a record 350%…

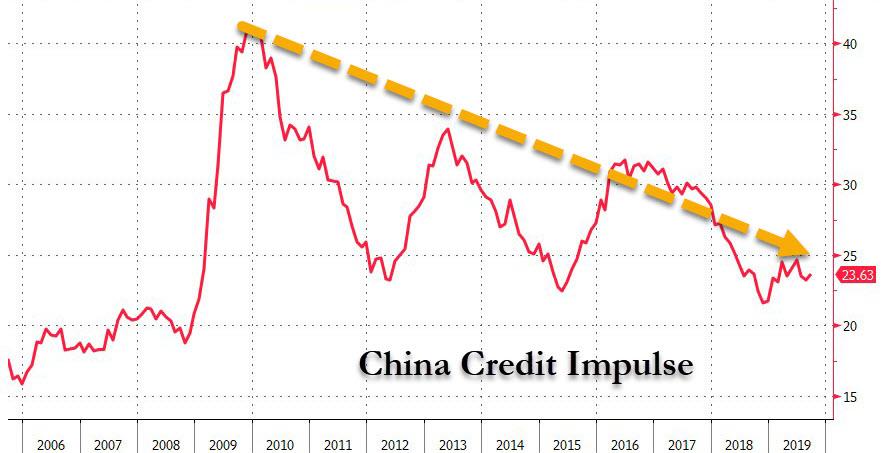

… the country that a decade ago managed to pull the world out of a financial depression thanks to its massive debt issuance, finds itself severely constrained in how much new debt it can dish out, and the result is a paltry credit impulse…

… which has so far been unable to push China out of its PPI slump, which in turn means that Beijing will continue dumping its exports abroad in a deflationary wave.

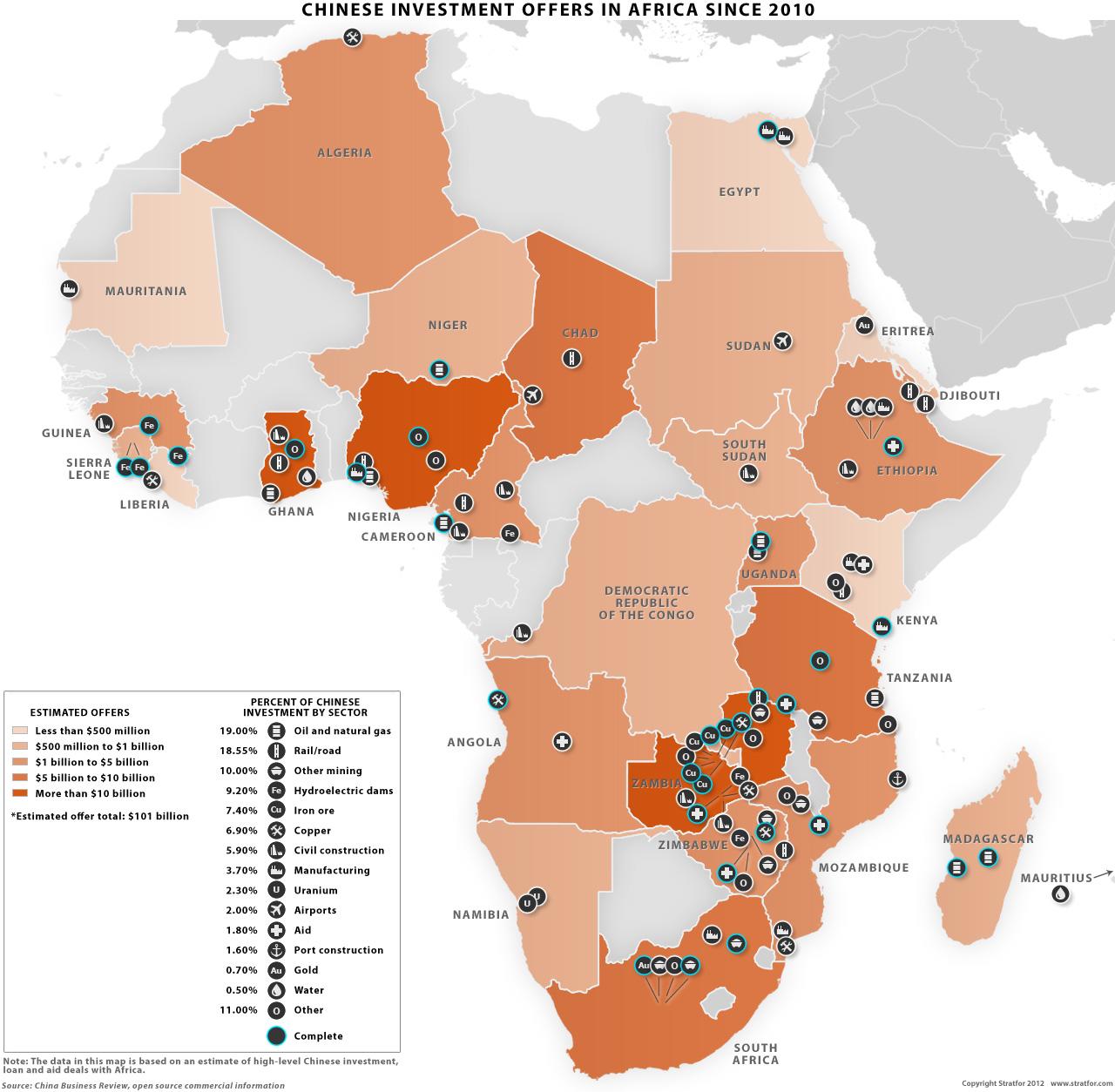

And yet, with Beijing now severely limited by how much debt it can raise domestically, China has come up with creative ways to circumvent such problems at the international level where it has taken a page out of America’s debt colonization playbook and done virtually the same with the continent of Africa.

But first, a quick reminder of an article we published in the long ago 2012, when we showed a map depicting the “Beijing Conference“, a spin on the Berlin Conference of 1885 which divided Africa among Europe’s then superpowers, and which showed how China had quietly taken over Africa, and specifically its commodity riches.

As we warned then, China’s “noble” crusade to modernize Africa, would not come cheaply, because less than a decade later Africa – that final debt frontier – is suddenly finding itself with an all too developed problem: too much debt… and almost all of it is owed to China.

And none other than the International Monetary Fund is now raising the alarm about Africa’s soaring debt level, with about 40% of countries on the continent at “distressed levels”, Managing Director Kristalina Georgieva said, noting that “in some cases we are concerned, in others we see that investing is going to pay off over time,” Georgieva said in an interview with Bloomberg TV from Berlin.

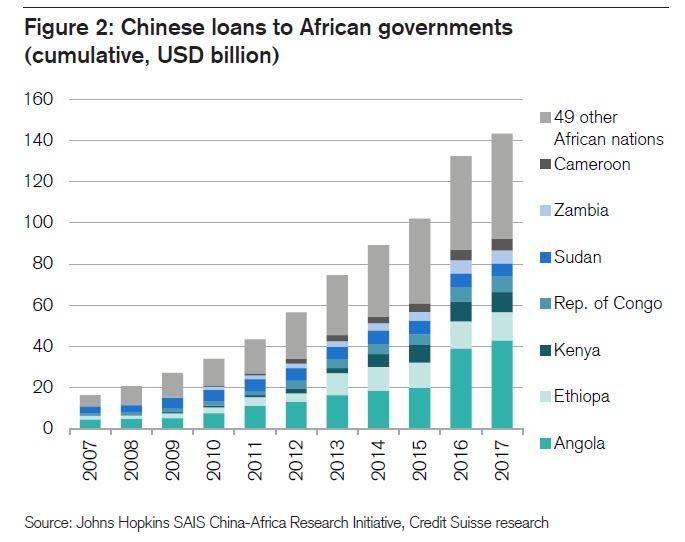

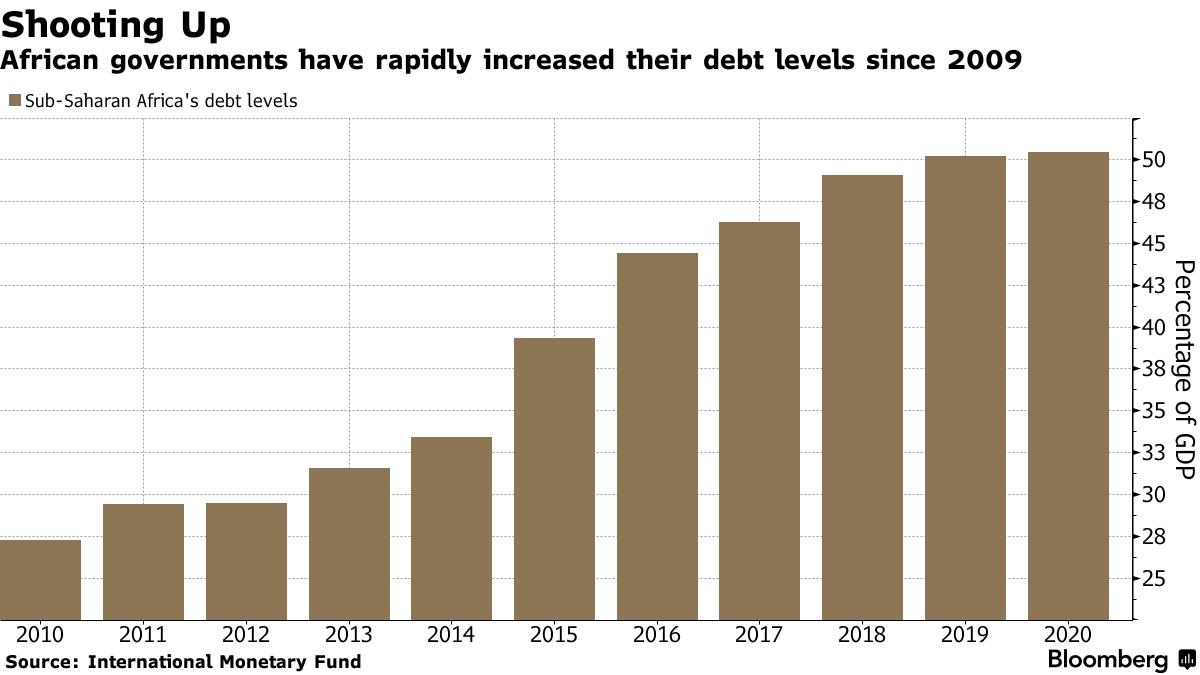

Needless to say, that’s an understatement – debt levels in the region have been surging as governments funded massive infrastructure projects – usually involving a Chinese “co-investor” – and are now struggling to collect and grow revenue while increasing their budgets.

In Zambia, government debt, including publicly-guaranteed obligations, is set to increase to 92% of GDP this year, and 96% in 2020, according to the IMF. South Africa’s ratio is projected to reach 81% of GDP by 2028 and Kenya recently doubled its debt ceiling to match the size of the entire economy.

“We do advise Kenya to be somewhat more cautious in building debt, but we have seen good macroeconomic policies in Kenya,” she said. “Our program with the country, our engagement with the country, by and large, are just as positive.”

Overall, sub-Saharan African debt is set to double in the past decade, largely as a result of China’s tactical approach to offshore new debt creation away from the mainland and to its offshore colonies, an “outsourcing” which we are confident “Confessions of an Economic Hitman, Part 2” will be delighted to cover.

“Debt on its own is not bad, it is bad when it goes for the wrong things, and when it goes with a speed that the economy cannot handle,” Georgieva said. “In cases where debt is dangerous – take Zambia – we do say, you need to really get a handle on your debt. In other cases, like Ethiopia, we say you do need to renegotiate some of your debt.”

Somehow we doubt China will be losing much sleep over Africa’s debt woes: after all, with most of this debt owed to China, once the debt is restructured, it is China that ends up the owner of the underlying assets, effectively colonizing an entire continent’s most valuable assets without firing a single shot.

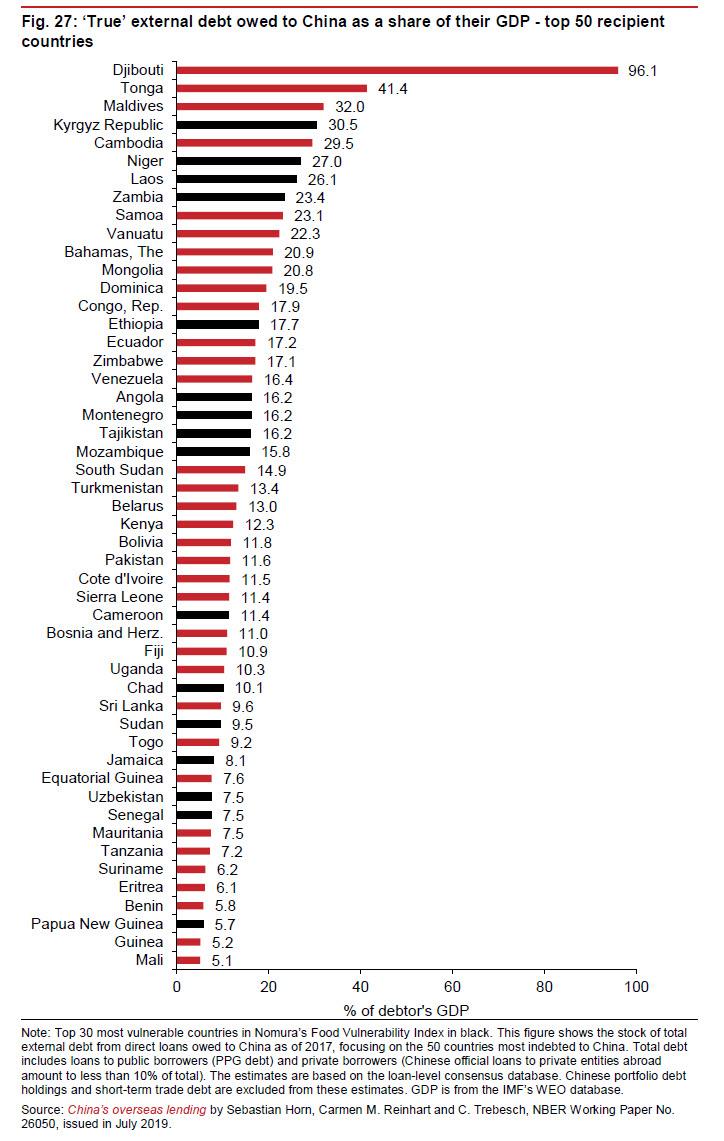

Meanwhile, as we noted back in January, just seven countries – the strategically important Angola, Cameroon, Ethiopia, Kenya, Republic of the Congo, Sudan and Zambia – accounted for two thirds of total cumulative borrowing in 2017 from China, with oil-rich Angola alone representing a 30% share, or $43 billion (35% of Angolan 2017 GDP). Ultimately, Angola reached a loans-for-oil settlement, with Beijing tying the country’s future oil production to shipments to China in order to service the country’s burgeoning infrastructure debt. According to an April 2018 IMF study, as of the end of 2017, about 40% of low-income Sub-Saharan African countries are now in debt distress or assessed as being at high risk of debt distress including Ethiopia, the Republic of the Congo and Zambia.

Amusingly, in a September 2018 speech to the triennial Forum on China-Africa Cooperation in Beijing, President Xi Jinping said Chinese investment came “with no strings attached” and pledged a further $ 60 billion of loans for African infrastructure development over the next three years. As it turns out, Xi was only joking because as we reported previously, China was set to take over Kenya’s lucrative Mombassa port if Kenya Railways Corporation defaults on its loan from the Exim Bank of China. The China-built, China-funded standard gauge railway, also known as the Madaraka Express, was plagued by cost overruns, and outside observers questioned its economic viability, but China was not worried: after all, if the 80%-China funded project failed, Beijing would have full recourse. Call it a “debt-for-sovereignty” exchange.

It’s not just Kenya and Angola: other notable examples of China’s debt-funded colonization endgame include Sri Lanka, where difficulties servicing $8 billion of infrastructure-related borrowing from China led to the handing over of a controlling equity stake and a 99-year operating lease for the country’s second-largest port at Hambantota to a subsidiary of a Chinese state-owned enterprise in December 2017. For Pakistan, more than 90% of revenues generated at the critical Gwadar Port at the mouth of the strategically significant Gulf of Oman are collected by the Chinese operator.

In fact, while the US and Europe have been scrambling to monetize their own debt over the past decade to avoid a social catastrophe, China was busy becoming the top creditor to not just most of Africa, but countless developing nations, in the process also effectively colonizing them, as after the inevitable debt restructurings, China will end up owning a majority of the developing world’s assets.

And so, as more developing, peripheral countries default on Chinese loans and are forced to hand over the keys to key sovereign projects to Beijing, China will slowly but surely “colonize” not just Africa but many of the Asian nations in the “Belt and Road Initiative” following a popular playbook developed by none other than the original “economic hitmen“…

[youtube https://www.youtube.com/watch?v=btF6nKHo2i0]

Tyler Durden

Sun, 11/24/2019 – 19:30

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com