China Downturn Could Last Five Years Warns Central Bank

An advisor to the People’s Bank of China (PBoC) said China’s economy might not recover for the next five years, reported Reuters.

Liu Shijin, a policy adviser to the PBoC, said the country’s GDP will decelerate through 2025 and could print in a range of 5 to 6%.

Shijin warned that excessive monetary policy is failing to stimulate the economy and could cause it to rapidly decelerate.

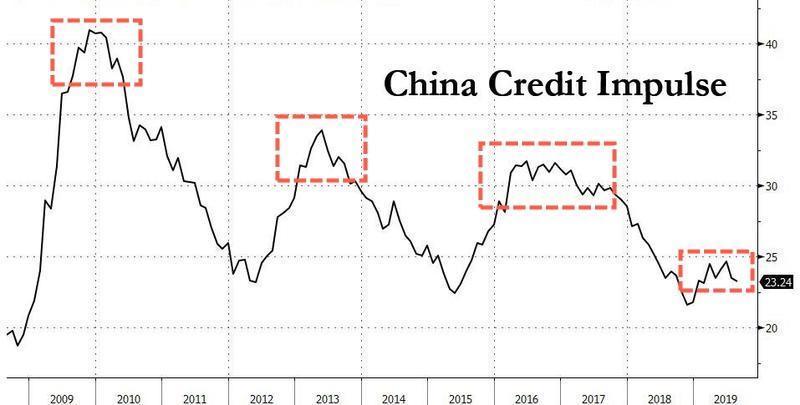

Last month, we noted that China’s credit growth plunged to the weakest pace since 2017 as a continued collapse in shadow banking, weak corporate demand for credit, and seasonal effects all signaled that China’s economy, nevertheless, the global economy, will continue to slow.

The latest Q3 GDP figure recorded a further drop in growth, now printing at 6% YoY, the weakest expansion since the early 1990s.

China will continue decelerating into 1H20 — thanks to ineffective monetary policy but could stabilize in a target range of 5.8% to 6% YoY.

A further economic slowdown in Chinese growth could ruin the party for equity bulls, who have already priced in a massive 2016-style rebound in the global economy. A slowing China means the world will fail to rebound, though we don’t discount the stabilization narrative.

With China’s economy unlikely to sharply rebound early next year, global investors will shortly have to reprice growth, which could result in a move down in global equities.

To gain more color on China’s extended slowdown, we turn to Fathom Consulting’s China Momentum Indicator (CMI), which provides a more in-depth view of China’s economic activity than the official Chinese GDP statistics.

CMI is based on ten alternative indicators for economic activity; some of those indicators include railway freight, electricity consumption, and the issuance of bank loans.

Fathom has stated that in CMI, the calculation of the index avoids measuring construction activity, and instead focuses on shadow measures of economic activity. The consulting group says this allows the index to be “less prone to manipulation than the headline GDP figures.”

“In 2014, when China’s traditional growth model was running out of steam and vulnerabilities were rising, authorities toyed with credit tightening and an enforced rebalancing. But at the end of 2015, when growth slowed too sharply, they quickly threw in the towel, resorting to the old growth model of credit-fuelled growth. With growth once again slowing, and past precedent suggesting credit has neared its limit, China finds itself at a crossroad,” Fathom recently said.

China’s failure to stimulate its economy suggests CMI will continue a downward trajectory that has been underway for the last decade.

We’ve recently outlined the bust of the global auto industry has weighed down the Chinese economy. With no signs of an upswing in the auto market, China’s economy will remain depressed in the years ahead.

As China’s economy slows, global commodity prices are stuck in a deflationary spiral.

China’s slowing economy warns that global equities have mispriced growth for early 1Q20.

Chinese stocks could see downside in the year ahead as the economy slows.

Looking for signs of life in the Chinese economy — there aren’t any at the moment.

Société Générale’s latest report shows employment in China contracting across manufacturing and non-manufacturing, outlining how the slowdown is broad-based.

It’s becoming increasingly clear that China’s economy is decelerating and could be locked in a downward spiral until 2025. This means without China being the beating heart of the global economy, which created 60% of all new global debt over the past decade – there can be no global recovery. Maybe the world has just transitioned into a period of low or below trend growth that could be the onset of a worldwide trade recession.

Tyler Durden

Thu, 12/12/2019 – 19:05

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com