After Five Years, Sweden Is About To Wave Goodbye To Negative Rates

In a few hours, at 10am GMT, Sweden is about to wave goodbye to the land of negative rates, if only for a little while.

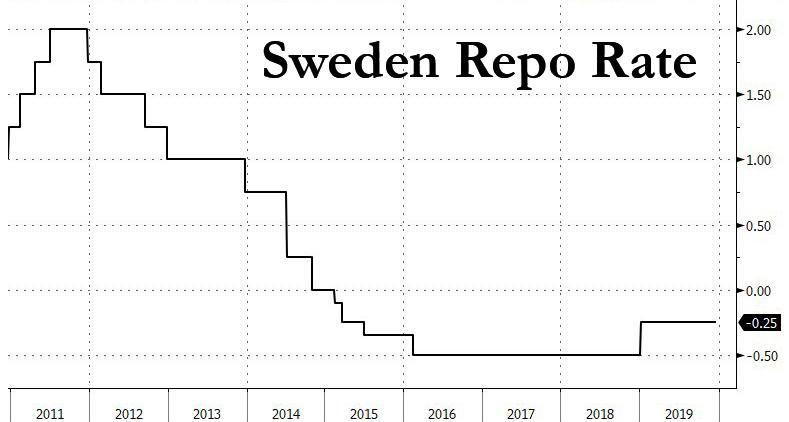

After the Swedish Riksbank cut rates as low as -0.5%, where it kept them for nearly three years, from 2016 until the start of 2019, when it hiked by 25bps on January, the Swedish Central bank is almost unanimously expected to hike rates by 25bps to 0.0% according almost all analysts polled by Reuters, putting its experiment with NIRP in the rearview mirror, at least until the next cut by the ECB drags it right back under.

As RanSquawk previews, if the Riksbank does hike as expected, focus will turn to if this is as their October repo path indicates a one-and-done increase to move out of negative rates, as well as the magnitude of opposition to the hike. This meeting includes a press conference which will begin at 10:00GMT.

Previous Meeting

In October, the Riksbank left rates unchanged at -0.25% but clearly signaled that the rate would ‘most probably’ be hiked to 0.0% in December’s meeting. Additionally, their forecast for the repo rate was downgraded, and now indicates that the rate will ‘be unchanged for a prolonged period after the expected rise in December’. In the post-meeting press conference, Governor Ingves said that negative rates were an exceptional measure and it is appropriate to gradually exit from negative rates.

Minutes & Rhetoric

While the October meeting and conference illustrated a desire to hike, the minutes were less in-fitting with this and highlighted a split amongst the board. Most notably, Skingsley said it is justifiable to ask whether it is appropriate to increase rates at all and one member expressed hesitance at hiking around year-end; instead, argued for such a move to be further down the forecast period.

Aside from the minutes, remarks out of the Riksbank has been fairly light; the most pertinent of comments, which question the December move, arising from Jansson stating that if the rate was to increase around year-end it may be perceived as the Bank deviating from its mandate. While not rhetoric in the traditional sense, the Central Bank Financial Market Survey indicated that several participants believe a less expansionary policy would improve the function of FX and Fixed income markets. Overall, while the pushback from the more Dovish members of the Riksbank is unlikely to be sufficient to alter the flagged hike it does open-up the potential for dissenters.

Data

The most pertinent release has been November’s CPIF which beat market expectation printing at 1.7% which is crucially in-line with the Riksbanks November forecast (1.71%); which according to Nordea emphasizes the likelihood of a December hike. Other metrics have been more downbeat, and do not support the planned hike, such as PMIs, Q3 GDP and November’s unemployment rate which rose from 6.0% to 6.8%. That said, Swedish labor market data has been affected by errors recently which ING suggests may lead to the Riksbank treating this with some skepticism. Overall, the domestic data front is not conducive to an interest rate increase, as such consensus is for any hike to be a one-off move, as the October forecast path suggested.

Deputy Governor Breman

Since the previous meeting Anna Breman has been appointed as Deputy Governor to replace af Jochnick, Breman will be partaking in the December policy meeting. Breman has previously expressed concern regarding a weak SEK and believes the Riksbank, with negative rate policy, has a limited tool-kit in the scenario of an economic downturn. For reference, Nordea highlight that her monetary policy stance is difficult to categorise and she is likely to follow the majority initially which, overall, makes the board more hawkish.

Tyler Durden

Wed, 12/18/2019 – 23:45

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com