“A Munich 1938 Moment?” – Blain Asks How The Chinese Will React To The Trade Deal Signing

Blain’s Morning Porridge, submitted by Bill Blain

“Give them an act with lots of flash in it, and the reaction will be passionate..”

US stocks hit new highs, the Dow breaches 29,000, the Bank of England is thinking about easing rates, the Phase 1 Trade Agreement is actually signed, a global recovery is (apparently) underway, recession fears are just a distant memory. What’s not to like? Well…. Just about everything, but hey-ho! Party on! The drink is free, the music is great, the girls and boys are pretty, so Let’s Dance, and damn the consequences! Never mind the debt bubble, the stock bubble or that financial assets look an illusion of wealth. Boogie Wonderland indeed…

In terms of scepticism about the trade agreement, let me simply refer you to some of the better articles in the media: FT: US-China “phase one” trade deal leaves markets virtually unmoved, BBerg – US and China Sign Phase One of Trade Deal. (The Oban Press and Journal said it all: US markets beat records amid China trade pact.)

If you want another perspective on the global outlook, this morning’s piece in the FT on Angela Merkel is well worth a read – Merkel warns EU: “Brexit is a wake-up call”. Her concerns on where Europe goes from here and how it fits the new global reality are well worth a few moments. But Germany is a story for another day….

Going back to yesterday’s deal, if I had the time this morning to trawl the last three years of trade headlines, I’d have analysed everything Donald Trump said he wanted from China and put them all on a list. I’d then put yesterday’s “agreement” beside it, and work out what’s missing. It’s likely to be a long list.

Of course, some of that stuff will be phase 2, 3…n (n+1) trade agreements, (if they ever happen) but you get my drift: 3 years of trade noise, dither and uncertainty, all so Donald can present it with fanfare, hordes of adoring fans, and razzle-dazzle the electorate ahead of the election. And folk say Trump is stupid? Stupid is as stupid does.

Of course, the Democrats want to rile him, so finally they play the impeachment trial. That will distract us momentarily – unless of course we get something truly shocking from witness statements, but they would have to be “Donald Trump ate my baby” magnitude for Republican senators to find him guilty… and even then….

Trump gets what Trump wanted. The “trade-deal” (for want of a better term) gives him a marginally stronger chance of 4 more years before the US becomes an SEP (a Someone Else’s Problem). Its Short-Term.

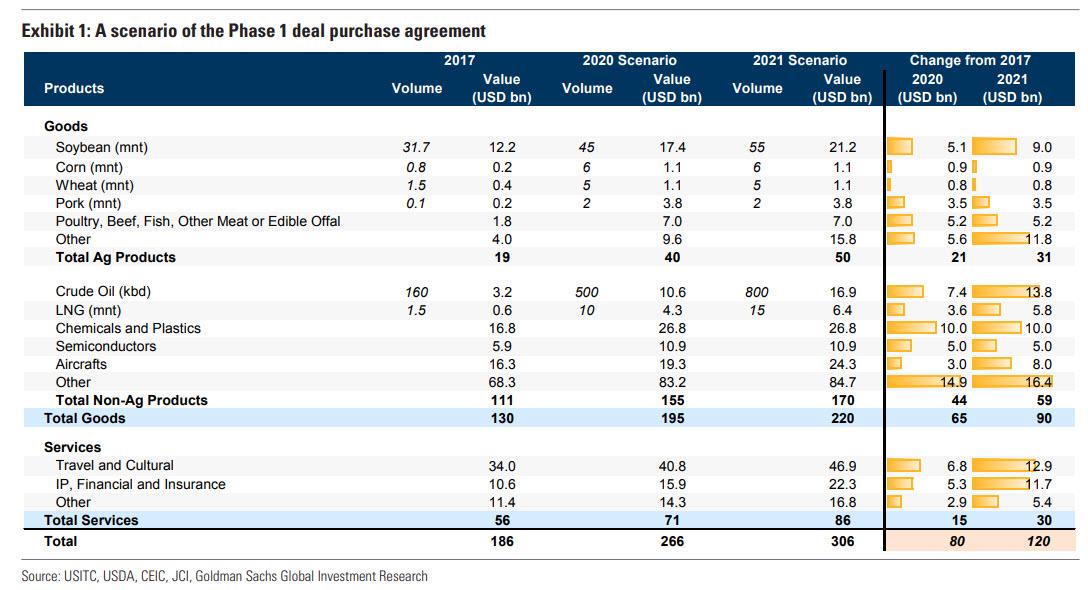

It’s great news if you are a US Soyabean producer. Its going to be more interesting to see how China really delivers demand on other aspects of US agribusiness. While the agreement looks great on paper in terms of addressing the trade balance, just what do Chinese Consumers want to buy that is made in the US?

And let’s not ignore the Huawei trap – that’s an incredibly complex box of frogs in terms of not just supply chains, but systems tech.

For the Chinese their perception of the Long-Term reality is very different. I suspect they will react to yesterday’s trade signing as a Munich 1938 Moment. They come back with a piece of paper saying trade war is averted – equivalent of peace in our time – and continue with the economic equivalent of rearmament: girding their economy for ongoing denial of access to US tech forcing them to develop and innovate their own Tech ecosystems, (which they are confident of doing), with increasingly limited access to US markets, increased geo-political tension, and the likelihood the US tries to persuade it allies to join an embargo of China across global commerce.

OF course, I don’t actually have time to spend re-reading the last 3 years of Trump. I’ve got a day job – in Alternative Assets.

Overheated financial assets and the prospect of ongoing global trade distractions means Alternatives are worthy of more attention than ever. As markets continue to rally on non-news, expectations of central bank support, and ignore the realities of changing global supply chains, earnings, implausible P/E ratios and put their faith in messianic cult investments, you have to wonder how safe the distorted bubbles in financial assets can be?

Remembering the old adage: the market can stay irrational longer than you can stay solvent, it’s time to be thinking about hedging for the coming top. Alternative Assets range from private equity, direct lending, secured assets, infrastructure, property, real assets, etc, but if they have one characteristic, it’s the degree to which they are decorrelated from financial assets.

For instance – if I buy an airline or aircraft maker’s stock, I reap the upside in today’s frothy market – market risk, but bear the downside risk if the bubble bursts, plus I’ve got credit risk and all the other associated business risks. However, if I own aircraft and lease them to airlines I still face a degree of credit risk on the users of my assets, but the ability to re-lease the asset to other users. My risks are different and less exposed to purely inflated financial asset risks. Alternatives are less dependent on volatile market risks, in the case of aircraft its economic risks like the propensity of people to fly which is an economic factor (although FLygSkam is an increasing consideration). If the supply of aircraft assets is limited, as it is, then the simple rules of demand and supply determine the economic value of the plane as an asset.

Before Central Banks discovered QE we believed the invisible hand of markets determined the value of financial assets, but the last 8 years of monetary experimentation and distortion has simply flooded financial assets with liquidity creating enormous inflation in financial assets, which many investors simply don’t get!

Tyler Durden

Thu, 01/16/2020 – 10:50

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com