World Stocks Tumble As Viral Pandemic Fears Return, Curve Re-Inverts

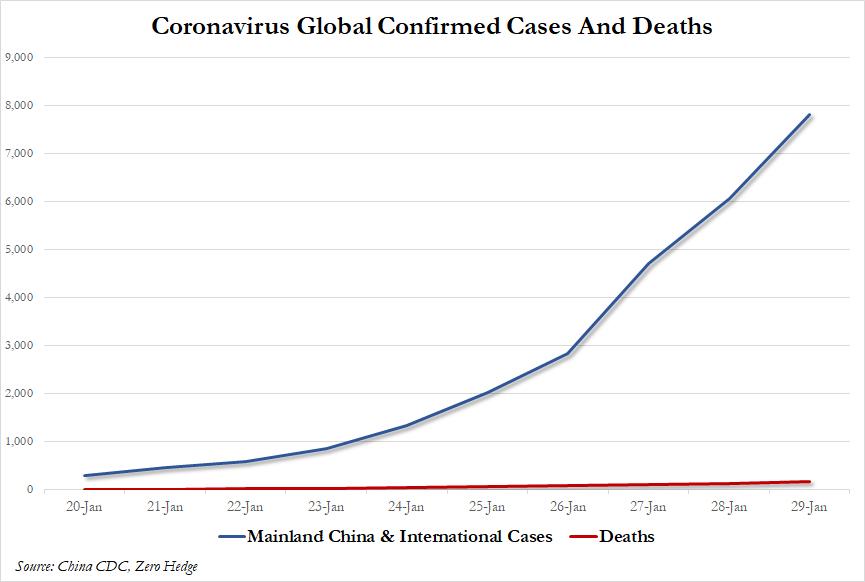

If yesterday, algos, millennial traders and generally markets acted as if the coronavirus epidemic was contained, all of that reversed overnight when global stocks and US equity futures across the world tumbled on Thursday as the death toll from the coronavirus epidemic reached 170 with nearly 8000 people now sick…

… forcing airlines to cut flights and stores to close as the potential economic hit from the outbreak came into focus.

And after dismissing the latest escalation on Wednesday, markets perhaps finally read up on what a geometric progression means and decided to freak out on Thursday, just because, with S&P futures tumbling, and undoing all of Wednesday’s gains, as tech giant giants presenting a mixed picture after the bell on Wednesday, with Facebook’s results underwhelming even as Microsoft and Tesla beat expectations.

Or perhaps someone in the market finally learned to do math, and it is ugly: Chinese factories have announced extended holidays, global airlines cut flights and Sweden’s Ikea said it would shut all stores in China. One Chinese government economist said the crisis could cut first quarter growth in the world’s second largest economy to 5% or lower, with the crisis hitting sectors from mining to luxury goods. Investment banks also started to put figures on what the damage could be. Citi has said it expects China’s 2020 growth to slow to 5.5%, after previously predicting it to be 5.8%, with the sharpest slowdown this quarter.

“The economic impact will be determined by the extent to which it spreads,” said Michael Bell, global market strategist at J.P. Morgan Asset Management, adding that hard evidence of a hit to economic data was needed before the impact of the virus could be judged.

Right or not, stocks wasted no time to selloff as pessimism returned, with the MSCI world equity index dropping 0.5% as European shares followed Asian indexes into the red, stoking demand for the perceived security of safe-haven assets from bonds to gold. Europe’s broad STOXX 600 tumbled over 1% in early trade, as all but two sectors traded in the red, with European markets a sea of red, as indexes in Frankfurt, Paris and London all lost between 0.7%-1.3%. Adding to the gloom, disappointing earnings and trading updates weighed further on blue-chip stocks. Royal Dutch Shell plunged 4.8% after fourth-quarter profit halved to its lowest in more than three years.

Earlier in the session, the MSCI index of Asia-Pacific shares ex-Japan fell 2.1% to a seven-week low and has now dropped for six straight sessions as the World Health Organization considered issuing a global alarm on China’s spreading coronavirus. The MSCI Asia Pacific Index extended losses to as much as 1.9%, with all major regional markets trading in the red. Taiwan’s shares slumped after market reopened from holidays, catching up with the slide elsewhere during Lunar New Year. Hong Kong’s Hang Seng Index had its worst two-day performance in almost a year. With China’s economy now expected to deteriorate the longer the outbreak persists, the government is expected to unveil efforts to cushion the economic blow, with the central bank set to keep liquidity ample, according to economists.

Earnings presented a mixed picture, and in addition to the Facebook plunge offset in part by the surge in Microsoft and Tesla, the following reports were notable, courtesy of Bloomberg:

- Coca-Cola climbed after fourth quarter organic revenue topped analyst estimates.

- United Parcel Service slipped in early trading after profit outlook fell short of analyst estimates.

- Royal Dutch Shell fell to the lowest in more than two years after missing profit expectations and scaling back buybacks.

- Deutsche Bank fluctuated after reporting a larger-than-expected loss in the fourth quarter.

- Unilever rose despite the company’s slowest quarterly growth in a decade.

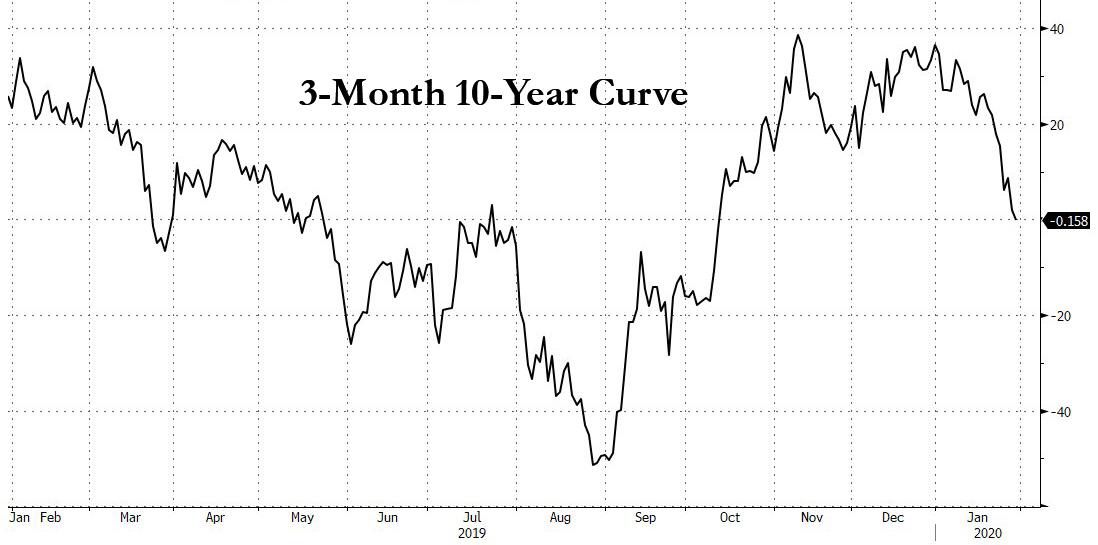

Meanwhile, the rush to safety continued with U.S. and German government bond yields falling sharply, with 10-year German bund yields dropping to a three-month low. 10-year Treasuries also fell 3 basis points to 1.5600%, their lowest since October. The yield curve – as measured by the 3M10Y spread, a closely watched indicator of looming recession – again sliding into negative territory.

The pain will likely get worse: the World Health Organisation’s Emergency Committee is due to reconvene later in the day to decide whether the rapid spread of the virus now constitutes a global emergency. “There is some concern about tonight’s presser by the WHO. The fear is that they might raise the alarm bells … so people are taking money off the table,” said Chris Weston, head of research at Melbourne brokerage Pepperstone.

Besides pandemics, there were also central banks: Fed chair Powell acknowledged on Wednesday the risks from any slowdown in the Chinese economy but said it was too early to judge the impact on the United States. The Fed held interest rates steady on Wednesday at its first policy meeting of the year, with Powell pointing to continued moderate economic growth and a “strong” job market.

In Europe, the pound jumped after the Bank of England Governor Mark Carney’s final policy vote, in which the central bank decided to keep rates unchanged despite rising speculation of a rate cut.

Elsewhere in currencies, a risk-averse mood ruled, with exposed Asian currencies and commodities sensitive to Chinese demand extending losses as economists made deep cuts to their China growth forecasts. The Chinese yuan reversed Wednesday’s gains to fall 0.4% to its lowest level since Dec. 30., breaking below the key level of 7 against the dollar. The Australian dollar and the kiwi dollar NZD=D3 both lost 0.3%. The Japanese yen rose 0.2% against the dollar, while the Swiss franc, also seen as a safe haven, also gained. The dollar against a basket of six major currencies was flat.

Oil prices, a barometer of the expected impact of the virus on the world’s economy, resumed their slide. Brent was down 95 cents, or 1.8%, at $58.71 a barrel and has dropped 10% since Jan 20.

Expected data include GDP and jobless claims. Altria, Blackstone, Coca-Cola, UPS, Verizon, Amazon, and Visa are among companies reporting earnings.

Market Snapshot

- S&P 500 futures down 0.5% to 3,255.25

- STOXX Europe 600 down 0.6% to 416.87

- MXAP down 1.8% to 165.99

- MXAPJ down 2.1% to 536.60

- Nikkei down 1.7% to 22,977.75

- Topix down 1.5% to 1,674.77

- Hang Seng Index down 2.6% to 26,449.13

- Shanghai Composite closed

- Sensex down 0.6% to 40,959.55

- Australia S&P/ASX 200 down 0.3% to 7,008.43

- Kospi down 1.7% to 2,148.00

- German 10Y yield fell 1.9 bps to -0.396%

- Euro up 0.05% to $1.1016

- Brent Futures down 1.3% to $59.01/bbl

- Italian 10Y yield fell 7.8 bps to 0.787%

- Spanish 10Y yield fell 1.9 bps to 0.281%

- Brent futures down 1.9% to $58.67/bbl

- Gold spot up 0.2% to $1,579.67

- U.S. Dollar Index little changed at 98.03

Top Overnight News from Bloomberg

- Federal Reserve Chairman Jerome Powell signaled that the central bank would pull out the stops to combat a global disinflationary downdraft, foreshadowing a potential shift toward an easier monetary policy over time

- Oil resumed declines as the biggest jump in U.S. crude stockpiles in almost three months added to concern over weak demand in a market already grappling with the spreading coronavirus

- The European Union stopped short of an outright ban on Huawei Technologies Co. and other Chinese 5G suppliers, seeking to navigate a path between warnings from U.S. President Donald Trump and provoking Beijing

- Argentina’s government late Wednesday announced its time line for debt negotiations with private creditors, according to a chronology published on the Economy Ministry’s website

- German unemployment unexpectedly declined at the start of 2020 as businesses ramped up operations after a yearlong industry slump.

- Europe’s manufacturers started the new year on an upbeat note, the latest sign that the uncertainty that’s shrouded the sector and the region’s economy more broadly has lifted somewhat in recent weeks.

- The pound held steady Thursday ahead of a delicately-poised Bank of England decision, but the chances are it could stay under pressure in the medium term.

- China is expected to unveil efforts to cushion the economic blow from coronavirus, with the central bank set to keep liquidity ample and the government likely to step up spending

Asian sentiment was downbeat as the overhang from the coronavirus outbreak continued to take its toll across the region and following an indecisive lead from the US, where markets reacted to the FOMC policy announcement. ASX 200 (-0.3%) and Nikkei 225 (-1.7%) were subdued with underperformance across Australian mining names as demand concerns overshadowed the higher quarterly production updates by Fortescue Metals and Newcrest Mining, but with downside for the broader market stemmed by resilience in financials, while losses in Tokyo were exacerbated by flows into the JPY. KOSPI (-1.7%) was pressured after index heavyweight Samsung Electronics posted a 38% drop in Q4 net and Hang Seng (-2.6%) slipped deeper into correction territory after the number of confirmed coronavirus cases in the mainland increased to 7711 and the death toll now at 170, while the TAIEX (-5.8%) slumped as Taiwan participants returned to the market for the 1st time in 10 days and took their turn to play catch up to the epidemic fears. Finally, 10yr JGBs were higher due to the broad weakness in risk appetite and following upside in T-notes which were supported post-FOMC and saw the US 10yr yield decline to a 3-month low, while the mostly improved results from the 2yr JGB auction added fuel to the upside momentum.

Top Asian News

- China Seen Boosting Stimulus as Virus Hammers the Economy

- Taiwan Prepares Measures to Stabilize Stock, Forex Markets

- Hong Kong Exports Grow 3.3% in December, Beating Estimates

- Turkey Sticks With Inflation Outlook, Tees Up More Rate Cuts

An overall bleak session in the European equity-space [Eurostoxx 50 -0.9%] following on from a similar APAC handover which saw the Hang Seng post losses in excess of 2.5% – as risk aversion continues to materialise with the virus outbreak. Sectors are mostly in the red with the exception of utilities amid and outperformance/less pronounced downside in defensives to reflect the risk aversion. The energy sector stands as the underperformer amid the price action in the oil complex coupled with downbeat earnings from oil-titan Shell (-3.4%) which account for ~1.2% of the Stoxx600 and ~10% of the FTSE 100 (Shell A and B shares combined). In terms of earning-driven movers: Roche (+0.7%) remain supported by an above-forecast EPS and a dividend increase despite missing on profit and sales forecasts. Swatch (-3.6%) missed on earnings estimates and noted that it sees no quick rebound in its key Hong Kong market. As such, luxury peers are pressured in sympathy with the likes of LVMH (-1.7%), Richemont (-1.7%) posting firm losses. H&M (+9.8%) rose to the top of pan-European index amid stellar numbers and the appointment of a new CEO. Meanwhile, Deutsche Bank (+2.1%) erased opening losses which came amid a deeper than forecast net loss. Losses diminished amidst the conference call which provided investors with reassurance regarding early signs of progress in its overhaul. Other earnings-related movers include Diageo (-1.9%), Volvo (+7.7%), BT (-5.9%) and Unilever (+1.4%).

Top European News

- Saint-Gobain Sees Closing of Continental Purchase on Feb. 3

- Siemens Gamesa Plunges on Loss Caused by Unforeseen Charges

- Carney’s Final BOE Rate Call Is a Knife Edge: Decision Day Guide

- Nordea Is Said to Name Virgin Money’s Ian Smith as New CFO

In FX, not much bang for the Buck from the Fed as downgrades to the state of US consumption and level of inflation relative to target halted the DXY’s steady rise above 98.000 and sapped broad demand for the Dollar amidst the progressive spread of China’s coronavirus. However, as the death toll and number of cases (confirmed or suspected) continue to mount, Usd/CNH has rebounded further to temporarily test and breach the psychological 7.0000 mark alongside more pronounced depreciation in EM currencies overall, and especially those closely connected or correlated to commodities that are prone to steep price declines on the probability of depressed demand. Hence, the Greenback may well retain a relatively firm underlying bid ahead of data in the form of advance Q4 GDP and initial claims even though a French bank is flagging mild month end selling for portfolio rebalancing purposes.

- CHF/EUR/JPY/XAU – The renowned, but not always reliable or consistent safe and pseudo safe havens are all outperforming, and particularly the Franc that has been flagging of late. Usd/Chf has retreated towards 0.9700 and Eur/Chf is back below 1.0700 as the single currency remains heavy on the 1.1000 handle within a spread of hefty Eur/Usd option expiries stretching from 1.0985 (1.3 bn) through 1.1000-05 (1.7 bn) to 1.1045-50 (1.1 bn). Note, firmer German state CPIs, solid jobs data and rather mixed Eurozone sentiment indicators have all hardly impacted, but the Euro did get a boost from more month end cross buying vs the Pound at one stage (into 9 am fix as usual). Meanwhile, the Yen has bounced over 109.00 ahead of a raft of Japanese macro releases and Gold remains bid between Usd1575-82/oz parameters.

- NOK/NZD/AUD/CAD/GBP – A triple blow for the Norwegian Krona as a steeper retracement in crude prices against the backdrop of heightened risk aversion combines with a big retail sales miss to propel Eur/Nok beyond resistance around 10.1200 and close to 10.1500. Similarly, the Kiwi, Aussie and Loonie have all declined through deeper chart support and/or significant levels vs their US counterpart, at 0.6500, 0.6737-25 and 1.3200 respectively, with the latter now eyeing Canadian average earnings for some independent impetus. Conversely, Sterling has staged a stoic recovery to reclaim 1.3000+ status in Cable terms and pare some lost ground vs the Euro within a 0.8454-87 band on short covering and position/hedge tweaking ahead of the BoE at high noon as expectations for a 25 bp rate cut or no move flit either side of evens – check out our full preview of super Thursday via the Research Suite.

- EM – More pain for regional currencies, but added angst for the Lira as the CBRT Governor echoes Turkey’s Finance Minister with regard to deeming the Try competitive at current levels (circa 5.9800), while maintaining projections for CPI to decelerate further and hit target over the forecast horizon.

- CBRT Governor says 2020 year-end inflation forecast mid-point 8.2% (Prev. 8.2%), 2021 mid-point at 5.4%, inflation is expected to stabilise around 5% target in the mid-term, downward trend in inflation expected to continue throughout 2021; Current dollarisation at 51% vs. 56% in May 2019, downward trend seen continuing. CBRT maintains their prudential stance.

In commodities, another downbeat session or the energy complex thus far, with prices weighed on by on the ongoing demand implication of the coronavirus, rise in US crude stocks as per yesterday’s DoEs and with the current sentiment also providing further pressure on the contracts. WTI Mar’20 futures found an overnight base at around 52.30/bbl ahead of the Monday’s (and January) low at 52.20/bbl, whilst its Brent counterpart hovers around the 59/bbl at time of writing, with support seen at 58.50/bbl – which marks the January low and has been tested twice this week. On the OPEC -front, the Algerian Energy Minister alluded to the possibility that the March confab will be brought forward to February amid the effect of the Wuhan flu on outbreak on prices, and added that an extension to the output cut pact is possible – no dates have been flagged for a February meeting yet. Moreover, OPEC members are said to be preparing a report on the virus’ impact on energy prices for members to review. Elsewhere, spot gold prices retain an underlying bid, part-aided by the FOMC’s decision yesterday ahead of today’s BOE and WHO presser. Copper prices sees continued downside pressure amid the ongoing coronavirus woes – on a sentiment and demand front with the latter a function of border closures to China.

US Event Calendar

- 8:30am: GDP Annualized QoQ, est. 2.0%, prior 2.1%

- 8:30am: Personal Consumption, est. 2.0%, prior 3.2%

- 8:30am: Initial Jobless Claims, est. 215,000, prior 211,000; Continuing Claims, est. 1.73m, prior 1.73m

- 9:45am: Bloomberg Consumer Comfort, prior 66

DB’s Jim Reid concludes the overnight wrap

As expected there wasn’t a great deal of new information to take away from the Fed last night although at the margin it did lean a touch dovish. That was certainly how bond markets felt with treasury yields ending the day a fair bit lower with 10yr yields trading at 1.563% this morning – including a move yesterday of -7.2bps – and to their lowest since early October. That leg lower also means yields are down an impressive -36.5bps from the December highs now.

The 2s10s curve also flattened -2.5bps to 16.5bps while Gold nudged up +0.62% – it’s sixth rise in the last seven sessions. Meanwhile, US equities were slightly firmer going into the meeting as they caught a tailwind from the various earnings reports – which seemed to offset the coronavirus headlines – however by the end of Powell’s press conference they had given up pretty much all of those gains. The S&P 500 actually closed slightly lower, down -0.09%, while the NASDAQ and DOW ended up a very modest +0.06% and +0.04% respectively.

As for the specifics of the Fed meeting, rates were left unchanged and there were a couple of small dovish tweaks to the FOMC’s statement. The first was that household spending was described as rising “at a moderate pace”, in contrast to the “strong pace” referred to in December. And the second change was that they said the current stance of policy was appropriate in supporting inflation “returning to the Committee’s symmetric 2 percent objective”. This is a change from last time, where the statement said “near the Committee’s … objective” instead. Chair Powell said in the press conference that the adjustment would underscore the commitment that the 2% target wasn’t a ceiling for the inflation rate.

In terms of policy changes, though they were secondary to the main decision, the interest rate paid on required and excess reserve balances was raised by 5bps to 1.60%, while the rate on the reverse repurchase-agreement facility was also raised by 5bps as well, up to 1.50%. In addition, the FOMC voted for the continuation of term and overnight repo operations at least through April, which had previously been through January. All-in-all our economists expect the Fed to remain on hold this year before cutting 50bps in 2021 in response to persistently below-target inflation, albeit with the risk of a rate cut sooner than they anticipate. See their full summary here.

At the press conference, Powell was asked about the coronavirus and its possible economic effects, saying in response that there was “likely to be some disruption to activity in China and possibly globally”, and that the Fed was “very carefully monitoring” the situation. That said, with a great deal of uncertainty over its eventual course, Powell said he was “not going to speculate”.

Speaking of which, yesterday we got wind that the World Health Organization’s International Health Regulations Emergency Committee would be gathering today over the question of whether to declare a public health emergency of international concern (PHEIC). The WHO emergencies chief said the few cases of human to human spread of the virus outside china in japan, Germany, Canada and Vietnam were of great concern and were part of the reason for calling today’s meeting. Prior to that a number of airlines confirmed that flights to China would be suspended including British Airways, Finnair and Lufthansa as well as some by American Airlines and Air Canada. Overnight, IKEA became the latest company to close all its stores in China beginning today. The governor of Hubei also confirmed that the virus outbreak in Huanggang is “especially severe” – the population for which is only slightly less than London. This morning the latest update is that the number of confirmed deaths is now at 170 (up from 132 yesterday) and confirmed cases at 7,783 (up from 4,515). Chinese universities, primary and middle schools and kindergartens across the country have now postponed the opening of the spring semester until further notice.

Markets in Asia have weakened in tow with the latest virus updates. The Nikkei (-2.00%), Hang Seng (-2.14%) and Kospi (-1.80%) have all seen sharp declines. Taiwan’s TAIEX index is down -5.69% having reopened post the NY holidays. As for FX, the offshore Chinese yuan is down -0.51% to 6.9873 while, the Japanese yen is up +0.12%. Meanwhile, crude oil prices are down around 1% this morning. It’s worth noting also that Samsung Electronics is down -2.88% overnight as the company reported a 39% drop in fourth-quarter net profit, albeit with forecasted improved market conditions in 2020.

After the close we’ve also had a number of high profile US earnings, with tech and industrials again the main focus. Facebook was down around 7% despite beating estimates on revenues and profits for the quarter, with concerns about growing expenses and low growth numbers. Conversely, Microsoft shares were up 4% post-announcement after rallying +1.56% intraday on a larger than expected beat driven by their cloud computing division. Tesla surged as much as 14% after beating expectations with a 2.14 EPS ($1.72 exp.), with the company expecting positive quarterly cash flow going forward “with possible temporary exceptions.” NASDAQ and S&P 500 futures are lower nevertheless, down -0.56% and -0.65% respectively as we go to print.

This followed broadly better than expected earnings reports yesterday. GE rallied +10.32% as the company continues their turnaround,reporting strong cash flows and revising next quarter’s guidance higher. McDonalds was another strong earnings performer, up +1.89% as price hikes helped offset declining store visits. Even a company that missed on earnings like Boeing was higher yesterday, up +1.66%, on a relief rally after 737 Max-related charges came in lower than analysts expected. However, stocks were not completely exempt from virus worries. Similar to Apple the night before, Starbucks management expressed some concerns over next quarter’s numbers after the coffee-maker decided to close more than half of their stores in China. SBUX was down -2.12% on the news even after beating analyst estimates with EPS of $0.79 ($0.76 expected).

Moving on, and next up in the central bank queue today is the BoE, in what should hopefully be a more interesting decision and is also Governor Carney’s last MPC meeting at the helm. The market is pricing in a 46% chance of a cut, though at one stage earlier this month we were pricing in just over a 70% chance before last week’s better than expected PMIs. Our economists expect a dovish meeting today with a 25bp cut, and believe that the case for a cut is strong. For one, there are clear signs of excess capacity in the economy. UK growth has been below potential for nearly two years and recent survey data continue to point to weaker growth. Importantly, inflation remains below the Bank’s 2% mandate (CPI came in at a 3-year low of 1.3% in December), with core CPI and services inflation relatively weak in spite of elevated unit labour costs. In addition Brexit uncertainty is here to stay.

Speaking of Brexit, the European Parliament voted in favour of the Withdrawal Agreement yesterday by a 621-49 margin ahead of the UK’s departure from the EU tomorrow. And in other European news, following the UK decision on Huawei the EU recommended limiting high-risk 5G vendors, including Huawei. EU governments will ultimately have the final word however. US Secretary of State Pompeo responded to the UK’s decision from the day prior by saying that “there is still a chance for the UK to relook at this as implementation moves forward” and also that “we should have western systems with western rules and American information should only pass across a trusted network”. Clearly tensions have been raised between the UK and the US in light of the decision however we have yet to have heard of any link to a trade deal.

Before we wrap up, prior to the Fed yesterday the data in the US included a December advance goods trade deficit of $68.3bn that was wider than expected, weaker than expected wholesale inventories in December (-0.1% mom vs. +0.1% expected) and very soft pending home sales (-4.9% mom vs. +0.5% expected) albeit data that tends to be fairly volatile. In Europe there wasn’t much to report datawise. The ECB’s monthly bank lending data was on the softer and while the bank credit impulse recovered, it still remains at a weak level.

Looking at the day ahead, the focus of the data in the US this afternoon is the advance Q4 GDP print (2.0% annualised qoq expected) while initial jobless claims will also be out. In Europe we’re expecting preliminary January CPI in Germany and January confidence indicators for the Euro Area. The aforementioned BoE meeting is the other big focus. Away from that the ECB’s Weidmann is due to speak while earnings highlights include Amazon, Visa, Roche, Verizon, Coca-Cola, Shell and Unilever.

Tyler Durden

Thu, 01/30/2020 – 08:03

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com