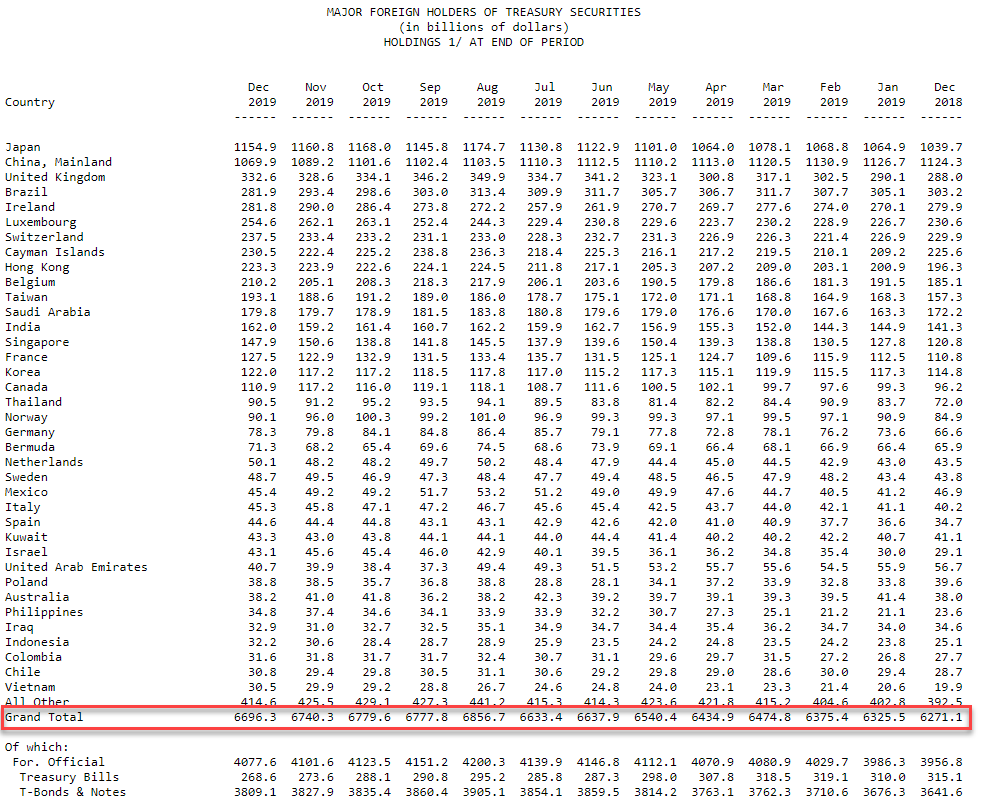

China Dumped Most US Treasuries In 18 Months In December

Foreign central banks have sold US Treasuries for the last 16 months (the last inflow was Aug 2018)

In fact, foreign central banks have only bought Treasurys in 6 in 63 months since Sept 2014.

China was December’s biggest seller, followed by Brazil, Luxembourg, and Canada.

China has dumped Treasuries for 9 of the last 10 months with December’s $19.3 bn sale the largest since July 2018…

Source: Bloomberg

Japan remains the largest foreign holder with $1.15 trillion, having added $115.2 billion over the year, but even they sold in December…

Source: Bloomberg

Overall, as Bloomberg notes, the pile of U.S. Treasuries held outside the country grew in 2019 to nearly $6.7 trillion from $6.3 trillion at the end of the previous year, as the government’s borrowing picked up to fresh record levels.

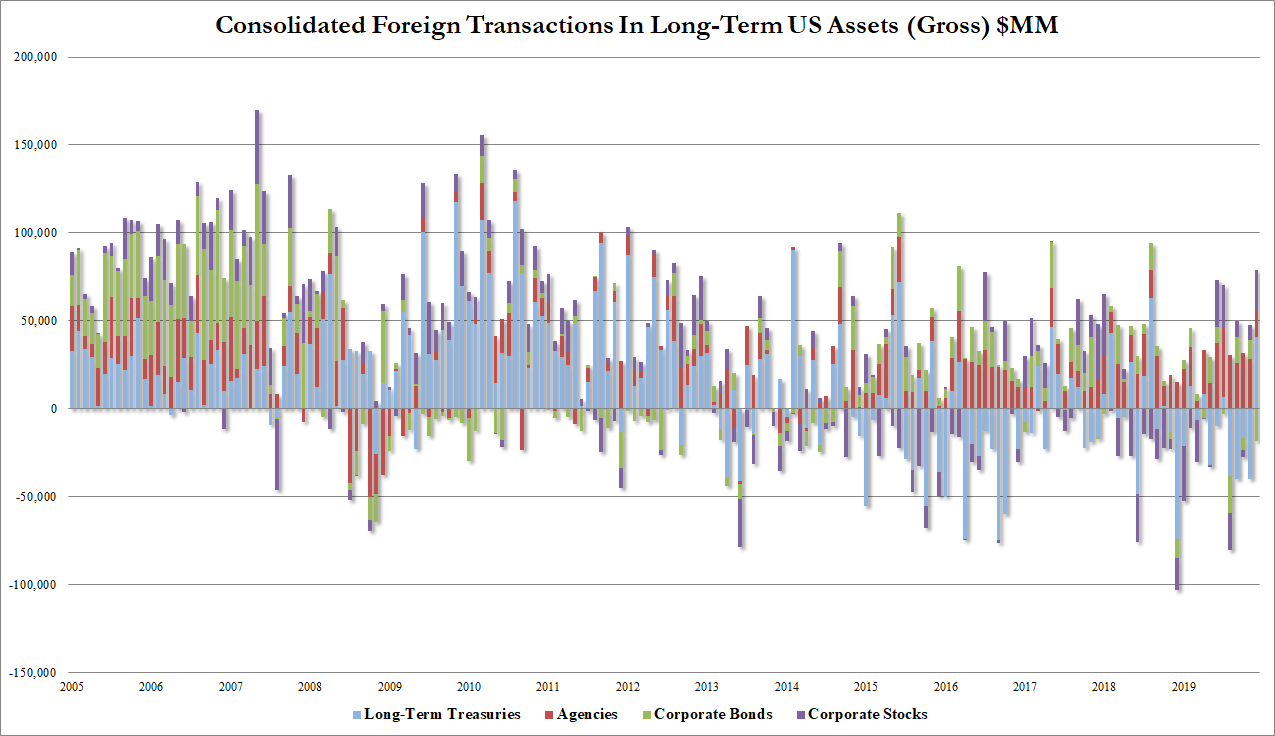

Foreigners bought a net of $60.7BN in long-term securities in Dec:

-

TSYs $41.1BN

-

Agencies $15.9BN

-

Corporate Bonds: -18.5BN

-

Stocks $22.2BN (most since July)

Exante’s Alex Etra says the clearest takeaway is that the investor base is shifting, with the share among global central banks sliding relative to private buyers such as pension funds and insurers, particularly in Asia’s larger surplus economies.

Tyler Durden

Tue, 02/18/2020 – 16:15![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com