US Producer Prices Rise At Fastest Pace In 9 Months As Service Costs Soar

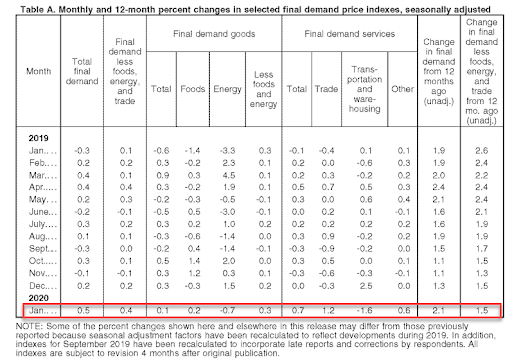

US Producer Prices spike 0.5% MoM in January, sending the Final Demand data up 2.1% YoY -the hottest inflationary print since April 2019.

Source: Bloomberg

Producer prices excluding food, energy, and trade services – a measure preferred by economists because it strips out the most volatile components – rose 0.4% from the prior month, the most since April, and 1.5% from a year earlier.

In January, 90% of the increase in final demand prices was due to a 0.7% jump in services costs.

Under the hood, there was some significant swings…

Final demand services: The index for final demand services climbed 0.7 percent in January, the largest increase since rising 0.7 percent in October 2018.

Forty percent of the January increase in the index for final demand services can be traced to margins for apparel, jewelry, footwear, and accessories retailing, which jumped 10.3 percent. The indexes for machinery and vehicle wholesaling; health, beauty, and optical goods retailing; inpatient care; guestroom rental; and portfolio management also moved higher. Conversely, prices for airline passenger services decreased 5.8 percent. The indexes for professional and commercial equipment wholesaling and for wireless telecommunication services also declined

Final demand goods: Prices for final demand goods inched up 0.1 percent in January, the fourth consecutive rise.

Product detail: A 13.9-percent rise for prices of iron and steel scrap was a major factor in the January advance in the index for final demand goods. Prices for fresh and dry vegetables; jet fuel; search, detection, navigation, and guidance systems and equipment; and grains also moved higher. Conversely, the gasoline index decreased 1.5 percent. Prices for chicken eggs, diesel fuel, and motor vehicles also declined.

Not much Goldilocks here for Powell to rely on – it’s all hot!

Tyler Durden

Wed, 02/19/2020 – 08:47![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com