Bank Of America: “We Are In A Global Recession”

The market scrambled to hit Michael Hartnett’s “S&P price target of 3,333 by March 3 ” more than a month early. And now comes the hangover.

With risk assets crashing, gold soaring, and bonds enjoying their biggest yield drop in years – if not ever -the time to pay the piper has come, and in his latest weekly Flow Show titled appropriately “Crashes, bubbles & leadership”, the Bank of America CIO shows the YTD cross asset performance, and it is a clear indication that a deflationary black swan has made a hard landing in the middle of Wall Street, with gold the best performing asset for the first time in a decade:

- gold 7.9%,

- government bonds 3.8%,

- IG bonds 2.8%,

- US dollar 1.0%,

- cash 0.3%,

- HY bonds 0.0%,

- global equities -4.8%,

- commodities -14.5% YTD.

Of course, for gold to be soaring, risk has to be crashing, and sure enough, the global equity market cap collapsed by a record $9tn – or two-thirds of China’s GDP – in 9 days, while developed market 10-year bond yields at 16bp, the lowest in 120 years.

It’s not a uniform puke in stocks, because while EU banks (SX7E -25%), US airlines (-30%) are in a bear market “meltdown” with laggards e.g. FAANG stocks, IG bonds, and “credit event” tells such as private equity (PSB), levered loans (BKLN) & CLOs (CLODI) vulnerable to policy impotence, recession, default, according to Hartnett, China stocks are back to old highs, although where they would be without now explicit government support is anyone’s guess.

But while governments may be buying risk assets to prop up markets, retail investors are puking, with $23.3BN in equity outflows (most since Aug’19), and $12.6BN in bond outflows, the most since Dec’18, as investors scramble for the safety of cash.

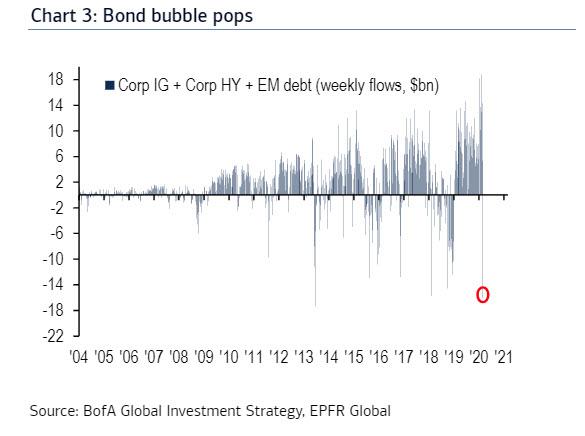

And speaking of bond flows, Hartnett concludes that the “bond bubble pops” with the 2nd biggest weekly outflow in IG/HY/EM debt ever of $16.1bn (biggest was 2013 Taper Tantrum )…

… and the 3rd biggest outflow from financials of $3.0bn (biggest was Dec’18 – Chart 5).

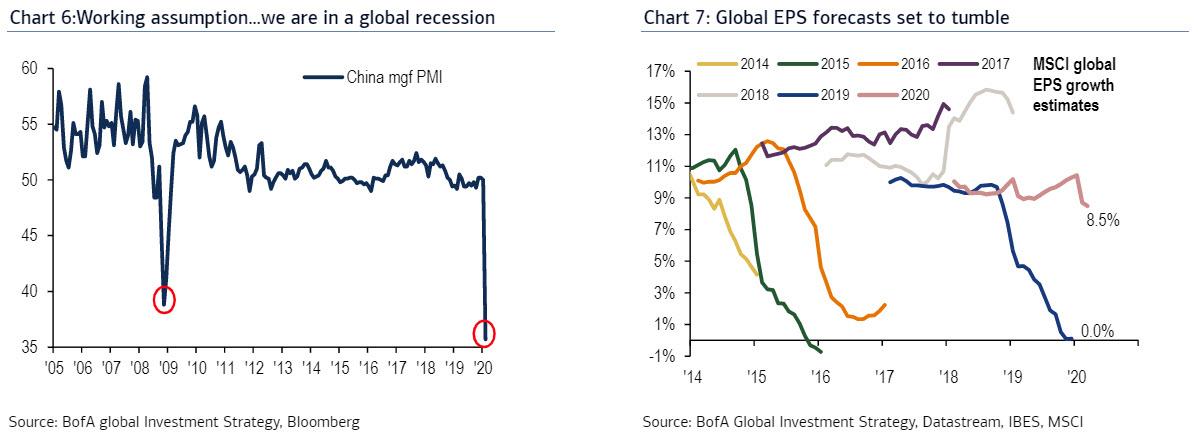

What does this unprecedented shift in investors sentiment mean for the global economy? Alas, nothing good: according to Hartnett, who may or may not speak for all of Bank of America, the “working assumption is that as of March 2020 we are in a global recession” (see PMI of world’s 2nd largest economy China – Chart 6); with the sharp drop in 2020 global EPS estimates (8.7%, down from 10.7%) just beginning (Chart 7).”

So with the economy now in a recession, the question is can it be “short-circuited” back into expansion? The answer will come from two distinct sources: US consumers and policy makers (i.e., monetary and fiscal policy):

- US consumers: they are the key to whether the global recession is measured in months not weeks. Key indicators here will be if small business confidence collapses below 100, and US jobless claims (currently 216k) surge above 250k; additionally, lower US mortgage purchase activity would be negative, especially in light of the record low yields; There are also political implications: the likelihood of Trump being re-elected (per Oddschecker.com) is dipping…Trump 58% (was 62% Fed 20th, Biden 36% (was 4%), Sanders 6% (was 17%).

- Policy makerts: One of Hartnett’s favorite sayings is that markets stop panicking when policymakers start panicking… and they have: 50bps Fed cut, 19 rate cuts YTD; fiscal $106bn pledge to counter Covid-19; but this time something is wrong – it does not appear to be working: the past week has seen biggest disconnect since 2008/9 between US banks relative performance & US yield curve steepening; until bond yield up and banks stocks up, policy makers “behind-the-curve”;

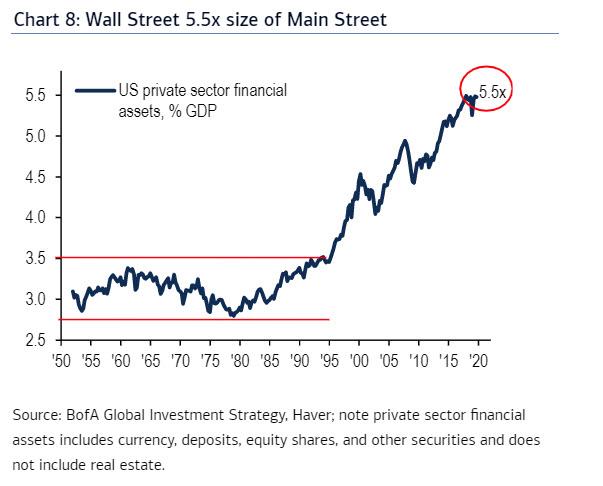

And here is why policymakers, and most notably Trump, need to push stock prices higher: as we have repeatedly shown in the past, Wall Street is 5.5x the size of Main Street (i.e., US GDP), and as such, the “easiest way to recession remains a sharp fall in asset prices.”

Those awaiting a Fed bailout can hardly be blamed – after all it has become an almost Pavlovian response: Black Monday 1987, LTCM 2008, 9/11 2001, Lehman 2008, US debt downgrade 2011 always caused the Fed to ease…

… as did the Covid-19 pandemic, resulting in a 50bps rate cut.

Yet this time may be different: after a decade of chronic central bank intervention to prop up markets, either CBs are out of ammo, or it no longer appears to be working. As Hartnett notes, “Wall Street era of excess liquidity giving way to debt deflation, policy impotence & Minsky moment or higher inflation, war on inequality and national insecurity; either way portfolio diversity (asset allocation of 25/25/25/25 bonds/stocks/cash/gold) likely to outperform today’s concentrated longs in QE winners (credit, private equity, tech) in coming years.”

While we wait for the Fed, there is a distinct shift in leadership as crash/recession concerns accelerate:

- Fed shift to YCC (Yield Curve Control, i.e. commitment to maintain Treasury yields within low range),

- peak US dollar (Bank of Japan announcement of YCC Sept’16 marked peak Japanese yen),

- shift from QE to Modern Monetary Theory to finance fiscal spending frenzy in coming quarters.

As such, the real question is what happens after the Fed’s imminent massive stimulus?

Well, as Hartnett concludes, crashes lead to bubbles or big leadership changes:

- Japan bubble followed ’87 crash,

- TMT bubble followed LTCM,

- US dollar peak & EM/commodity/China leadership after 9/11

- Lehman… end of Europe & global bank bulls

- US debt downgrade beginning of great credit & private equity boom.

Finally how to trade it: well, after Hartnett was right in his 3,333 S&P price target (which came well before his stated deadline of March 3, which ironically was the date of the Fed’s emergency rate cut), he now sees a stock drop as low as 2,880 as a good re-entry point in stocks:

Base case: adjust 2020 EPS of $175 to $160, apply policy reaction/bond yield collapse PE of 17-18X, suggests SPX 2880-3040 good entry point back into S&P500; policy panic has begun (and likely has further to go)…own barbell of extreme growth and extreme value…long US Tech/FAANG and long “value ghettos” of Asia cyclicals/FTSE/oil.

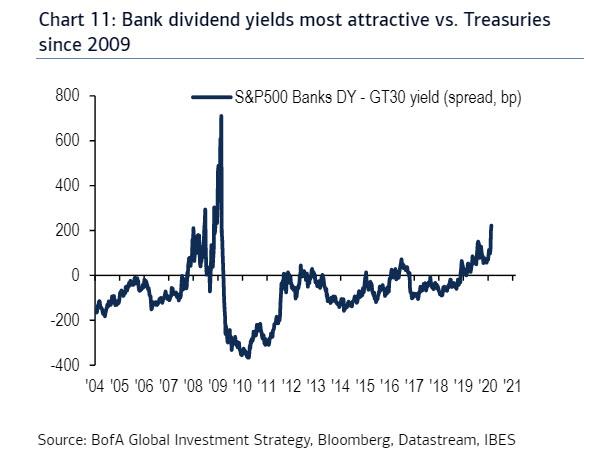

However, as he noted earlier, stocks will (should) no longer be a key pillar of portfolios. Instead, as we approach a crucial low in inflation expectations and rotation to weak dollar & inflation plays, investors should load up on gold, commodities, EM bonds, value stocks & high dividend yielding equities found mostly outside of the US market; today 41% (1149/2827) MSCI ACWI stocks have dividends yielding >3% global bond yields (16bp); even US bank stocks now have dividend yields of 250bps above Treasuries.

To this all we can say is that perhaps there is a reason why the risk premium has become so grotesque: perhaps the market, in suggesting a great depression is coming for profits, is right…

Tyler Durden

Fri, 03/06/2020 – 13:45![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com