Market Bottom Indicators #2 – Financials To Utilities Ratio

Submitted by Peter Garnry, head of equity strategy at Saxo Bank

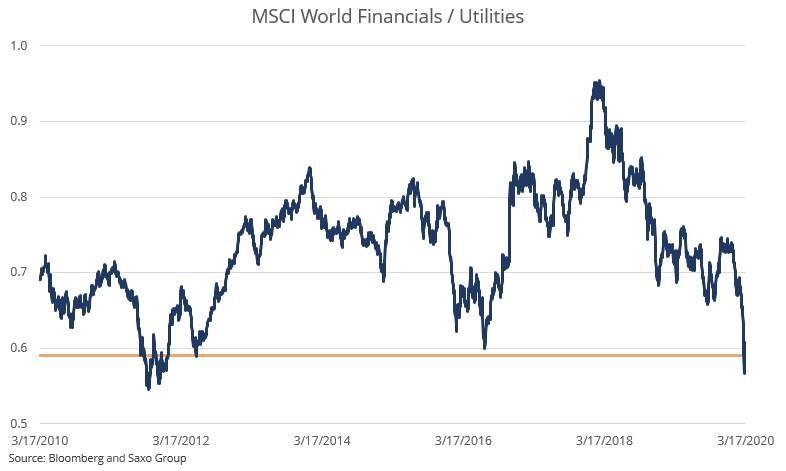

Summary: The current financials to utilities ratio has actually bounced off recent lows but given the recent volatility and bad liquidity in US Treasuries investors should be careful drawing conclusions just yet that the equity market has bottomed.

This is our second turning point indicators research notes. In our first research note we looked at the VIX futures term structure and volatility markets can help indicate market bottoms. In this research note we look at the financials to utilities spread ratio. Why is this spread interesting and relevant?

Financials and utilities are interesting against each other because both sectors are the most sensitive to changes and levels in interest rates, but importantly they react opposite to interest rates. Higher interest rates are negative for utilities as their long-term and very predictable cash flows get a lower present value. Financials gain from higher long-term interest rates as it steepens the yield curve and thus help banks expand their net interest margin improving profitability. Because these two sectors are so sensitive to interest rates but with the opposite force the spread ratio provides a very fast signal to investors from policy changes and their impact on interest rates and markets.

The current ratio is a bit higher than the recent bottom and could suggest a bottom in equities. However, with the extreme volatility and liquidity issues in the US Treasuries market we would be hesitant in drawing conclusions. A good sign would be to see an improvement in the volatility market. In the SaxoTraderGO the financials to utilities spread can be tracked by adding two instruments tracking the two sectors and then create a “Ratio” under the “Indicators” menu.

Tyler Durden

Tue, 03/17/2020 – 21:10![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com