$9,000,000,000,000: Former Fed Strategist Now Expects Fed’s Balance Sheet To Double This Year

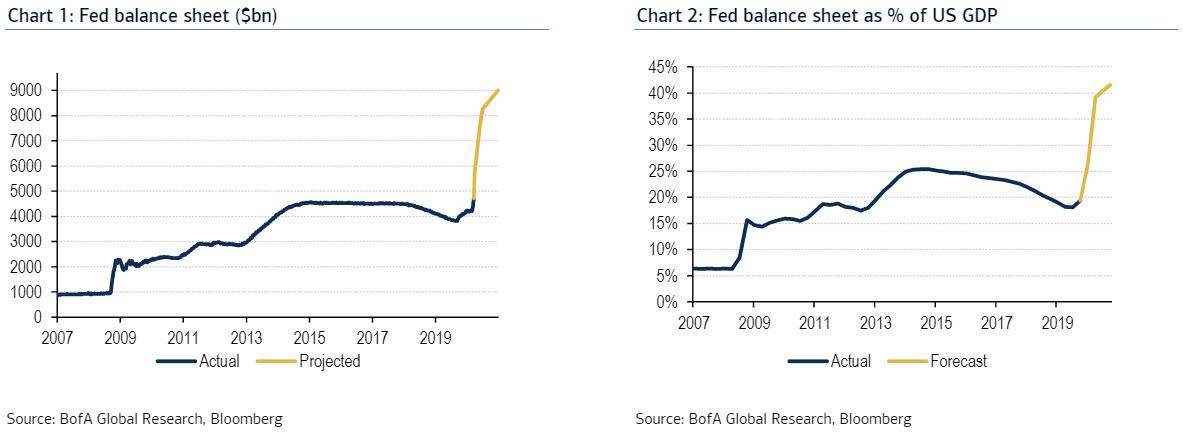

Late on Thursday, we calculated that as of the end of this turbulent week, the Fed will have added a record $625 billion to its balance sheet, bringing the total to $5.5 trillion, an increase of $1.3 trillion in two weeks (6% of GDP), which was the amount the Fed monetized during all of QE1 in response to the financial crisis, but which took place over a period of almost 2 years.

That’s just the start of what will soon become the most aggressive expansion in Fed balance sheet history because according to BofA’s Fed guru Mark Cabana, who was a former officer in the New York Fed’s Markets Group, the Fed’s balance sheet is now set to double to $9 trillion by the end of the year, to wit:

We acknowledge there is elevated uncertainty around the outlook for the balance sheet, but anticipate it will approximately double in size from end ’19 to end ’20.

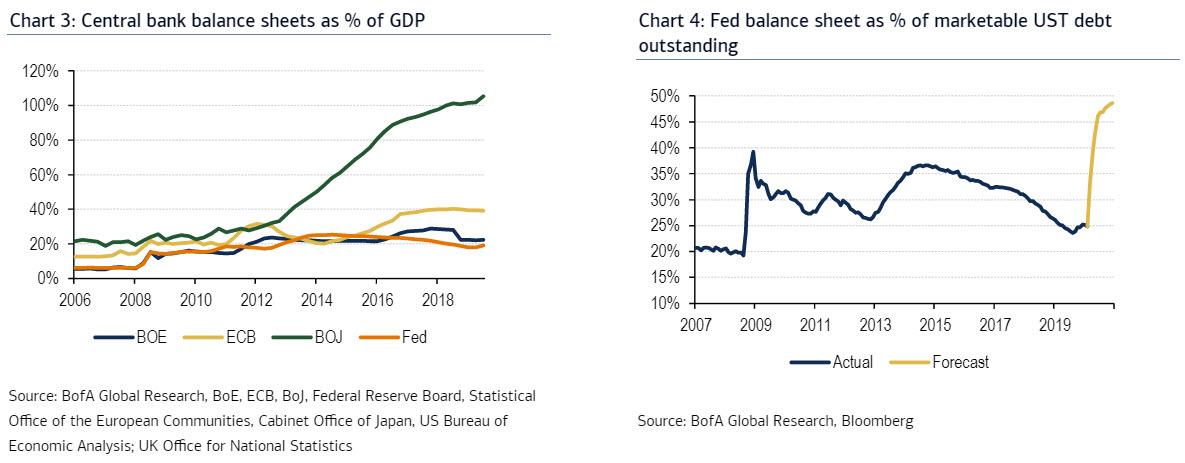

The estimates for the Fed’s balance sheet “after unlimited QE and new programs” currently imply that between end ’19 & end ’20:

- Fed balance sheet to US GDP will rise from 20% to 40%, in the process unleashing an unprecedented liquidity tsunami that will send asset prices soaring once the pandemic is over yet the Fed refuses to shrink its balance sheet (Chart 2)

- Fed UST as percentage of marketable debt will rise from 20% to 50%, in other words the Fed will now monetize all US Treasury issuance and then some (Chart 4)

- Fed UST holdings will increase by $1.8tn and agency MBS by $700+bn

- Reserves will increase three- to four-fold

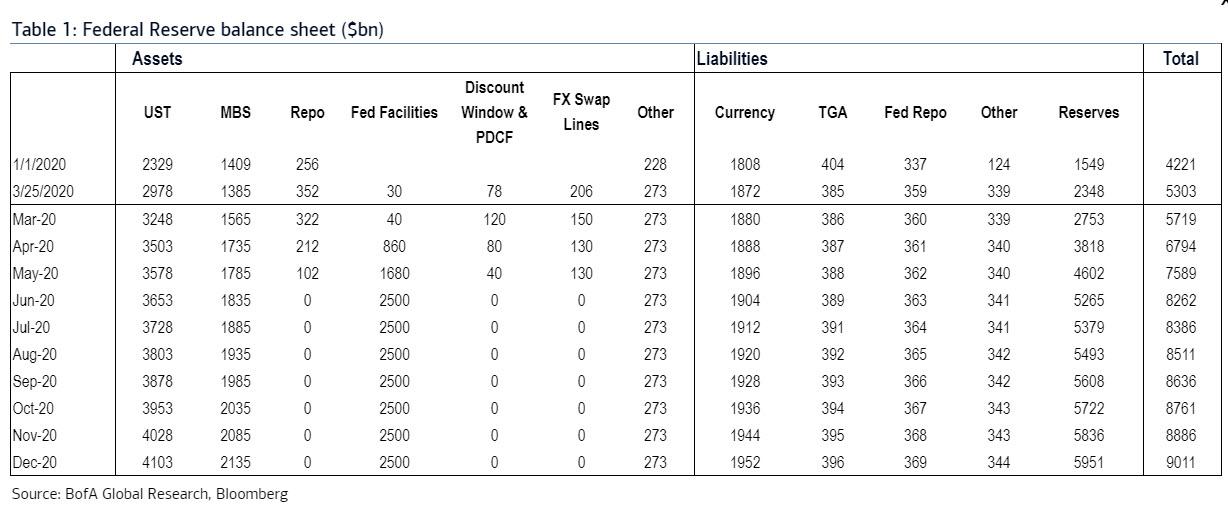

All of the above in table format:

To arrive at these estimates, Cabana make the following assumptions about Fed purchases and use of the Fed’s facilities:

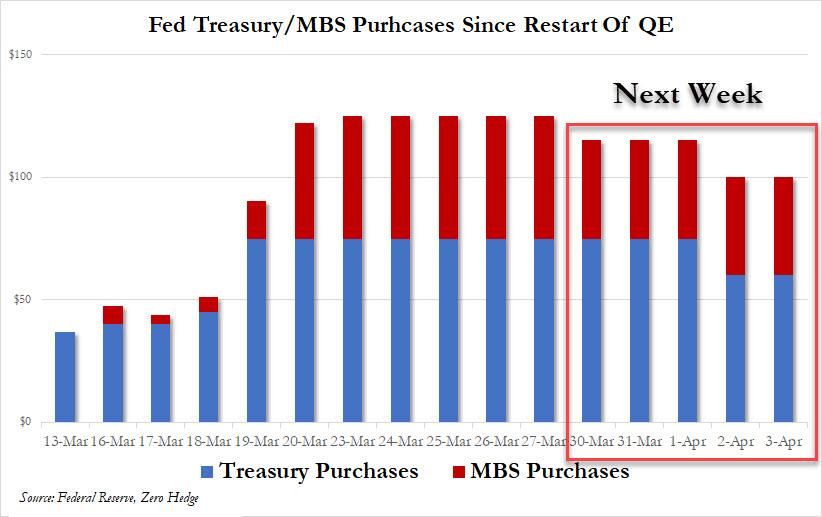

UST and MBS purchases: expect two phases:

- (1) initial bazooka to support market functioning. The Fed has purchased $75bn/day of USTs and $50bn/day of MBS. Through next week Cabana anticipates an average of $60bn/day of USTs and $40bn/day of MBS, which is fascinating because Cabana published this report in the early morning hours of Friday, and just a few hours later the Fed announced that it would follow precisely this schedule, tapering TSY QE from $75BN to $60BN and MBS from $50BN to $40, which announcement sent stocks sharply lower in the last 30 minutes of trading on Friday.

- (2) standard QE from April through December with $75bn/month of USTs and $50bn/month of MBS; this would help with the glut of upcoming UST supply.

Fed facilities – The Fed has announced five facilities: CPFF, MMLF, PMCCF, SMCCF and TALF. Treasury made an initial investment of $10bn in these facilities, which can be 10x levered. Congress is set to allocate another $454bn to the Fed facilities, which can be 10x levered. This implies the max size of these facilities is roughly $5tn, and BofA anticipates 50% takeup spread across three months. In ’08, TALF saw 35% takeup, so assume about 1.5x takeup of facilities now vs ’08 levels.

Discount window and PDFC – Assume discount window and PDCF use peaks at around $120bn in the near term then gradually declines.

FX swap lines – Assume FX swap line use peaks around $200bn, and current 84 day operations roll off in June.

While the former NY Fed staffer acknowledges that there is an elevated uncertainty around these estimates, he sees the risks to his estimates “as skewed to the high side.”

In short, once you start helicopter money you never stop.

* * *

Finally, what are the market implications from the Fed going full BOJ. There are three, as the Fed’s launch of helicopter money in conjunction with the treasury should support:

- liquidity – the sharp reserve increase will allow for funding markets to operate in state of abundant liquidity

- low long-term US rates – As even Cabana admits, “the Fed’s large holdings of US Treasuries will amount to COVID-19 stimulus debt monetization and support low longer-term UST yields”, in short after 11 years of debate whether the Fed is or isn’t monetizing debt, we finally have a clear answer and guess what, the tinfoil conspiracy blog won.

- Corporate bonds (i.e. LQD) will benefit from Fed credit programs.

One final point: buy physical gold, lots of it (pay whatever premium over spot is asked), because the real purpose behind the Fed’s helicopter money which miraculously came at the “right” time – just as the economy was about to tailspin into a recession even without covid-19- courtesy of a virus which prompted a coordinated global reset and the launch of helicopter money, will allow the Fed to commence the endgame of fiat currencies. In the process, the Fed will inject $4.5 trillion into capital markets which will eventually trickle down to the economy.

The endgame is simple: an initial deflationary bust followed by hyperinflation, first in asset markets and soon after, as the Fed triples down on helicopter money until it eventually buys gold outright in the final dollar devaluation, everywhere else.

Tyler Durden

Sat, 03/28/2020 – 19:10![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com