Morton’s Parent Scrambles To Reopen Frozen Loan Market With Record-Yielding 15% Secured Paper

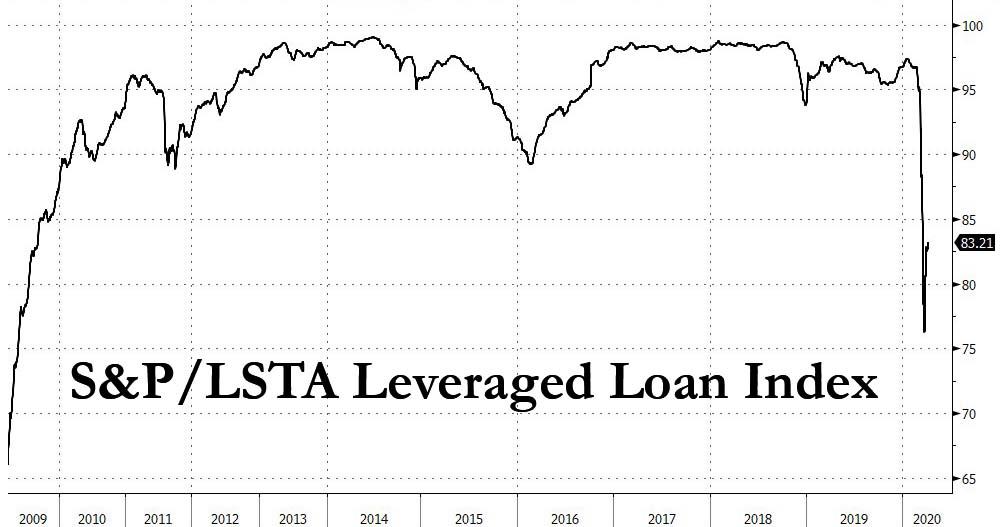

While investment grade bonds have recouped most of their early March losses thanks to the Fed’s takeover of the IG bond market now that the NY Fed, via Blackrock, is purchasing the LQD ETF as well as bonds in the open market, the junk bond market has yet to rebound although it is the leveraged loan market that is hurting the most, with the S&P/LSTA index trading a 83 cents of par most recently, still a post crisis low.

Worse, for the past month the loan market which despite being secured is even more illiquid than junk, has been frozen without a single issuers coming to market.

That changed today when Texas billionaire Tilman Fertitta, owner of casinos and such restaurants as Mortons, Mastro’s and hundreds of others, tried to become the first to end the near one-month drought in the U.S. leveraged loan market with a deal to boost liquidity for his hospitality empire ravaged by the coronavirus.

Landry’s, which is the parent company of Golden Nugget casinos and hundreds of restaurants including Chart House, Saltgrass Steak House, Bubba Gump Shrimp Co., Claim Jumper, Morton’s The Steakhouse, McCormick & Schmick’s, Mastro’s Restaurants, is hoping to crack the leveraged loan ice by offering investors a record interest rate of 14% over Libor for a $250 million loan, Bloomberg reported citing “people familiar with the matter.”

The deal, which is being underwritten by the B2/B focused, middle-market titan Jefferies, a long-time go to bank for Fertita, is offering a spread which according to Bloomberg would be the highest ever on a leveraged loan excluding companies in bankruptcy.

Which such an unprecedented yield on paper that is secured? Because the paper is secured by assets that may well be bankrupt in months, if not weeks: Landry’s told investors it is seeking the funds to increase liquidity as it navigates the impact of the Covid-19 outbreak on its business. The pandemic has brought the travel and leisure industry to a near standstill, leaving Fertitta’s businesses shuttered and burning cash with thousands of lay-offs.

In effect, the $250MM, 14%, non-call 2 term loan is a quasi-priming DIP loan with the option to take over the company in bankruptcy.

A lender meeting for the paper which matures in October 2023 took place at 2 pm New York time Monday, somewhere close to Jefferies office on 52nd and Madison. Based on initial discussions with investors, the loan will have a 1% Libor floor (just in case the Fed goes NIRP in the next few years) and may be offered at a discount of about 96 cents on the dollar, which would push the already record yield to an all-in total well above 15%!

Leveraged loans have been slower to recover from the recent turmoil than than the high-yield bond market, which reopened last week as we reported at the time. Borrowers have sold debt to replenish credit lines that they’ve been forced to draw during a credit freeze and to shore up liquidity. Some, like Landry’s, are effectively pre-selling a DIP should the company have no choice but to file, which also explains the record yield on what is otherwise secured paper.

Tyler Durden

Mon, 04/06/2020 – 21:08![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com