Insiders “Bought The Dip” In Record Numbers

What a difference 6 months makes.

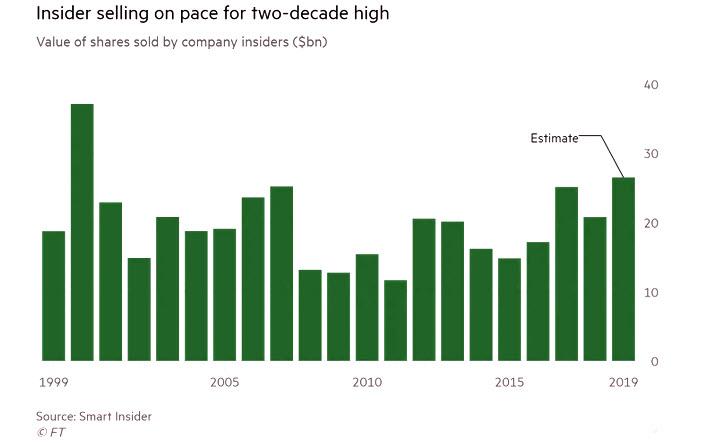

Back in September, shortly after the Fed unleashed the “Not QE” meltup in markets (which despite the Fed’s most valiant effort to pretend was not QE ended up being steamrolled by the unlimited QE which has since bought $2 trillion in Tsys and MBS in the past 2 months), we wrote that when it comes to the “fair value” of stocks, nobody knows it better than insiders, who tend to aggressively offload shares any time they see the price of their equity holdings as generously high. Which, as we pointed out, was a problem for the bulls as “executives across the US are shedding stock in their own companies at the fastest pace in two decades, amid concerns that the long bull market in equities is reaching its final stages.”

To wit: at the end of Q3 2019, corporate insiders – CEOs, CFOs, and board members, but also venture capital and other early state investors – sold a combined $19BN of stock in their companies YTD. Annualized, this had put them on track to hit $26BN for the year, which would mark the most active year since 2000, when executives sold $37bn of stock amid the giddy highs of the dotcom bubble. That 2019 total would also set a post-crisis high, eclipsing the $25bn of stock sold in 2017.

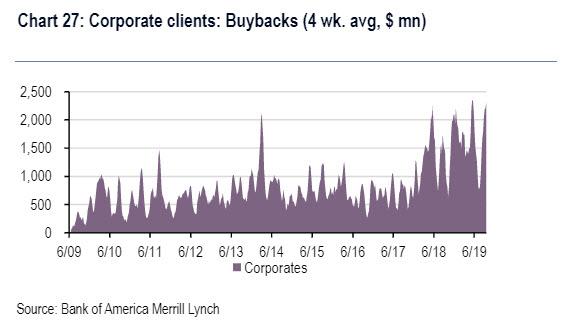

In retrospect, insiders knew perfectly well what they were doing, and thanks to record corporate buybacks around that time, insiders had a perfectly willing buyer: their own companies.

Ironically, it is those same insiders who are now begging the government to get bailed out, because to fund this this buyback flood execs issued so much debt – as we have repeatedly documented – that these companies are now unviable without bailouts. Ironically, while there has been lots of discussion of forgiving corporate buyback stupidity, nobody has mentioned anything about C-suite clawbacks from management that sold record numbers of shares to their own companies. We hope that changes soon.

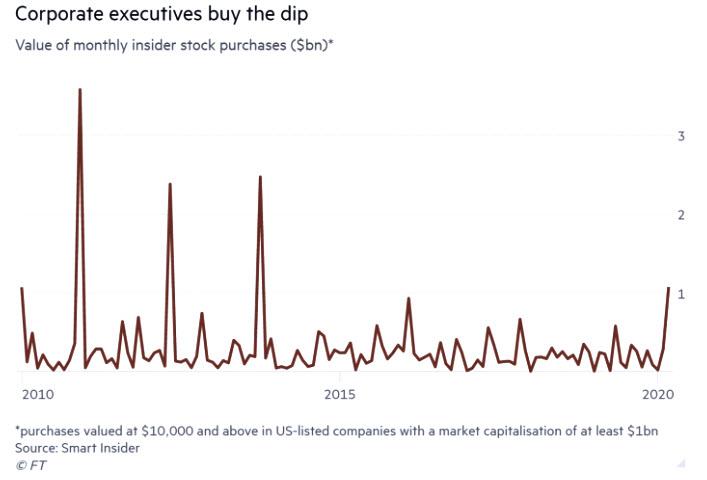

In any case, six months after they dumped their own stock to never before seen levels, insiders are back and this time they are buying their own stock in record amount, taking advantage of the sharp plunge in stock prices or perhaps just correctly anticipating that the Fed would inject, both directly and indirectly, over $4 trillion in liquidity.

According to Smart Insider, whom we quoted back in September to highlight the record insider selling, in March insider buying from CEOs, CFOs and board directors at big US public companies hit $1.1bn, the most since 2013…

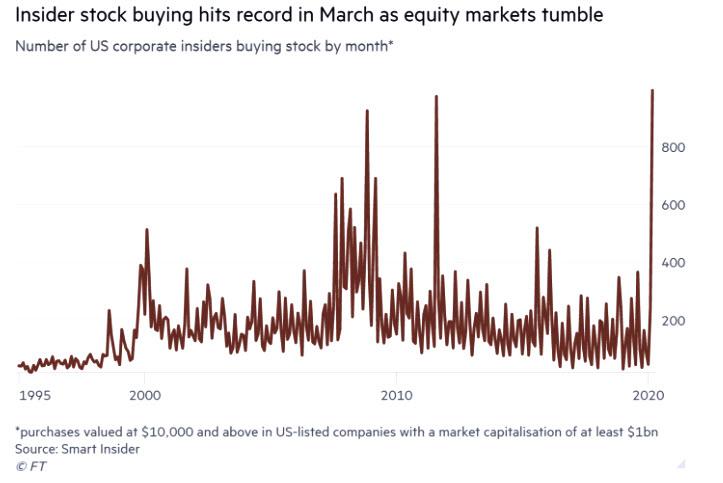

… with purchases coming from at least 994 executives, an all time high in the data running back to 1990.

And since insider buying is closely tracked by investors to gauge the levels of confidence in boardrooms, according to the FT it helps explain a 25% gain in US stocks since March 23 that has partially reversed the rapid decline that began in February. Curiously, the FT did not have a similar analysis that when it pointed out back in September the record insider selling levels, but anyway…

One of the most active buyers of stock was Charlie Scharf, the new CEO of Wells Fargo; he bought $5 MM of the bank’s stock last month, which has already given him a paper gain of about $275,000, helped by a big rise in the stock this week after its main US regulator lifted restrictions that were imposed after a series of scandals after the bank said it can’t help main street unless the Fed raises the limits on growth it had imposed on the criminal bank.

If the recovery continues, the chief executive’s purchase could mirror Jamie Dimon’s 2016 deal to buy $26m of JPMorgan Chase shares, which coincided with a bottom in bank stocks (more specifically, it coincided with the Shanghai Accord, which was an unspoken agreement between financial officials to backstop the global economy; these days such accords are much more in your face and take place on a daily if not hourly basis).

Another big spends was Richard Kinder, chairman of energy group Kinder Morgan, who buying $14MM of his stock last month, the biggest insider purchase in March. The company’s shares have lost almost 30% this year and touched the lowest level in March since listing in 2011. The company faces the twin challenges of a weaker oil price and big hits to economic activity from coronavirus.

According to the FT, Brett Icahn, son of the billionaire Carl Icahn, was the second heaviest spender. He purchased $11MM of stock in consumer goods maker Newell Brands, whose shares are down almost 30% this year. Brett joined the board at Newell last year after his father’s company, where he also works, took a large equity stake. Carl Icahn, who is not considered an insider, also purchased $35MM of Newell stock in March through investment funds he controls, according to filings with the US securities regulator.

Unlike Scharf, Kinder and Icahn have lost money so far on their March purchases based on last week’s stock prices.

While the insider buying alone does not explain the recent market rally, but “adds to the sense that market participants are feeling that the worst is behind us”, said Alicia Levine, chief market strategist for BNY Mellon Investment Management, who also was strangely quiet when investors were selling in droves, because apparently it is only when insiders are buying that it is a forward looking indicator. “People think they can see the other side of the curve” she added forgetting that just 6 months ago insiders seeing the crash yet we fail to find any comments from her warning her clients to sell.

Tyler Durden

Sat, 04/11/2020 – 15:40![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com