Futures Slide With Dismal Earnings On Deck

S&P index futures declined as much as 1% on Monday along with Asia stocks (Europe was still closed for Easter) after a torrid 27% rally last week, with investors bracing for what will be the worst earnings season since the financial crisis. Even if EPS do not drop by as much as the 9% consensus is expecting, the decline will last into all of 2020 and the S&P is now more overvalued based on forward earnings that it was at the February all time highs…

… and traders may be starting to realize that.

The benchmark index ended a holiday-shortened week on Thursday with its biggest weekly percentage gain in more than four decades as the Federal Reserve rolled out trillions of dollars to backstop businesses. Exxon Mobil Corp fell about 1%, while Chevron rose 0.5% and Apache Corp shed 3% in thin premarket trading.

Earlier in the session, the MSCI’ index of Asia-Pacific shares ex-Japan lost 0.3%. The Nikkei fell 1.9%, South Korean shares dropped 1.3% while China’s CSI300 index lost 0.5%.

Asia’s main ex-Japan stocks gauge is up 18% from a four-year low struck around mid-March following unprecedented global stimulus. But the index is off about 18% so far this year as investors are unconvinced that the worst is over for the markets.

Most markets in the region were down, with South Korea’s Kospi Index dropping 1.9% and India’s S&P BSE Sensex Index falling 1.7%, while Thailand’s SET gained 0.2%. The Topix declined 1.7%, with Pipedo and Hokko Chem falling the most. The Shanghai Composite Index retreated 0.5%, with Jiangsu Chengxing Phosph-Chemicals and Join. in Holding posting the biggest slides

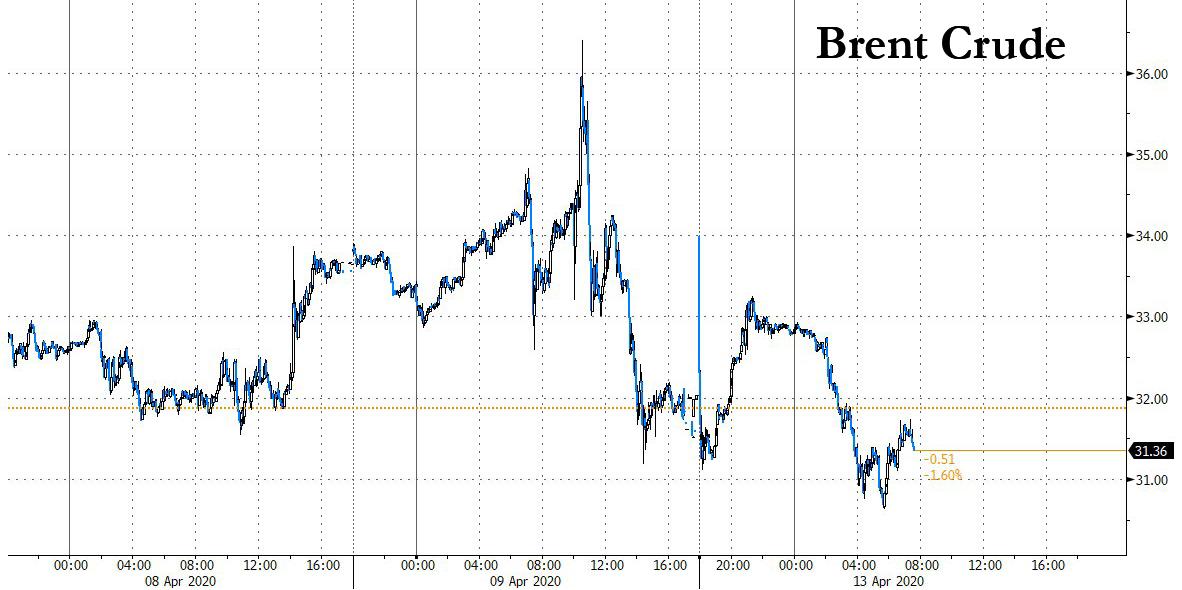

Meanwhile, over the weekend, major oil producers agreed to their biggest-ever output cut, which however traders also now realize will not be enough (as Goldman calculated, it only pulls out a little over 4mmb/d in supply in a market that has over 30mmb/d less demand) and crude prices were subdued – trading unchanged from Friday’s close – on concerns even that would not be enough to head off oversupply with the health crisis hammering demand.

Brent futures were unchanged, trading around $31.30 or largely unchanged from Friday’s close; oil prices have slumped more than 50% from their January peak as the novel coronavirus pandemic brought the global economy to a standstill and hit fuel demand.

“The combined OPEC+ and G-20 cuts should set in place a bottoming process for oil prices and significantly limit the tail risk of free-falling into the single digits in our view,” Bank of Singapore, the private banking arm of OCBC, said in a report.

Elsewhere, US Congress faces intense pressure to negotiate an interim rescue package this week as the pandemic’s impact accelerates across the country. Seventy coronavirus vaccines are in development globally, with three already being tested in human trials, the World Health Organization said.

Notably, Dr. Anthony Fauci said that parts of the U.S. may be ready in May to ease emergency measures taken so far. But there’s also the possibility of a Covid-19 rebound in the fall which could be a factor in November’s elections, he said.

“While panic selling we saw last month has faded, not many investors would want to chase stock prices higher given we are about to see more evidence of economic downturns,” said Masahiro Ichikawa, senior strategist at Sumitomo Mitsui DS Asset Management.

With earnings season kicking off this week, investors will be hoping to get a sense of how bad the hit to global earnings could be as the coronavirus upends the world’s economies. Without an effective therapy or a vaccine for the novel coronavirus, the U.S. economy could face 18 months of rolling shutdowns as the outbreak recedes and flares up again, Federal Reserve Bank of Minneapolis President Neel Kashkari said. JPMorgan Chase and Wells Fargo will kick off the corporate earnings season on Tuesday, with analysts expecting first-quarter earnings at S&P 500 firms to fall 9% compared with a Jan. 1 forecast of a 6.3% rise.

Companies are only now adjusting their behaviour to deal with an expected global recession, which the International Monetary Fund (IMF) has said will be “way worse” than the global financial crisis a decade ago.

In FX, commodity currencies were softer while the safe-haven yen strengthened while the dollar erased earlier declines against other major currencies. The Australian dollar fell 0.2% to $0.63337. The euro stood steady at $1.0937 and the yen gained 0.5% to 107.91 to the dollar.

Market Snapshot

- S&P 500 futures down 1.1% at 2,748.50

- MXAP down 0.6% to 140.65

- MXAPJ down 0.2% to 454.93

- Nikkei down 2.3% to 19,043.40

- Topix down 1.7% to 1,405.91

- Hang Seng Index up 1.4% to 24,300.33

- Shanghai Composite down 0.5% to 2,783.05

- Sensex down 1.5% to 30,707.55

- Kospi down 1.9% to 1,825.76

- Brent Futures down 1.4% at $30.99/bbl

- Gold spot down 0.3% at $1,691.46

- U.S. Dollar Index down 0.1% at 99.39

Top Overnight News

- The world’s top oil producers pulled off a historic deal to cut global petroleum output by nearly a 10th, putting an end to the devastating price war that brought the energy industry to its knees

- The world’s ability to check the coronavirus contagion and fully recover from the worst peacetime recession since the Great Depression may depend on what international economic policy makers decide this week

- U.K. Prime Minister Boris Johnson praised doctors for saving his life during his week-long hospitalization for Covid-19 treatment that has left him too weakened to resume immediate leadership of the government

- The Bank of Thailand is studying a number of unconventional policy options, including a large-scale asset purchase program and some form of yield-curve control, if they become necessary, a senior official said

Asian equity markets were subdued amid the holiday-thinned conditions and oil price volatility, while coronavirus concerns also lingered after the US recently suffered the highest number of coronavirus daily casualties and surpassed Italy with the largest total death toll of more than 22k. US equity futures were also lacklustre after they shrugged off opening gains alongside fluctuations in oil prices following the OPEC+ breakthrough with Mexico in which producers agreed to cuts of 9.7mln bpd for May-June and suggested that total global oil cuts effective next month will total more than 20mln bpd, although oil prices briefly turned negative as some were not convinced including Goldman Sachs which suggested the deal was insufficient and that the cuts were too little too late. In terms of the regional indices, Nikkei 225 (-1.1%) was lacklustre amid the coronavirus-related disruptions to industries and unfavourable currency moves, while KOSPI (-1.0%) and Shanghai Comp. (-0.3%) were also downbeat with the latter not helped by PBoC liquidity inaction and the absence of participants in Hong Kong, which alongside Australia, New Zealand, UK and EU all observe Easter Monday holidays. Finally, 10yr JGBs were relatively unchanged despite the humdrum tone in the region and BoJ’s presence in the market for nearly JPY 1tln of JGBs with 1yr-10yr maturities.

Top Asian News

- The World’s Biggest Pork Producer Is Warning of Meat Shortfalls

- Hedge Funds Stay Bearish on Aussie Dollar as Recession Looms

- China Startups Tumble After Regulator Says Investors Misled

- Japanese Stocks Slide on Stronger Yen, Lower Hope for BOJ Move

Europe remained closed for Eeaster

US Event Calendar

- Nothing major scheduled

Tyler Durden

Mon, 04/13/2020 – 08:08![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com