Boeing Debt Explodes After Sale Of $25BN In 7x Oversubscribed, Junk-Like Bond Offering

Who could have known that instead of asking for taxpayer bailouts, all Boeing – whose market cap is now far below that of Tesla – had to do to replenish much needed liquidity, was to come to the Fed-backstopped bond market.

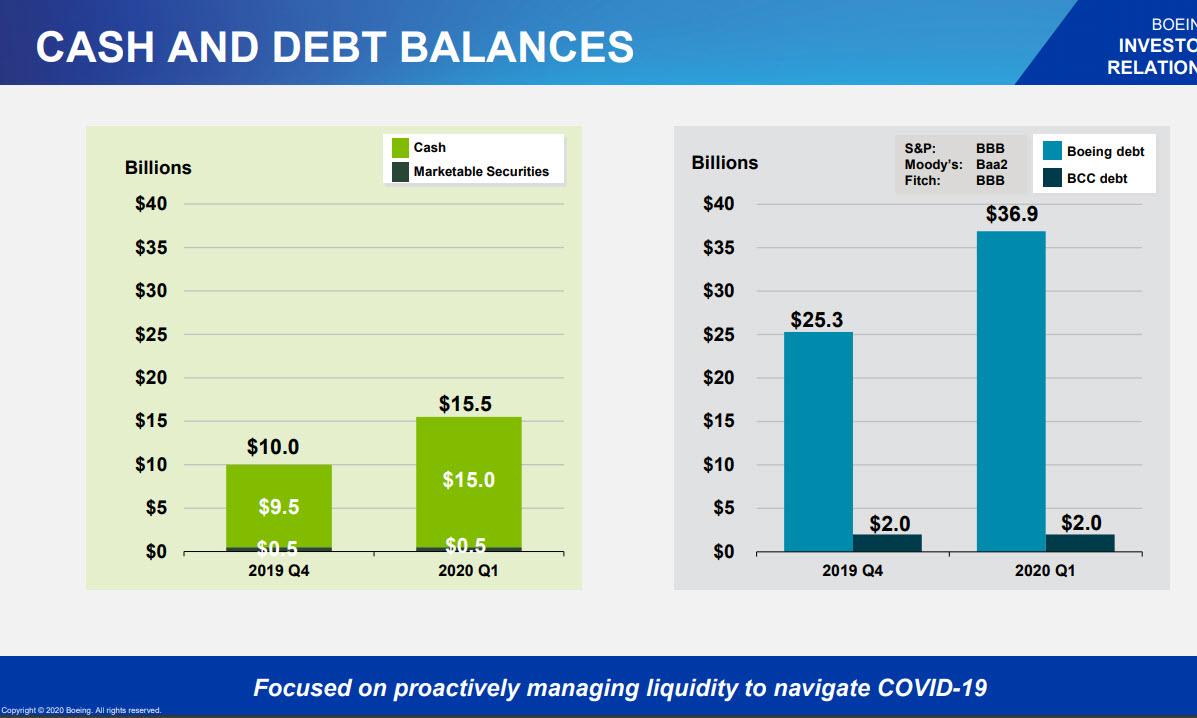

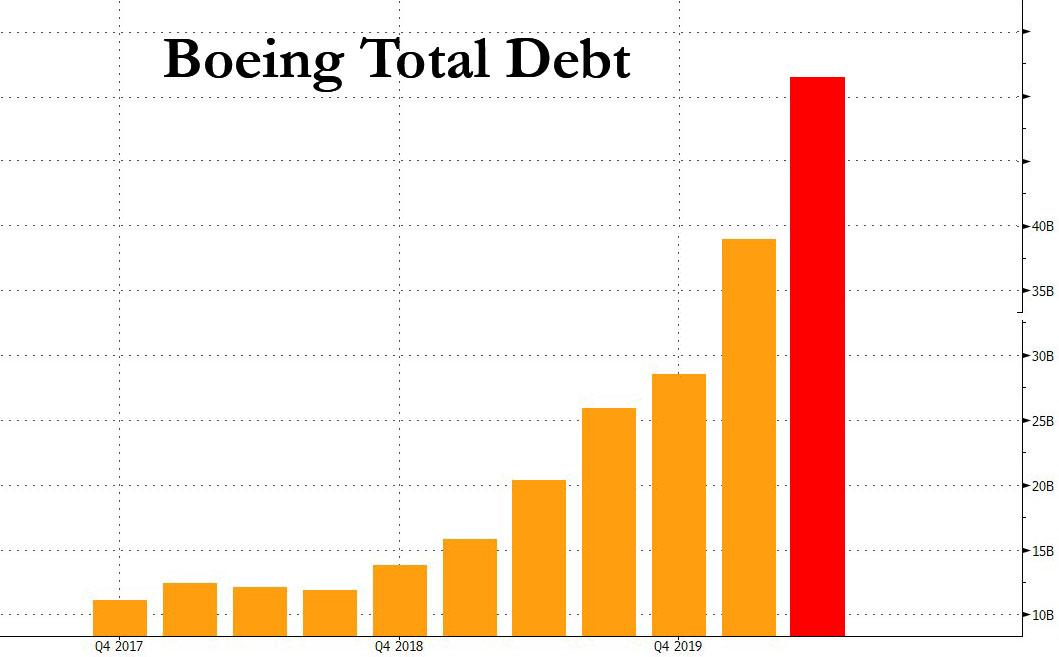

One day after S&P downgraded Boeing to just one notch above junk, or BBB-, as a result of the company’s massive debt load which was a record $38.9 billion as of the end of Q1…

… the Baa2/BBB- company added another $25 billion in debt to its balance sheet, effectively assuring that it will be downgraded to junk in the coming months. But what is fascinating is how easy it was for the soon-to-be fallen angel to issue the debt.

According to Reuters, Boeing approached the market targeting a $10BN in new debt. However, after a brief but successful roadshow, Bloomberg reported that the company had received $70BN in orders for its offering. The massive, 5x oversubscribtion meant that the company could upsize the offering at will, and what was originally a $10BN bond sale ended up being $25BN – the largest offering this year – across seven tranches, with initial price talk as follows:

- 3yr T+425bp

- 5yr T+450bp

- 7yr T+450bp

- 10yr T+450bp

- 20yr T+440bp

- 30yr T+450bp

- 40yr T+462.5bp

Those initial risk premiums are more in line with junk-rated companies, and will “get the greed juices flowing,” said David Knutson, head of credit research for the Americas at Schroder Investment Management.

Boeing had already fully drawn on a nearly $14 billion term loan which it needed to fund its operations at a time when the entire ec0onomy had virtually shut down, and Thursday’s bond sale will add even more cash as the company received $70 billion of orders at the peak, according to a Bloomberg source.

Assuming roughly $24 BN in net proceeds, Boeing’s new cash balance will be $40BN. It will, however, also have a record $63BN in debt as shown below.

The extra liquidity will provide “solid upside” to Boeing’s stock, Bernstein analysts led by Douglas Harned said in a report Thursday. Creditors however were less amused at the surge in leverage, and its existing bonds traded lower, with debt maturing in 2050 and 2059 quoted at less than 80 cents on the dollar.

None of this mattered to new bond investors however, who assumed that the Fed will backstop Boeing’s debt – after all it was IG at time of issuance, and nothing else matters.

In other words, if it was the Fed’s intention to make the current bond bubble much, much bigger, it has succeeded.

Tyler Durden

Thu, 04/30/2020 – 14:04![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com