“A V-Shaped Recovery Will Not Be Possible”: Today’s Job Losses Reflect A 40% GDP Crash

Now that the worst jobless print and unemployment rate in US history are in the record books, the next questions are i) what does this mean for the US economy and ii) how long before things revert back to normal.

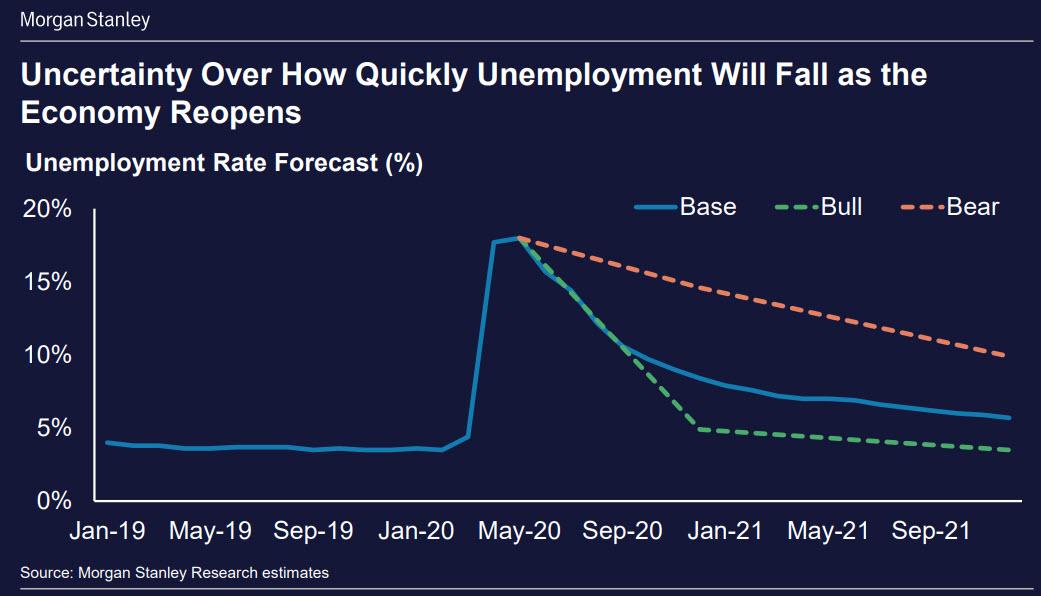

Addressing the second question first, Morgan Stanley earlier this week laid out three scenarios, a bull, base and bear case. What is notable is that even the bull case sees a full recovery only in 2021. The base case tacks on another year to the recovery while the bear case sees double-digit unemployment into 2022 and onward.

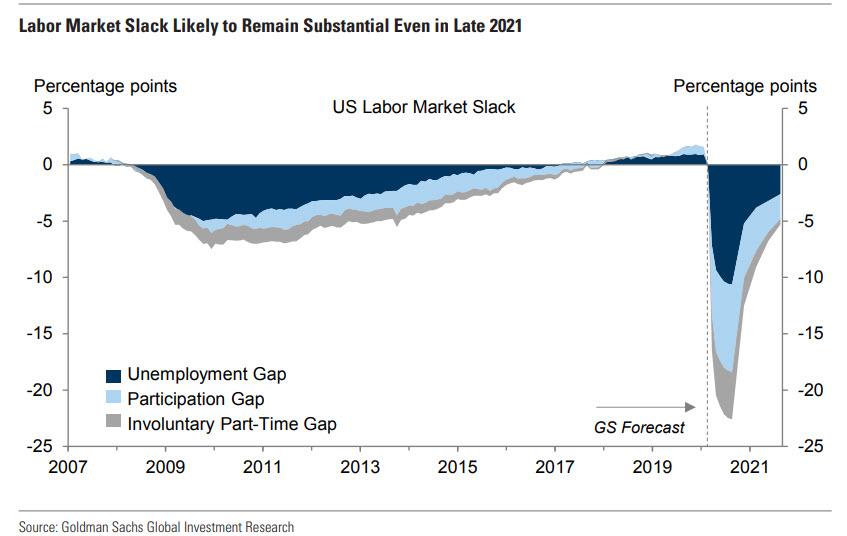

Goldman agrees with Morgan Stanley, and even in its optimistic report that the US has now moved past the bottom (assuming the is no second round of closures in late 2020), the bank expects labor market slack to remain substantial even in late 2021 and entering 2022.

The bottom line here is that contrary to expectations for a quick return to normal, it will take years (if ever) before the unemployment rate recorded in late 2019 is back.

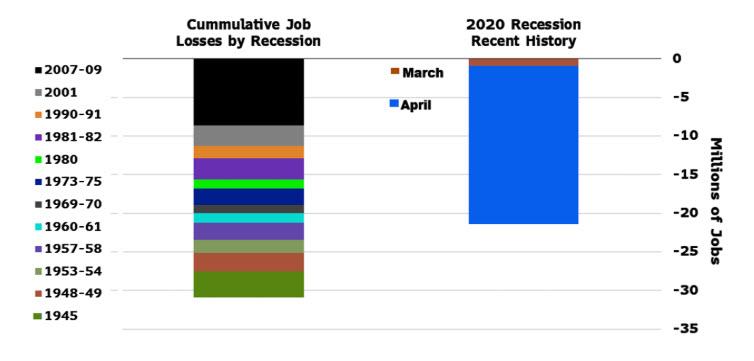

As for the first question, namely what is the economic impact from today’s catastrophic jobs report, here is the answer from Bloomberg’s Economic team:

“The extent of job losses is consistent with Bloomberg Economics’ modeling of a near 40% contraction in real GDP for the quarter. While layoffs were concentrated in sectors such as restaurants, hospitality and leisure, losses occurred in nearly all subcategories.”

As Bloomberg concludes:

“the breadth of job losses is a jarring signal of the massive challenge of restarting vast swaths of the economy – not just a few sectors – and it therefore serves as a stark indication that a ‘V-shaped’ recovery will not be possible.”

Meanwhile, stocks are now higher than they were a year ago, when the unemployment rate was about 3.5%. Thanks Fed.

Tyler Durden

Fri, 05/08/2020 – 10:41![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com