As World Braces For US-China Trade War Fireworks, This Is How One Bank Is Trading The Coming Conflict

Tyler Durden

Sun, 05/17/2020 – 14:20

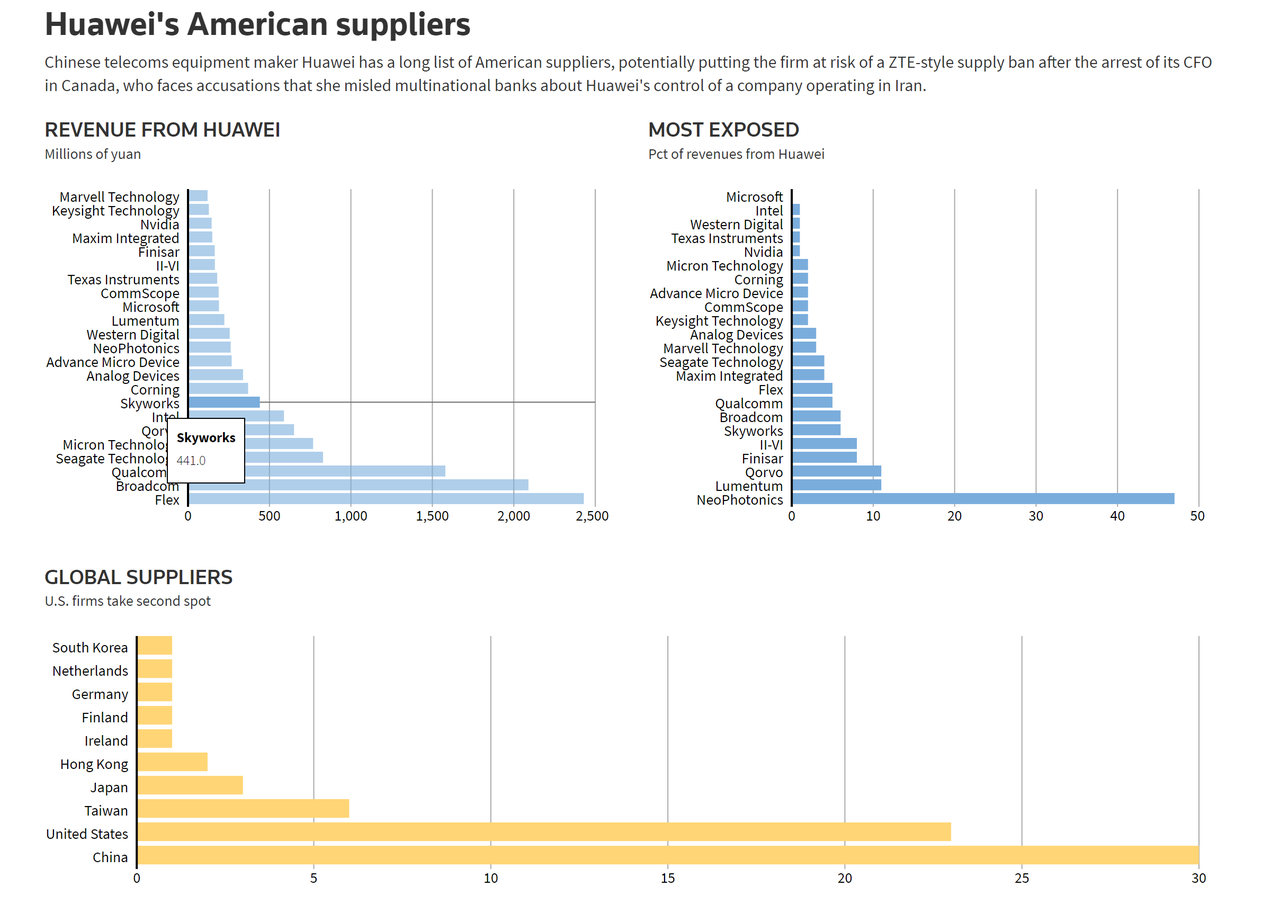

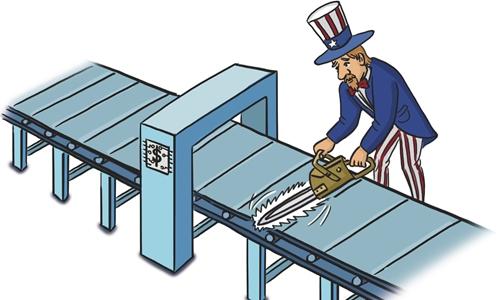

On Friday there was a startling escalation in the trade and tech war between the US and China, when the Trump administration moved to block global chip supplies to blacklisted telecom equipment company Huawei Technologies, spurring fears of Chinese retaliation and hammering shares of U.S. producers of chipmaking equipment. The rule change was designed to be a major blow to Huawei, the world’s no. 2 smartphone maker, and to disintermediate the Chinese telecom conglomerate from global supply chains.

The escalation was preceded one day earlier by Trump warning that he could “cut off the whole relationship” with China as he blames Beijing for the global spread of the coronavirus, in what is now a clear pre-election gambit where Trump is aggressively adopting an anti-China stance: “There are many things we could do,” Trump told Fox Business’ Mornings With Maria on Thursday. “We could cut off the whole relationship. Now if you did, what would happen? You’d save $500 billion.”

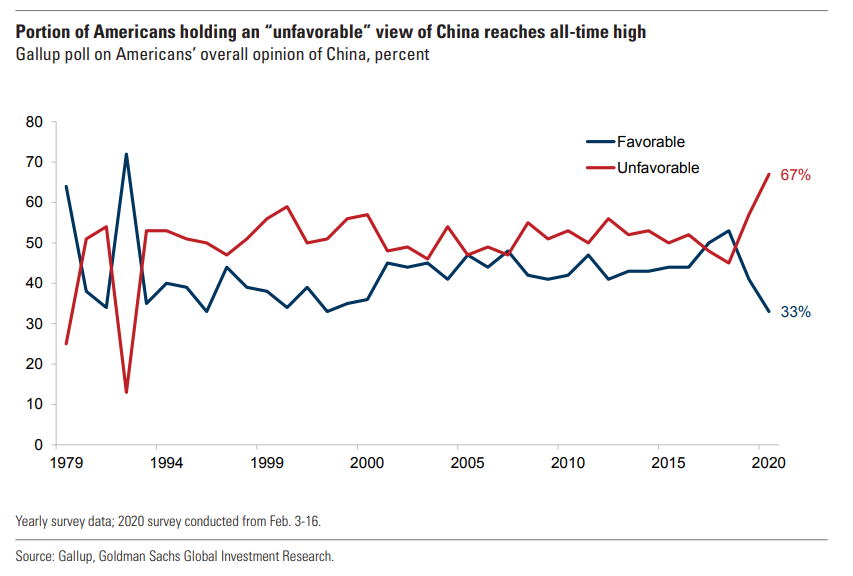

There is a very simple reason for Trump’s anti-Chinaese posture: in a nation that seems impossibly divided on most issues and is ideologically polarized more than ever in history, on Friday we showed that China is the one thing that more than two-thirds of Americans can agree on, and they agree that they simply do not like China. Looking at the chart below, Goldman said that the upcoming US presidential election, “coupled with deteriorating sentiment towards China among Americans, will make it harder for US policymakers to strike a conciliatory tone on China.”

Of course, it will only get worse if and when China responds and retaliates, which it now appears set to do. On Sunday, China’s commerce ministry said it is firmly opposed to the latest rules by the United States against Huawei and “will take all necessary measures to safeguard Chinese firms’ rights and interests.” The ministry said in a statement that it urges the United States to immediately stop the wrong actions, referring to the lockout of Huawei, which went into effect on Friday but has a 120-day grace period.

On Friday, China’s state-run newspaper Global Times, citing an unidentified source, reported in response to the new limits on Huawei, Beijing was ready to put U.S. companies on an “unreliable entity list” as part of its countermeasures. Those countermeasures include launching investigations and imposing restrictions on U.S. companies such as Apple, Cisco Systems and Qualcomm.

“The U.S. has utilized national power and used the so-called national security concern as an excuse, and abused export controls to continue to suppress some particular companies in other countries,” China’s commerce ministry said in today’s statement.

The bitter tirades continued on Sunday, when the Global Times published an op-ed in which the author accused the US of “re-constructing the industrial chain of global semiconductors in a bid to fully control it from design to assembly and testing, which has been dubbed as semiconductor nationalism.”

Not that there is anything inherently wrong with that, of course, and is the most logical strategy in a trade war. China is just disappointed it failed to get there first, because as we have been writing since late 2018, when it comes to the technological arms race, one place where China is badly lagging the US, is in the production of semiconductors, which is also China’s biggest weakness in its ongoing scramble to catch up with the US technologically.

The Chinese media outlet admits as much, writing that “although the US had experienced a large-scale deindustrialization in the second half of the 20th century, it still maintains advantages in the semiconductor sector with companies such as Intel, which could complete the whole process of the chip design to producing. The country has held on to cutting-edge semiconductor manufacturing techniques over the past decade.”

It then adds that “against the backdrop of intensifying tech protectionism, countries and regions, including China, need to get ready to deal with the enhancing anti-globalization and switch development strategies from integration to independent development.

Countries such as the US and Japan, which are at the upstream of the global semiconductor industry chain, are showing increasingly stronger intention of anti-globalization now. The US government is in talks with chip manufacturing giants Intel and Taiwan-based TSMC, seeking to set up new chip factories in the US to realize self-sufficiency, according to the Wall Street Journal.

The Global Times then correctly notes that China’s semiconductor sector “has faced a crackdown by the US government since the trade war and companies in business with Western firms are seeing rising risks of cutting off technology cooperation.”

Under such circumstances, China should switch its strategy from integration with the international mainstream to independently develop own core technologies. While on the other hand, it should step up efforts to promote cooperation among different parts of its semiconductor industry and try to independently develop instead of pursuing advancement of a single technology.

This suggests that regardless the outcome of the coronavirus pandemic, globalization is doomed in its current iteration as China reels in any global supply chains while seeking to build out its own semiconductor industry, one which is on par with that of the US, Japan or Taiwan.

* * *

Rhetoric aside, it’s what China does that matters, and picking up on our observationsabout Trump’s motivations to escalate the feud with Beijing, Nordea’s Andreas Steno Larsen writes that the question is what happens to that most direct indicator of diplomatic tensions between the US and China, the yuan exchange rate, next.

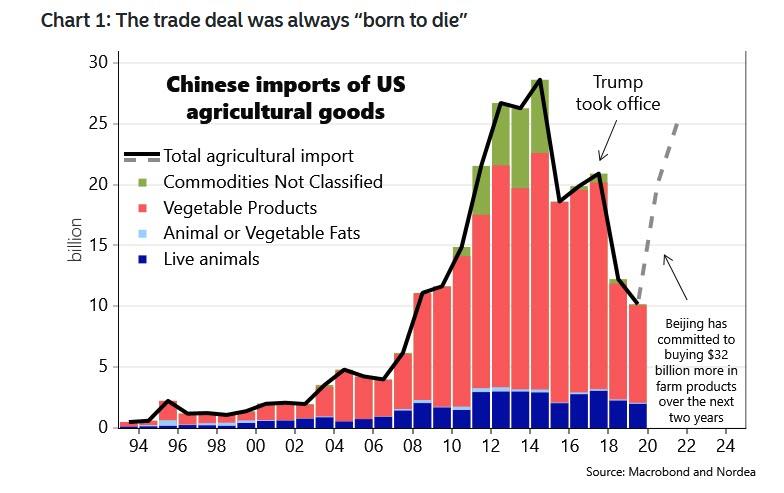

But first, let’s remember that the catalyst that pushed the US stock market 30% higher in 2019 (as earnings were flat), namely the “Phase One” trade deal with China, is now officially over or as Larsen puts it, “the trade deal between US and China was stone dead from the outset, as e.g. the USD 32bn increase in agricultural purchases (from a base below USD 10bn) was almost practically impossible to implement due to low commodity prices. When Corona entered the lime-light (maybe China already knew about Corona by the time of the signing ceremony), it was essentially 100% certain that none of the thresholds in the trade deal would be met.“

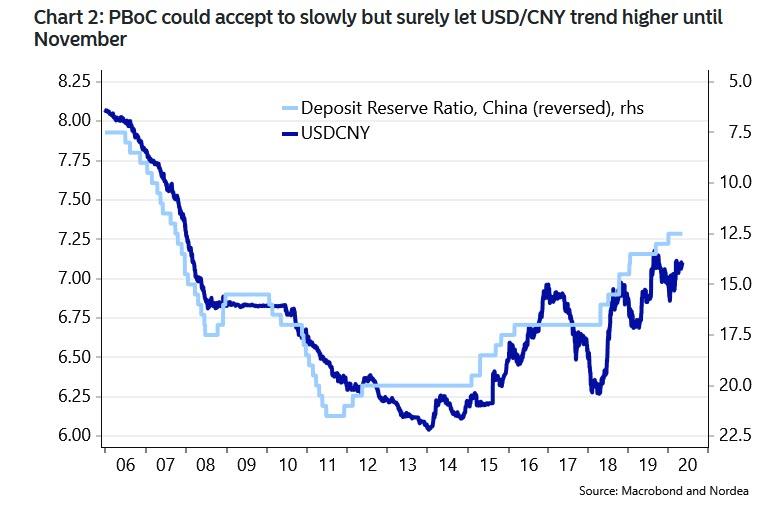

As such, the FX strategist would be surprised “if the PBoC didn’t allow USD/CNY to slowly but surely pave its way higher towards November, given the crystal-clear risk of a re-escalation of the tariffs war and continued issues of re-booting credit growth in China.”

In short, “more PBoC easing and more exported disinflation coming up”, and that’s ignoring the war of words between Trump and Xi, which is getting more bitter by the day.

Finally, how is Nordea trading this coming battle in the US-China trade war: “We buy USD/CNH with a target of 7.3850, and a S/L at 6.9520.”

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com