Oil Soars, Prompt WTI Contango Disappears As Chinese Oil Demand “Almost Back To Pre-Crisis Levels”

Tyler Durden

Mon, 05/18/2020 – 08:53

After plunging more than 20% in Q1 due to the economic shutdown from the coronavirus pandemic, Chinese oil demand is now “all but back to levels last seen before Beijing imposed a national lockdown to fight the coronavirus outbreak” Bloomberg reported citing people with inside knowledge of the country’s energy industry, who may or may not be long oil futures.

Gasoline and diesel are leading the recovery in China as commuters prefer the safety of their own cars, rather than using public transport, while jet-fuel demand has remained subdued.

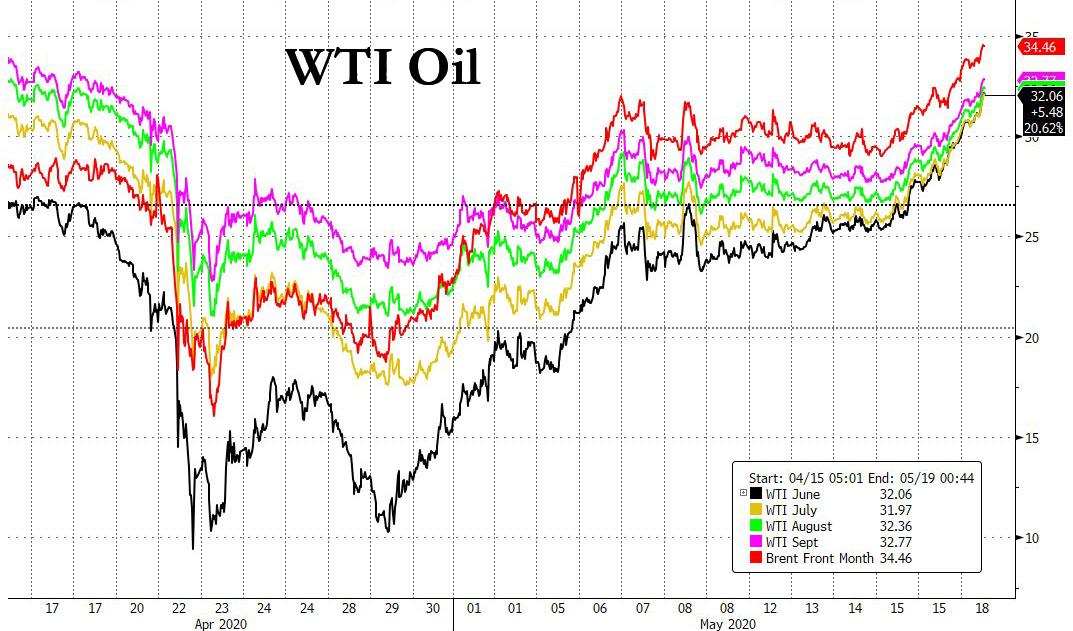

The quick turnaround in China, the world’s second largest oil consumer behind only the U.S., has helped tighten the petroleum market sooner-than-expected, and the result is a sharp rally in West Texas Intermediate crude, which a month ago plunged into negative prices and last traded above $32 a barrel.

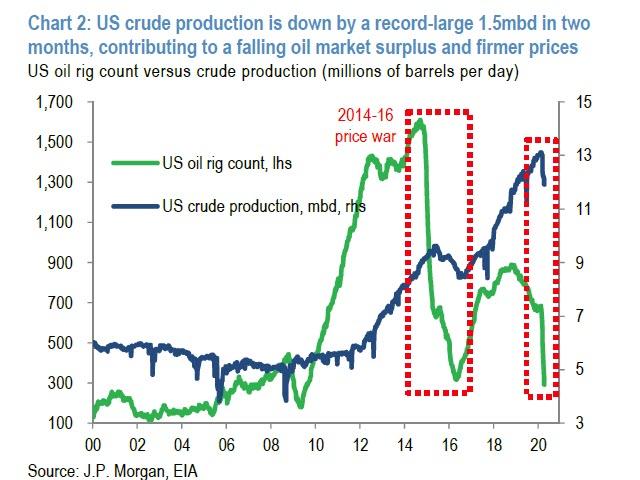

Helping the impressive rebound in oil is the accelerating shutdown in US crude production, which as shown below is down by a record 1.5mmb/d in the past two months, helping reduce supply and firm prices.

According to Bloomberg sources, Chinese consumption of gasoline and diesel has fully recovered as factories reopen and commuters drive rather than use public transport, according to the people, who are long crude asked not to be named because they aren’t authorized to discuss the matter publicly.

The same “people” adds that while pinpointing the exact level of Chinese oil demand in real time is a difficult exercise, executives and traders who monitor the country’s consumption said it was at about 13 million barrels a day, just shy of the 13.4 million barrels a day of May 2019 and 13.7 million barrels a day of December 2019. The overall number would be higher were it not for jet-fuel demand, which is still running well below a year’s ago level, as a result of a continued slump in both domestic and international air travel.

Unlike the “unnamed people” who may or may not be long oil on Monday (before they dump it and change their mind), the International Energy Agency is far more pessimist about Chinese consumption. In a report last week, it predicted that the Asian giant will consume less oil every month for the rest of the year than it did during the same period of 2019.

To reach their optimistic conclusion, the “people” are likely looking at rush hour traffic data (provided publically by TomTom International) in multiple Chinese cities , which has surged in the last couple of weeks, in many cases running either at or even above year-ago levels, according to data from navigation company TomTom International BV. The traffic has particularly intensified in cities other than Beijing and Shanghai, which typically have more space for the drivers that are now using their cars to commute into work.

At the same time, diesel demand is also recovering strongly as Beijing encourages farmers to plant more to guarantee the country’s food security and industrial consumption recovers. The uptick in China’s gasoline and diesel consumption has prompted state and independently-owned refiners to crank up run rates to convert more crude oil into fuel. That means Chinese crude stockpiles are actually being drawn down.

As Bloomberg also notes, Chinese oil refiners had in recent days embarked on a buying spree, snapping up barrels in the physical market, prompting prices to recover. “The Chinese are buying everything in sight,” said a senior executive at a major trading house.

The price of crude that’s popular with Chinese refiners, including Lula from Brazil, Djeno from the Republic of Congo, and Oman has rallied so far this month. A month ago, Lula changed hands at a discount of about $6 a barrel under the benchmark Brent. On Monday, one Chinese company bought a cargo at around $1-$1.50 a barrel premium to Brent, traders said.

“China’s oil demand is starting to show optimistic signs of full recovery, led by diesel,” said Liu Yuntao, a London-based analyst with consultant Energy Aspects.

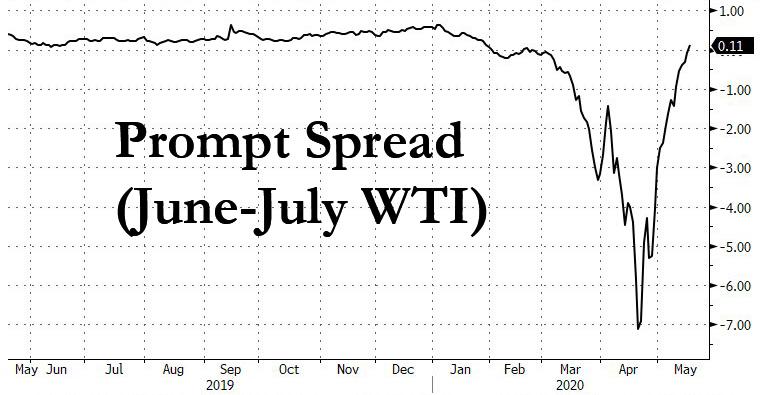

And as optimism returns to the oil market, and as prices soar, what was until a few weeks ago a super contango in the prompt Jun-July spread is now back to backwardation, which is making the storage of oil on tankers increasingly unprofitable.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com