SoftBank’s Latest Presentation: A Surreal Slideshow Of Unicorns Running, Plunging, Flying

Tyler Durden

Mon, 05/18/2020 – 14:45

Going into today’s Softbank results, we knew they would be catastrophic, and sure enough the company did not disappoint (the bears), when the poster child for all that is wrong with the central banks’ “everything bubble” (and the company which last October we said would be the “bubble era” short of the century) reported this morning that it lost 1.9 trillion yen ($17.7 billion) in 2019 after writing down the value of its numerous “unicorn” investments, including WeWork and Uber Technologies.

The company posted an overall operating loss of 1.36 trillion yen in the 12 months ended March and a net loss of 961.6 billion yen, confirming preliminary earnings results released last month. The losses are the worst ever in the company’s 39-year history.

As Bloomberg adds, the company’s $100 billion “unicorn incubator”, the Vision Fund, went from the group’s main contributor to profit a year ago to its biggest loser. Uber’s disappointing public debut last May was followed by the implosion of WeWork in September and its subsequent rescue by SoftBank. The plunge in Uber’s share price was responsible for about $5.2 billion of Vision Fund’s losses in the period, while WeWork contributed $4.6 billion and another $7.5 billion came from the rest of the portfolio, SoftBank said. The $75 billion the Vision Fund has spent to invest in 88 companies as of March 31 is now worth $69.6 billion.

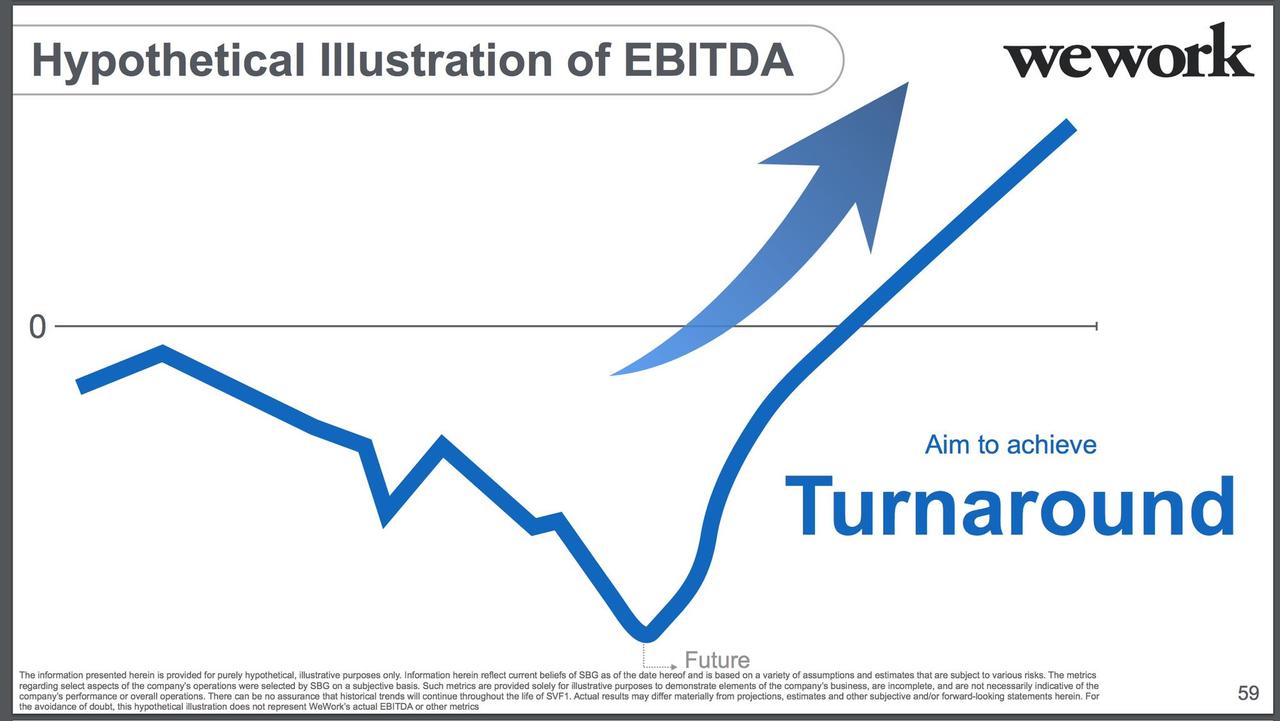

Indicatively, WeWork’s valuation is now $2.9 billion, down more than 90% from its peak. SoftBank has invested more than $10 billion in the company, which means it is underwater by about $7 billion on the office subletting company whose future is now more opaque than ever.

To be sure, Son has been struggling with the impact of the coronavirus on the portfolio of startups weighted heavily toward the sharing economy which have been crushed by imposed social distancing norms and regulations. Son’s investments in hotel-booking service Oyo Hotels & Homes and Uber, among the biggest in his portfolio, have also fared poorly. Oyo, in which SoftBank invested about $1.5 billion, last month furloughed employees in countries outside its home market of India as it struggles to survive the virus. Uber’s shares are trading about 28% below its IPO price.

Having learned from the “best” – such as Boeing – Son responded forcefully in preempting another plunge in Softbank stocks, unveiling two share buybacks in rapid succession. The first 500 billion yen repurchase announced in mid-March initially failed to lift SoftBank’s stock. When the shares plunged more than 30% in the week that followed, Son unveiled a 2 trillion yen follow-up. Hilariously, SoftBank has already used roughly half of the first allotment. The company said on Friday that it had bought 250.6 billion yen of its own stock since March 13 under the original re-purchase plan.

Which, naturally means, it’s time for #3: before the earnings were announced on Monday, the company said it plans to spend up to 500 billion yen more to buy back shares through next March. The announcement is part of a broader plan to sell assets to raise as much as 4.5 trillion yen over the coming year to buy shares and slash debt. SoftBank is likely to raise the funds by selling its stakes in Alibaba Group Holding Ltd., Japanese telecom unit SoftBank Corp. and the company that results from the merger of Sprint Corp. and T-Mobile US Inc.

But while none of the above will come as a surprise to anyone, investors were still eagerly expecting today’s earnings if for no other reason than to see what slides Masa Son would stuff in his presentation.

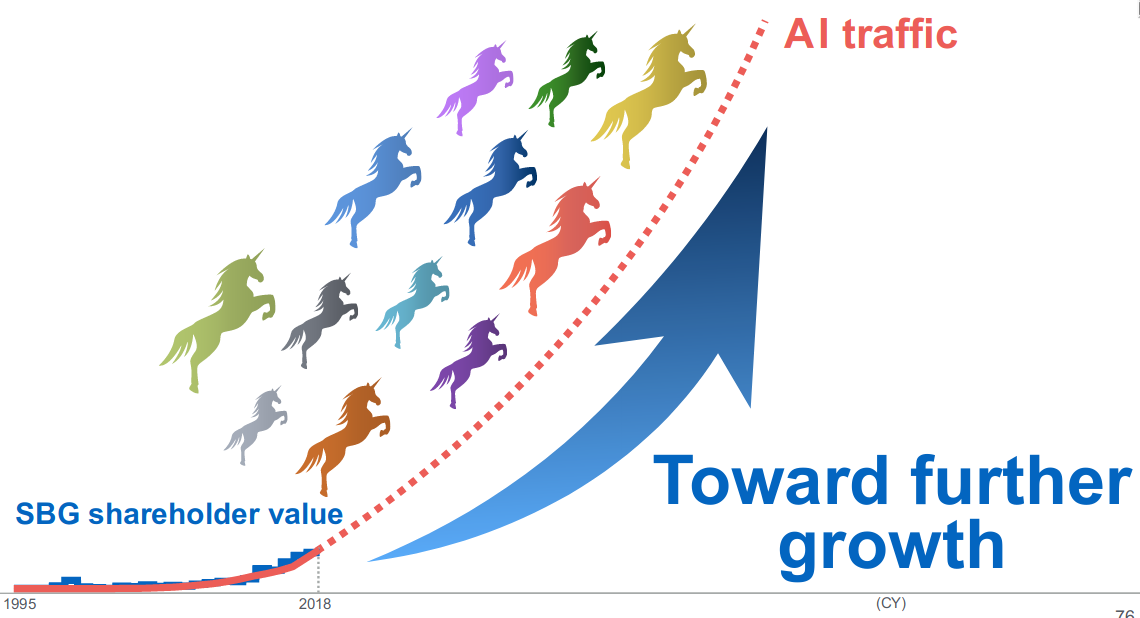

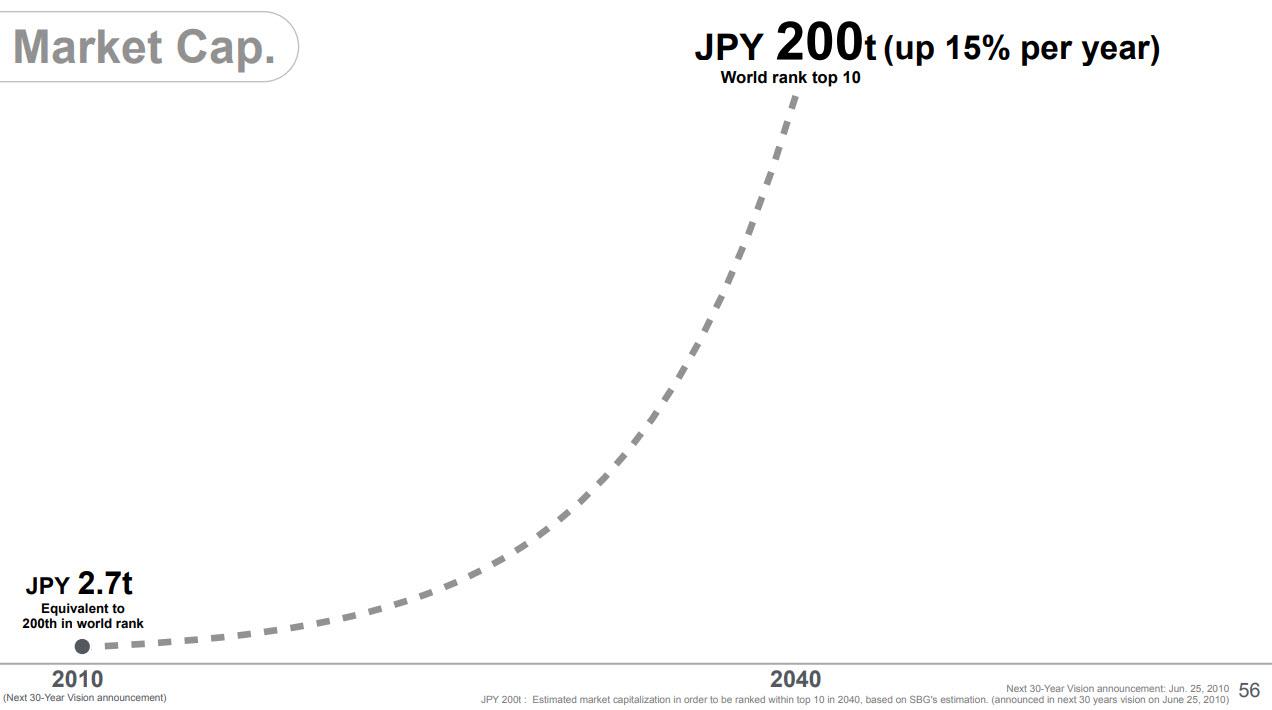

As a reminder, in the past the Japanese billionaire, perhaps unaware that he moonlights as a comedian, added slides such as the following which were probably meant to telegraph a deep sophistication and to confuse the dumbest money, when in reality the slides were simply idiotic :

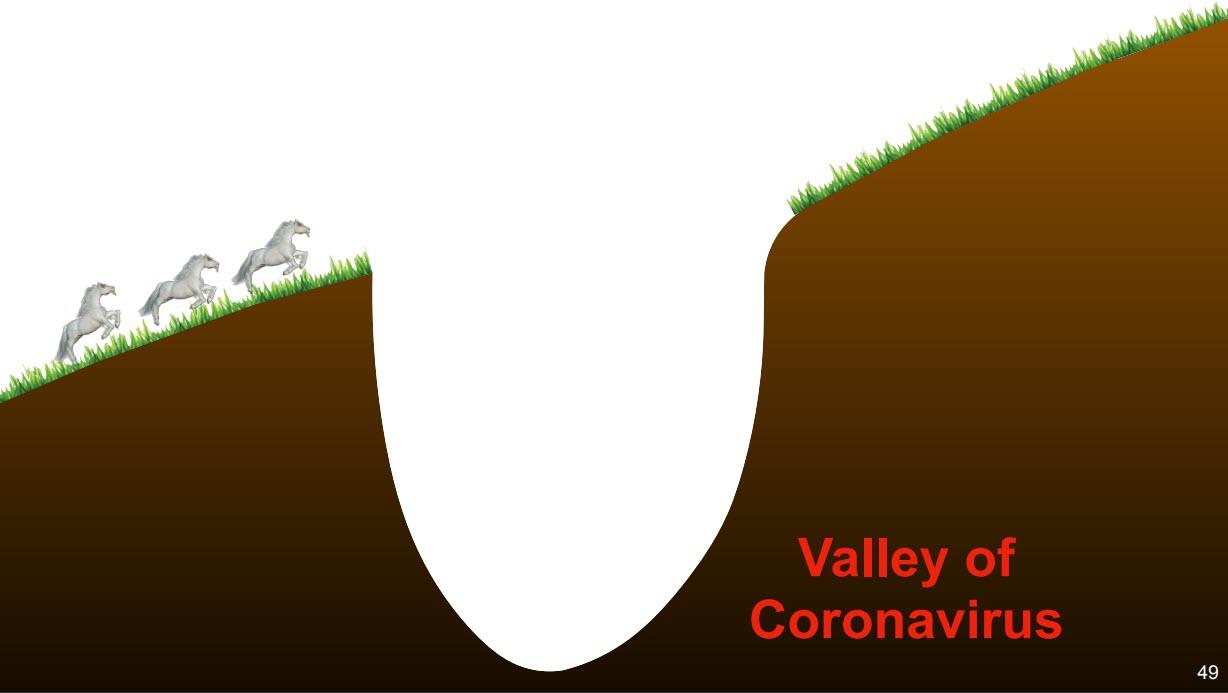

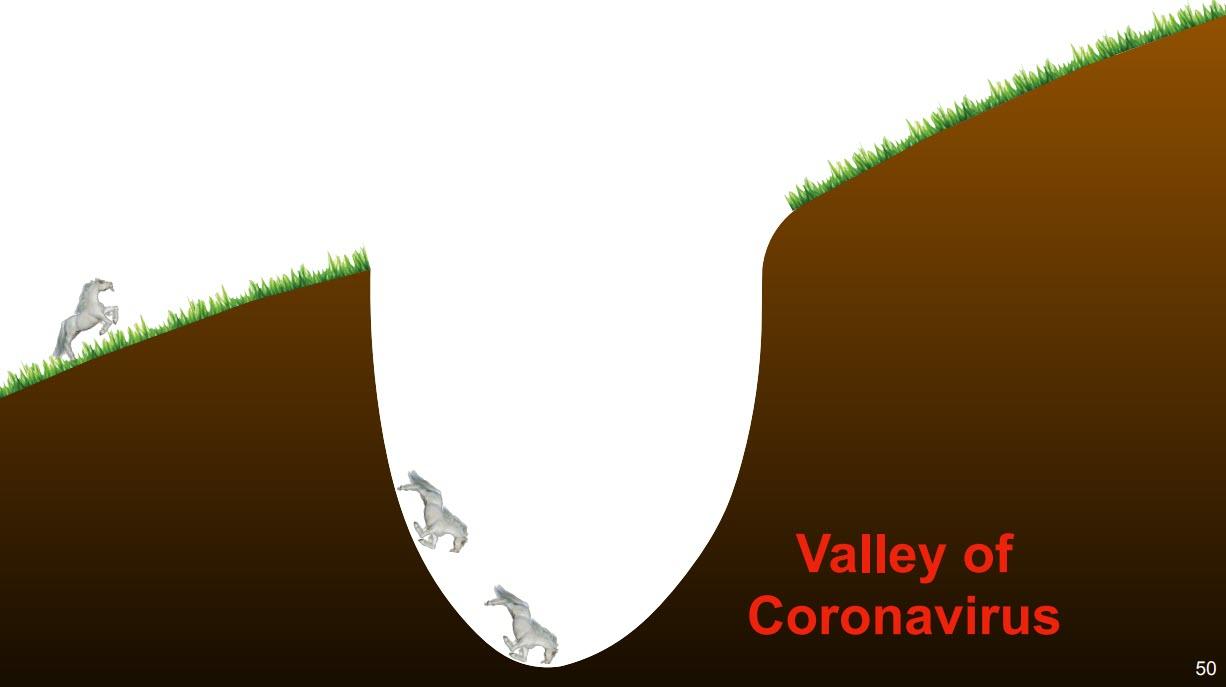

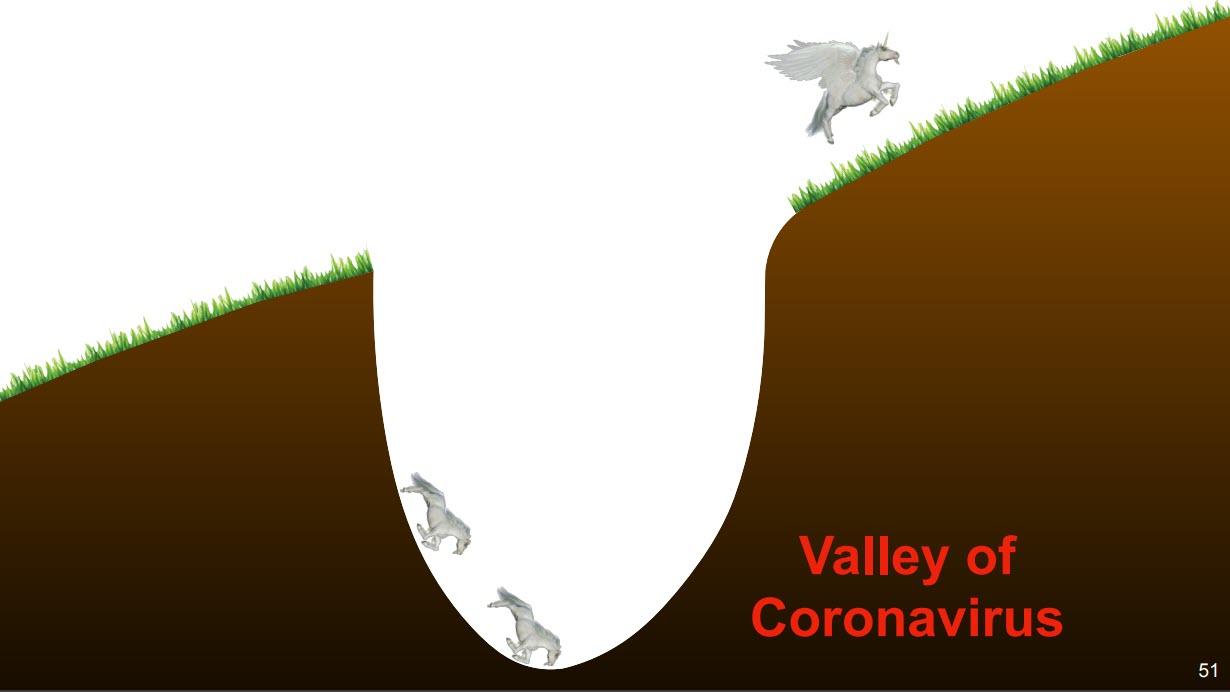

Masa did not disappoint, and prefacing by saying that “the situation is exceedingly difficult,” Masa said that “our unicorns have fallen into this sudden coronavirus ravine. But some of them will use this crisis to grow wings.”

And then, perhaps in hopes of killing Q&A time with five (5) surreal slides meant to provoke awkward silence and also to show to everyone precisely what goes on inside his brain, Son showed just what he meant:

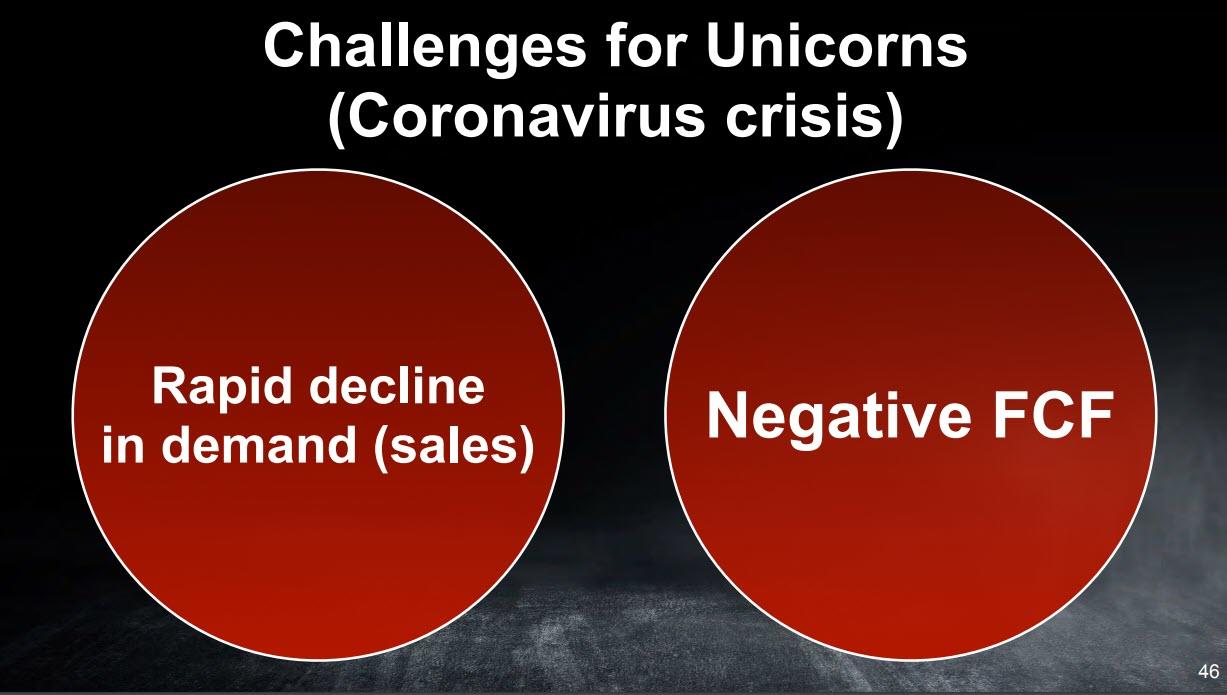

Which unicorns will successfully “fly” out of the coronavirus valley? Why obviously those who overcome these two modest “challenges”: collapsing demand and a cash inferno.

Son’s parting words of wisdom: where manufacturing, electricity and food processing pulled the global economy out of the Great depression…

… this time it will be such ‘revolutionary’ services as online meetings, food delivery, online shopping and video streaming that will bail out the global economy….

… resulting in that utopia for every Ponzi scheme: “happiness for everyone.”

Want more? Read the full thing here.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com