Fed Reveals Which ETFs It Has Bought So Far

Tyler Durden

Fri, 05/29/2020 – 14:05

Back in April, we published a list of which ETFs Goldman thought the Fed would purchase as part of its Secondary Market Corporate Credit Facility, which among others, included the HYG and JNK ETFs that held bonds by bankruptcy Hertz as we reported over the weekend.

Perhaps in response to inbound inquiries following that publication, moments ago, the Fed for the first time reported which ETFs it held as Of May 19, just days after its started purchasing ETFs in the open market.

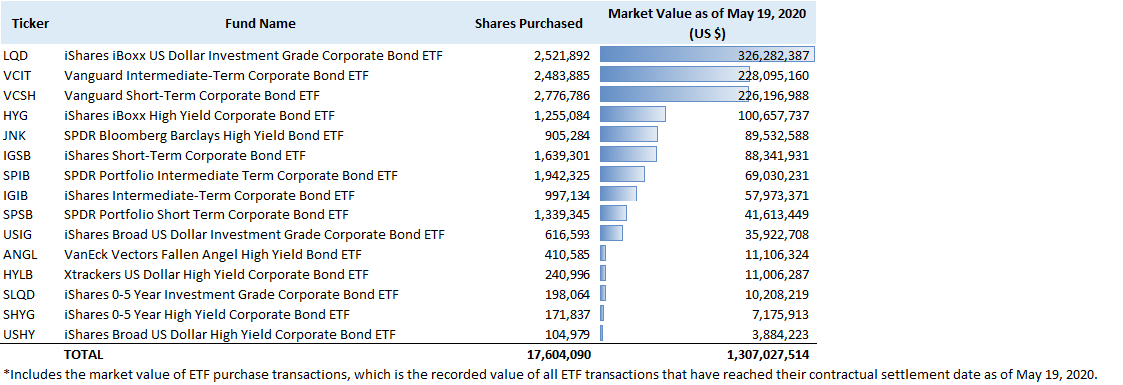

As shown in the table below, the Fed’s purchases were left by the iShares investment grade ETF LQD (at $326MM), followed by two Vanguard corporate bond ETFs, the VCIT ($228MM) and VCSH ($226MM), with the junk bond ETFs, HYG and JNK in 4th and 5th place owning $89.5MM and $88.3MM, respectively.

The Fed also announced that Bank of America was the largest market participant in the ETF purchasing program (the SMCCF) with 40 trades, accounting for $337MM in purchases.

The list above is as of May 19 which means that the total notional amount of purchases has increased substantially since then. In its latest H.4.1 statement published yesterday, the Fed announced that as of May 26, it had purchased a total of $3 billion of corporate debt-tracking funds as of May 26, accounting for about 1.2% of the $252.7 billion market for credit ETFs.

In a curious twist, the Fed reported total assets held in its Secondary Market Corporate Credit Facility, at $34.8 billion in the latest release, a sharp increase from the prior week. However, a note with the release explained that this reflected the U.S. Treasury Department’s equity contribution to the facility to shield the Fed from losses, of which 85% must be invested in non-marketable Treasury securities and reported in the net holdings of the program.

Some have wondered why the Fed was so slow to roll out purchases after its ETF monetization announcement on March 23, and why it has been purchasing ETF assets at a relatively slow pace. In response, Collin Martin, a fixed-income strategist at the Schwab Center for Financial Research said that “There’s no need for the Fed to be using all of their firepower now when the market is functioning smoothly. The small purchases seem to be another signal, with the Fed saying ‘we’re up and running’ but keeping plenty of powder dry until it needs to really help the market.”

To be sure, the Fed’s backstop jawboning may have been enough: the $49 billion LQD has rallied over 14% since March 23. LQD has taken in $964 million this week, and is leading 2020 fixed-income inflows with an $11.7 billion haul.

And yes, the ownership of both HYG and JNK, as well as several other junk bond-focused ETFs, confirms that as of this moment, the Fed owns bonds of bankrupt Hertz, and unless the ETFs divest of these bonds, the Fed will become an unwilling equityhold in the Hertz post-petition equity once its bond holdings are equitized.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com