Bond Market On Edge Of Chaos As 10Y Yields Blow Out To CTA Liquidation Trigger

Tyler Durden

Thu, 06/04/2020 – 10:17

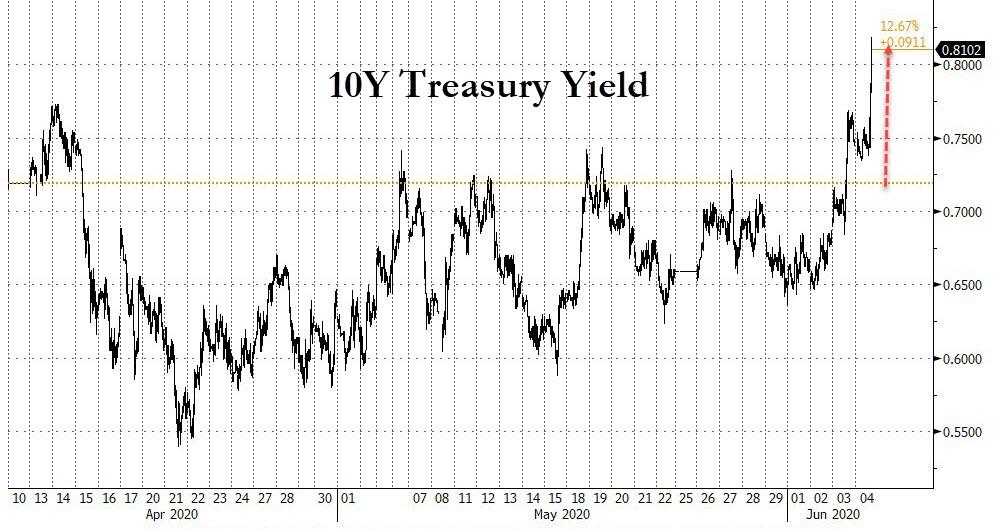

After trading in a tight 20bps range for the past two months, 10Y yields are blowing out and have jumped to the highest level since March 26.

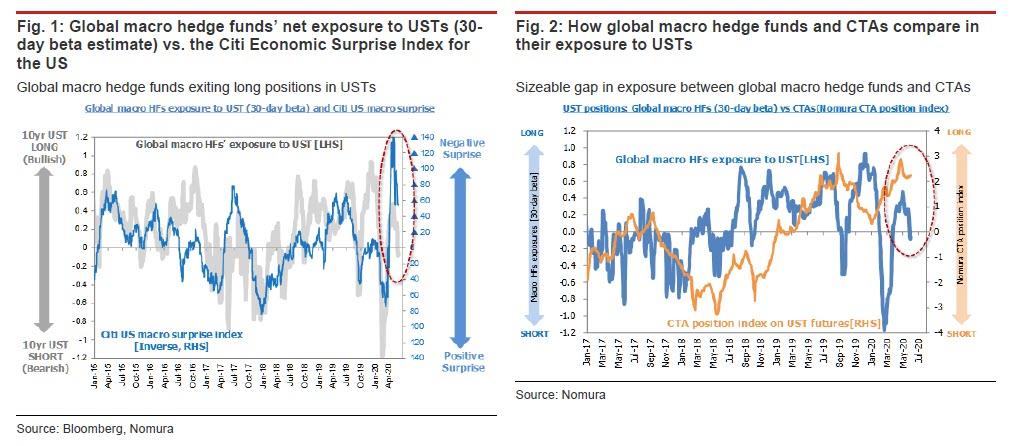

There have been a bevy explanations for the move, including that markets have now priced in virtually all of the monetary stimulus from central banks (after today’s surprisingly large, €600BN QE expansion by the ECB) and that supply/demand fundamentals are once again going to matter (with trillions in new issuance coming in the US), or that the move is simply due to reopening optimism, with Nomura noting that investor sentiment—an expression of investors’ willingness to take on risk—has made its way up from pessimistic to neutral, and the improvement is starting to have an effect on where Nomura estimates that global macro hedge funds have backed out of the totality of their long positions in US government bonds, and now have a net position in the aggregate that is either flat or slightly to the short side. The improvement in the US economic surprise index may be helping to fuel this trend.

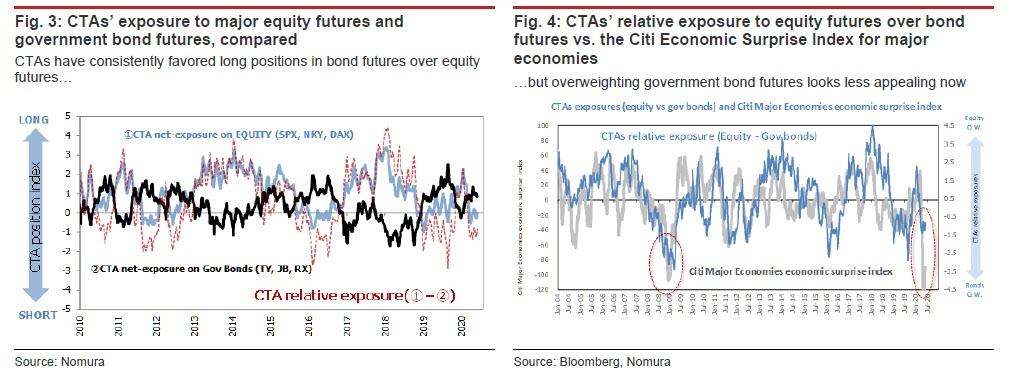

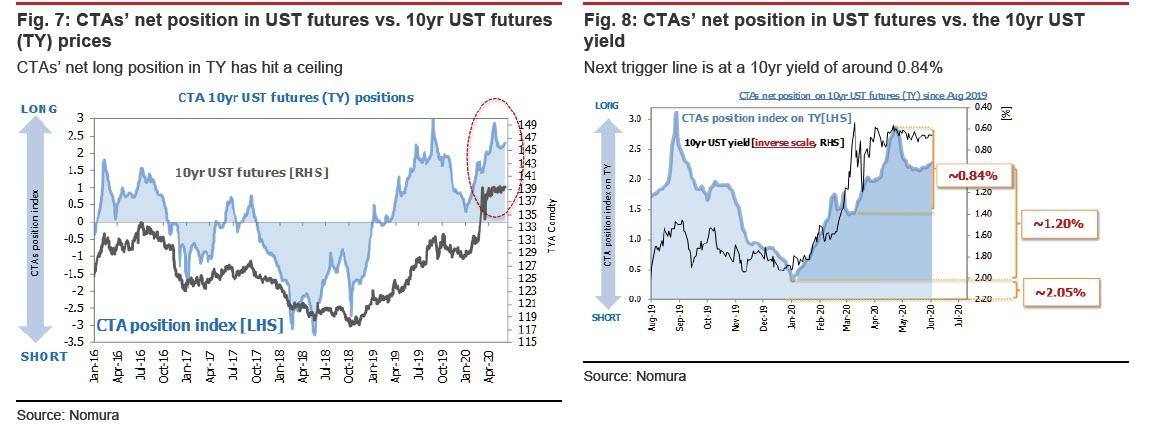

As a result of the actions of global macro hedge funds in the market, and following the latest push higher in yields, Nomura thinks that it is possible that CTAs (systematic trend-following investors with a top-down perspective) are being pressed into a further portfolio shift away from overweighting bonds towards overweighting equities. For the moment, CTAs’ positions still show a preferential tilt towards long positions in bonds (DM government bond futures). However, the prospect of a bottoming out in the economy (as pointed to by the improvement in the economic surprise index) has probably made bond-buying a less appealing idea from a technical standpoint as well.

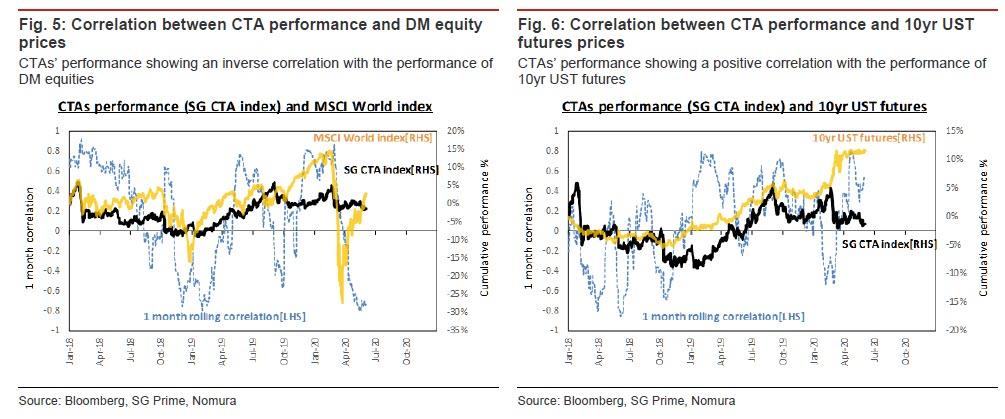

Indeed, if we look at the one-month rolling correlations between actual CTA performance (as measured by the SG CTA Index) on the one hand and stock market or bond market performance on the other, we find that CTA performance has been inversely correlated with the performance of equities (normally an indication of short positions) and positively correlated with the performance of bonds (normally an indication of long positions). If nothing else, this would seem to make it clear that CTAs have been slow to get on board the current equity rally, and that a sell-off in bonds is still the pain side for them.

So at what level do CTAs capitulate on their bond longs and turn short, unleashing a selling cascade?

According to Nomura’s CTA position index (representing our estimate of the positioning of CTAs based on real-time data) CTAs to still have a net long position in 10yr UST futures, “although with a conspicuous notch recently where that position appears to have hit a ceiling.” This means that should the pressure created by global macro hedge funds’ sell-off of USTs increase to the point that the 10yr UST yield climbs above the “red line” that exists at around 0.84%, CTAs would likely be drawn into exiting their long positions in TY to cut their losses.

Moments ago, in what may be one giant CTA stop hunt to force CTAs to puke, we got as far as 0.82%: should yields rise another 2bps, the chaos in the bond market may observed in early and mid-March may make a triumphal reappearance.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com