“The $700 Billion Gorilla In The Room”

Tyler Durden

Fri, 06/12/2020 – 13:25

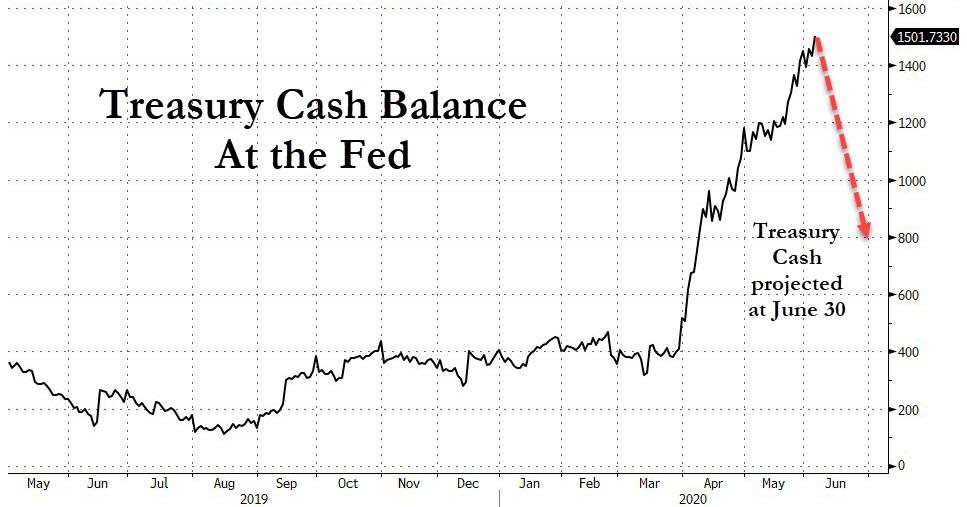

Earlier this week, we observed that as a direct result of a flood of Bill issuance in the past two months, the Treasury’s cash balance which it will use to fund various stimulus programs and other fiscal initiatives, has exploded since the onset of the coronavirus crisis, hitting a record $1.5 trillion last Friday. This, we said, “is notable because in the Treasury’s latest quarterly borrowing needs forecast which projected a funding need of $3 trillion for the current quarter, the Treasury also projected that the cash balance at the end of the quarter would be $800 billion.”

This also means that if indeed the Treasury’s forecast is accurate, then over the next two weeks, the Treasury’s cash balance has to drop by a record $700 billion to hit the $800 billion target!

Picking up on this quandary facing both the Treasury and the financial system, today Bloomberg writes that what the Treasury will do with its record $1.5 trillion pile of cash “has become the biggest wild card for funding markets as quarter-end approaches.”

That’s because, as we explained first last year when the Treasury’s cash balance spiked in September, triggering the first repo crisis as system reserves were quickly drained, swings in the government’s cash on deposit at the Fed “effectively drain bank reserves as the amount climbs.”

As a quick aside, the Treasury General Account which is published daily by the Treasury, operates like the government’s checking account at the Fed. When Treasury increases its cash balance, that’s on the liability side of the Fed’s balance sheet, so as that goes up, it drains reserves from the system In 2015, the Treasury instituted a policy of keeping at least five days’ worth of expenditures, or about $150 billion, in the account in case unexpected disruptions locked it out of debt markets. Before that, Treasury kept enough cash for just two days. But as the US budget deficit has begun to soar, the size of that buffer has grown.

* * *

Echoing these our observations from Monday, today Bloomberg cautions that this dynamic “is taking on added meaning before quarter-end, with strains in the banking system already appearing to build in the lead-up to June 30. The big question now is whether the Treasury will stick to its end-of-June cash-balance target of $800 billion – about $700 billion below its current level.”

To be sure, unlike last September, and the massive cash build observed since March when the Treasury pre-funded much of the upcoming stimulus payments, the concern is now in reverse as shrinking the balance would help ease any quarter-end stress by adding liquidity to the banking system, however “uncertainty is complicating decisions for participants in this key segment of financial markets – from managers of money-market funds, to hedge funds using it to generate liquidity through repurchase agreements.“

Indeed, as BMO’s rates strategist Jon Hill says, “It’s like the $700 billion gorilla in the room” adding that “the Treasury has created a multi-hundred billion dollar level of uncertainty for the Fed’s balance sheet going into quarter-end. This is one of, if not the biggest, question over the next three weeks on how the front end plays out with regard to liquidity conditions.”

In other words, the question on everyone’s mind, as we put it on Monday, is whether “The Treasury Is About To Flood The US With $700 Billion Over The Next Three Weeks?“

While some have speculated that it will very difficult for the Treasury to allocate all those funds over the next two weeks, especially since there is virtually no demand for the remaining $140BN in unused PPP funds, on Thursday Steven Mnuchin sought to ease concerns, saying that more money is about to flow out of the government’s coffers. Of the roughly $3 trillion of pandemic relief, about $1.6 trillion has been used, and “we’re busy working on disbursing the rest of the money,” he told reporters in a video conference.

“There’s a lot of money that hasn’t been allocated” yet, and over the next month $1 trillion will be pumped into the economy, he said. It was, however, not clear just how this money would be “pumped into the economy.”

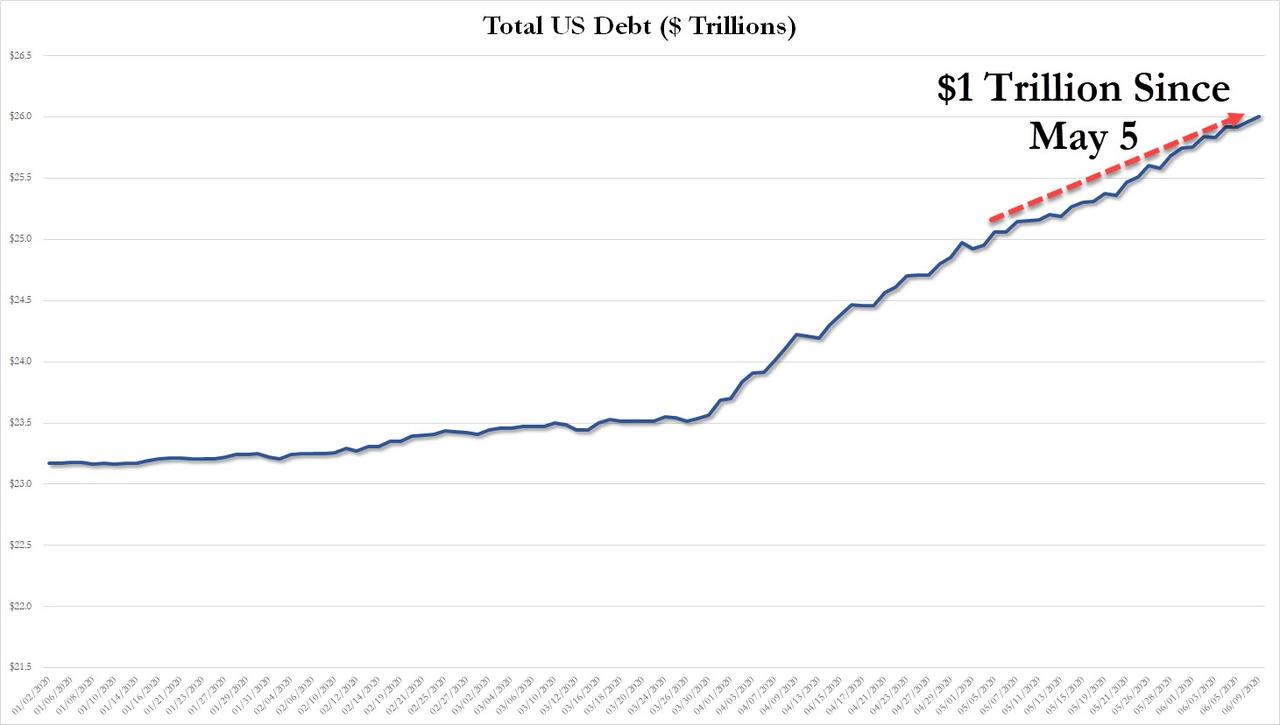

The problem, as Bloomberg notes, is that while investors have been able to absorb the record barrage of new debt, which has seen US Federal Debt increase by $1 trillion in the past month, rising above $26 trillion for the first time ever this week…

… with relative ease, signs of funding dysfunction are starting to emerge.

As one example consider that the spread between yields on three-month Treasury bills and overnight index swaps, which measures the health of a key part of the government debt market, is near the widest level since April. Persistent outflows from government money-market funds – which have shed cash in the past month – could reduce investment in T-bills and repurchase agreements, forcing rates even higher. This is the top reasons why many, including repo “guru” Zoltan Pozsar, have speculated that the Fed will have to roll out a form of Yield Curve Control in the coming months to contain a possible spike in short-term yields.

DB strategist Steven Zeng, disagrees with Mnuchin and considers it unlikely that government outlays will prove large enough by month-end to drive the cash balance below about $1 trillion, meaning that the Treasury cash balance on June 30 will be far higher than what the government projected at the start of May, potentially reducing the need for more debt issuance.

Keeping the extra cash on hand will also allow Treasury to capitalize on having tapped the money already at very low rates. However, sooner or later that money will have to hit the broader economy: “It’s not that the money won’t be spent, it’s just a matter of the timing.”

Of course, it the Terasury is right, and “if the $700bn actually leave the account at Fed and flow into the real economy before quarter-end, then it is likely a massive boost for risk assets” Nordea’s Andreas Steno-Larsen wrote last weekend.

In any case, as we concluded on Monday, it is still not immediately clear just how the Treasury could deal with this “$700 billion gorilla in the room” and ram this cash into the real economy: as a reminder, roughly $140BN of the latest iteration of the Paycheck Protection Program remains unused as business demand for what is effectively free money in the form of grants, appears to have peaked. Will the Treasury then proceed with literally paradopping tens of billions in cash on Americans? To be sure, that would be one way to make the protests across America a far more festive event.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com