24 Hour Fitness Files For Chapter 11 Bankruptcy

Tyler Durden

Mon, 06/15/2020 – 08:52

The government closure of non-essential businesses to arrest the spread of the COVID-19 outbreak crushed the economy. This caused significant financial strain for many gym operators. As a result, several gyms filed for bankruptcy, last month it was Gold’s Gym, now it’s 24 Hour Fitness Worldwide.

The most significant financial weight holding down fitness centers has been their lease obligations and heavy debt loads. As members cancel, and according to Bloomberg, approximately 30% of US gym members are expected to drop their membership this year, fitness centers are swamped with unserviceable debt payments that will leave them no other choice than to restructure.

Ahead of Monday’s bankruptcy filing, we noted in April — 24 Hour Fitness was working with restructuring advisors, including Lazard and law firm Weil, Gotshal & Manges, to weigh options such as protecting the company from its creditors.

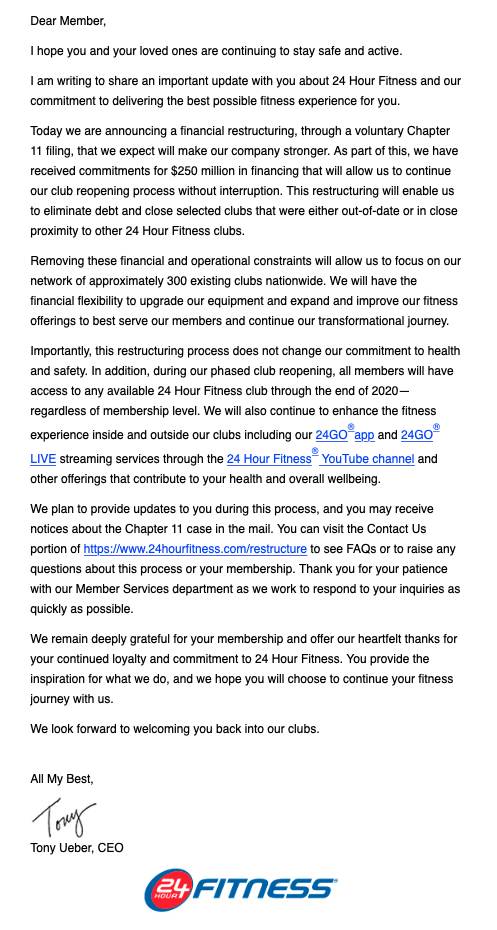

After several months of talks with the law firm, it appears CEO Tony Ueber decided it was time to file Chapter 11, as the company was unable to keep up with debt payments. Ueber secured $250 million debtor-in-possession financing (DIP) that will provide the company with enough operating capital to reopen gyms, pay wages, salaries, and cover expenses.

“24 Hour Fitness comments as part of the company’s bankruptcy filing saying it expects the majority of its footprint to reopen by the end of June. Company says DIP financing, combined with the Company’s cash from operations, is expected to provide sufficient liquidity and allow the Company to continue operations, including club reopenings, without interruption during the Chapter 11 process Company has asked the Court for authorization to continue paying team members’ wages, salaries and benefits and to continue its various member programs,” Bloomberg reports.

We noted in April that the company had an $837 million term loan maturing in March 2022 and $500 million in unsecured notes maturing in June 2022. While the company had roughly $1.5 billion in sales in 2019, its cash is currently a catastrophic $1 million, according to Moody’s.

The highly levered company was already suffering deteriorating performance ahead of the virus pandemic. It was already struggling to compete against premium rivals like Equinox and cheaper competitors like Planet Fitness. Moody’s recently downgraded the chain over worries around its “negative membership trends, very high-interest burden and negative free cash flow before the coronavirus outbreak, as well as approaching maturities to provide limited flexibility to manage through the crisis.”

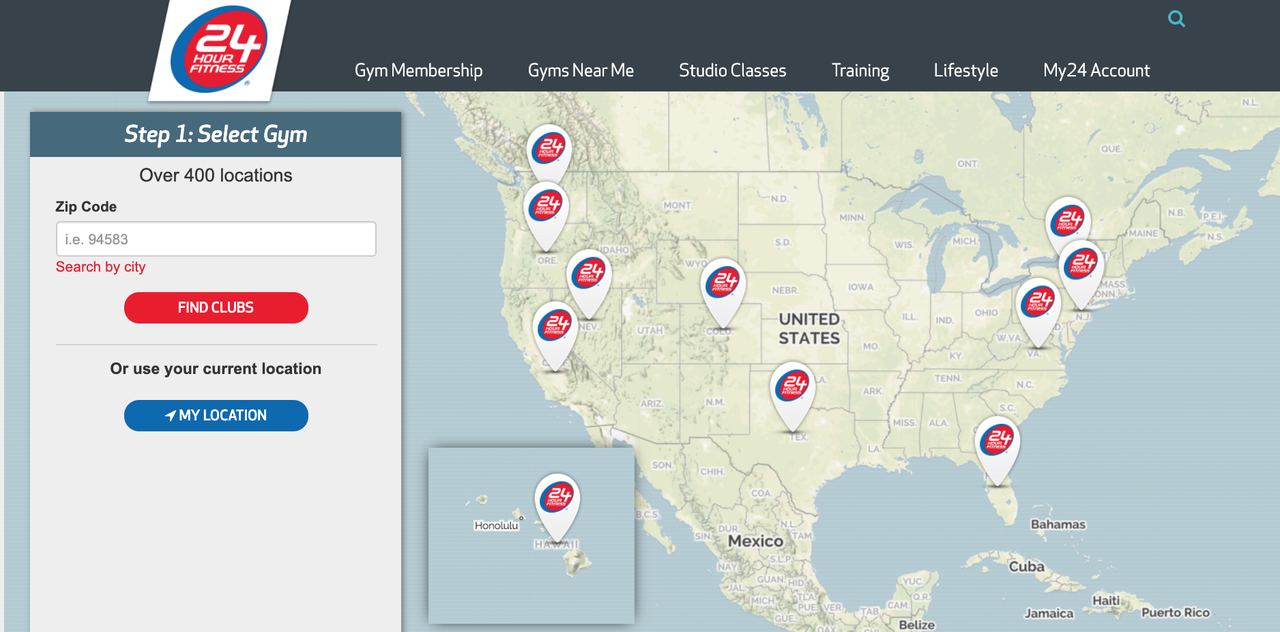

The fitness center has 430 locations, is planning to close 100 gyms or nearly 25% of its US footprint.

Around 0700 ET Monday, Ueber sent an email to all club members about the voluntary Chapter 11 filing:

The collapse of gyms and fitness centers has been a boon for at-home high tech fitness pioneer Peloton, which has seen sales exploding higher since the start of the pandemic.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com