UBS Tells Ultra-Rich Clients To “Avoid” Stock Bubbles; It’s A “Dangerous Place To Be”

Tyler Durden

Sat, 06/20/2020 – 08:45

UBS Global Wealth Management’s Charles Day warned wealthy clients to “avoid” chasing parts of the equity market pushed up into a speculative frenzy by day traders.

“The stocks that I hadn’t heard of three months ago all of a sudden are the most active — that’s not where investors go, that’s where traders might go, or hobbyists might go,” said Day. “If you’re a wealthy investor, you have to avoid thinking that you’re missing out on huge returns in these stocks.”

He told Bloomberg that parabolic stock moves over the last several months draw a comparison with the 2000 market crash “when obscure companies were doubling and tripling monthly.”

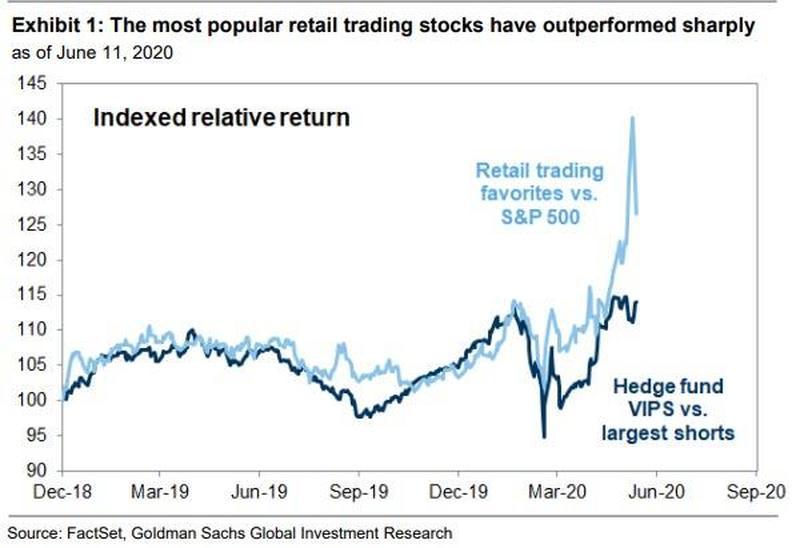

A basket of “retail favorite” stocks has outperformed not only the broader market this year but also the basket of most popular, “hedge fund VIP” index.

“Retail favorite” index vs. S&P500

“Retail favorite” index vs. “hedge fund VIP” index

We urge readers to catch up on the speculative bubble inflated by a flurry of retail day traders, starting with How Retail Investors Took Over The Stock Market, and concluding with Goldman’s Clients Are Getting Angry That Teenage Daytraders Are Crushing Them.

Some have put a face on the sizzling outperformance of retail stocks – that is, Barstool Sports’ Dave Portnoy the market’s crazy genius, able to whip up his frenzied 1.5 million twitter followers into a day trading army that panic bought airline and cruise ship stocks in the last several months – his focus also consists of shifting from one penny stock to the next.

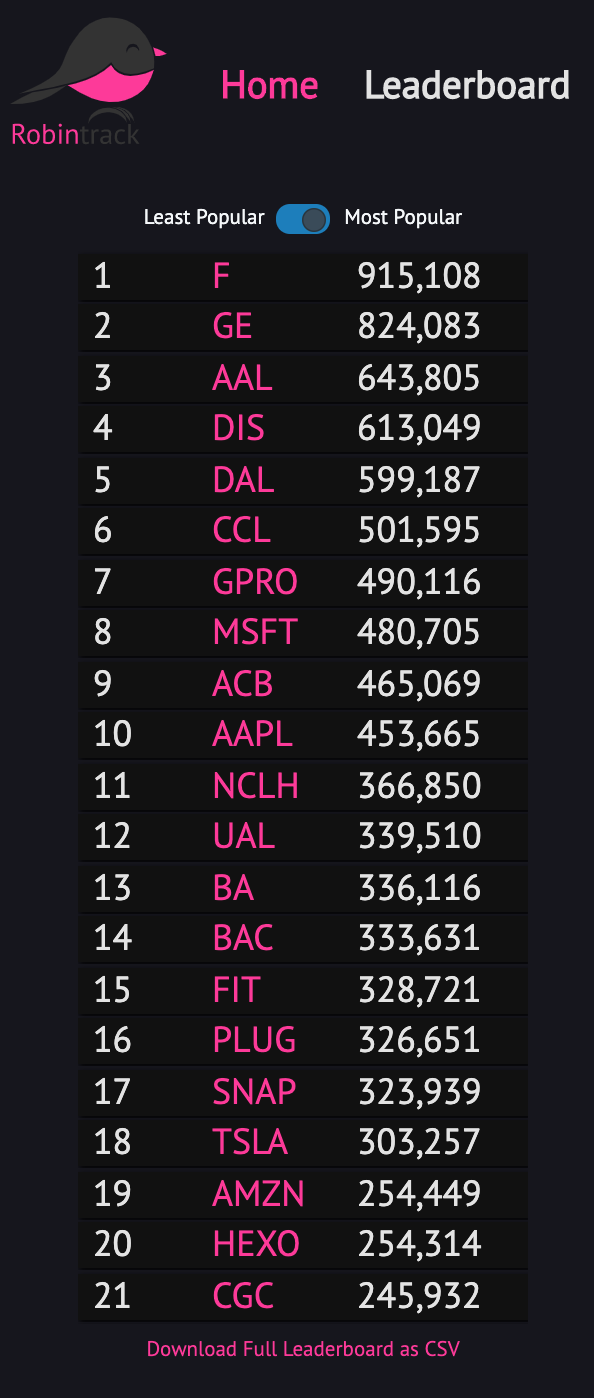

While Portnoy’s style of trading depends on the ‘greater fool’ – Day, whose firm oversees $2.3 trillion in assets, is likely warning clients not to buy the stocks the stocks below (many have doubled since late March):

Incidentally, one of the most favorite retail stocks (above) is Penn National Gaming (PENN), which Portnoy owns a lot of as he reminds his followers with the following blurb in his twitter bio “I own a ton of Penn Stock” as a result of PENN buying his company Barstool Sports for $450 million in January.

Day warns that day traders are at risk of getting crushed by market volatility in some of these speculative stocks.

“That’s what makes it extremely vulnerable to extreme volatility, is that people going into those trades don’t have a lot of experience, and now they’re going to start to think it’s easy, and that’s a dangerous place to be,” he said. “The Robinhood names, I think, are almost all froth.”

Top stocks held by Robinhood daytraders

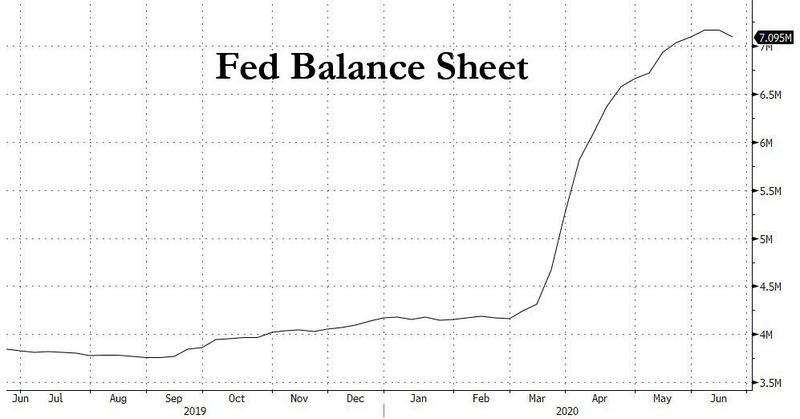

Day’s warning to wealthy clients comes at a time when the Fed’s balance sheet has finally posted its first weekly decline since the start of the corona crisis.

As readers know, a shrinking Fed balance sheet could be bad news for the stock market.

“If you’re very wealthy, what you want to have is some protection of your downside so you feel more comfortable with your risk assets,” Day said.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com