With Cross-Asset Correlation At All Time High, JPM Asks “Why Not Just Own Anything?”

Tyler Durden

Sat, 06/20/2020 – 18:00

In the latest weekly JPMorgan View report by John Normand, the strategist answers the four most common questions that have arisen after such strong market performance:

-

how much longer will the growth boom last;

-

how much of that recovery is already discounted in asset prices;

-

which wildcards, both negative and positive, are most material in coming months; and

-

why not just own anything when growth is improving, policy hyper-stimulative and cash holdings extraordinary.

Before we get to the answers, a quick rundown of where the markets are today: as JPM notes, after a torrid, 30%+ rally since the March 23 lows, indexes across FICC and Equities have been tracing a consolidation range this month rather than extending the price highs/spread lows generated since late March. (Oil, which is making new four-month highs, is an exception). Yet even this consolidation still leaves most markets with extraordinary retracements since March – every market but EM Currencies and Agricutural Commodites has retraced at least 50% of its crisis lossses, and several like Large Cap Equities and High Grade Credit have retraced at least 80%.

The staggering rally, however, is now in the rearview mirror, and the first question JPM clients have is…

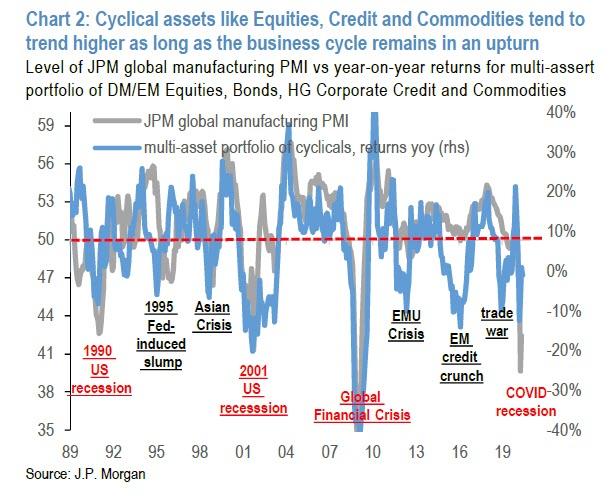

1. How much longer will this “growth boom” last? According to Normand, what will matter for most asset prices over Q3 and possibly Q4 is “the near-term momentum rather than the medium-term malaise.” This judgement reflects a simple observation that most cyclical assets tend to rise in price/tighten in spread as long as the global business cycle is in an upturn which for now it is due to the tremendous drop in March and April.

Furthermore, JPM notes that price momentum can be particularly strong at turning points when valuations are cheap, defensive positioning more prevalent and upside data surprises more prevalent (JPM’s global surprise index has been rising since mid-May). But even as the surprise factor fades (these indices are generally designed to mean-revert in shorter cycles than the actual business cycle), market momentum can persist, albeit at a slower pace. These more gradual gains should reflect the eventual economic malaise – or incomplete recovery. Recall, however, that the anemic recovery of the post-Global Financial Crisis still delivered positive returns on most cyclical assets, even if the time required to reclaim pre-crisis price highs was much more extended than the path which followed most previous US recesions between 1970 and 2001.

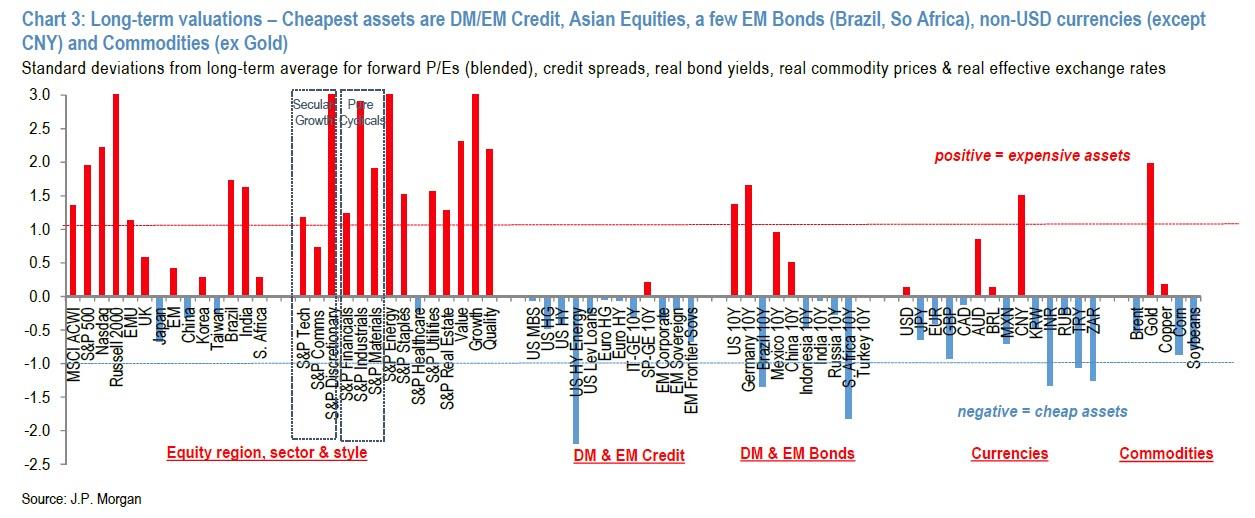

2. Is the recovery priced in, or “what is the completeness of the growth/profits recovery.“ According to JPM, even if the budding business cycle upturn could extend for years because of extremely loose monetary policy, there are limits to what markets can achieve over shorter horizons due to lack of visibility beyond the next couple of quarters. That is why the bank has judged valuations from a few perspectives: (1) a long-term framework based on generally mean-reverting measures like forward P/Es for Equities, spreads for Credit and real (inflation-adjusted) levels of exchange rates, commodity pries and bond yields for the rest of the FICC universe; (2) a short-to-medium term framework that scores markets on the degree of retracements they tend to experience in the last month of recession and the first few quarters of an expansion.

- Long-term measures, where valuations for each asset class, sector or security are expressed in standard deviations from their multi-decade averages (chart 3), suggest that the cheapest markets are DM/EM Credit followed by Asian Equities; a few EM Bonds (Brazil, South Africa); non-USD currencies (ex CNY); and some Commodities (Oil, Agriculture). The apparent high valuations in US Large Caps are skewed by multiples for Secular Growth sectors (Tech, Com Services, AMZN within Discretionary), whereas other post COVID-19 beneficiaries like Healthcare look cheap.

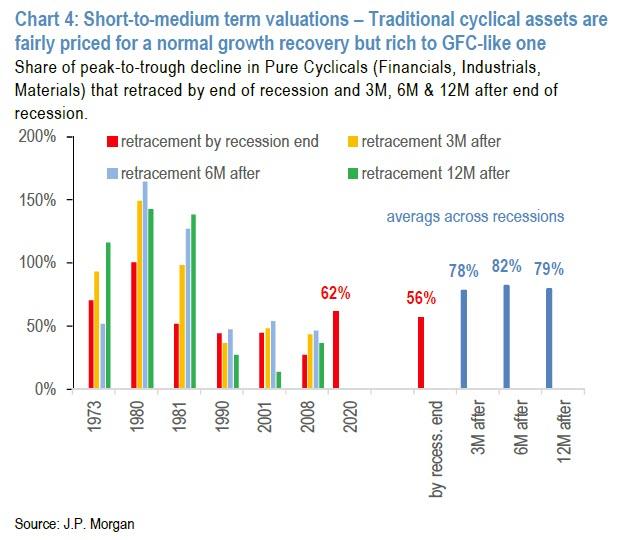

Short-to-medium term measures, which compare recent market retracements to those that typically occur at business cycle turning points, suggest fair value if the global economy recovers lost output extremely quickly, but broad expensiveness if the malaise sets in. Credit and Equities tend to retrace about half their crisis losses by the time a recession ends, and can return to pre-crisis highs in prices/lows in spreads within the first year of the expansion if the recovery recoups lost output and profits within the first year (chart 4). So if the emerging recovery mirrors all previous recessions from 1970 to 2001, then markets are fairly valued. But if the recovery proves more anemic like the post-Global Financial Crisis years were due to impaired balance sheets, then markets have overshot. JPM thinks the GFC is the proper template and are therefore concerned about valuations, which is why its portfolio strategy is conservative.

(3) The wildcards, both positive and negative. This potential valuation problem makes more relevant the role of wildcards. Perhaps because market momentum has been so strong in recent months, the sources of downside risk in H2 seem more abundant than the sources of upside. Potential spoilers include:

- (a) growth upturn fizzles after three to six months, rather than the usual one to two-year upswing (as measured by PMI improvement) that normally follows a recession, due to a second wave of COVID-19 that motivates lockdown or just consumer/corporate caution;

- (b) fiscal cliffs in various countries from expiration of temporary stimulus measures, partially in Q3 but more so in 2021;

- (c) US credit cliff if Fed does not extend its facilities beyond Sep 30th;

- (d) material US sanctions on China/Hong Kong, SAR pre-November to boost Trump’s rating or post-November on Trump’s re-election;

- (e) Democratic sweep in US elections then corporate tax hikes; and (f) hard Brexit at end of 2020.

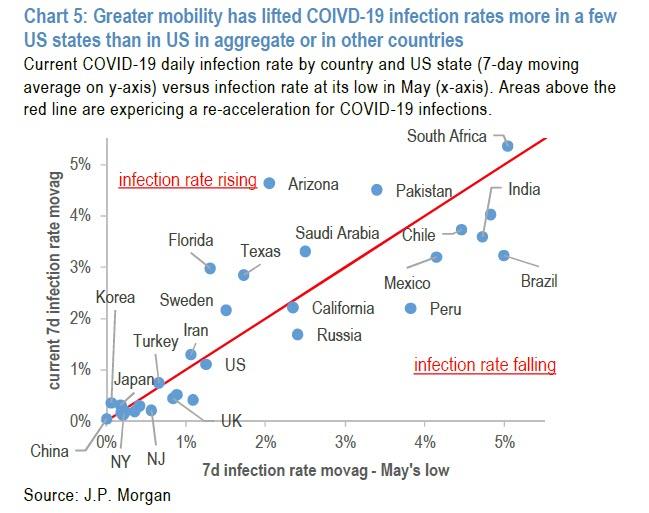

The most material ones to JPM are COVID infections because these are indeed rising in a few US states…

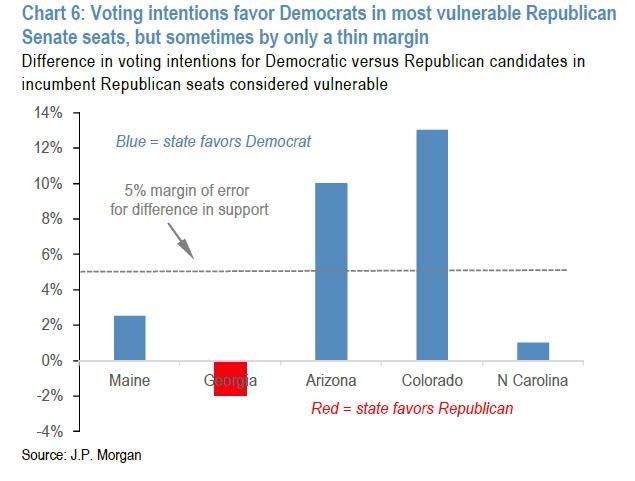

… the Democratic sweep because swing state polls favor both Biden versus Trump and Democrats versus Republicans in vulnerable Republican Sentate seats…

… and broader US sanctions on China because both the US public and both sides of the US political spectrum hold an overwhelming negative impression of China (66% of Americans have an unfavorable view of China, according to an April Pew Research Center poll). The bank then admits that it isn’t properly hedged against a second wave that triggers lockdowns, other than through a preference for the Tech and Healthcare sectors, because there is sufficient hospital capacity to accommodate the inevitable rise in infections as mobility increases. Normand then admits that he might tilt Equity allocations towards non-US market closer to the elections, but for now his position for the possibility of a Democratic sweep is through short USD positions and longs in Gold (the bank has also bee short CNH for a couple of months in anticipation of US-China tensions and view this trade as one to potentially hold into 2021).

* * *

This brings us to JPM’s punchline: does any of the above actually matter at a time when there has been an unprecedented liquidity injection in the markets? The answer is that while the rising tide has indeed lifted all boats, it can only do so much:

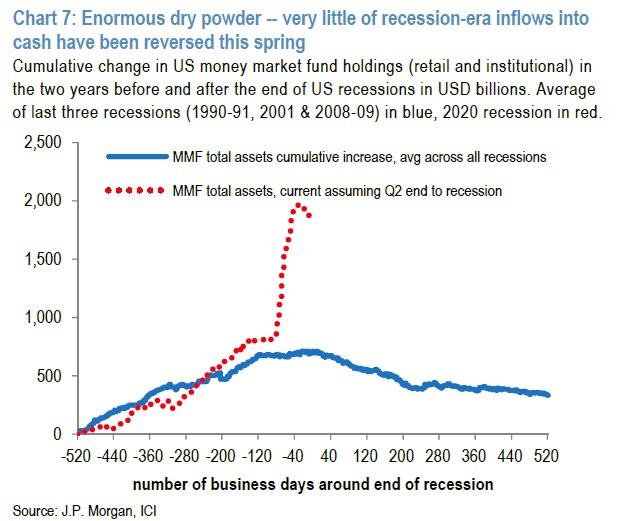

(4) The case for selectivity: According to Normand, “liquidity cannot paper over specific weaknesses indefinitely.” When the business cycle is turning higher, policy hyper-stimulative and downside risks manageable, the obvious investment strategy might be to own anything but cash, holdings of which remain extraordinarily high.

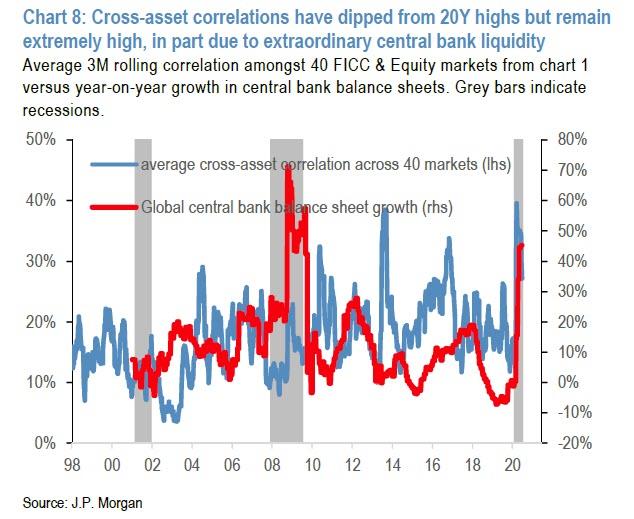

This indiscriminate approach would not have damaged absolute returns over the past few months given that all financial assets, but DM Bonds and the US dollar have rallied. Such high cross-asset correlations are typical at turning points in the cycle, when extreme positioning and liquidity dynamics drive both broad selling as the global economy enters recession then buying as the economy enters expansion. Massive central bank asset purchases can also boost correlations due to a combination of scarcity created by central bank asset purchases and rising growth expectations from central bank easing.

However, typically such high correlations mean-revert to their long-term averages within a few months, in part because the pace of QE slows and in turn allows country, sector and company-specific factors to reassert themselves. H2 should bring this sort of differentiation, which is why the April/May strategy of owning anything is unlikely to perform as well going forward. That would mean these choices:

But typically these high correlations mean-revert to their long-term averages within a few months, in part because the pace of QE slows and in turn allows country, sector and company-specific factors to reassert themselves. H2 should bring this sort of differentiation, which is why as JPM concludes, “the April/May strategy of owning anything is unlikely to perform as well going forward.“

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com