WTO Says ‘Historic’ World Trade Plunge Could Have Been Worse, Cushioned By Government Response

Tyler Durden

Wed, 06/24/2020 – 02:45

The World Trade Organization (WTO) outlines, in a new report, that “rapid government responses helped temper the contraction” in the world trade and likely thwarted the worst-case scenario projected in April.

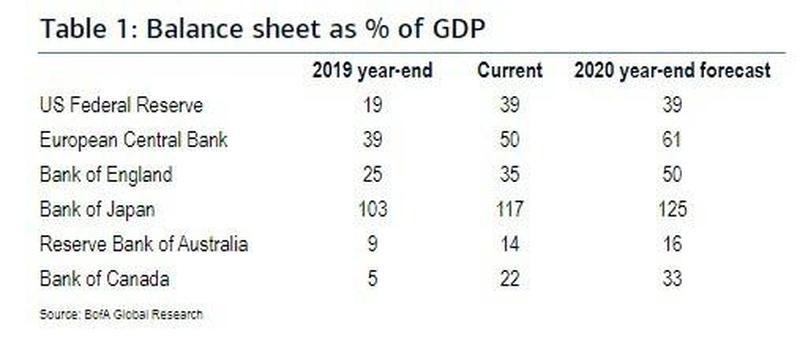

WTO is referring to massive fiscal stimulus deployed by governments, and the balance sheet of the G-6 central banks that has exploded, with the Fed’s total asset expected to double in 2020 amid an avalanche of money printing that has helped arrest the collapse in world trade.

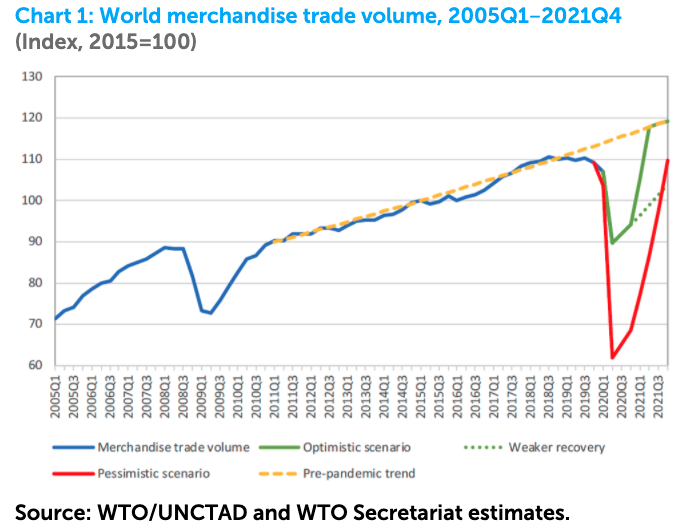

The Geneva-based organization said the volume of merchandise trade contracted 3% YoY in the first quarter and plunged 18.5% in the second.

WTO’s previous outlook in April set out two growth models: an optimistic scenario in which world trade in 2020 would contract by 13%, and a pessimistic scenario in which trade would drop by 32%.

As things currently stand, the report said, “trade would only need to grow by 2.5% per quarter for the remainder of the year to meet the optimistic projection. However, looking ahead to 2021, adverse developments, including a second wave of COVID‑19 outbreaks, weaker than expected economic growth, or widespread recourse to trade restrictions, could see trade expansion fall short of earlier projections.”

“The fall in trade we are now seeing is historically large – in fact, it would be the steepest on record. But there is an important silver lining here: it could have been much worse,” said Director‑General Roberto Azevedo.

“Policy decisions have been critical in softening the ongoing blow to output and trade, and they will continue to play an important role in determining the pace of economic recovery. For output and trade to rebound strongly in 2021, fiscal, monetary, and trade policies will all need to keep pulling in the same direction,” said Azevedo.

The report said the dark green line in Chart 1 could suggest a 5% to 20% rebound next year, which is in line with the optimistic scenario. But there are many uncertainties, including the second wave of Covid-19 outbreak and the effectiveness of fiscal and monetary policy (something we outlined here).

“For output and trade to rebound strongly in 2021, fiscal, monetary, and trade policies will all need to keep pulling in the same direction,” Azevedo said.

To sum up, the outlook for the global economy over the next several years remains highly uncertain – though unprecedented money printing has cushioned the global crash in trade – that doesn’t necessary mean a V-shaped recovery will be seen.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com