Is This The Next Big Short?

Tyler Durden

Sat, 06/27/2020 – 16:30

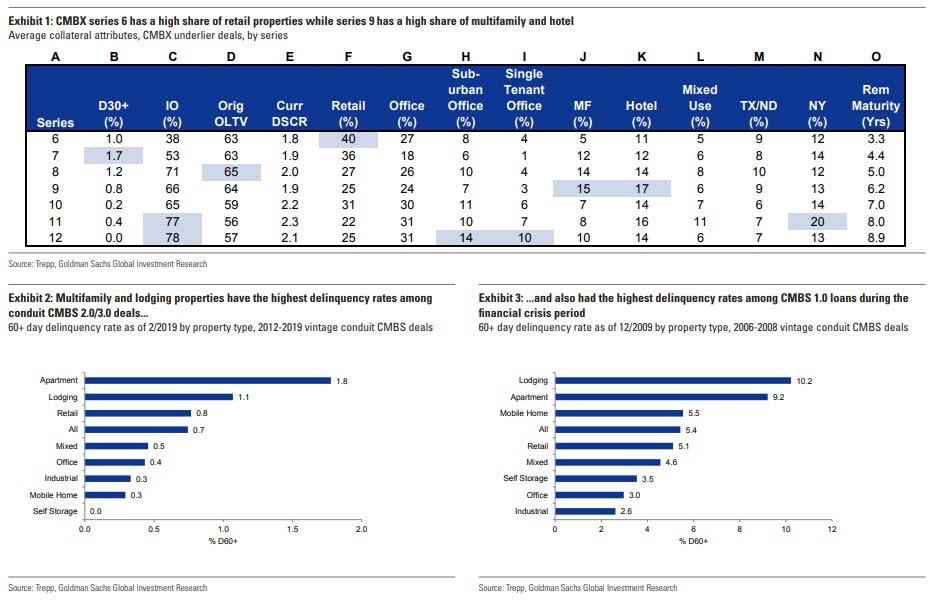

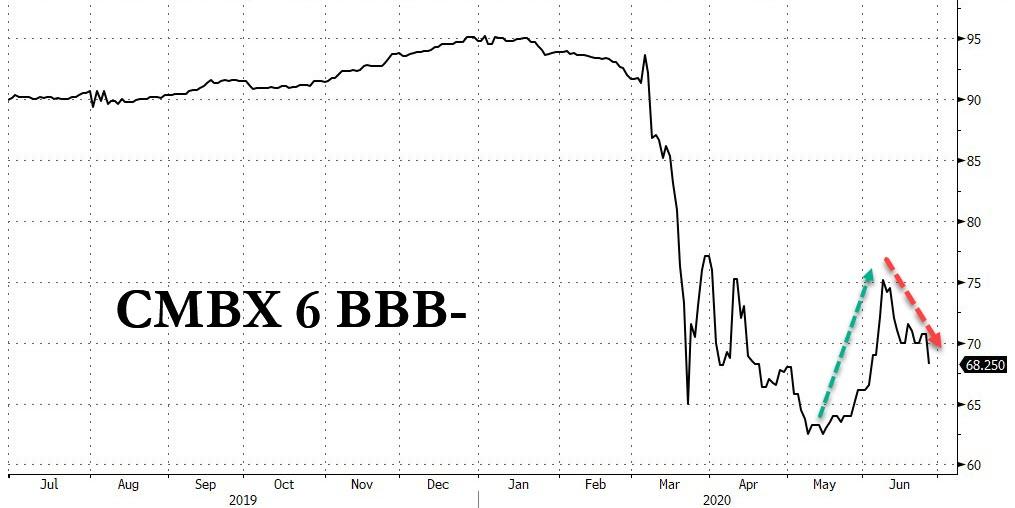

As we reported previously, with commercial real estate failing to benefit from the rebound in overall risk over the past 3 months as a result of a tidal wave of retail bankruptcies, CMBX Series 6 – which back in March 2017 was dubbed the “Big Short 2.0” trade due to its substantial exposure to malls which were hurting long before the arrival of the pandemic…

… and especially the BBB- tranche has been stuck in purgatory, and after surging to 75, is back to where it was in mid-April as investors signal that the worst is yet to come for commercial real estate.

Of course, all of this is well-known by now, and it is safe to say that the riskier tranches of CMBX S6 are now fairly priced for even a downside scenario among retail outlets. But what about other CMBX issues, and is there another “Big Short” lurking among the various tranches, especially in the aftermath of the coronavirus shutdowns which will cripple not just retail outlets but everything from restaurants, to multi-family housing (as city renters flee for the suburbs), to offices and hotels.

In our view, the answer to all those seeking the next Big Short is CMBX 9. This is what we wrote +:

… with CMBX 6 now done, keep a close eye on CMBX 9. With its outlier exposure to hotels which have quickly emerged as the most impacted sector from the pandemic, this may well be the next big short.

Fast forward a few weeks, when commercial real estate analytics specialist Trepp seems to agree with us.

As Trepp’s Manus Clancy writes in a blog post on Friday, “the COVID-related volatility over the last three months has resulted in growing interest over CMBX as a way to take positions on US commercial real estate. This week we are back to hone in on CMBX 9.“

Below are some of the reasons why CMBX 9 – which so far is off-limits to the Fed’s blatant bailouts of most, but not all, asset classes – may be the cleanest and safest way to bet on the devastation resulting from the coronavirus pandemic. Courtesy of Trepp:

What Makes CMBX 9 Unique?

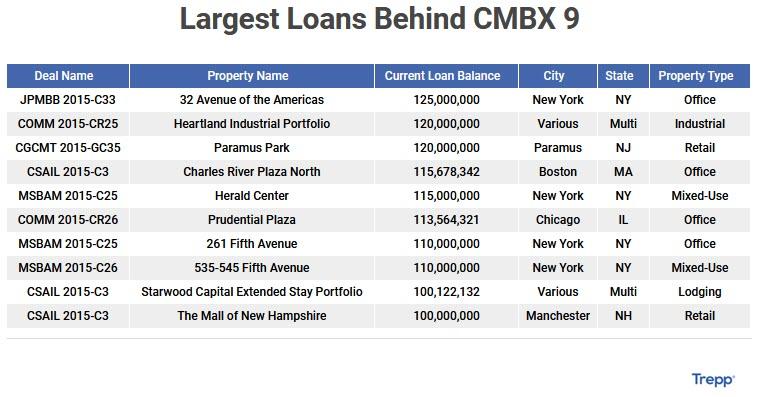

For one, it’s the only CMBX index backed by 2015 deals. Before the COVID-19 crisis began, the last meaningful hiccup in CMBS lending came in early 2016. In late 2015, volatility in the US equity markets picked up considerably and oil prices fell to under $30 a barrel. The sharp price decline in black gold led investors to fear a wave of forthcoming bankruptcies from energy companies.

That fear led to a sharp repricing of credit in the leveraged loan market and that widening had a gravitational pull on CMBS, dragging spreads wider over the course of two months. That widening in CMBS led to an abrupt pause to CMBS lending leading to a standstill in issuance in Q1 2016.

The 2015 CMBX 9 reference obligations consist of deals issued before any of that drama emerged. (The 2016 oil downturn in CMBS also led to several defaults of hotel and multifamily loans backed by “man-camps” in the shale regions of North Dakota and elsewhere.)

Other Attributes of CMBX 9?

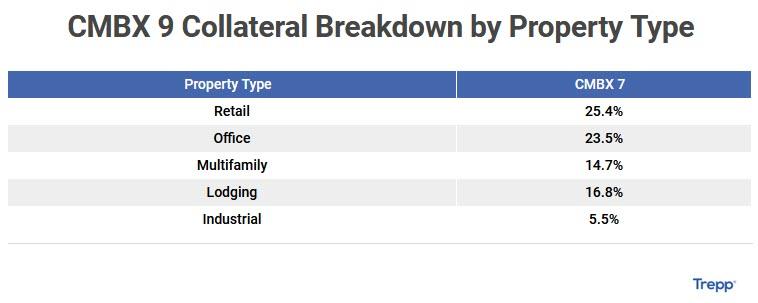

It has the highest concentration of multifamily loans of any CMBX series with 14.7%. (The only other series that is close is CMBX 13 with 14.1%.)

CMBX 9 also has the highest concentration of hotel loans with 16.7%. (CMBX 11 is next with 13.8%.) In terms of protection premiums, CMBX 9 BBB- costs about 725 basis points to insure. That’s well inside of the 925 basis points for CMBX 8 BBB- but wider than the 675 for CMBX 10 BBB-. (Those spread levels are from IHS Markit).

For comparison purposes, CMBX 9 BBB- ended 2019 with a spread of 310 basis points. So there has been about 400 basis points of widening since the beginning of the year.

As of June 2020, 9.8% of the collateral behind CMBX 9 is 30 or more days delinquent. That puts the index slightly ahead of the average CMBS delinquency rate as of June.

Another 6.6% of the loans behind CMBX 9 missed their June payment, but were not yet 30 days late – so there is room for the delinquency rate to move higher over the summer. (Those percentages include defeased loans in the denominator of the calculation.)

The pool of defeased loans totals 4.5% by loan balance. In addition, 23% of the collateral pool is on servicer watchlist and another 5.1% of the collateral pool is with the special servicer.

CMBX Background

For background, CMBX is a set of indexes administered by Markit Partners. There are 13 separate indexes – the first five were launched prior to the Great Financial Crisis of 2008.

When the markets are functioning, a new series is rolled out every 18 to 24 months by Markit. Each series allows an investor to buy protection (“go short”) or sell protection (“go long”) on a bucket of 25 separate tranches. An investor can go long or short on AAA, AA, A, BBB- or BB. To buy protection, a buyer pays a fixed premium each month – the premium level is set when the index is launched. If selling protection, the seller is committing to “insuring” the buyer of protection against any bond writedowns.

The price of the index fluctuates up and down – up when the perceived likelihood of losses is low and down when perceived creditworthiness is low. Since the COVID-19 crisis began, prices have been trending lower. The lower down the credit stack, the bigger the price drop.

Within a series – say, CMBX 13 – the same 25 deals are represented across all ratings classes. (So for the CMBX 13 AAA index, it will be the AAA tranches from 25 deals that serve as “reference obligations.” For the CMBX 13 BBB-, it will be the BBB- tranches from the same 25 deals.) All deals that serve as reference obligations are US conduit deals.

For historical reference, for many of the deals used for reference obligations in 2006 and 2007 saw meaningful losses, with some deals seeing losses erase even the AA classes of some deals. (The ABX indexes got most of the attention during the GFC, but those that “shorted” CMBX BBB- from some of the pre-crisis CMBX indexes made out handsomely as well.) In fact, for CMBX 5 BBB-, 22 of the 25 reference tranches suffered 100% losses.

* * *

Finally, for those asking, yes there is a lot of potential downside for CMBX Series 9 BBB-. In fact, if the hotel world suffers a perfect storm of pent up defaults coupled with a second wave of covid which send the hotel industry into another tailspin, the potential downside here could be even greater than for Series 6.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com