S&P Futures Flat As China’s Bubblemania Storms Higher For 8th Day

Tyler Durden

Thu, 07/09/2020 – 08:04

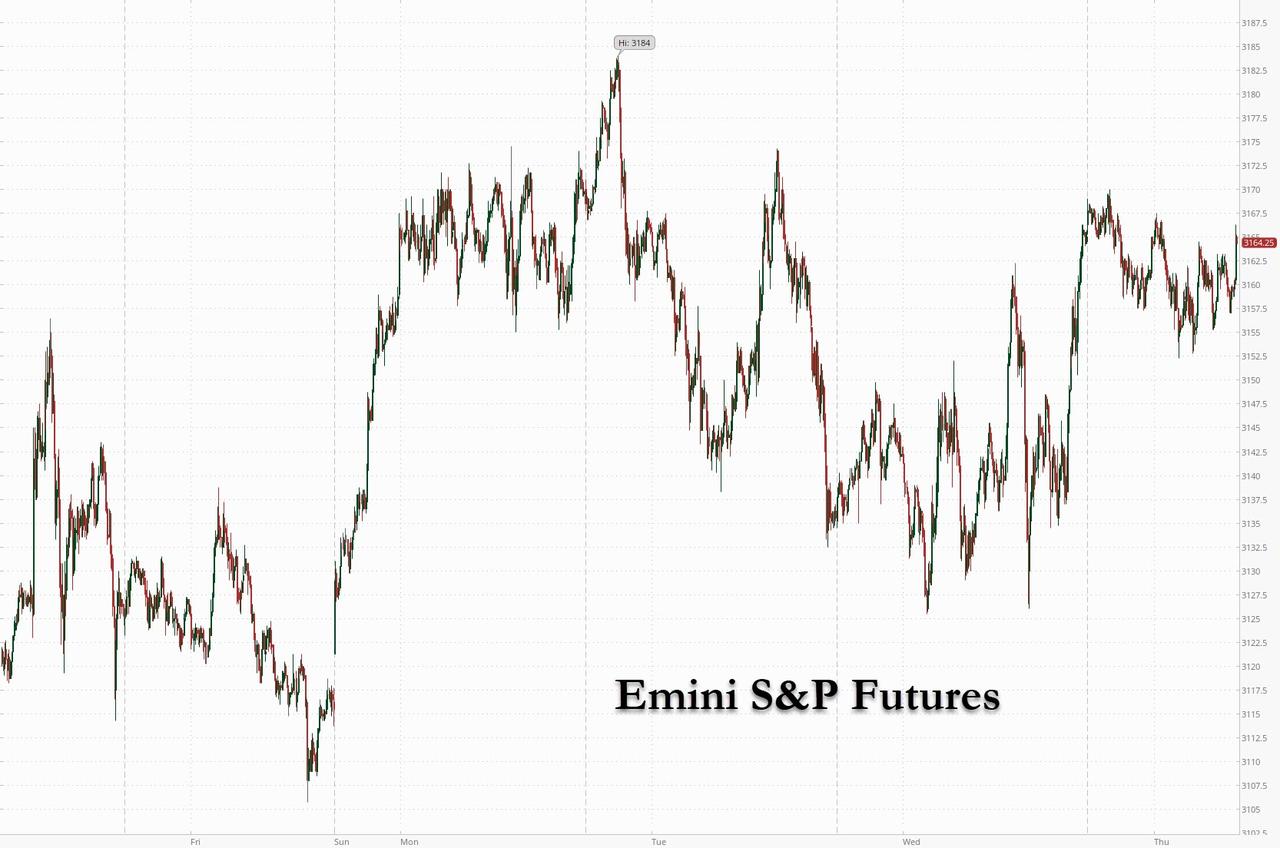

S&P futures were flat on Thursday, rebounded from an earlier dip in a low-volume session ahead of the closely watched weekly jobless claims report, with investors weighing the risk of another business shutdown amid soaring U.S. COVID-19 cases.

Despite the muted overnight session, the S&P 500 has now risen more than 40% from its March lows and is now about 7% below its February record high. The Labor Department’s most timely data on the economy is expected to show 1.38 million Americans filed for state unemployment benefits in the latest week, down from 1.43 million claims in the prior week. Cisco Systems rose 2% in premarket trading as Morgan Stanley upgraded its rating on the network gear maker’s stock to “overweight”. Walgreen’s slumped 3% after the company reported disappointing results with sales hit by the pandemic, announced it would suspend its buyback and cut 4,000 jobs. Best Buy was down 8.8% also as a result of sales and margin hits due to the pandemic.

The United States reported more than 60,000 new COVID-19 infections on Wednesday, setting a single day global record. And yet, investors continue to look past news of rising virus infections, concentrating on the continued reopening of economies. Confidence in policy support measures has mostly held firm, even as Hong Kong reported its biggest jump in cases since the start of the pandemic. The number of U.S. infections topped 3 million, more than a quarter of the global total.

“Risk is bouncing back broadly in equities but the real show is in Chinese equities, U.S. technology stocks and then gold,” said Saxo Bank CIO Steen Jakobsen. “U.S. Covid-19 cases rose yesterday to a new record and signs are now emerging that daily deaths are on the rise nationally which could suddenly become a new risk factor for the market.”

European stocks rose for the first time in three days, with shares in the region’s largest technology company, SAP SE, jumping over 7% after it reported better-than-expected second quarter revenue on returning demand for software in Asia.

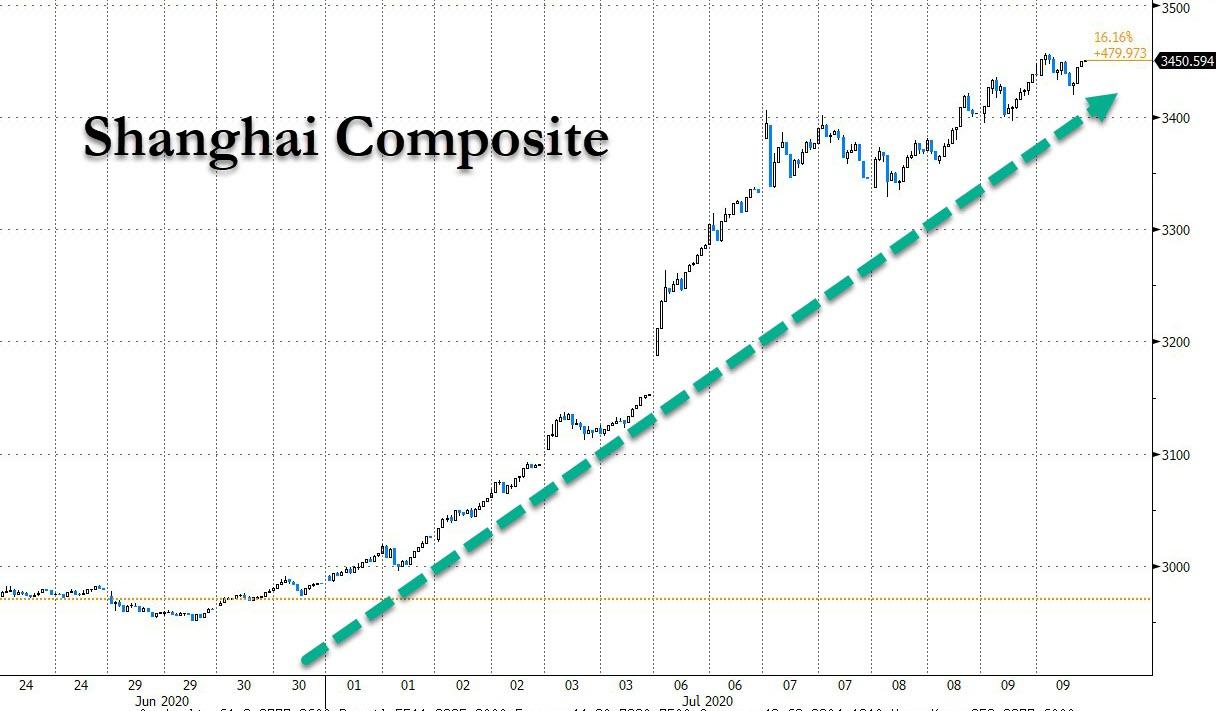

Halfway across the world, the Chinese stock rally continued for an eighth day as margin debt soared to the highest level since 2015, even after authorities cracked down on margin financing platforms and state media warns of risks. The Shanghai Composite Index rose 1.4%, with Xining Special Steel and Shanghai Sanmao Enterprise Group posting the biggest advances.

Elsewhere in Asia, stocks gained led by communications and materials, after rising in the last session. Markets in the region were mixed, with Shanghai Composite and India’s S&P BSE Sensex Index rising, and Jakarta Composite and Singapore’s Straits Times Index falling. Trading volume for MSCI Asia Pacific Index members was 70% above the monthly average for this time of the day. The Topix was little changed, with FamilyMart rising and Aeon Financial falling the most. Hong Kong’s Hang Seng Index erased a gain after the news site HK01 reported that at least 16 new local virus cases were found Thursday.

In rates, treasuries edged higher on low volume, with the 30Y auction at 1pm today. Yields from 5- to 30-year sectors lower on the day by 1bp-1.5bp, 10-year to ~0.65%, flattening 2s10s by ~1bp; bunds, gilts ~0.5bp cheaper on the day vs U.S. 10-year. Treasury yields richened slightly from belly to long end during Asia session and European morning in lackluster trading; front end little changed. Bunds, gilts lag. The week’s Treasury auction cycle concludes with $19BN 30-year reopening at 1pm ET; Wednesday’s 10-year reopening was well-bid, stopping 1bp below the WI yield at the bidding deadline at a record low yield.

In FX, the Bloomberg Dollar Index inched down to a three-week low as risk assets mostly held firm, dampening demand for the world’s reserve currency ahead of U.S. jobs data. Weaker-than-expected data on jobless claims would add to market concerns that the coronavirus outbreak is impacting the U.S. labor market recovery, according to Commonwealth Bank of Australia in note. EUR/USD climbed to a four-week high as investors bought the euro against the dollar and the yen, according to one FX trader. Chinese stocks led a rally in Asian equities after U.S. shares climbed on Wednesday.

“Amidst the improvement in economic data of late and the relatively buoyant market sentiment, a bearish consensus with the greenback seems to have been the case,” said Jingyi Pan, market strategist at IG Asia.

In commodities, oil was steady around $41 a barrel in New York after swelling U.S. crude stockpiles raised fresh concerns about oversupply. Silver rose above $19/oz with gold trading above $1800.

To the day ahead now, and the data highlights will include the weekly initial jobless claims from the US, along with Germany’s trade balance for May, Canadian housing starts for June. Elsewhere, we’ll hear from the Fed’s Bostic and the ECB’s Hernandez de Cos.

Market snapshot

- S&P 500 futures down 0.1% to 3,160.00

- MXAP up 0.6% to 166.19

- STOXX Europe 600 up 0.3% to 367.63

- German 10Y yield fell 0.6 bps to -0.446%

- Euro up 0.04% to $1.1335

- Italian 10Y yield fell 0.2 bps to 1.075%

- Spanish 10Y yield fell 0.6 bps to 0.404%

- MXAPJ up 0.7% to 552.43

- Nikkei up 0.4% to 22,529.29

- Topix unchanged at 1,557.24

- Hang Seng Index up 0.3% to 26,210.16

- Shanghai Composite up 1.4% to 3,450.59

- Sensex up 0.9% to 36,669.43

- Australia S&P/ASX 200 up 0.6% to 5,955.46

- Kospi up 0.4% to 2,167.90

- Brent futures up 0.1% to $43.35/bbl

- Gold spot up 0.3% to $1,814.94

- U.S. Dollar Index little changed at at 96.43

Top Overnight News

- Gold’s allure in 2020 continues to strengthen, with spot prices surpassing $1,800 an ounce and inflows into bullion-backed ETFs already topping the record full-year total set in 2009.

- European policy makers who frantically assembled plans to help their economies weather the coronavirus lockdowns are starting to focus on how to prevent cascading bankruptcies that could derail the rebound.

- Asian stocks pushed higher Thursday as investors continued to place faith in policy support and shrugged off simmering tensions between Washington and Beijing.

Asian equity markets traded mostly higher as the region took its cue from the positive rollover from US, where a late tech-led push helped all major indices finish in the green and lifted the Nasdaq to another record close on what had otherwise been predominantly indecisive session amid COVID-19 concerns. ASX 200 (+0.6%) and Nikkei 225 (+0.4%) were positive with gains in Australia led by tech as the sector found inspiration from its counterparts stateside and with gold miners euphoric after spot prices of the precious metal rose above USD 1800/oz for the first time since 2011, while stocks in Tokyo remained afloat after better than expected Machinery Orders data which showed a surprise expansion of 1.7% M/M although upside was initially capped amid virus fears. Hang Seng (+0.3%) and Shanghai Comp. (+1.4%) began indecisive after the PBoC continued to refrain from liquidity operations and with Chinese press calling for investors to manage risks, but gradually advanced amid a more amicable tone from China as Foreign Minister Wang stated that US-China relations need a more positive message and that China is willing to develop ties with US based on sincerity, despite noting that relations face serious challenges. Furthermore, Alibaba shares were among today’s stellar performers to track the upside in its US listing following reports its unit Ant Financial plans a Hong Kong IPO despite a denial by the unit. Finally, 10yr JGBs were indecisive as gains in stocks saw prices stall around the 152.00 level and with participants side-lined ahead of today’s 5yr auction. Finally, 10yr JGBs were indecisive as gains in stocks saw prices stall around the 152.00 level but later eked mild gains following firm demand at the 5yr JGB auction result.

Top Asian News

- Australia Suspends Hong Kong Extradition Deal in Swipe at China

- India Plans to Raise $2.7 Billion Selling Stakes in Two Firms

- Top Hong Kong Official Says Pan-Dem Primary May Break New Law

European equities have somewhat diverged to trade mixed [Euro Stoxx 50 +0.5%] as the optimism seen during the APAC session, which initially reverberated across Europe, petered out for some indices. Sentiment overnight was more-so a function of the tech-led gains seen on Wall Street and rally among miners, whilst Chinese press called on investors to manage risks accordingly amid the recent gains seen in the Mainland and Hong Kong. On that front, and more-so from a technical standpoint, reports note that over 70% of the CSI300 have a 14-day RSI over 70 – i.e. an overbought signal. Back to Europe, the FTSE 100 (-0.1%) is the only core bourse in the red amid unfavourable currency dynamics coupled with some large-cap movers to the downside. Sectors are mixed with a cyclical bias, with the detailed breakdown also painting a similar picture. The IT sector heavily outperforms peers and the broader market amid SAP’s (+7.7%) prelim earnings in which it reiterated guidance and stated that business recovered more than expected in Q2, while its flagship cloud revenue rose 21% YY. SAP carries an almost-10% weighting in the DAX and as such, the German index outperforms regional peers. Elsewhere, Rolls-Royce (-7.0%) immediately reversed course after opening higher by 3%, originally stemming from a positive trading update at face-value, as the breakdown warned of a significant revenue drop over the next seven years. Elsewhere, Siemens (+1.0%) hold onto gains after reports shareholders will vote on its proposal to spin off 55% of Siemens Energy to them. Finally, Atlantia (-9.0%) shares were halted to the downside after Italy’s 5-Star Leader Di Maio said the Co’s motorway concessions need to be withdrawn.

Top European News

- Siemens CEO Says Spinoff Is Best Way to Boost Share Price

- Commerzbank Power Vacuum Set to Last as Board Extends Search

- WeWork Rival Workspace Is Losing More London Office Tenants

- ECB Should Examine Targeting Average Inflation, Villeroy Says

- Bulgarian Police Raid President Radev’s Offices

In FX, cable is consolidating gains on the 1.2600 handle in wake of Wednesday’s fiscal support measures from UK Chancellor Sunak, while Eur/Gbp probes stops and support said to be sitting sub-0.8970 on positive Brexit vibes following EU chief negotiator Barnier conceding some ground on post-transition zonal arrangements, prompting more short covering of oversold Sterling positions. However, resistance looms ahead of the next round number in the form of a Fib retracement level at 1.2680 and then the 200 DMA at 1.2698.

- NZD/AUD – The Kiwi and Aussie continue to benefit from Greenback weakness alongside upturns in broad risk sentiment that are compensating/offsetting negatives for the latter via the COVID-19 related problems in Melbourne, Victoria that has now prompted Tasmania to extend its state of emergency. Nzd/Usd has advanced closer to 0.6600 with independent impetus coming from an improvement in ANZ business sentiment and even more pronounced rebound in the activity outlook, while Aud/Usd has retested 0.7000 as the Aud/Nzd cross hovers above 1.0600. Conversely, the DXY is struggling to retain sight of 96.500 having dipped below support to 96.233 in the run up to the latest US initial claims data and wholesale inventories, as the Buck remains prone to safe haven unwinding and the ongoing spiral in coronavirus infections/deaths in several hotspots.

- CAD/CHF/EUR/JPY – All narrowly mixed and still eyeing Usd moves alongside the general market tone, but the Loonie also conscious of decent option expiry interest between 1.3495-1.3500 (1 bn) and the 200 DMA (bang on 1.3500) ahead of Canada’s June leading index that follow’s yesterday’s economic and fiscal snapshot. Meanwhile, the Franc is meandering around 0.9375 and 1.0635 vs the Euro that pivots 1.1350 against the Dollar amidst expiries extending from 1.1300 (1.8 bn) through 1.1350-60 (1 bn) to 1.1375 (1.1 bn). Elsewhere, the Yen has eked gains towards 107.00 having been confined to a relatively tight range either side of 107.50, but could yet gravitate back given 1.1 bn option expiry for the NY cut, and with Jpy crosses firmer in line with the overall risk tone.

- SCANDI/EM – Indecisive and choppy trade across the board, but currencies mostly on the up and especially the Yuan that has made a more concerted 7.0000+ break following a PBoC midpoint fixing very close to the level and yet more strength in Chinese stock indices overnight.

In commodities, WTI and Brent front month futures trade choppy within tight ranges with price action somewhat lacklustre amid a lack of newsflow for the complex coupled with a number of bearish factors including this week’s inventory releases. News-flow for the complex has been light in early trade, although on the geopolitical front, one to keep on the radar would be the escalating tensions between Saudi and the Houthis, with the latest reports nothing that a Saudi-led coalition in Yemen have reportedly struck and destroyed two explosive laden-boats south of the port of Al Salif, according to Saudi TV. Nonetheless, crude prices remain flat/modestly softer with WTI Aug just above USD 40.50/bbl and Brent Sep keeps its head above USD 43/bbl. Elsewhere, spot gold retains at USD 1800/oz+ status having touched a recent high of USD 1816/oz. Shanghai copper hit a 16-month high on supply woes coupled with a firm performance in Chinese markets, whilst Dalian iron ore extended gains for a fifth straight day as steel mills replenish inventories on higher demand hopes.

US Event Calendar

- 8:30am: Initial Jobless Claims, est. 1.38m, prior 1.43m

- 8:30am: Continuing Claims, est. 18.8m, prior 19.3m

- 9:45am: Bloomberg Consumer Comfort, prior 43.3

- 10am: Wholesale Trade Sales MoM, est. 4.5%, prior -16.9%; Wholesale Inventories MoM, est. -1.2%, prior -1.2%

DB’s Jim Reid concludes the overnight wrap

In terms of yesterday’s market moves, one of the major headlines was the continued rally in gold, with the precious metal surpassing $1800/oz yesterday for the first time since 2011, before closing at a fresh 8-year high of $1809/oz. As we’ve written about in our monthly performance reviews, gold has been one of the strongest performing assets on a YTD basis in 2020 – up +19.22%. In many ways this isn’t surprising given central banks are printing money like it is going out of fashion. See Tuesday’s CoTD here showing that US money supply is up 25% yoy – only the 10th time above 20% in last 190 years of data.

Other metals continued to perform strongly too yesterday, with silver advancing by +2.45% yesterday to its own 4-month high, with the industrial bellwether of copper (+0.71%) up for a 7th straight session and to a new 5-month high. For more on the outlook for commodities see our strategists’ new note linked here. Notably our team has upgraded their 2021 gold target to $2000/oz, while shifting to a bullish Crude bias.

As gold and other metals advanced, US equity markets had a tough early session falling over 1% as several US states again announced elevated case counts. However, a steady recovery to just above flat was given a late boost in the last couple of hours of the day. It is possible that the late rally was partly due to Fed Reserve Bank of Atlanta President Bostic saying that the current pace of virus infections may warrant further policy action by either the central bank or Congress. With that the S&P 500 ended the session up +0.78% with another strong performance from tech stocks which saw the NASDAQ rise a further +1.44% and to a new record. Europe underperformed significantly however having been long closed before sentiment got a boost. The STOXX 600 ending the session down -0.67%, as other bourses experienced even larger declines, including the DAX (-0.97%) and the CAC 40 (-1.24%). Banks were among the laggards once again with the STOXX Banks index falling a further -2.12%. It was the reverse picture in fixed income though, with US Treasuries losing ground as European sovereign bonds advanced. By the close, 10yr Treasury yields had risen +2.5bps, in contrast to bunds which fell -1.1bps. BTPs were fairly flat to bunds.

Asian markets are trading higher this morning following Wall Street’s lead with the Nikkei (+0.59%), Hang Seng (+0.47%), Shanghai Comp (+1.03%; marking 8 days of consecutive gains), Kospi (+0.78%) and ASX (+1.07%) all posting gains. In Fx, the US dollar index is down a further -0.13% after yesterday’s -0.47% decline. Meanwhile, futures on the S&P 500 are trading flat. In terms of data out overnight, China’s June CPI printed in line with consensus at +2.5% yoy while PPI came in at -3.0% yoy (vs. -3.2% yoy expected).

In other news, Bloomberg reported overnight that Joe Biden will call for a moderate approach toward reviving the U.S. economy if elected President that includes spurring manufacturing and encouraging innovation, shelving for now the more ambitious proposals pushed by progressive Democrats. He is likely to deliver an economic speech today framing his argument for the rest of the campaign. As an aside the challenges going forward were further highlighted yesterday as United Airlines notified 45% of its workforce (36,000 employees in total) that their jobs are at risk after federal payroll aid expires at the end of September.

On the coronavirus, there weren’t a great deal of fresh headlines yesterday, though we saw yet further case increases in the US, with Florida and Arizona rising by 4.7% and 3.3% respectively. The country overall has now passed 3 million cases, with daily cases now increasing by over 50,000 per day for the first time. For context, the peak in April saw 31,500 average cases per day. Texas posted its second record day of fatalities with a further 97 yesterday. The 7 day average rise in fatalities is now 1.9% per day, after being in a range between 1.3% and 1.5% for the last 3 weeks, so this bears paying attention to even if the lagged ratio of deaths to cases is still well below that of the first wave. Citing backlogs in some counties, the Governor of California announced that cases in the state rose by over 11,000, the largest one day rise yet. Positive test rates in the state are now up to 7% after being at 5% just 2 weeks ago. With caseloads rising, the New Jersey Governor said that he would issue an order for the public to wear masks outside where crowds are congregating, whilst here in the UK, one hospital in west London closed for emergencies following a Covid-19 outbreak there. Globally, cases have now crossed the 12 million mark and even in areas with a low number of cases there are still fears. Indeed Hong Kong’s government has expressed worries that the city might be in the early days of a wider outbreak. Hong Kong has seen 118 new cases since June 30 and reported 19 new community transmissions yesterday.

Elsewhere disputes emerged in the US over school reopenings, with President Trump tweeting that he disagreed with the CDC’s school reopening guidelines, referring to them as “very tough & expensive”. Meanwhile NYC mayor de Blasio said on schools that he anticipated a “blended” learning program that would see students in class 2-3 days each week once school restarts in September, though Governor Cuomo announced he will be making a final decision on NY schools in early August.

Back to the U.K., Chancellor Sunak announced a fresh package of fiscal stimulus measures to bolster the recovery, which could be worth up to £30bn in total. In terms of the main announcements, the biggest is potentially the job retention bonus, whereby employers who bring back furloughed workers can qualify for a £1,000 bonus per employee, provided certain conditions are met. In theory, if all 9.4m furloughed jobs were retained, then this could be worth £9.4bn. The other main highlights include a temporary 9-month VAT cut from 20% to 5% for hospitality, accommodation and attractions, as well as a temporary Stamp Duty cut (the tax paid on home purchases) that will see the threshold rise to from £125k to £500k up to the end of March. And finally, though it was far from the costliest measure announced, one of the most headline-grabbing was an “Eat Out to Help Out” scheme whereby diners will get a 50% discount of up to £10 per head when eating out, valid Monday to Wednesday throughout August. The Early Morning Reid will come live from the terrace at my golf course opposite my house early in the week in August. For more on the Chancellor’s announcement see out UK economists note here.

On the longer term implications, it’s worth noting that in spite of the fiscal largesse yesterday, Sunak said that “over the medium term, we must, and we will, put out public finances back on a sustainable footing.” So clearly a nod towards future fiscal tightening now that the national debt is over 100% of GDP for the first time since 1963. Furthermore, there was also the acknowledgement that the furlough scheme “cannot and should not go on forever.” We should hear more this autumn when we get the next Budget and Spending Review from the UK government. For what it’s worth I suspect governments (including the U.K.) will talk a tough game on fiscal discipline going forward but the reality is that the fiscal genie is now out of the bottle and we’re set for a decade of MMT and helicopter money type policies. We will see.

To the day ahead now, and the data highlights will include the weekly initial jobless claims from the US, along with Germany’s trade balance for May, Canadian housing starts for June, and Japan’s preliminary machine tool orders reading for June. Elsewhere, we’ll hear from the Fed’s Bostic and the ECB’s Hernandez de Cos.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com