No ‘Phase 2’ China Trade Deal Could Be Bad News For Stocks

Tyler Durden

Sun, 07/12/2020 – 09:55

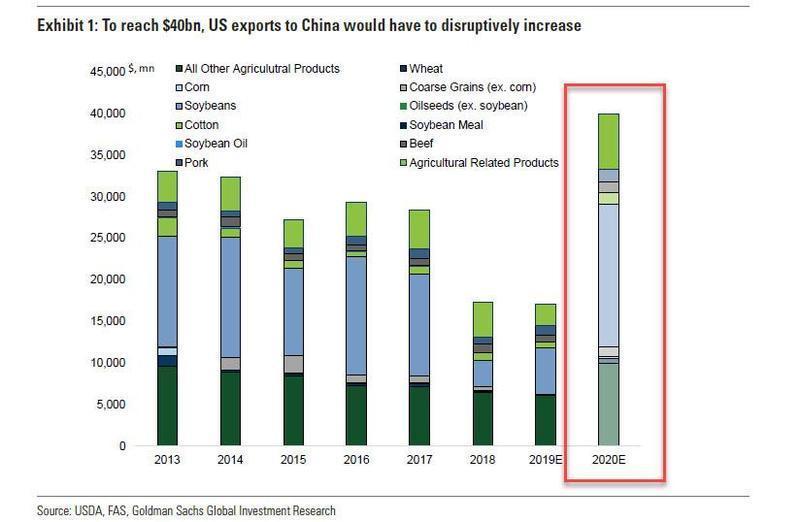

President Trump spent the last year overhyping the prospects of a trade deal with China to boost the stock market. It seems now after China abandoned US farmers for Latin American ones – Trump has partially come clean about the flimsy deal and said Friday, a ‘Phase 2’ trade deal is ‘unlikely.’

Readers may recall, President Trump said in 2018: “trade wars are good, and easy to win.” Yeah, okay… As phase one of the deal was signed in January, we outlined how there was no way in hell that China’s purchases (in terms of dollar amount) under the trade agreement would be met this year.

For more color on China, not upholding trade commitments under the first phase – Peterson Institute for International Economics (PIIE) trade deal tracker (latest data from April), shows China’s purchases under the agreement have been significantly below agreed-upon levels.

Back in May, Trump said he was “very torn” about whether to scrap the ‘Phase 1’ deal or keep it in place. Treasury Secretary Mnuchin has defended the deal and assured the public it would remain in place.

However, Pete Navarro recently received a ton of flack from others in the administration when he told a Fox reporter that phase one of the deal was “over.” Navarro was forced to walk back those comments, but we suspected there was more truth to them than the administration would admit.

Larry Kudlow was out last week, unable to pump trade deal numbers, said, “We are very unhappy with China.”

So with phase one deal commitments likely unable to be met in the next five or so months, a phase two deal dead in the water – this suggests international trade between both countries will remain depressed in the back half of the year.

The consequence of slumping Sino-US trade flows could be bad news for global stock markets:

Gross (exports plus imports) Sino-US trade flows on a twelve-month rolling sum, in billions of dollars, peaked during the trade war in November 2018, has since plunged below 2016 lows. In other words, peak globalism.

Sino-US trade flows on a twelve-month rolling sum, in billions of dollars, versus the Wilshire 5000, suggests declining trade flows between the largest (the US) and second-largest (China) economies (in terms of GDP) could impact stock prices in the coming quarters.

Sino-US trade flows on a twelve-month rolling sum, in billions of dollars, versus MSCI World, shows slumping trade between both countries could prove disasters for stocks, and or lead to a reversal in the latest central bank-fueled rally.

Sino-US trade flows on a twelve-month rolling sum, in billions of dollars, versus the CRB Commodity Index shows commodity prices will remain depressed this year.

More or less, declining trade flows between the US and China is bad news for stock and commodity prices.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com