Never Before Has So Much Stimulus Been Injected In The Economy In A Single Quarter

Tyler Durden

Tue, 07/21/2020 – 05:00

Submitted by Joe Carson, former chief economist at AllianceBernstein

Pandemic-Driven Recession Is Not Over

Back-to-back strong monthly gains in retail sales in May and June and a powerful rebound in the equity markets in Q2 create the impression the recession is over. But the recessionary environment is only delayed, hidden by the record amount of fiscal and monetary stimulus that has postponed layoffs, spending cutbacks, bankruptcies, and business failures and operating losses.

The pandemic crisis is unique in that it involves public health, finance, and economics. An all-out policy package of fiscal and monetary stimulus helped finance recover and the economy to rebound. However, a pandemic-driven recession runs on its own timeline and is unaffected by the scale of stimulus. The new wave of COVID cases could quickly trigger a shift in investor sentiment from optimism to pessimism as the rebound in corporate earnings is postponed.

Record Output Loss & Record Stimulus

According to the latest GDP NOW report from the Federal Reserve Bank of Atlanta, Q2 GDP is estimated to have declined 35% at an annualized rate. That would be 4x times larger than the prior record decline of 8.4% annualized in Q4 2008.

Quarterly dollar estimates of GDP are reported on an annual rate basis. So assuming the GDP NOW estimate is close to the mark, Q2 Nominal GDP would fall below the $20 trillion (or $ 5 trillion for the quarter), a level last seen in 2017.

$5 trillion in nominal output (and income) in Q2 would essentially match the record amount of fiscal and monetary stimulus that hit the economy in the period.

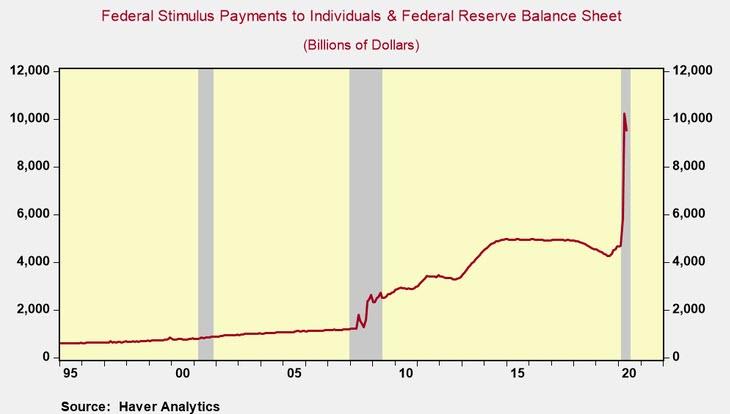

According to my estimates, the combination of federal stimulus payments to individuals (i.e., stimulus checks to individuals, additional unemployment benefits to a broader range of workers never before eligible and other programs) plus the expansion of Federal Reserve Balance sheet amounted to an increase of approximately $5 trillion in aggregate fiscal and monetary stimulus over the three months ending in June (see chart).

Never before has so much fiscal and monetary stimulus been injected in the economy in a single quarter. And never before has the scale of the stimulus matched the nation’s nominal output.

To be fair, the rapid expansion of the Federal Reserve’s balance sheet did not directly feed into GDP. But it did help drive up asset prices, lift investor sentiment, and in the process boost consumer spending as well.

But there also forms of fiscal stimulus or financial support that are missing from my calculations. For example, the US Treasury allowed individuals and corporations to delay a portion of final tax settlements due on April 15 to July 15. The US Treasury estimated that would boost provide about $300 billion in additional liquidity in the quarter.

Also, states and municipalities placed moratoriums on evictions for non-payment of rents. Several states have now extended those restrictions until the end of Q3. Meanwhile, the Federal CARES ACT passed in March protects renters living in properties with government-backed mortgages from eviction until July 25. Borrowers with similar mortgages can request temporary loan forbearance for 180 days, with an extension of up to an additional 180 days.

Meanwhile, economic and financial strains emanating from pandemic are far from over. The current daily rate of 70,000 COVID cases is more than three times the daily figures of March when the fiscal and monetary stimulus were passed and implemented.

How many of these new cases are showing up in new jobless claims is hard to say. But with jobless claims running at 1.3 million a week or over 5 million in a month labor market conditions are far from normal. And with COVID cases on the rise, the bigger risk is that jobless claims remain elevated or increase again as states re-impose restrictions on businesses and people.

In the weeks and months ahead the US economy faces several challenges. Individuals and companies face unpaid tax and other bills. But states and municipalities might face the most severe crisis.

In April, the National Association of Governors asked for $500 billion in federal aid to help deal with their budget crisis as revenues collapsed while trying to maintain essential services as well as the increased outlays for public health care.

Congress did not respond to their request. States now face the task of opening of schools with new health care requirements and added costs, and still owing on past bills.

Congress is expected to begin a discussion soon on another stimulus package of around $1 trillion. A trillion dollars of additional fiscal stimulus sounds big but in reality, it’s not. That’s because the federal government never filled all of the “holes” (aid to states, public health & testing, and support to small businesses) in earlier stimulus bills. Some of those “holes” have deepened and widened over the past month or so as new COVID cases have hit states that were previously unaffected (e.g. Florida and Texas) while reappearing in force in others, such as California.

Optimism about a second-half recovery could soon run into disappointments as the pandemic-driven recession runs on its timeline, forcing states to reimpose harsh restrictions on businesses while also delaying the opening of schools. Accordingly, declines in retail sales and employment could reappear before Q3 is over, triggering a rapid shift from optimism to pessimism among investors in the outlook for corporate earnings.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com