Gundlach Says “Classic Bear Market Rally” Reminds Him Of 1999

Tyler Durden

Sat, 07/25/2020 – 16:20

Jeffrey Gundlach, the billionaire chief investment officer of DoubleLine Capital, was quoted by Reuters on Friday as saying the stock market’s parabolic move in the last couple of months reminds him of the days right before the Dot Com bust.

Gundlach, who oversees a $138 billion fund that is primarily invested in fixed income assets, was troubled by the rapid surge in government debt that has propped up the ailing economy.

He said the dollar would be pressured to the downside as deficits rise. Dollar weakness could boost equities in the short term, he said, adding that “ultimately it weakens as the debt situation is really remarkably bad for a developed country.”

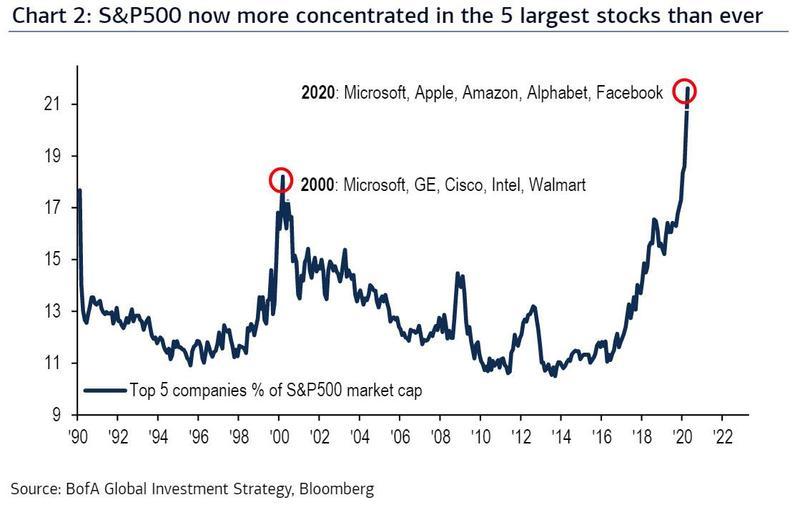

Gundlach voiced concerns about the V-shaped recovery in the S&P500 from its March lows, along with how much of the gains are concentrated in a handful of technology stocks.

He said the concentration in equity market leadership is mainly in FANG stocks (that is Amazon, Apple, Microsoft, and Google) and retail investors panic buying stocks “is classic bear market rally activity,” and a reminder of what he believes could be similar to the days right before the Dot Com implosion.

Gundlach warned today’s situation is “way worse because we don’t have the ability to cut interest rates” and have “used all the tools that are typically reserved for fighting economic problems.”

Gundlach said there could be more opportunities in overseas markets. His latest warning is similar to the DoubleLine Total Return Bond Fund webcast on July 9, where he said stocks are likely to fall from its “lofty” perch.

For more color on why Gundlach is convinced today’s move in stocks is a “bear market rally,” the first chart below is the ratio of tech-heavy Nasdaq 100 over S&P500, hitting levels not seen since the Dot Com peak as investors panic buy FANG stocks.

In early July, the ratio breached the Dot Com peak, implying high-flying tech stocks were more overvalued today than right before the bust in late 1999/2000. Shown below, the ratio has since faded below the 2000 peak, due mainly to valuation concerns.

Nasdaq 100 remains disconnected from reality as treasury yields slide due to stalling recovery.

Gold soars to decade high. Gundlach mentioned in his July webcast that he was still bullish on precious metals.

Gold rises as negative-yielding debt market value increases.

While Gundlach fears 1999, many are more concerned the current bear-market bounce is more akin to the 1930s collapse. Either way, this is far from over…

Gary Shilling believes a 1930s-style decline in the stock market is just ahead…

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com