Charting The Retail Devastation: Here Is The Stunning List Of US Store Closures In 2020

Tyler Durden

Sun, 07/26/2020 – 21:00

While the US “bricks-and-mortar” retail industry was already on its deathbed before the covid pandemic struck with stories discussing the “retail apocalypse” as far back as 2015, the events in the past few months have simply accelerated a long-overdue process that would have taken several years to conclude with mass bankruptcies of corporate zombies coupled with tens of thousands of store closures.

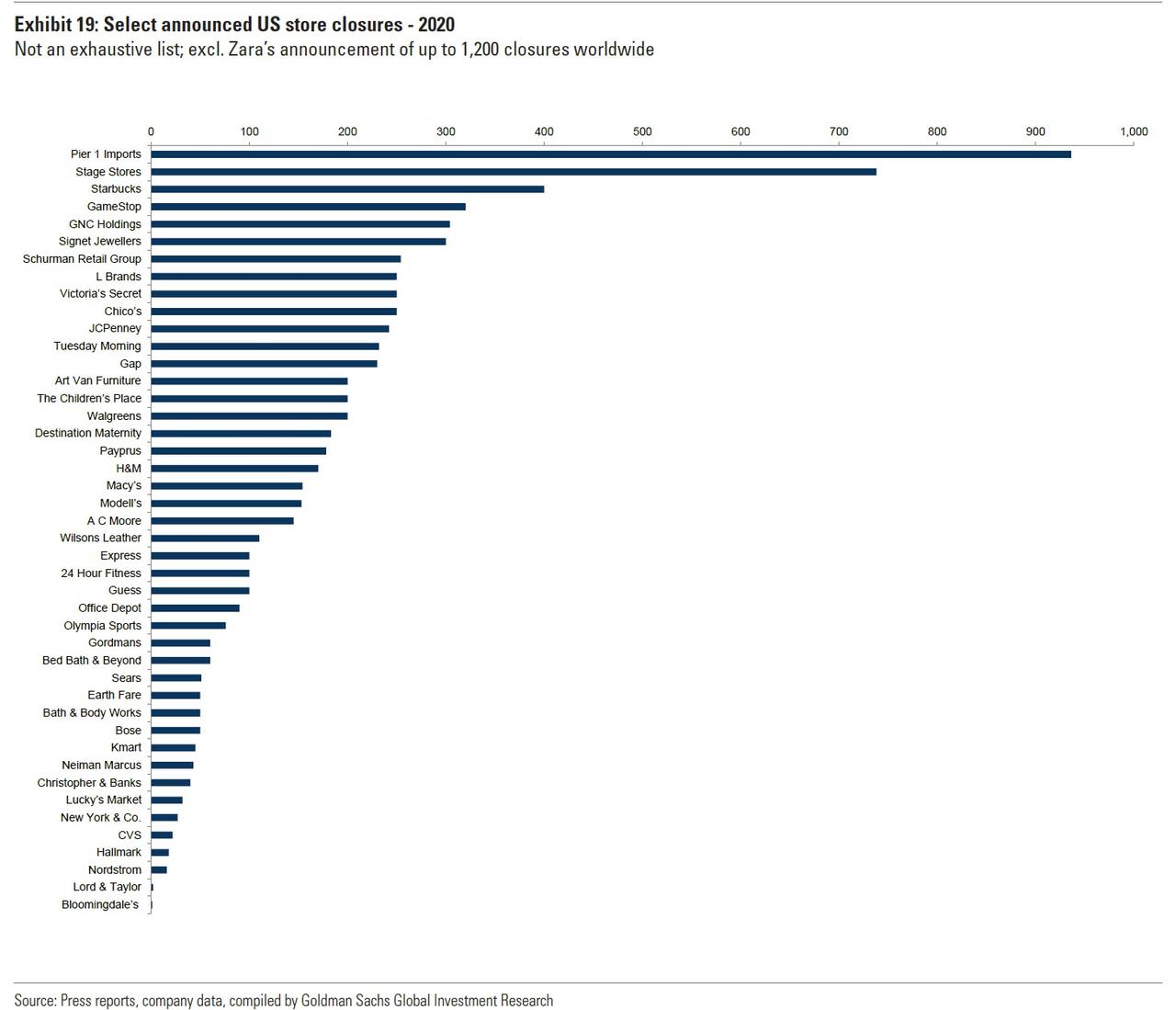

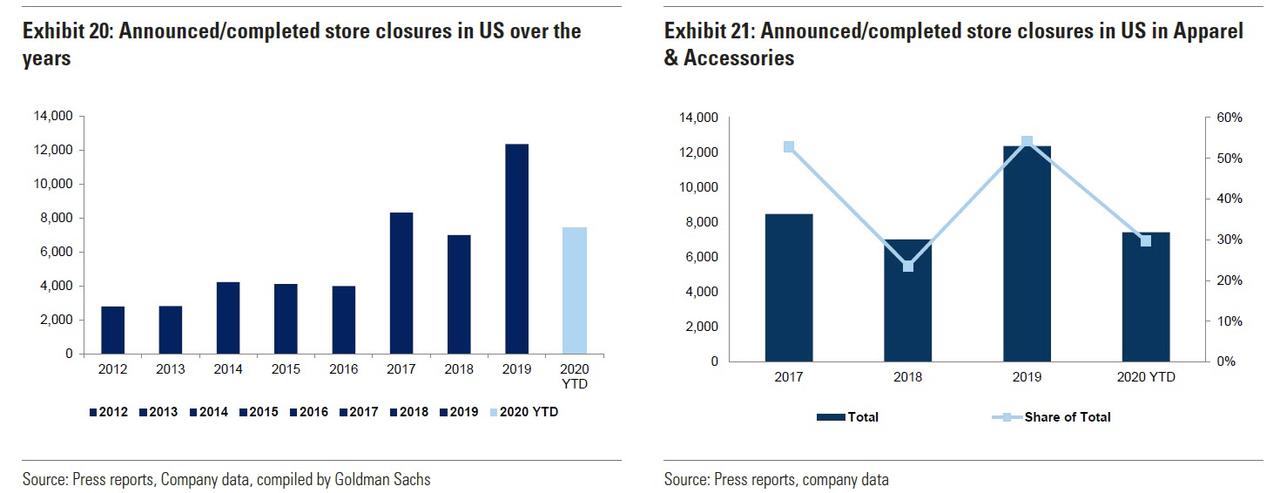

And so, unlike other sectors of the US economy which have – for now – avoided to be swept by the “biblical” default wave that is sweeping across the US corporate sector, amid temporary store closures as part of shelter-in-place measures, Goldman calculates that the announcement (and completion) of permanent store closures YTD (~7,430) has already reached more than half of 2019 figures (~12,370) due to slowing/declining sales growth, leveraged balance sheets, and rising occupancy costs.

It’s only going to get worse: according to Coresight Research, around 20,000-25,000 stores could permanently close in 2020 on COVID-19 headwinds in the US, implying an accelerated store closure schedule in the second half of the year. Further, it expects to see an increase in bankruptcy filings owing to reorganizations or difficulties with financing activities amid the current pandemic.

Meanwhile, as some retailers are experiencing a surge in digital volumes, pure-play eCommerce companies like Amazon continue to benefit from greater access to consumer data and purchase history that enable compelling consumer experiences and also deliver efficiency and competitive benefits through advertising, product recommendations, and dynamic pricing.

This is also why Goldman believes that eCommerce growth will accelerate over the course of the second half amid social distancing measures, record number of retail store closures, investments in fulfillment by Amazon, and increasing tech investments by traditional retailers.

Not surprisingly, with apparel & accessories continuing to record large share of store closures as shown in the charts above and below, Goldman which just upped its price target on Amazon to $3,800, believe the online retail giant will be the primary beneficiary considering this segment already sees >20% online penetration.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com