Amazon Soars After Smashing Expectations, Guiding Sharply Higher

Tyler Durden

Thu, 07/30/2020 – 16:30

Heading into today’s earnings call juggernaut which sees almost $5 trillion in market cap report among just 4 companies (AAPL $1.7TN, $1.2TN, GOOGL $1TN, AMZN FB $670BN) Amazon had emerged as the one FAAMG stock that was viewed as the cleanest clean shirt among the uber-mega-cap techs (unlike Facebook and Google it has no risky ad exposure; unlike Apple it has no risky China exposure) and despite a drop in its consensus earnings estimates…

… the stock has soared 60% in 2020 hitting a new all time high, and a record market cap of $1.5 trillion, more than $300 billion higher than where it was during its last, Q1 earnings calls (which was a disappointment due to the company’s forecast of shrinking profits) on expectations that the online retailer would be the biggest beneficiary of the transformation in US society to one where most work from home and just order random stuff online while conventional retailers rush to file for bankruptcy.

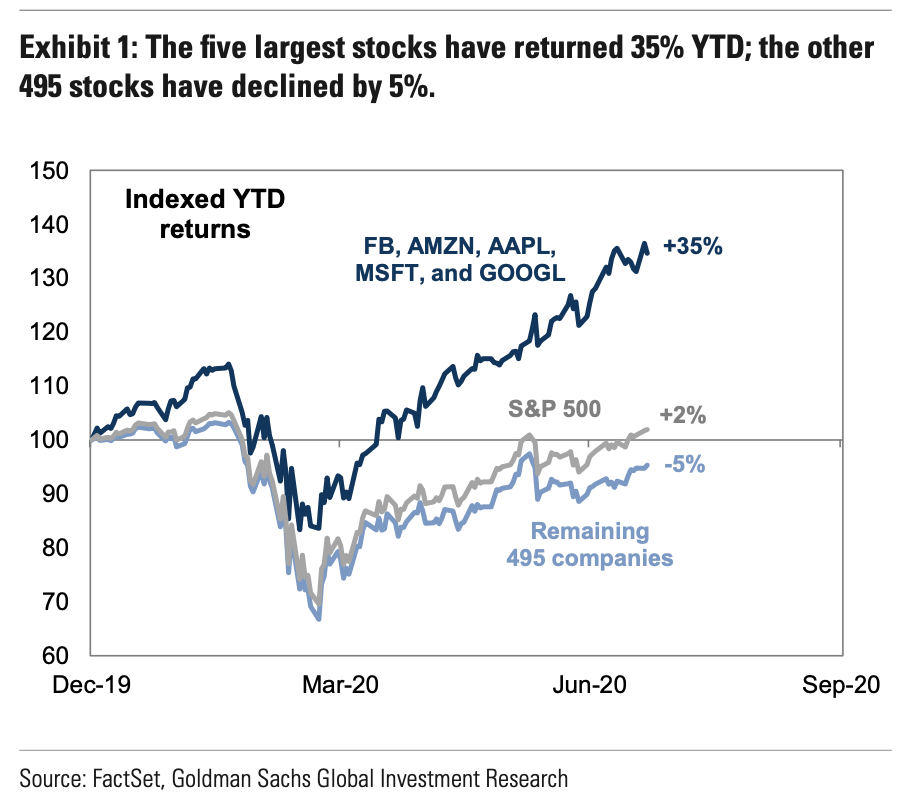

Which is not to say that the other megatechs have done poorly, on the contrary, the Nasdaq has rallied more than 50% from the depths of the market rout in March and is trading near a record high, thanks almost entirely just to five stocks, among which all the four companies reporting today including Apple, Amazon, Facebook and Alphabet, which are also among the top 5 heaviest-weighted stocks in the S&P 500. Needless to say, an outsized move in any or all of the four would tilt the whole market.

Here, a quick reminder: last quarter, Amazon said the current quarter would come with a multi-billion footnote: while under normal circumstances, Amazon would be expected to reap a second-quarter operating profit of something like $4 billion, instead the company projected a surge in covid-linked costs such as logistical changes, more staff in warehouses, as well as measures to keep them and their corporate peers safe, which would offset the profit. As a result, Amazon forecast an operating income range of $1.5 billion to a $1.5 billion loss, which however clearly did not adversely impact the stock (except for a brief period of a few hours after last earnings were reported).

So was all this optimism – and staggering stock price surge – justified? Well, apparently yes and bigly so because the company not only smashed earnings expectations, but also reported net sales for the second quarter that beat the highest analyst estimate.

- Q2 Revenue of $88.9BN, Exp. $81.24BN

- Q2 EPS of a whopping $10.30 vs exp. $1.51

- Q2 EBIT of $5.843BN vs exp. $420MM

- Q2 AWS revenue of $10.81BN, a small miss of expectations of $11.01BN, up 31%

- As noted above, Amazon said it spent over $4BN on incremental Covid-19 costs

In other words, Amazon smashed both top and bottom line expectations, despite a small miss on AWS expectations. But it was Amazon’s superb forecast that stoked investors, sending the stock soaring after hours:

- Amazon sees 3Q Net Sales $87.0B to $93.0B, both well above the exp. $86.51B

-

Operating income is expected to be between $2.0 billion and $5.0 billion, compared with $3.2 billion in third quarter 2019. This guidance assumes more than $2.0 billion of costs related to COVID-19.

Of note, the Covid-19 bill is getting cut in half at Amazon. The company, as expected, said it spent an additional $4 billion on its operations because of the pandemic during 2Q. Looking ahead, for 3Q Amazon forecasts pandemic related costs of $2 billion. That explains the much more optimistic income guidance of $2 billion to $5 billion. Analysts going into earnings forecast $2.8 billion.

As shown in the chart below…

… projected Q3 revenue growth of 28.6% (taking the midline) was clearly just as impressive and indicates the company does not expect any headwinds on the topline.

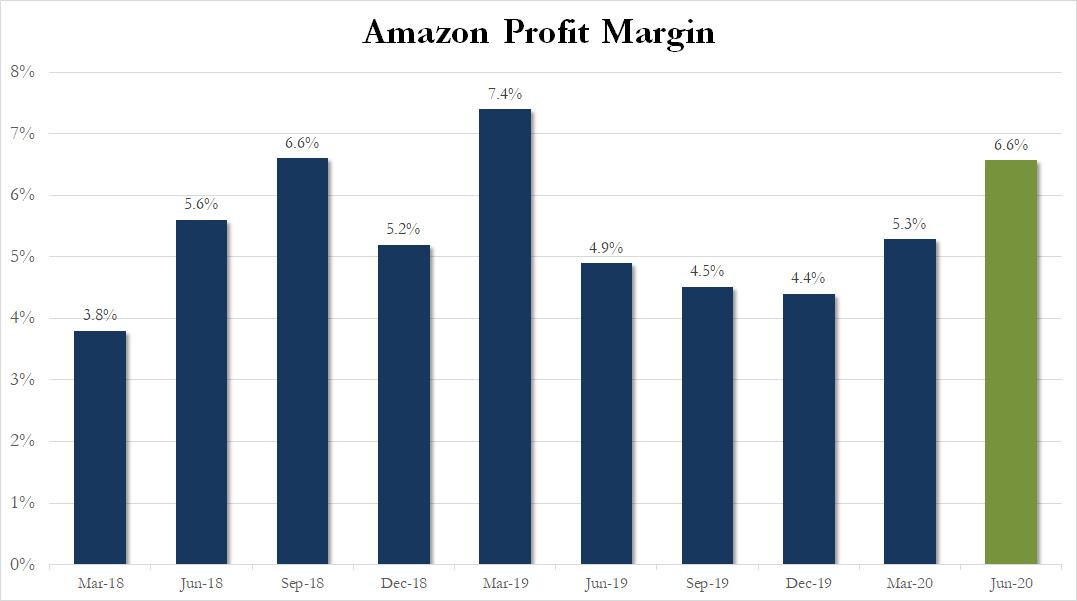

There was more good news in the company’s profit margin which rose sequentially to 6.6%, the second highest in recent history.

Some other headlines from the report:

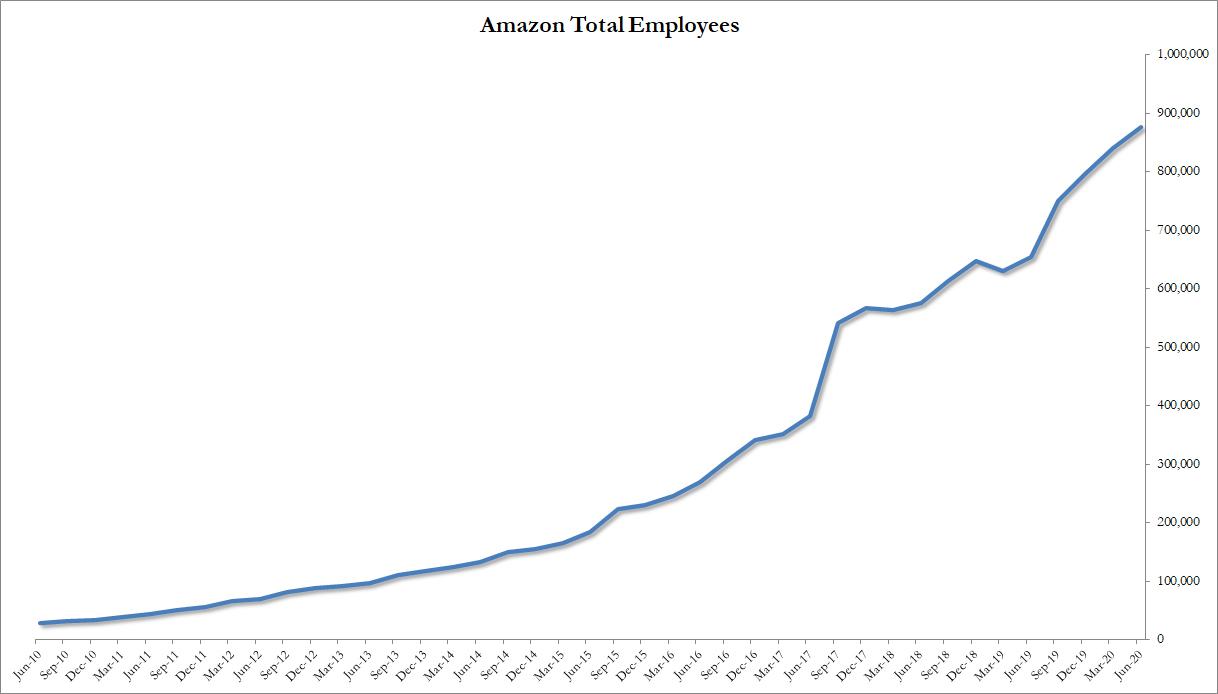

- Created Over 175,000 New Jobs Since March

- Invested Over $9B in Capital Projects

- Increased Grocery Delivery Capacity by Over 160%

- Online Grocery Sales Tripled in 2Q vs Period Last Year

- 3Q Oper Income View Assumes Over $2B Covid-19 Costs

- Third-Party Sales Grew Faster Than First-Party Sales

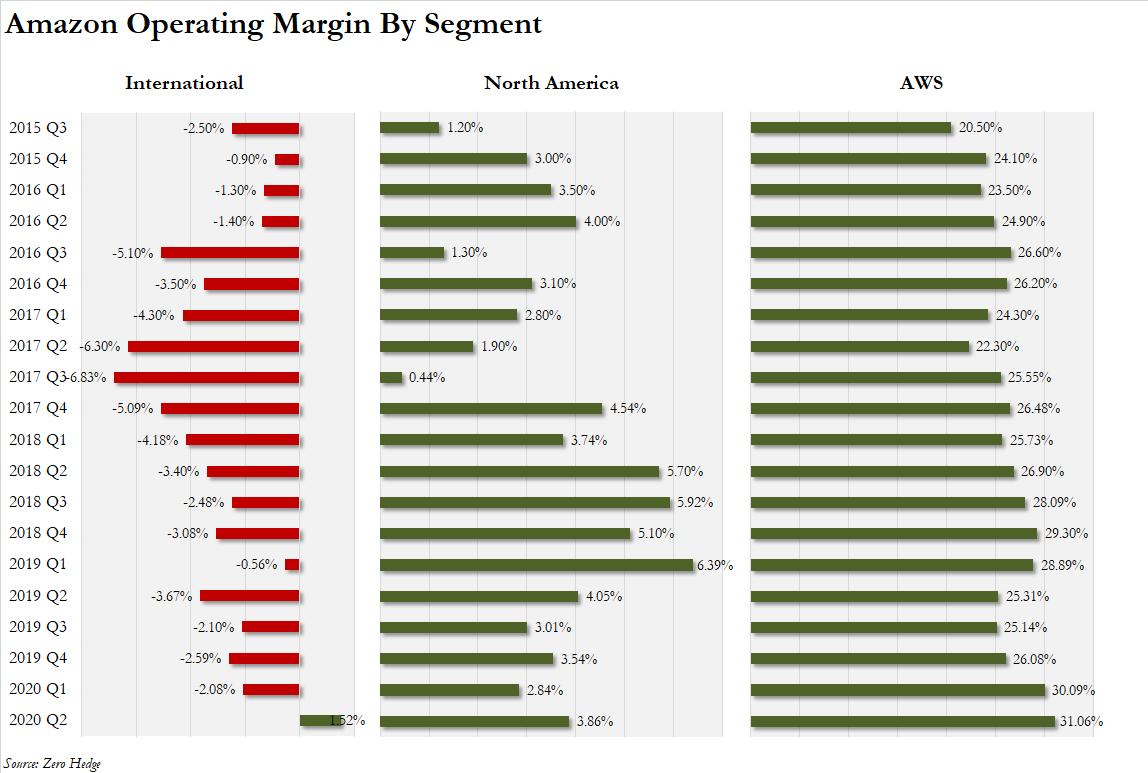

As usual AWS was the primary source of profit, and with $3.357 BN in operating income (up from $2.121 BN a year ago) or 57.5% of the company’s total operating income of $5.843. Meanwhile, the international division finally appears to have stopped burning cash, and after generating $22.7BN in sales, it resulted in its first profit in years, to the tune of $345MM in Q2.

To summarize, AWS revenue growth continues to slow modestly:

- Q1 2018: 48%

- Q2 2018: 49%

- Q3 2018: 46%

- Q4 2018: 46%

- Q1 2019: 42%

- Q2 2019: 37%

- Q3 2019: 35%

- Q4 2019: 34%

- Q1 2020: 33%

- Q2 2020: 28.9%

However, offsetting this is that after declining for a year, AWS operating margins posted a rebound for a second consecutive quarter:

- Q1 2018: 25.7%

- Q2 2018: 26.9%

- Q3 2018: 31.1%

- Q4 2018: 29.3%

- Q1 2019: 28.9%

- Q2 2019: 25.3%

- Q3 2019: 25.1%

- Q4 2019: 26.1%

- Q1 2020: 30.1%

- Q2 2020: 31.0%

Meanwhile, Amazon’s North America segment margins rebounded from 2.84%, the lowest in three years, to 3.86%.

Commenting on the results, Jeff Bezos said that this was another highly unusual quarter:

“This was another highly unusual quarter, and I couldn’t be more proud of and grateful to our employees around the globe.”

“As expected, we spent over $4 billion on incremental COVID-19-related costs in the quarter to help keep employees safe and deliver products to customers in this time of high demand—purchasing personal protective equipment, increasing cleaning of our facilities, following new safety process paths, adding new backup family care benefits, and paying a special thank you bonus of over $500 million to front-line employees and delivery partners. We’ve created over 175,000 new jobs since March and are in the process of bringing 125,000 of these employees into regular, full-time positions. And third-party sales again grew faster this quarter than Amazon’s first-party sales. Lastly, even in this unpredictable time, we injected significant money into the economy this quarter, investing over $9 billion in capital projects, including fulfillment, transportation, and AWS.”

And speaking of employees, Amazon now has a record 876.8K workers.

Needless to say, with blowout earnings and stellar guidance, the stock is surging after hours, and was approaching it all time high.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com