Key Events In The Coming Week: Payrolls, PMIs And (Lack Of) Profits

Tyler Durden

Mon, 08/03/2020 – 09:16

Looking ahead to this week now, the release of PMIs from around the world (today and Wednesday mostly) will set the tone, before the July US jobs report on Friday rounds out the week. On the central bank front, we will hear the monetary policy decision from the Bank of England and Governor Bailey’s ensuing press conference on Thursday. The market also enters the second half of Q2 earnings season, which has already seen a record number of beats in the S&P 500.

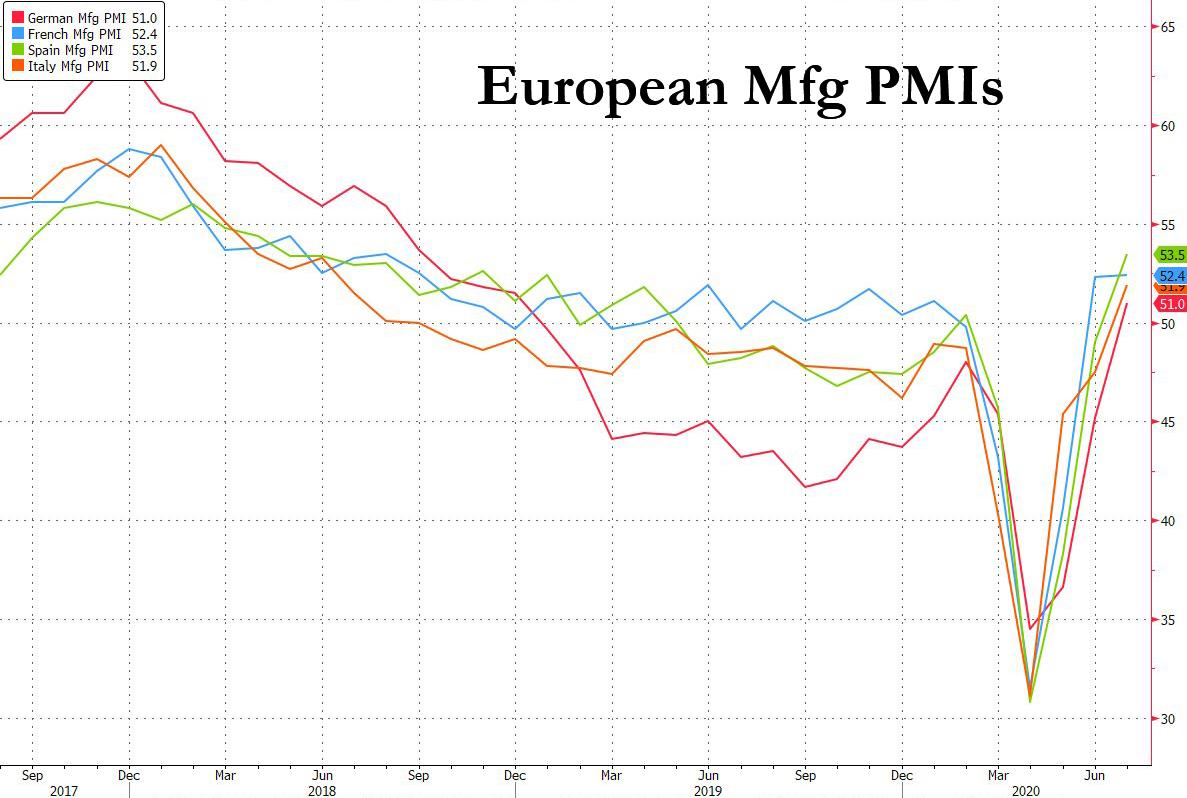

Looking at the current week, the data highlights will be Friday’s payrolls and various high-frequency economic in the form of survey, with the majority of manufacturing PMIs out on today, before services and composite PMIs come out on Wednesday for the most part. There’ll also be the ISM manufacturing index from the US (today) and non-manufacturing ISM on Wednesday. The key here, according to DB’s Jim Reid, will be to see how differentiated PMIs are given that some governments around the world are cautiously easing restrictions with others needing to tighten. For the countries where we already have a flash PMI reading, they generally showed that the recovery has more momentum in Europe than in the US. Many of the flash European levels were the strongest in at least two years, while both manufacturing and services PMIs in the US failed to meet expectations.

As ever caution is required as these are diffusion indices which simply monitor whether activity is better or worse than the previous month. And as the DB strategist notes, remember that the US was never as shutdown as Europe so momentum was always likely to be more in the latter’s favor regardless of the recent rise in cases.

In terms of payrolls on Friday, markets are generally expecting a third straight month of gains, though likely at a slower rate than we saw in June. DB economists are looking for a further +900k gain in the headline, below consensus estimates at +1.578m. This follows last month’s blowout +4.8m increase. The economists also see the unemployment rate falling to 10.5% from 11.1%, in line with the median estimate. This data will give some insight into how the renewed spread of the coronavirus through the US, especially in the South and West have affected the US economy. The rest of the key data can be found in the day by day week ahead guide at the end.

On the central bank front, one highlight will be the Bank of England meeting and Governor Bailey’s ensuing press conference on Thursday. While most economists do not expect any change to the policy rate this meeting, there is a chance for a dovish surprise on the overall commentary and tone. Focus will be on the central bank’s economic projections, the ongoing review of the effective lower bound, and the path of QE.

Elsewhere in central banks, India and Brazil are also releasing their policy decisions on Wednesday and Thursday, respectively. The two countries have the highest confirmed coronavirus caseloads outside the US, and are expected to lower interest rates in light of the continued economic impact of the pandemic. Following the FOMC last week and the lifting of the blackout period, we will hear from the Fed’s Bullard, Evans, Mester and Kaplan.

Earnings will continue to be in focus, with 133 companies reporting from the S&P 500 and a further 95 from the STOXX 600. Among the releases include HSBC, Heineken, Siemens, Berkshire Hathaway, and Ferrari today. Then tomorrow markets will hear from Bayer, Diageo, Fidelity, BP, Walt Disney and Activision Blizzard. Wednesday will see Deutsche Post, Allianz, Humana, Bayerische Motoren, Regeneron Pharmaceuticals, CVS Health, MetLife and Fiserv release earnings. Following that, Thursday includes Merck, AXA, Siemens, adidas, Bristol-Myers Squibb, Novo Nordisk, Becton Dickinson & Co, Zoetis, T-Mobile, Illumina. Finally on Friday, Standard Life Aberdeen, Norwegian Cruise Line, Royal Caribbean Cruises and Ventas. So another busy week.

Here is a day-by-day calendar of events

Monday

- Data: Japan final Q1 GDP; Japan, China (Caixin), Brazil, Spain, Italy, France, Germany, Euro Area, UK and US (Markit) final July manufacturing PMIs; US July ISM manufacturing index, June construction spending and July total vehicle sales

- Central Banks: Fed’s Bullard and Evans speak on economic outlook

- Earnings: HSBC, Heineken, Siemens Healthineers, Berkshire Hathaway, Global Payments, Ferrari

Tuesday

- Data: Euro Area June PPI; Canada July manufacturing PMI; US June factory orders, and final durable goods orders; Japan CPI, France June budget balance

- Earnings: Bayer, Diageo, Fidelity, BP, Walt Disney, Activision Blizzard

Wednesday

- Data: Japan, China (Caixin), Spain, Italy, France, Germany, Euro Area, UK and US Markit final July services and composite PMIs; US July ISM non-manufacturing index, weekly MBA mortgage applications, June trade balance, and July ADP employment change; UK July new car registrations

- Central Banks: Brazil Monetary policy decision; Fed’s Mester speaks

- Earnings: Deutsche Post, Allianz, Humana, Bayerische Motoren, Regeneron Pharmaceuticals, CVS Health, MetLife, Fiserv

Thursday

- Data: Germany June factory orders and July construction PMI; Italy June industrial production; UK July construction PMI; US July job cuts, weekly initials jobless claims and continuing claims

- Central Banks: Monetary policy decisions from India and the Bank of England; BoE Governor Bailey speaks; Fed’s Kaplan speaks

- Earnings: Merck, AXA, Siemens, adidas, Bristol-Myers Squibb, Novo Nordisk, Becton Dickinson & Co, Zoetis, American Electric, Booking Holdings, T-Mobile, Illumina

Friday

- Data: Japan June labour cash earnings, real cash earnings, household spending, and preliminary June leading index; Germany June trade balance, June current account balance and June industrial production; France preliminary Q2 private sector payrolls, June industrial production, manufacturing production, trade balance and Q2 wages; Spain June industrial output; US July change in nonfarm payrolls, unemployment rate, average weekly hours, average hourly earnings, labour force participation rate, final June wholesale inventories, June consumer credit; China July trade balance, foreign reserves, and Q2 BoP current account balance

- Central Banks: Reserve Bank of Australia statement on monetary policy

- Earnings: Standard Life Aberdeen, Norwegian Cruise Line, Royal Caribbean Cruises, Ventas

Finally as Goldman notes, focusing just on the US, the key economic data releases this week are the ISM manufacturing index on Monday, the ISM non-manufacturing index on Wednesday, and the employment report on Friday. There are several scheduled speaking engagements by Fed officials this week.

Monday, August 3

- 09:45 AM Markit US manufacturing PMI, July final (consensus 51.3, last 51.3)

- 10:00 AM ISM manufacturing index, July (GS 53.6, consensus 53.5, last 52.6); We expect the ISM manufacturing index to increase by 1.0pt to 53.6 in July, after rising by 9.5pt in June. Our manufacturing survey tracker increased from 51.2 to 53.6 in July.

- 10:00 AM Construction spending, June (GS +0.7%, consensus +1.0%, last -2.1%); We estimate a 0.7% increase in construction spending in June, with a faster recovery in non-residential than residential construction.

- 12:30 PM St. Louis Fed President Bullard (FOMC non-voter) speaks; St. Louis Fed President James Bullard will give a speech on monetary policy and the economy at a virtual event. Audience and media Q&A are expected.

- 01:00 PM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Thomas Barkin will give a speech on the economic outlook at a virtual event.

- 02:00 PM Chicago Fed President Evans (FOMC non-voter) speaks: Chicago Fed President Charles Evans will provide a briefing on the economy to reporters on a conference call.

Tuesday, August 4

- 10:00 AM Factory orders, June (GS +6.0%, consensus +5.0%, last +8.0%); Durable goods orders, June final (last +7.3%); Durable goods orders ex-transportation, June final (last +3.3%); Core capital goods orders, June final (last +3.3%); Core capital goods shipments, June final (last +3.4%): We estimate factory orders increased by 6.0% in June following an 8.0% rebound in May. Durable goods orders rose by 7.3% in the June advance report.

Wednesday, August 5

- 08:15 AM ADP employment report, July (GS +1,600k, consensus +1,200k, last +1,000k); We expect a 1,600k gain in ADP payroll employment, reflecting a boost from lower jobless claims and prior-month payrolls.

- 08:30 AM Trade balance, June (GS -$50.0bn, consensus -$50.3bn, last -$54.6bn); We estimate the trade deficit decreased by $4.6bn in June, reflecting a decline in the goods trade deficit.

- 10:00 AM ISM non-manufacturing index, July (GS 54.0, consensus 55.0, last 57.1); Our non-manufacturing survey tracker increased by 49.4pt to 51.2 in July, following stronger regional service sector surveys. However, increased virus-related restrictions in some states are likely weigh on responses. We expect the ISM non-manufacturing index to decrease by 3.1pt to 54.0 in the July report.

- 05:00 PM Cleveland Fed President Mester (FOMC voter) speaks; Cleveland Fed President Loretta Mester will give a speech on the economic outlook at a virtual event. Prepared text and audience Q&A are expected.

Thursday, August 6

- 08:30 AM Initial jobless claims, week ended August 1 (GS 1,300k, consensus 1,415k, last 1,434k); Continuing jobless claims, week ended July 25 (consensus 16,940k, last 17,018k); We estimate initial jobless claims declined but remain elevated at 1,300k in the week ended August 1.

- 10:00 AM Dallas Fed President Kaplan (FOMC voter) speaks; Dallas Fed President Robert Kaplan will discuss the outlook for monetary policy and the economy at a virtual panel hosted by the Official Monetary and Financial Institutions Forum.

Friday, August 7

- 08:30 AM Nonfarm payroll employment, July (GS +1,000k, consensus +1,578k, last +4,800k); Private payroll employment, July (GS +800k, consensus +1,326k, last +4,767k); Average hourly earnings (mom), July (GS -0.3%, consensus -0.5%, last -1.2%); Average hourly earnings (yoy), July (GS +4.4%, consensus +4.2%, last +5.0%); Unemployment rate, July (GS 10.7%, consensus 10.5%, last 11.1%): We estimate nonfarm payroll growth slowed to +1.0mn in July after +4.8mn in June. Our forecast reflects an outright decline in employment in the Sunbelt that is more than offset by net gains in the rest of the country. We also believe education seasonality could boost July payroll growth by as much as 500-750k, as many end-of-school-year layoffs took place in April rather than in June/July. Because of difficulty measuring temporary business closures in the establishment survey, we note scope for nonfarm payrolls to outperform the household survey measure of employment in Friday’s report. We expect that household employment rose by slightly less than payrolls and that the labor force participation rate increased as a recovering labor market encouraged job searches, but that the unemployment rate still fell by four tenths to 10.7% in July. We estimate average hourly earnings declined 0.3% month-over-month (but remain up 4.4% year-over-year) as lower-paid workers were rehired and the composition shift toward higher paid workers continued to unwind.

- 08:30 AM Wholesale inventories, June final (consensus -2.0%, prior -2.0%)

Source: DB, BofA, Goldman

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com