European Funds Post Stunning $835 Billion In Trading Losses For First Half Of 2020

Tyler Durden

Fri, 08/07/2020 – 05:30

Putting a face to some of the very real economic impact from the coronavirus are European funds that suffered a combined 706.4 billion euros in trading losses ($835 billion USD) over the first half of 2020, according to Refinitiv Lipper data released Wednesday and reported on by Reuters.

Like many other industries, the pandemic had its way with European funds – specifically in March, when global markets plunged, prompting massive interventions from Central Banks.

Assets managed by the European fund industry saw both losses and first quarter outflows, falling to 11.2 trillion euros on June 30 from 12.3 trillion euros on December 31.

Detlef Glow, Lipper Head of EMEA Research at Refinitiv, said: “The coronavirus pandemic hit the European fund industry with declining markets and estimated net outflows of 125.9 billion euros in the first quarter of 2020.”

He continued: “This trend reversed over the course of the second quarter as central banks and governments around the globe started quantitative easing programs and economic relief packages to cushion the economic drawdowns caused by the spread of the coronavirus and the lockdowns of economies around the globe.”

The industry recovered with inflows of 123 billion euros for the first half of the year after respective Central Banks stepped in to steady the market. The European fund market still saw a net addition of funds over the same period of time, as well. 942 funds were launched, 390 merged and 531 liquidated during the period.

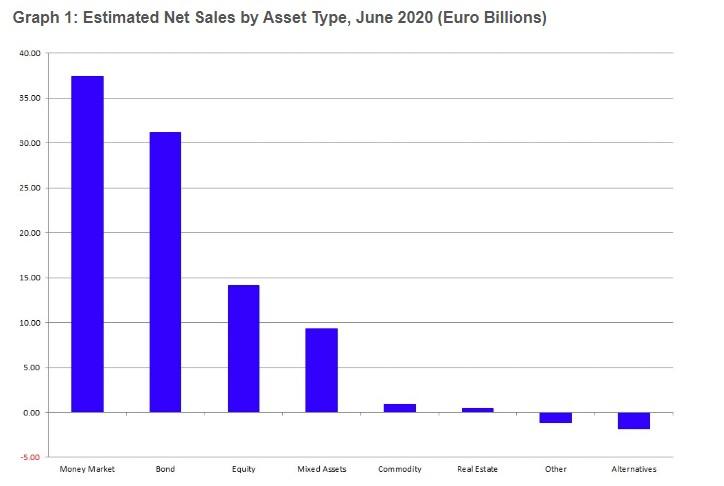

Mutual funds added 105.6 billion euros in assets with bond funds emerging as the best-selling asset type. ETFs added 17.4 billion euros. Money market funds were the best selling, bringing in 152.5 billion euros.

Equity funds saw the highest amount of liquidations. So much for buying and holding…

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com