Futures Shrug Off Latest China Sanctions, Approach All Time Highs

Tyler Durden

Mon, 08/10/2020 – 08:03

S&P futures edged higher with European stocks, and approached all time highs after President Donald Trump signed 4 executive orders to maintain some assistance, including for unemployment benefits, a temporary payroll tax deferral, eviction protection and student-loan relief, in doing so bolstering investor enthusiasm and helping market shrug off a brief wobble after China announced token sanctions against 11 US politicians over Hong Kong but no members of Trump’s cabinet.

“The fresh stimulus provided by President Trump through executive orders is better than none at all and provides a stop- gap solution,” wrote analysts at MUFG in London.

Trump’s orders, aimed at unemployment benefits and evictions, came after negotiations broke down between the White House and top Democrats in Congress over new stimulus steps to help the US economy. Trump’s policy announcements come as Democrats and Republicans are still negotiating a broader additional coronavirus relief package. The two sides are still trillions of dollars apart on overall spending and on key issues, including aid to state and local governments and the amount of supplementary unemployment benefits. Still, Nancy Pelosi and Steven Mnuchin said on Sunday they were open to restarting aid talks.

“The fresh stimulus provided by President Trump through executive orders is better than none at all and provides a stopgap solution,” said Lee Hardman, a strategist at MUFG Bank in London. “Pressure remains though on both the Democrats and Republicans to reach a more substantial and durable compromise solution.”

And even though total infections in the country crossing five million and recent data suggesting that an economic recovery was stalling, and markets had few positive cues to trade on, futures still continued on last week’s momentum, approaching within 1% of the 3,387.50 all time high hit on Feb 19, 2020. A better-than-expected earnings season – with P 500 EPS plunging by 34% year/year, but above consensus expectations for -45% growth at the start of earnings season – and hopes of more stimulus put the S&P 500 higher on the day, while the Nasdaq scaled several peaks as its major technology constituents benefited from the pandemic.

Among individual movers, Eastman Kodak plunged 44.3% premarket after its $765-million loan agreement with the U.S. government to produce pharmaceutical ingredients was put on hold due to “recent allegations of wrongdoing.”

Marriott International dropped about 2% and Royal Caribbean Cruises fell 0.6% ahead of their quarterly reports. The No. 1 U.S. mall owner Simon Property Group rose 4.5% after a report that it has been in talks with Amazon.com Inc about turning some of its department-store sites into Amazon fulfillment centers.

European Bank shares rallied and oil advanced after Saudi Aramco said demand will continue to improve. Portugal’s 30-year bond yield fell below 1% for the first time since March. Shares in BP and Royal Dutch Shell rose 2.6% and 1.5% respectively after Saudi Aramco raised optimism about a growth in Asian demand and Iraq pledged to further cut supply.

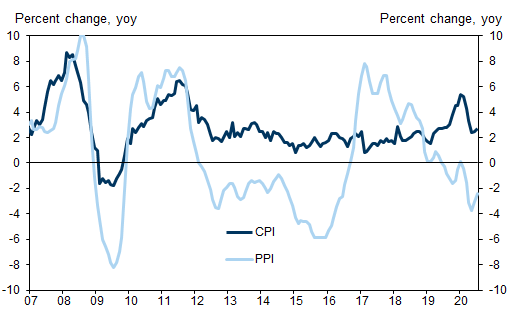

Earlier in the session Asian shares outside Japan seesawed in holiday-thinned trade, staying below a six-and-a-half-month peak touched last week. Stronger industrial activity in China offered signs it was recovering from the coronavirus pandemic that outweighed jitters over U.S.-Sino trade tensions. Deflation at China’s factories eased in July, data showed, driven by a rise in global energy prices and as industrial activity climbed back towards pre-coronavirus levels.

Industrial output in China is returning to levels seen before the pandemic paralysed huge swathes of the economy, driven by pent-up demand, government stimulus and surprisingly resilient exports. That bodes well for the global recovery from the coronavirus pandemic, analysts said.

“China is so much in advance in this process of lockdowns and exiting lockdown, that any good signs for the Chinese economy is essential (for the world economy),” said Florian Ielpo, head of macroeconomic research at Unigestion.

In FX, the dollar gained 0.3% to 93.620 against a basket of currencies, rising against most major currencies after Beijing’s retaliation. Markets are also assessing President Donald Trump’s executive orders to bolster the U.S. economy and the chances of Democrats and Republicans making progress on a fresh fiscal stimulus plan. The Norwegian krone sees the biggest gains among the G-10 as oil prices advance, while the Australian dollar trimmed gains, with the Kiwi falling and the yen little changed.

The euro fell for the second session in a row against the greenback as France’s central bank warned the pace of economic recovery is slowing. The common currency was largely bought by speculative-oriented investors such as hedge funds for much of last week, which implies it is now “trading in even more overbought territory, with such conditions keeping corrective downside risk high,” Credit Agricole strategists including Valentin Marinov said.

In commodities, WTI and Brent continued to drift higher in early trade, with the benchmarks underpinned by Saudi Arabia, Iraq and Gulf producers stating that they are encouraged by recent signs of improvement in the global economy and reaffirm commitments to the OPEC+ supply curb deal. Looking ahead, participants are likely to focus on any further US-Sino developments and State-side stimulus talks in the absence of pertinent data releases.

Elsewhere, spot gold remains uneventful on either side of USD 2030/oz, with spot silver eking mild gains above USD 28/oz. In terms of base metals, Dalian iron ore and Shanghai copper both saw losses on Monday as sentiment in the region was dampened by the US’ sanctions on the Hong Kong and Chinese officials in relation to the National Security Law. Meanwhile, analysts at Westpac have lifted their near term iron ore forecast to USD 100/t (Prev. USD 90/t for September) but still see it moderating from there to USD 87/t by end-2021 (unchanged); copper revised higher from USD 6,000/t to USD 6,400/t.

Looking ahead, Canopy Growth and Marriott International are among companies reporting earnings.

Market Snapshot

- S&P 500 futures up 0.1% to 3,349.25

- MXAP down 0.02% to 167.91

- MXAPJ up 0.03% to 559.72

- Nikkei down 0.4% to 22,329.94

- Topix down 0.2% to 1,546.74

- Hang Seng Index down 0.6% to 24,377.43

- Shanghai Composite up 0.8% to 3,379.25

- Sensex up 0.5% to 38,232.84

- Australia S&P/ASX 200 up 1.8% to 6,110.20

- Kospi up 1.5% to 2,386.38

- STOXX Europe 600 down 0.03% to 363.44

- German 10Y yield fell 0.7 bps to -0.516%

- Euro down 0.2% to $1.1763

- Italian 10Y yield fell 0.3 bps to 0.803%

- Spanish 10Y yield fell 0.9 bps to 0.269%

- Brent futures up 1% to $44.84/bbl

- Gold spot down 0.1% to $2,033.03

- U.S. Dollar Index little changed at 93.45

Top US News from Bloomberg

- China said it will sanction 11 Americans including Senators Marco Rubio and Ted Cruz in retaliation for similar measures imposed by the U.S. on Friday, but the list doesn’t include any members of the Trump administration

- Hong Kong police arrested media tycoon Jimmy Lai and raided the offices of his flagship newspaper, the highest-profile case yet against the city’s democracy activists under a national security law that has fueled U.S.-China tensions

- Banks operating in Hong Kong are stepping up scrutiny of their customers and at least one U.S. bank is moving to suspend accounts to avoid running afoul of U.S. sanctions slapped on city officials

- The pace of France’s economic recovery is slowing, the country’s central bank said, confirming expectations of a prolonged period before output catches up with pre-crisis levels

In today’s global recap courtesy of NewsSquawk, Asian equity markets eventually traded mostly higher on what was an indecisive start to the week amid the thinned conditions due to holiday closures in Japan and Singapore, with participants mulling over the recent US NFP beat, firmer than expected Chinese inflation data and last week’s Congressional impasse which prompted US President Trump to sign executive orders over the weekend. ASX 200 (+1.8%) was underpinned with financials and consumer staples frontrunning the broad-based sector gains and as earnings also provided a tailwind. Elsewhere, a rally in Hyundai Motor shares helped fuel the KOSPI (+1.5%) after reports it is to create a family of Ioniq-brand electric vehicles in its pursuit to become the third-largest EV maker by 2025, while Hang Seng (-0.5%) and Shanghai Comp. (+0.8%) were indecisive as participants digested the latest inflation figures from China which were firmer than expected but showed that PPI remained negative and with risk appetite in Hong Kong mired by the arrest of Next Digital’s founder Jimmy Lai who is a main contributor to the pro-democracy camp and the highest-profile arrest under the National Security Law so far which subsequently saw as much as a 16% intraday drop in Next Digital shares.

Top Asian News

- New Oriental Is Said to Pick Banks for Hong Kong Second Listing

- Temasek Unit Scraps $3 Billion Bid for Keppel After Loss

- Lira Extends Drop in Sign of Further Turkish-Market Turmoil

- Turkey Lowers Key Banking Ratio to Slow Credit as Lira Falls

European stocks have lost steam since the cash open and now see a mixed performance [Euro Stoxx 50 +0.1%], following on from a similar APAC handover – with downside in the European session emanating from China’s sanctions announcement against some US officials in a tit-for-tat retaliation for US’ move last week over HK Chief Executive Lam alongside ten other Chinese/Hong Kong officials. The move from China was widely expected but reinforces the ever-escalating tensions between the two nations, not to mention the condemned high-level meeting between US and Taiwan on Monday. Broader indices trade without conviction with no major under/outperformers, albeit the region has come off post-China lows. Sectors are also seeing a mixed performance with no clear risk profile to be derived – Energy outperforms amid gains in the complex whilst IT continues to be weighed on by the escalating US-Sino tech landscape. The sectoral breakdown adds little meat to the bones, with Banks outpacing, Travel & Leisure retaining gains and Tech the laggard. Individual movers include Suez (+3.2%) amid reports Co’s Waste division is said to have attracted interest from German billionaire Scharz and could be worth EUR 35bln. Co. could mull an auction for the unit if talks with Scharz collapse, sources stated. Elsewhere, AA (+12.9%) shares soared after Co’s top shareholder Dickson (12% stake) said he believes GBP 0.40/shr very “opportunistic” and argued the stock is worth much more than current price. Finally, Roche (-0.1%) remains subdued after its Phase III study for Etrolizumab met its primary endpoint of inducting remission vs. placebo in only two out of three studies.

Top European News

- U.K. Bank Stocks Shrug Aside Report of Further PPI Payouts

- France’s Economic Recovery Loses Pace After Initial Surge

- Pharming Enrolls First Patient in Covid Trial; Shares Surge

- Italy’s Richest Family Builds $3 Billion Side Bet to Candy Giant

In FX, the Greenback remains on a firmer footing following Friday’s above forecast rise in jobs and lower than expected unemployment rate, but the DXY looks toppy around 93.500 and has not quite been able to emulate its post-NFP peak (93.629) within a 93.601-290 band. Relatively light, lacklustre Monday trading volumes have been compounded by market holidays in Japan (Mountain Day) and Singapore (National Day), while the Buck may be capped by the ongoing stalemate over fiscal stimulus in Washington and some modest unwinding of bear-steepening along the US Treasury curve.

- GBP – Sterling continues to display a degree of resilience across the board, and aside from a short base Cable seems to be forming a base circa 1.3050 and Eur/Gbp appears intent on a test of 0.9000 given the Euro’s failure to sustain gains through 0.9050 and 0.9100 in line with key round number or psychological level failures vs the Dollar. However, the Pound faces some independent hurdles in wake of last Thursday’s BoE from tomorrow in the form of labour and earnings data before GDP and ip on Wednesday.

- AUD/JPY/CAD/EUR/NZD/CHF – All weaker against their US rival, albeit mildly and to varying extents as the Aussie pivots 0.7150 amidst bullish iron ore projections from Westpac, the Yen meanders between 106.05-105.73, Loonie pare some losses to reclaim 1.3400+ status and Euro finds some support ahead of 1.1750 having waned circa 1.1800. Note, mega option expiry interest at the big figure (3 bn) could be keeping the headline pair in check, but a decent amount in Usd/Jpy at 105.50 (1.65 bn) appears to be safe ahead of the NY cut. Elsewhere, the Kiwi is hovering just below 0.6600 and lagging its Antipodean peer with Aud/Nzd straddling 1.0850 after deteriorations in ANZ’s business sentiment and activity outlook overnight. Nevertheless, the Franc is the current G10 laggard sub-0.9150 vs the Greenback and under 1.0750 against the single currency as weekly Swiss bank sight deposits increase yet again.

- SCANDI/EM – A firm start to the week for crude prices via supportive vibes from Saudi Arabia, Iraq and Gulf oil producers has helped the Norwegian Crown rebound further than the Swedish Krona from recent lows, but the former may also be taking note of largely firmer inflation metrics. Conversely, the Turkish Lira has handed back a chunk of Friday’s recovery gains to revisit all time lows under 7.3650 even though the Banking Watchdog has trimmed the asset ratio rate to 95% from 100%

In commodities, WTI and Brent front month futures continue to drift higher in early trade, with the benchmarks underpinned by Saudi Arabia, Iraq and Gulf producers stating that they are encouraged by recent signs of improvement in the global economy and reaffirm commitments to the OPEC+ supply curb deal. These comments come ahead of the JMMC meeting on August 18th, in which the non-policy-setting panel will review compliance and demand data and make recommendations to the oil producers. Furthermore, Friday’s Baker Hughes rig count also provides some support after active oil rigs declined by four. Looking ahead, participants are likely to focus on any further US-Sino developments and State-side stimulus talks in the absence of pertinent data releases. Elsewhere, spot gold remains uneventful on either side of USD 2030/oz, with spot silver eking mild gains above USD 28/oz. In terms of base metals, Dalian iron ore and Shanghai copper both saw losses on Monday as sentiment in the region was dampened by the US’ sanctions on the Hong Kong and Chinese officials in relation to the National Security Law. Meanwhile, analysts at Westpac have lifted their near term iron ore forecast to USD 100/t (Prev. USD 90/t for September) but still see it moderating from there to USD 87/t by end-2021 (unchanged); copper revised higher from USD 6,000/t to USD 6,400/t.

US Event Calendar

- 10am: JOLTS Job Openins, est. 5,300, prior 5,397

DB’s Craig Nicol concludes the overnight wrap

While most of the U.K. contends with finding anyway to cool down from these scorching temperatures, with a fairly sparse calendar this week it’s likely that markets will be taking their temperature from the state of play in Washington. So far we’ve shrugged off the disappointment around the lack of agreement on the next US fiscal package, however with each passing day the greater the risk is to consumer confidence and spending as our US economists highlighted over the weekend, especially given that the over 31 million people receiving unemployment insurance as of the week of July 18 are set to see their monthly income decline by 60%-plus in August.

Over the weekend President Trump signed four executive orders amid the impasse over the relief bill, including a temporary payroll tax deferral and continued expanded unemployment benefits however that has been met with criticism by Democrats and also some Republicans. There’s also some question marks around the legalities of Trump’s actions as per Bloomberg. There were

comments from Mnuchin and Pelosi yesterday – both signaling a readiness to resume talks – however neither offered any hints of when they may resume. Nevertheless, S&P 500 futures are up +0.14% in the early going while in Asia the Shanghai Comp (+0.42%), Kospi (+1.43%) and ASX (+1.60%) all up with just the Hang Seng (-0.36%) lower. Markets in Japan are closed for a holiday.

That retreat for the Hang Seng follows news that Hong Kong police have arrested media tycoon and prominent democracy activist Jimmy Lai under the national security law passed in late June, and raided the offices of his flagship newspaper. Police said that seven people aged between 39-72 had been arrested on suspicion of “breaches” of the security legislation, with offenses including collusion with a foreign country or external elements to endanger national security. The move comes after the US sanctioned the City’s Chief Executive Carrie Lam as well as other officials on Friday. A reminder that officials from US and China are due to meet this weekend to review compliance with the trade accord, while today a senior US official is visiting Taiwan for the first time in decades. So expect US-China tensions to also play a role in dictating sentiment this week.

Aside from that, there’s not a huge amount else to report from the weekend. Inflation data in China surprised to the upside (July CPI of 2.7% yoy vs. 2.6% expected) while in Italy Finance Minister Roberto Gualtieri told La Repubblica that the government will work on cutting taxes in fiscal 2021, including personal income taxes, and added that the economy is forecast to grow slightly below 15% in the third quarter given the strong rebound observed.

As for the latest on the virus, case growth in the US has continued to slow with cases growing at an average rate of 1.04% per day over the weekend versus the previous 5 weekends’ average of 1.60%. Meanwhile, in Europe, Paris has mandated masks outdoors in the busiest streets starting today while Germany’s transmission rate (Rt) rose to 1.16 on Friday, the highest level in 10 days. Italy also reported 463 new infections yesterday, the second-highest number in two months after reaching 552 on Friday.

Aside from fiscal developments, the only notable data releases this week in the US are July CPI on Wednesday and July retail sales on Friday. The latest weekly jobless claims print on Thursday is also worth keeping an eye on. In Europe we’ve got Germany’s August ZEW survey on Tuesday and a second look at Q2 GDP for the Euro Area on Friday. In China the highlight is on Friday with the July activity indicators data. Finally, earnings season starts to wind down with the best part of 90% of the S&P 500 having already reported. On that, our asset allocation team published a summary of earnings season so far which you can find here . What’s notable is that the early trends of outsized and broad earnings beats has only continued, with forward estimates also ticking higher.

To recap last week, in equity markets the S&P 500 climbed +2.45% (+0.06% Friday), closing the week roughly 1% below its record high reached in February. Friday’s gain meant the index has now risen for six sessions in a row, the longest such streak since April 2019. The Dow rallied +3.80% (+0.17% Friday), snapping two weeks of losses and the NASDAQ advanced +2.47% (-0.87% Friday). Risk assets in Europe also rose. The STOXX 600 ended up +2.03% (+0.29% Friday) for the week, the largest weekly gain since 19 June.

With risk sentiment rising core sovereign bonds yields rose. US 10yr Treasury yields climbed +3.6bps (+2.8bps Friday) after hitting record closing lows early in the week. The weekly rise in US yields broke a four week streak of yields dipping lower. Gilts rose +3.1bps on Friday, making up the majority of the weekly +3.5bps move while Bunds rose +1.5bps (+2.2bps Friday) to -0.51%. Peripheral spreads also tightened to Bunds in Italy (-10.0bps), Spain (-7.8bps), Portugal (-6.9bps) and Greece (-9.2bps). The BTP-Bund spread ended at the tightest level since the measure started widening in late February as the pandemic spread. Meanwhile, in credit high yield cash spreads in the US (-10bps) and Europe (-16bps) tightened.

In FX, the USD index rose +0.09% on the week, strengthening for the first time since mid-June. That move included a +0.70% gain on Friday after July payrolls surprised to the upside. In commodities, Gold made record highs midweek before

pulling back a bit on Friday. It finished +3.02% on the week (-1.36% Friday), the ninth weekly gain a row.

In terms of data, as hinted above the highlight was the US employment report on Friday. Nonfarm payrolls gained for a third straight month as jobs rose by 1.763m (vs. 1.480m expected) and the unemployment rate fell to 10.2% (vs 10.6% expected) – a near 4pp improvement from the peak of the pandemic. Even average hourly wages rose +0.2% (vs. -0.5% expected). For more on the US labour market, see our US economists’ new chartbook here. Elsewhere, in Germany June industrial output rose +8.9% (vs. +8.2% expected) after it expanded +7.4% the month prior, while France’s industrial production rose 12.7% (vs. +8.4% expected).

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com