Goldman’s Head Of HF Sales: “If Anyone Had Told You 5 Months Ago This Would Happen, You’d Think They Were Crazy”

Tyler Durden

Mon, 08/17/2020 – 17:10

By Tony Pasquariello, global head of Goldman HF Sales

Starting in the third week of February — and, from all-time highs — S&P dropped 35% in just 23 trading days. In that moment, we were confronting the greatest collapse of the global economy in modern history — and, sitting in the US, specifically in New York, you knew with certainty that the crisis was about to hit your shores.

If someone had told you back then that just five months later (a period covering less than 100 market sessions) the stock market would be within a whisker of those highs — without a vaccine or treatment yet in hand — you’d think they were nothing short of crazy.

Again, this was a May of 1942 moment: things couldn’t have looked bleaker, yet what’s followed a historic collapse in risk assets has been a historic recovery.

Ex-post, one can rationalize the retracement: the composition of the stock market is skewed towards industries that don’t necessarily mirror the cyclical growth, the nature of stock operators is to look forward and the collective policy response has been both unprecedented and unbounded.

As we sit here today, with consideration for current asset values and the enormous set of challenges in front of us, let’s hope the GS call proves correct: global GDP growth should swing from -3.3% in 2020 to +6.5% in ’21 (link) … with no rate hikes until 2025 … and, along the way, the balance sheets of global central banks grow larger and larger.

Over the next month, we’ll enter a new phase of the game, as market participants shift from a policy trade to a proper re-opening trade; so, get your R&R in now, as the period from Labor Day through election day will surely be spirited.

What follows from here is quick points and charts. As always, a taker of your views and feedback:

1. One subplot of the past week has been significant stress on consensus positions across asset markets. In turn, within the equities space, the value question is coming up a lot these days. With respect for the structural trajectory of secular growers, I’d argue one should have tactical upside on value to position for “right tail” outcomes. Given the formal GS view on vaccine (GIR expects at least one vaccine approved by end-’20 with wide distribution by the end of 2Q’21, link) … as well as the broad positioning setup (the market has shown its hand in the past week) … one can see a scenario where value (e.g. Europe, US small cap, transports) benefits the most on a vaccine-driven cyclical upgrade, if only short-term. These are not the best houses on the block, but that’s essentially the point.

2. The interplay between real rates and the stock market is a well-worn truism. At some point, it’s fair to ask: how much further can real rates go from here? The informal blink from Dominic Wilson in GIR: given the Fed’s anchoring, it’s reasonable to expect a further drop in front end real rates; further out the curve things are likely to be a bit more sticky. Now, while I understand that financial markets live in the future, I find this a little interesting: today, 10yr real rates are … -1%. I don’t know how much further they can go. But, I do know that back in March of 2000 they were … +4%. my point here: we live in a world of extremely easy financial conditions with central banks who aren’t likely to change directions for a long, long time — that’s a positive undertow for risk in an absolute sense, even if scope for further drops in long-dated real rates is apt to be more constrained.

3. As the US election becomes a more dominant market variable in coming months, one can argue that a Democratic administration — while perhaps not changing policy on China — may see some more certainty on trade policy. This comment from GIR is on point: “while the dominant focus thus far has been on the potential tax changes from a Democratic ‘sweep,’ the chances of shifts in international and trade policy have received relatively less attention. The threat and imposition of tariffs, especially against China, was a key market dynamic in 2019 in particular. Even if the China-US relationship remains fractious, it is likely that a Biden administration would rely less on this tool and that the difference in policy between a Trump and a Biden administration could be significant on this front.”

4. within quick points, some very quick points:

i. the outcome of the fiscal stimulus negotiations remains unclear, which introduces downside risk to the market … that said, the official GIR view is a $1.5tr package becomes law in August … if it spills into September, the tail risks grow in both directions (link).

ii. ESG remains a theme that is still attracting serious capital … the charts in the attached email give a very good feel for the magnitude and trajectory of these inflows.

iii. for better and worse, realized volatility is melting in equities … on the margin, this is a bullish development (demand from vol control strategies — and, you can start to own call wings again at reasonable levels of implied).

iv. yes, the transports have underperformed the broader market in recent years … then again, in the context of everything that’s going on, is it not a little remarkable that this sector is just 5% off the all-time highs?

v. at some point, I suspect EUR strength will become an issue for European equities … I still like it for a “vaccine trade,” but with the understanding it’s just a trade.

vi. AAPL is a few good days away from a $2tr market cap … as pointed out by sales & trading colleague Pete Callahan, it was 38 years from IPO to $1tr … and would be just about two years from $1tr to $2tr.

vii. I saw this on a Boston sports blog: home runs hit by the great Hank Aaron, grouped in five year intervals:

– age 20 – 24 … 150

– age 25 – 29 … 202

– age 30 – 34 … 168

– age 35 – 40 … 203

5. It’s been a long road to recover the pre-GFC peaks in US housing stocks, but the retracement is now complete:

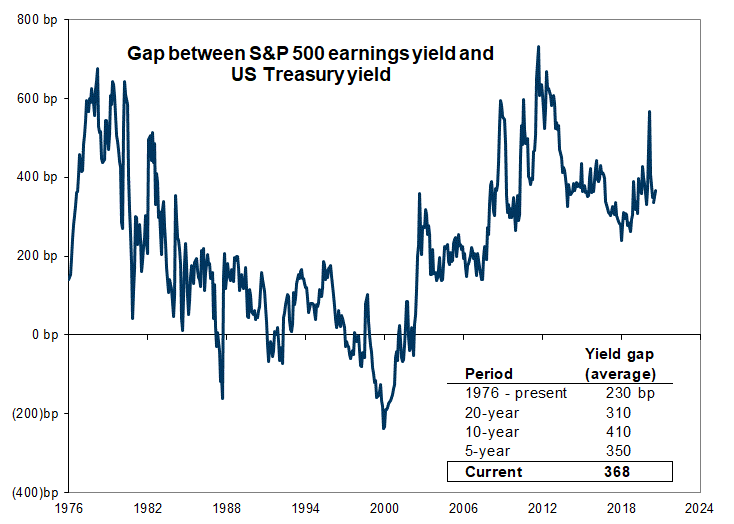

6. As mentioned before, on most any traditional metric — P/E, price/book, EV/sales — stocks are expensive. The one exception, of course, is when stocks are compared with the bond market. Thanks to Cole Hunter in GIR, the moral of this story is the spread between the earnings yield on S&P and 10yr nominal rates is currently 368bps … while off the wides, that compares to an average spread over the past 44 years of 230bps:

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com