Four Reasons Why Morgan Stanley Believes The Covid Recession Triggered A Structural Shift Toward Higher Inflation

Tyler Durden

Sun, 08/23/2020 – 20:35

In a time when the most important question in all of finance is whether “what comes next” is inflationary or deflationary, earlier today we posted an eloquent twitter thread in which the author presented a case why despite the Fed’s printers working overtime, the conditions for a sustained inflationary impulse are simply not there (read the full thing here).

That said, Morgan Stanley – whose bullish stock market outlook has been anchored on a reflationary view – vehemently disagrees.

As the bank’s chief economist Chetan Ahya writes, explaining why the Great Covid-19 Recession (GCR) left an “indelible mark” on the global economy which has resulted in a structural shift in inflation dynamics, “in the case of the GCR, the consensus is of the view that it will be an amplified version of 2008, where deleveraging dynamics took hold and the rebuilding of saving across balance sheets meant that it resulted in weak aggregate demand and persistent disinflationary pressures. Moreover, considering the magnitude of the shock, they also perceive that it will be a long time before we get back to the pre-crisis levels of output.” In contrast, Ahya – and Morgan Stanley in general, including Michael Wilson – has been arguing since early on as this crisis unfolded, that “the most important structural change is the return of inflation – specifically that inflation could rise above DM central banks’ targets, especially in the US.”

There are “four pillars” to the bank’s inflation thesis:

#1 – The V-shaped recovery: A key part of why MS expects inflation to emerge is because it anticipates a sharper but shorter recession. At its core, this recession was triggered by an exogenous shock in the form of a public health crisis. Coming into 2020, there wasn’t an excessive leverage build-up in the private sector and the banking system was in better shape than it was in 2007. This means that deleveraging pressures are more moderate and the financial system can still play its role as a key intermediary, unlike post-2008. Morgan Stanley therefore expects global and DM output levels to reach pre-COVID-19 levels by 4Q20 and 4Q21, respectively.

#2 – The policy response is very different… According to Morgan Stanley, “the policy response also matters in shaping the growth and inflation outlook and it has been timely, sizeable and coordinated (both monetary and fiscal easing).” The fiscal response in particular has been far more aggressive and quicker because, as the chief economist amusingly puts it “the recession is nobody’s fault” (and what if it had been, would the response be any different). A large fiscal response is important because monetary stimulus, expansionary as it is, would not be adequate to lift aggregate demand on its own. Interestingly, the recognition of this issue was growing before 2020. Hence, policy-makers knew that they had to act quickly on fiscal policy (almost as if they welcomed the covid shock). Moreover – and just to repeat the most amusing aspect of this entire argument – Ahya once again notes that “this time around, there were also lesser moral hazard concerns simply because the shock was exogenous.”

…and the use of active fiscal policy is here to stay: Next, the MS economist writes that “policy-makers were increasingly concerned about rising inequality and they recognised that monetary policy was a blunt tool which is not able to address the distributional effects”, if only they could recognize that their policies actually accelerated this rising inequality. The GCR exacerbated these concerns and left a deep scar on lower-income households. At the peak of the COVID-19 shock, 70% of the job losses in the US were in the low-income segments. Hence, the focus on unemployment and impact on lower-income households will mean that expansionary policies will remain in place for longer. Policy efforts to address inequality, and this we do not disagree with “will impart an inflationary impulse, particularly if the mix is skewed towards transfers to households.”

#3 – Risk of scrutiny of the interplay between tech, trade and titans will persist: Policy-makers’ “focus on inequality” will also mean that efforts to restrain trade could continue while there are risks of increased scrutiny of tech and titans. Trade tension is one such example, in which policy-makers had already begun to check the impact of globalization on inequality. However, as the interplay between this trio of tech, trade and titans has been a key driving force of disinflation in the past 30 years, disentangling them will also lead to a shift in the inflation dynamics.

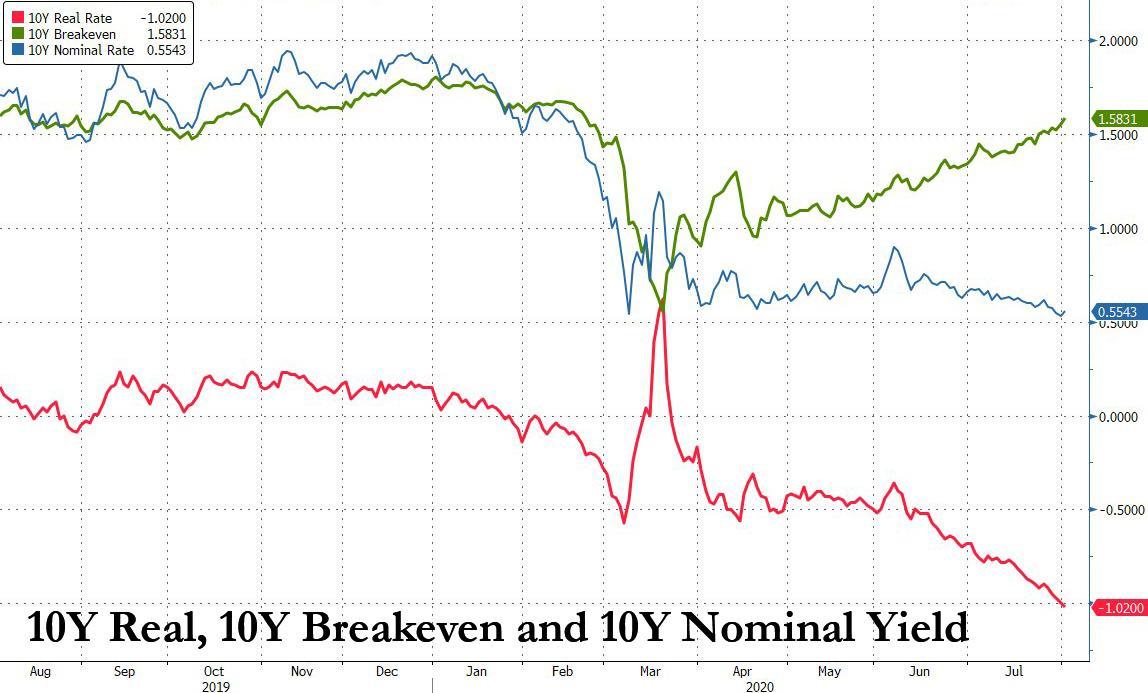

#4 – Central banks are doubling down: At the same time, central banks – which supposedly are so very concerned about rising inequality (which their actions have caused) “have doubled down on their commitment to achieving their inflation goals.” The Fed is already emphasizing the symmetry of its 2%Y inflation goal (meaning after its September review, the Fed will go all-in on further debasing the dollar). Market-based real rates have already declined significantly, and a shift in strategy will allow the Fed to provide more accommodation.

As Ahya summarizes, “this confluence of factors has already led to a very different outcome for US inflation breakevens. They did not decline to the levels seen post the GFC and have also rebounded in a quicker manner to pre-COVID-19 levels.” Of course, one can argue – as we did – that as a placeholder between nominal and real rates, they are merely reflecting the record chasm that has emerged as traders fear to push nominal yields below zero in a time of YCC, but face no such constraints when it comes to real rates, but we’ll leave this argument for another day.

In any event, Morgan Stanley still – correctly – expects additional fiscal accommodation in the form of another fiscal package (especially since the current one has already ended and the result is a sharp drop in spending by those on UI). On monetary policy, the bank’s chief US economist Ellen Zentner expects the FOMC to codify this and update its framework at the September FOMC meeting, which then lays the groundwork for the FOMC to adopt forward guidance in the FOMC statement at the December meeting. “Both these factors should further bolster the case for inflation” according to Ahya.

And here is Morgan Stanley’s conclusion:

Just as the effects of deleveraging were underappreciated post-2008, we think that the effects that this Great COVID-19 recession will have on inflation dynamics are also not as well understood, with most investors still very much in the disinflation camp. But when we look back at 2020, it may well be that the most important structural change that COVID-19 gave rise to from a macro perspective will be this structural shift towards higher inflation.

To be sure, none of that should come as a surprise: after all the Fed has made it abundantly clear that its endgame goal is (asymmetric) inflation, and one way or another – with trillions more in QE or with direct payments to US households – it will achieve it. Now, whether readers agree with this is unclear, and with adherents of both the reflation and deflation thesis battling it out in the market every day, is why back in June we said that whether what comes next is inflation or deflation was, and remains, the most important question in all of finance.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com