Global Stocks Hit Record High, Gold Spikes Ahead Of Powell Speech

Tyler Durden

Wed, 08/26/2020 – 16:00

Global stocks finally took out their old record highs today (as measured by the MSCI World Index)…. and all it took was almost $10 trillion in global liquidity…

Source: Bloomberg

Global sovereign bond yields (blue above) are at the same time hovering near record lows (though have lifted a little in the last week ahead of Powell’s “I Promise Inflation” speech tomorrow).

“You are meddling with the primary forces of nature, Mr Powell, and I won’t have it! Is that clear?”

[youtube https://www.youtube.com/watch?v=zI5hrcwU7Dk]

Reflecting that somewhat, Breakevens continued to rebound notably today…

Source: Bloomberg

Sending 5Y Breakevens (strong TSY auction today) back to pre-COVID levels…

Source: Bloomberg

Which sent real yields tumbling (back to -1.05%), and grabbed gold higher…

Source: Bloomberg

The momo/value ‘rotation’ from Monday has been unrotated…

Source: Bloomberg

Leaving Nasdaq (blue) soaring and Small Caps (red) slammed… S&P was up over 1% and The Dow managed modest gains…

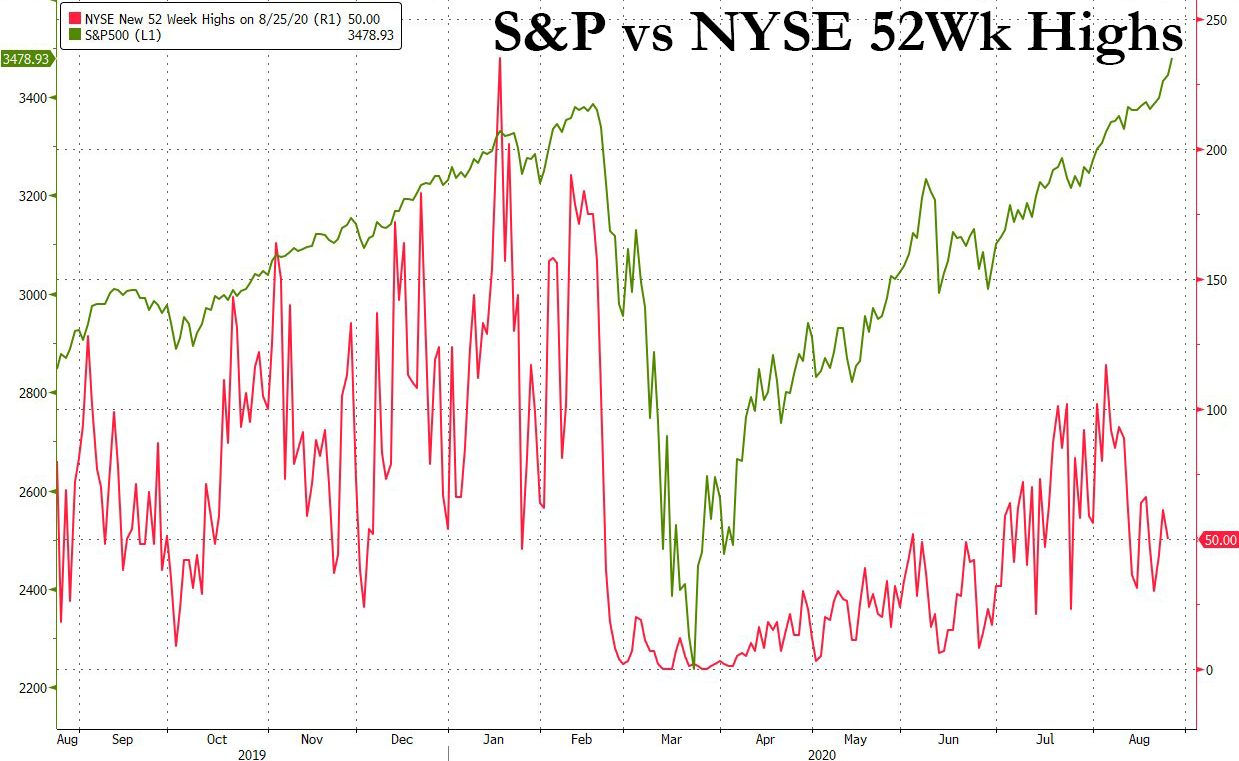

“Another day, another new record as internals continue to get more lopsided…”

Source: Bloomberg

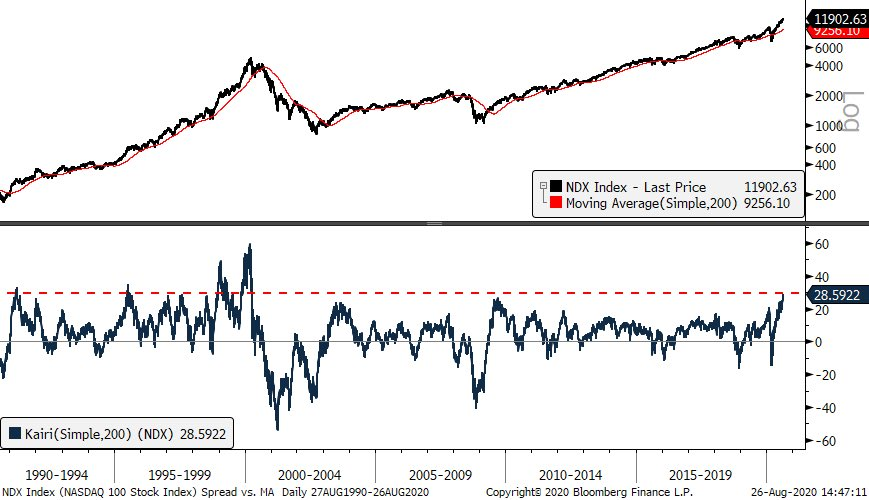

NDX is now 28% above its 200 DMA, the widest spread since 2000. .. Can it get wider? Of course, it went to ~60% at the peak in 2000. “But this is certainly rarified air” over last 30 yrs.

Source: Bloomberg

This didn’t seem to spook stocks at all:

1035ET *FED’S BARKIN: BIG TECH DONE WELL IN PANDEMIC, REFLECTED IN STOCK MKT, THERE CLEARLY IS SOME RISK AS VALUATIONS GET ELEVATED

As FANG stocks soared by the most since April 6th to a new record high…

Source: Bloomberg

TSLA did what TSLA does…

And then there’s Salesforce!!!!! Up fucking 26% today!!!!!! And it announced layoffs!!! Bwuahahaha

Small Caps very volatile around the cash open.

There was a big short-squeeze at the open but it faded the rest of the day…

Source: Bloomberg

VIX and stocks decoupled today but once again we caution readers of the record low put/call ratio as traders buy calls not downside protection (which also bids up vol, and thus VIX)…

Source: Bloomberg

Very strong 5Y auction reversed the trend higher in yields.

Source: Bloomberg

10Y Yields fell back below 70bps (again)…

Source: Bloomberg

Dollar dumped after briefly spiking at 0830ET on the durable goods orders beat (it appears it was fake breakout of that coiling pattern we suggested yesterday)…

Source: Bloomberg

Cryptos bounced back today with Bitcoin testing back up to $11,5000…

Source: Bloomberg

Oil was flat on the day, Silver the big gainer with gold and copper stronger by around 1%…

Source: Bloomberg

Finally, year-to-date, global investors (in bonds and stocks) have made almost $10 trillion ($6.66 trillion from bonds and $3.07 trillion from stocks), after being down over $25 trillion at the trough in March…

Source: Bloomberg

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com