Capital One Cuts Credit Card Borrowing Limits As US Reduces Support For Unemployed Americans

Tyler Durden

Thu, 08/27/2020 – 22:05

One month after credit card giant Capital One Financial disappointed investors after reporting losses more than $1 billion for the second consecutive quarter (with 80% of revenue coming from net interest income, of which 60% comes from the card business, the top line was hit really hard), there was more bad news. According to Bloomberg, Capital One – which is perhaps most exposed to the financial state of the US middle class of all US financial companies – is cutting borrowing limits on credit cards, and reining in its exposure as the U.S. reduces support for millions of unemployed Americans.

“Capital One periodically reviews accounts based on a variety of factors and may make changes to existing credit lines,” the company told Bloomberg.

Capital One, which is third-largest US credit card lender after JPMorgan and Citigroup, has been at the forefront of offering cards to people with riskier profiles, which while boosting the company’s value during expansions, has made it especially sensitive to economic downturns. Its management of credit is watched closely as a harbinger of what’s to come at other major banks according to Bloomberg, and sure enough the latest numbers were woeful: shortly after it slashed its dividend from 40 cents to just 10 cents, the company added reserves of $2.7BN in Q2, on top of the $3.6BN it added in the first quarter, making reserves 6.7% of total loans outstanding (in theory,t This should be enough to weather net charge-offs around 350bps per year in the next two years).

And while the company’s 2008-2010 average was higher at around 450bps, peaking at over 500bps in 2010, the company has benefited from forbearance programs as customers are deferring auto payments but continue to pay down their credit cards, which also means less net interest income. Indeed, net interest income fell 9% QoQ (-5% YoY) as margins narrowed, making the company’s NIM contraction was the worst among large peers. Margins nosedived 100bps QoQ to 5.78% – the lowest in the past decade.

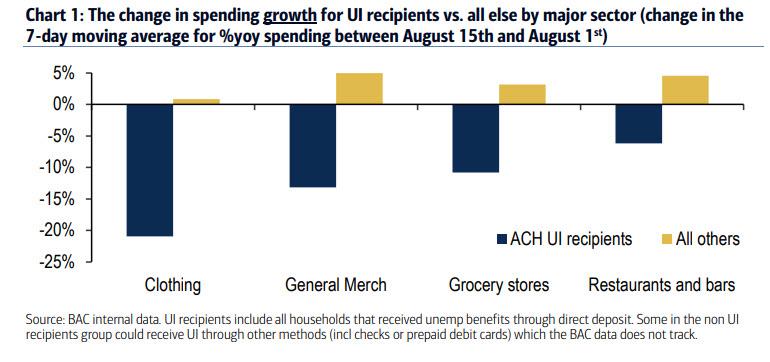

All of that prompted the company to take aggressive measures ahead of what appears to be an almost certain double dip should fiscal stimulus not be extended in the immediate future. As Bloomberg notes, suspense has been mounting in the credit card industry in recent weeks, as Congress and President Donald Trump’s administration deadlocked on extending $600 in additional weekly unemployment benefits. That assistance has helped millions of households keep up with debts as the pandemic sent unemployment soaring above 10%. As we showed recently, spending by unemployed people who claim ongoing unemployment assistance from regular state programs – which amounts to some 14.5 million people – has tumbled since the July 31 fiscal cliff.

That sharp drop in benefits raises the risk for banks that some cardholders won’t be able to make ends meet through the pandemic, maxing out credit limits as they spiral into bankruptcy.

To an extent, Capital One’s move was expected: card lenders have been warning for months that rapidly shifting outbreaks and shutdowns have left them in the dark on which customers have lost work or their jobs, making it difficult for executives to assess risks. “I don’t think we have a rigorous measure of how many of our current borrowers are unemployed,” Capital One Chief Executive Officer Richard Fairbank said last month.

“There are a lot of people that are in different degrees of unemployment right now.”

To protect itself from the coming crunch, Capital One is doing the opposite of what corporations did in the immediate aftermath of the covid shutdowns, when countless companies drew down on their available revolvers to maximize liquidity. Unfortunately, for millions of ordinary Americans who rely on their credit cards to make ends meet, their borrowing base just got slashed.

The reduction in borrowing capacity set off a swift outcry on social media. Some customers have complained in recent days their limits have been slashed by a third to two-thirds, eroding their ability to borrow in an emergency during a pandemic or potentially hurting their credit scores. A spokesman declined to specify how many people are affected.

In recent days, Capital One’s customers have flocked to platforms such as Twitter to complain after receiving emails with an “important update” on their account that turned out to slash their ability to borrow. Some were told their limits are being aligned with past spending patterns. Messages from Capital One explained users could still borrow “significantly above your highest balance over the last two years,” essentially allowing them to continue using cards as they have.

Capital One is hardly unique: card issuers, learning from past downturns, often trim or close inactive credit lines to avoid becoming a borrower’s lender of last resort. This year, they have also been offering lower limits on new accounts.

“We have been tightening credit at the margin as we have felt for some time that we are in late credit cycle,” Discover Financial Services Chief Executive Officer Roger Hochschild said in April. “But given the present environment, we are adopting a significantly more cautious view.”

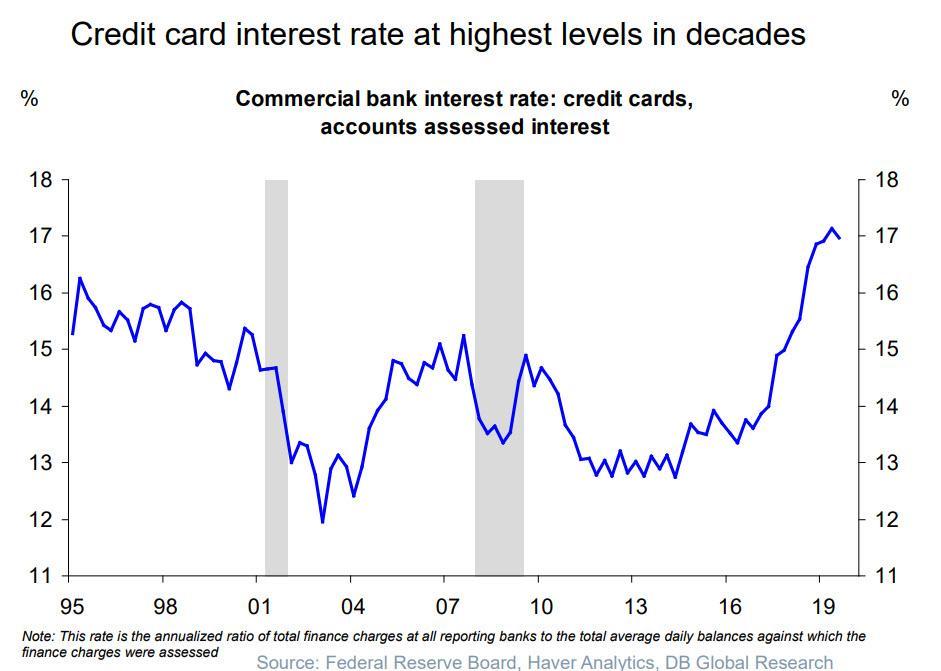

But what is most paradoxical about this situation is that even as the Fed cut rates to all time lows, a boon to companies which have borrowed a record $1.4 trillion in the investment grade bond market, if hurting savers who once again receive no income on their savings accounts, credit card interest rates remain at all time highs, just around 17%.

Bizarrely, the fact that credit card rates remain stratospheric for millions of Americans even as corporate borrowing rates have never been lower, has not been address by either the Fed – which allegedly is so worried about inequality – nor US politicians. Meanwhile, the Fed continues to directly purchase bonds of some of the biggest companies in the world including Apple, Berkshire, cutting their cost of capital even lower.

Some have suggested that instead of the Fed buying AAA-rated corporate bonds from companies which can sell massively oversubscribed debt in the open market, a simple solution is to simply backstop Capital One’s credit card receivables. That way Capital One would not have to cut its limits, and it would also be able to cut rates assuring more people can end up affording to pay down their interest. Unfortunately, since the tens of millions of subprime Capital One credit card holders can’t afford to lobby Congress or have a direct line to the Marriner Eccles building, this will never happen.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com