Robinhooders Discover 3x Levered ETFs

Tyler Durden

Mon, 09/14/2020 – 15:35

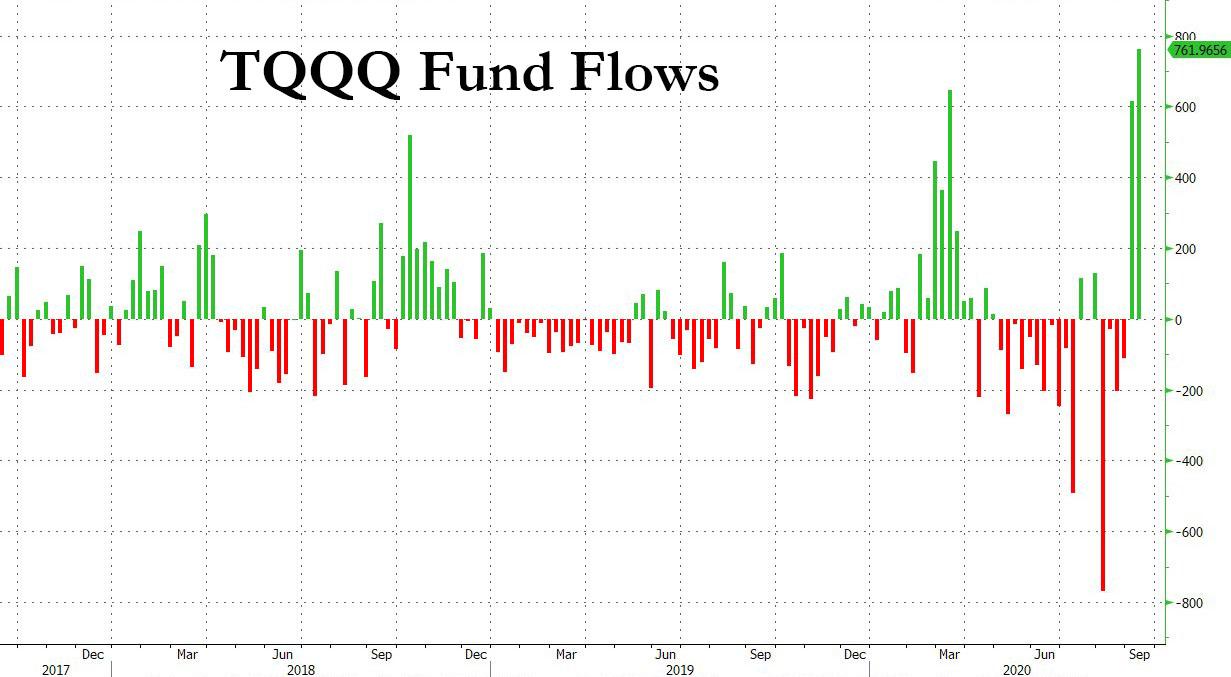

There was a bit of consternation last week when, in the aftermath of the brief Nasdaq 10% correction, the Nasdaq ETF, the QQQ, suffered its biggest weekly outflow on record, prompting fears that last week’s tech slump was just the beginning.

Well, not so fast, because a quick look at the 3x levered QQQ ETF, the TQQQ showed a mirror image, specifically it had just enjoyed two weeks of solidly inflows, including the largest weekly inflow on record, amounting to $762 million (or $2.3 billion notional including leverage).

The flood into the 3x levered Nasdaq ETF was even more aggressive if looking on a daily basis: according to Bloomberg, the $7.8 billion ProShares ETF attracted more than $1.5 billion in the past eight days, “the most for such a span since it began trading in 2010.”

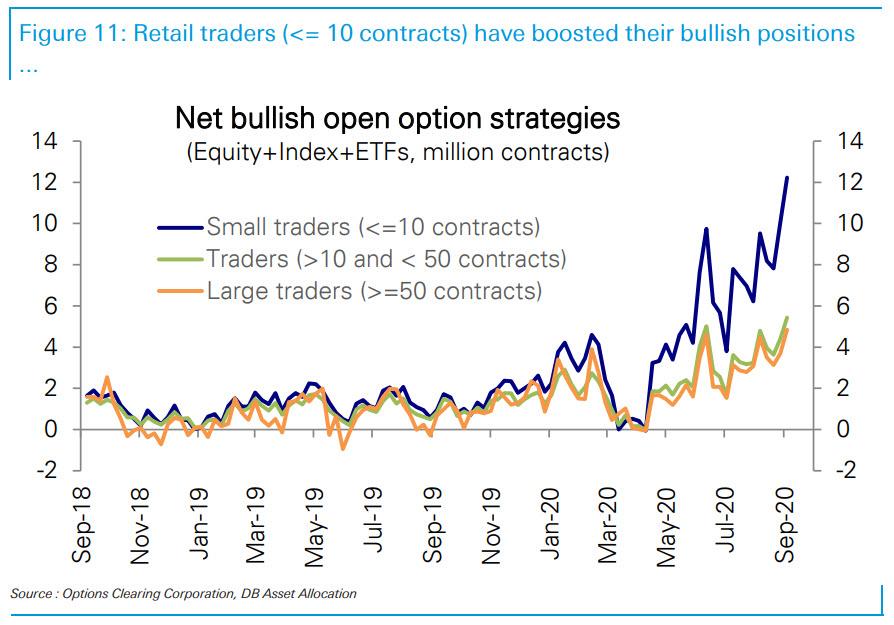

What’s going on here? Well, in a nutshell it appears that Robinhood (and TikTok) traders – who as we wrote over the weekend continue to flood into short-dated, out of the money calls, and especially Apple “lottery tickets” in pursuit of the highest-levered momentum trades despite the recent Nasdaq correction…

… they have now also discovered 3x levered ETFs.

Looks like #fintok just discovered 3x levered ETFs. $SPXL #prayforfintok pic.twitter.com/pjqnTE9Dbk

— TikTok Investors (@TikTokInvestors) September 9, 2020

Indeed, it appears that any trading instrument that allows the Gen-Z and Millennial generations to get rich as fast as possible with massive leverage (and even more theta) no matter how scary the final outcome, is now the preferred gambling “trading” strategy:

“Bullish sentiment toward growth and technology securities remains high, and TQQQ provides an aggressive approach to gaining short-term exposure,” said Rosenbluth, CFRA’s head of ETF and mutual fund research.

Bloomberg confirms as much, writing that despite TQQQ’s massive risks as a leveraged product – where one reversal could wipe out weeks of levered gains – it’s become popular with day traders, who pushed volume to a record earlier this month, according to a report from Bloomberg Intelligence. The product is held by 24,000 Robinhood accounts, ranking 20th among ETFs.

“The new variable this year is the number of new, typically younger day traders who use many platforms, but are most visible on Robinhood,” Bloomberg ETF analyst Eric Balchunas wrote. “These more aggressive traders prefer single-stock and 3x ETPs to vanilla ETFs or mutual funds, which are less risky.”

Below are some other observations from Balchunas and others who are watching in stunned disbelief how millions of young Americans are literally setting their money on fire in hopes of recreating the “gamma meltup” that SoftBank created, without realizing that the most likely outcome of their trades are near total losses:

$FNGU, the 3x FANG+ ETN, is also seeing some whopper flows (really for the first time ever) and it’s now trading $100m a day regularly (top 2% among all ETFs). Now up to $670m in aum as well. Nowhere near TQQQ but def catching the same wave. pic.twitter.com/3DCzsgBu8k

— Eric Balchunas (@EricBalchunas) September 14, 2020

RobinHooders leaving QQQ to buy TQQQ because 3x as much leverage means 3x as much profit. https://t.co/UXohEFvWfc pic.twitter.com/TvkOHWqM26

— Michael Goodwell (@MichaelGoodwell) September 14, 2020

That feeling you get when you trade the TQQQ leveraged ETF! https://t.co/qG6K6fbTQU

— Richard Muller (@MullerRichard) September 11, 2020

To be sure it’s not just Robinhooders: the TQQQ was the 6th most popular security among Fidelity customers as recently as May 6.

And to be sure Robinhood ppl aren’t the only ones who likes to party, Fidelity users put more orders for $TQQQ more than any other ETF today, and it ranked 6th overall while $SQQQ was 14th. Those two rank 111th and 397th in assets, so outsized usage here. h/t @mbarna6 pic.twitter.com/Y2NB7wuNSt

— Eric Balchunas (@EricBalchunas) September 3, 2020

Though nothing compares to the sheer momentum-chasing determination of 16-year-old traders who have discovered both momentum and leverage in one brilliant flash of eureka.

Then again, in a market where the Fed has eliminated all risk, who can blame young Americans for rushing into what may literally be the riskiest widely available product in the market. With little to no job prospects, America’s youth has to find salvation in the manipulated stock market where the TQQQ has posted staggering returns: before the 5.2% Nasdaq plunge on Sept. 3, the product had returned more than 10,000% since its creation in 2010. Even after the correction, its lifetime return is still 8,400%.

And until Powell makes it clear that stocks can go down again instead of just up, expect even more concentration in such 3x levered ETFs and out of the money calls.

Meanwhile, the inverse of the TQQQ, the Short QQQ (SQQQ), whose returns correspond to three times the inverse of the daily performance of the QQQ, posted its worst week of outflows since March. It is also down 99.98% since inception.

What happens next? Why even more happy 19-year-old blondes of course.

Sign-of-the-times piece saying that Robinhood traders should check out some of the more risky stuff Fidelity traders are using incl $TQQQ and $UVXY. Also lol the pic.. Are Robinhood Investors Missing Out on Popular Fidelity Stocks? https://t.co/8fyvGXV4gj

— Eric Balchunas (@EricBalchunas) September 13, 2020

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com