Step Aside FAAMGs: Goldman Presents The “Future Five” Stocks That Will Define The Decade

Tyler Durden

Wed, 09/16/2020 – 11:05

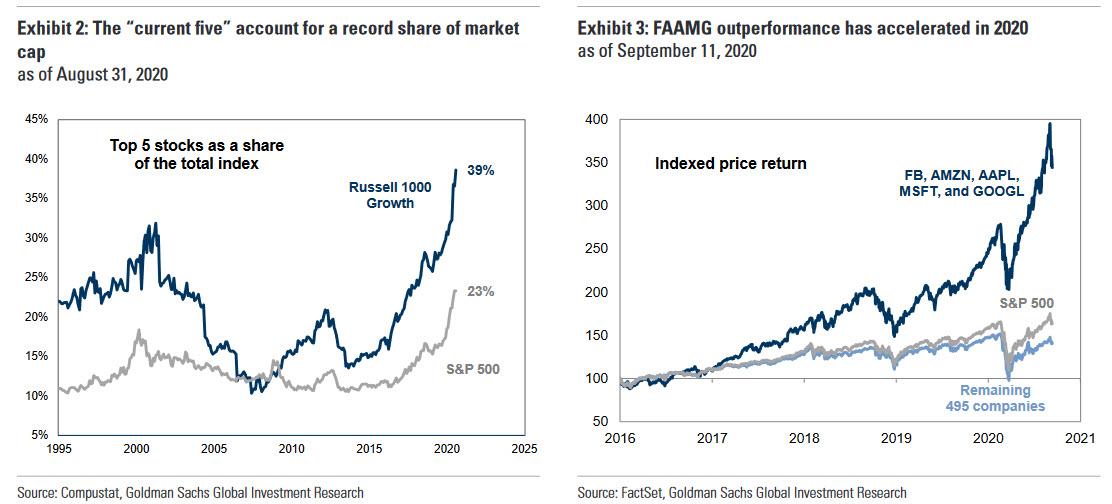

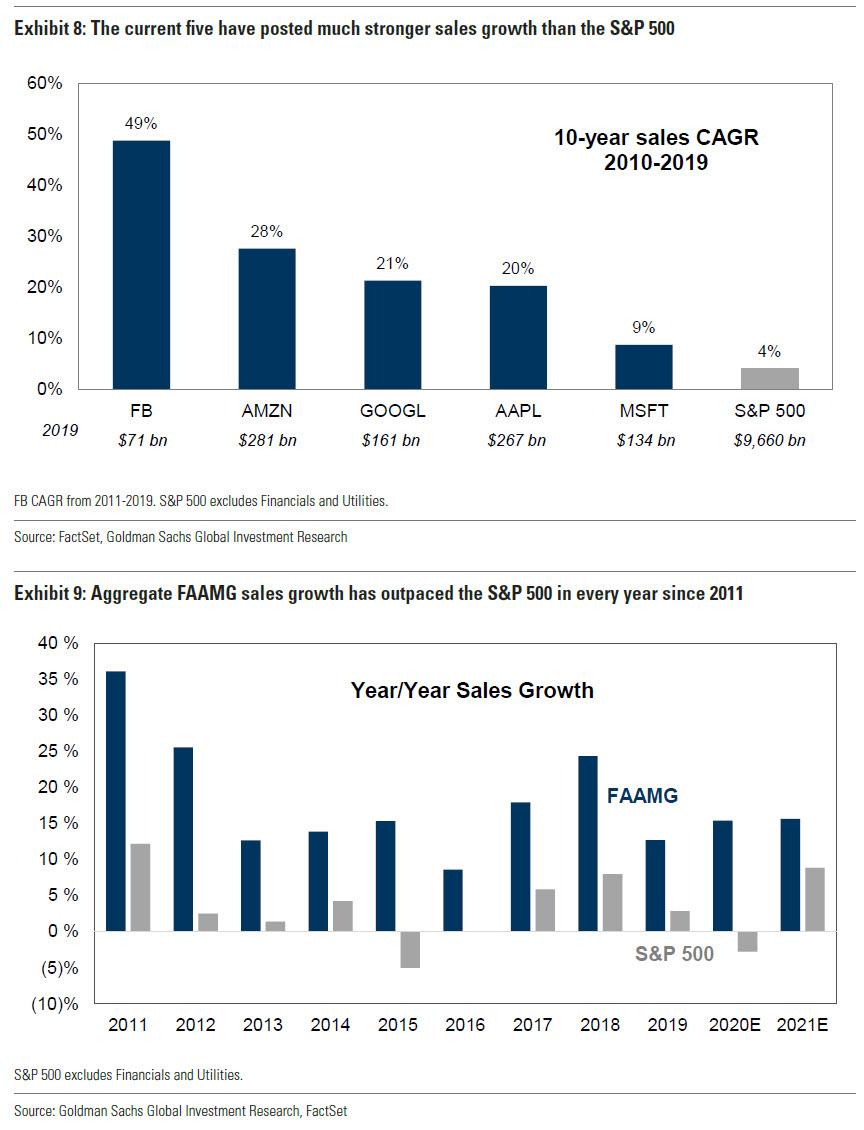

By now it is common knowledge that never in the history of capital markets has some much value (and interest) been concentrated in just five tech stocks, the FAAMGs. According to Goldman the five largest companies comprise 23% and a staggering 39% of the capitalization of the S&P500 and Russell 1000 Growth indices (with Apple recently surpassing the market cap of the entire Russell 2000), respectively… and for good reason based on their YTD performance: AAPL, MSFT, AMZN, GOOGL,and FB have returned 40% YTD compared with 5% for the S&P 500. Furthermore, the firms form the pinnacle of the red hot “growth” factor as they are forecast to grow sales at a 22% annualized pace from 2018 to 2022 (vs. 4% for theS&P 500) and trade at 6x EV/sales (vs. 3x).

That said, as Goldman’s David Kostin writes in an overnight note, investors are increasingly searching for fast-growing firms beyond the “current five.” The reasons range from skepticism about continued momentum and valuation concerns, to the purely structural. As Kostin notes, many mutual fund managers face limits on the weight of any individual stock in their portfolio (usually around 5% to be classified as a “diversified fund”). With several stocks exceeding the 5% threshold in benchmark indices, potential solutions for fund managers that face these limits include either reclassifying as a“non-diversified” fund or using factor- or performance-based substitutes for the largest constituents.

So what options do investors who need to branch out beyond the “current five” have? The answer, in a moment, but first a look at how we got here.

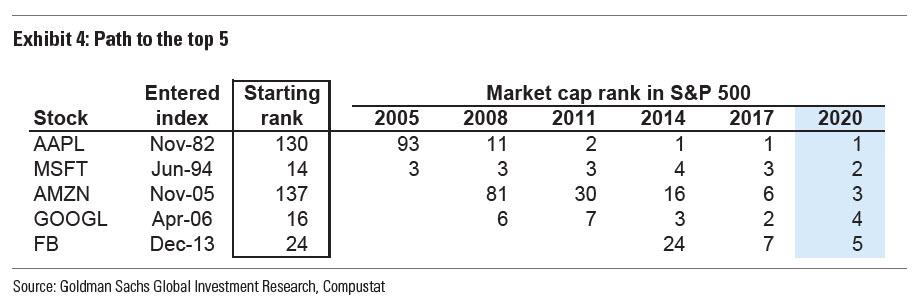

As Kostin writes, “the paths to market leadership varied for the “current five.” AAPL is currently the largest stock in the index, with a market cap of roughly $2 trillion. AAPL experienced extraordinary growth in the late 2000s, rising from the 93rd largest S&P 500 stock at the start of 2005 to 11th in 2008, following the introduction of the iPhone in 2007. The stock has maintained its dominance since 2010 by combining its hardware business with services. AMZN has followed a similar path, entering the index in 2005 ranked 137th, but capturing substantial market share in e-commerce — often at the expense of near-term profitability — and growing to its current position as the third-largest company. FB and GOOGL both grew in size as private companies, entering the index in the top 25 and maintaining their rapid sales growth. In contrast, MSFT is the second-largest stock in the index, and has been one of the five largest stocks in at least one month of every year since 1995.

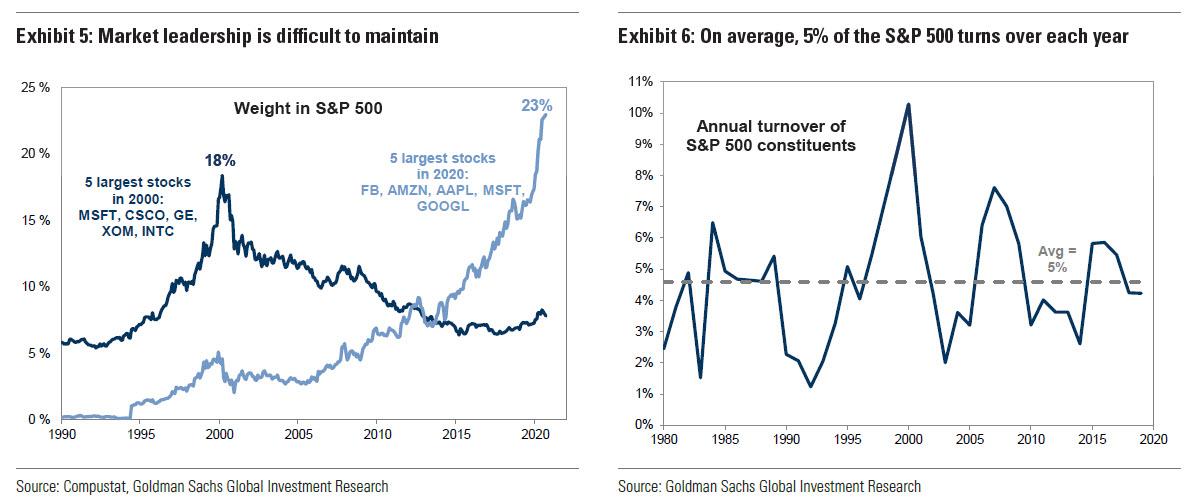

Of course, maintaining market leadership can be a difficult task and this unprecedented concentration may well prove to be fleeing because as Goldman notes, “index leadership is difficult to maintain” adding that the list of companies comprising the top positions in indices is not immutable. For one, index membership fluidity stems from the survivorship bias inherent in their design. Underperforming firms decline in weight or may be removed altogether and are replaced by newer, faster-growing constituents. Looking at the previous period of elevated market concentration, the Tech Bubble, saw the five largest stocks comprise 18% of S&P 500 market cap in 2000. But five years later, those same stocks accounted for 12% of market cap, and just 8% of market cap twenty years later. In contrast, 20 years ago the current five market leaders represented just 3% of the S&P 500 vs. 23% today. Only one of the five largest stocks in 2000 remains on the current list (MSFT) while the fifth-largest stock today (FB) was not even a member of the index until eight years ago.

The point here is that as firms become larger, rapid growth is challenging and threats to market positioning are plentiful. Regulation has been a particular focus for the current five, with the Department of Justice and Federal Trade Commission investigating AMZN, AAPL, GOOGL, and – as the WSJ reported overnight – FB. New market entrants also pose a risk to market leaders. On average, 5% of S&P 500 index constituents turn over each year. For instance, FB did not exist at the previous peak in market concentration in 2000. Finally, as in the case of XOM and Energy, industries may fall out of favor with investors.

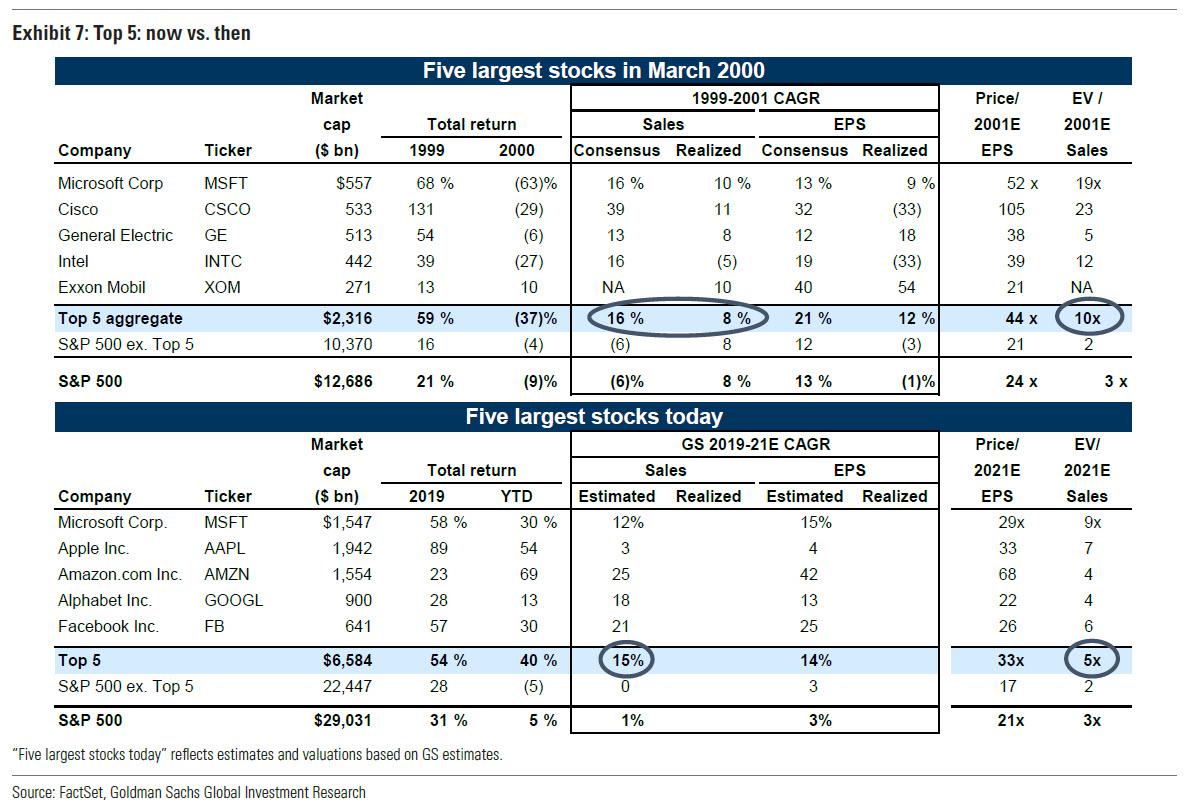

One last look back at history: in March 2000, the five largest stocks were expected to post 1999-2001 CAGR sales and EPS growth of 16% and 21%, respectively. The shares traded at a 2001E P/E of 44x and 10x EV/Sales. However, realized sales and EPS growth equaled just 8% and 12%, respectively. Today, the top five firms are forecast to deliver 2019-2021 CAGR sales and EPS of 15% sales and 14%, respectively, and trade at 2021E P/E of 33x and 5x EV/Sales. Expect a similar degree of disappointment when we look back at this time period in 20 years.

But enough about the past; what about the future, and the companies that Goldman believes will be the “Future Five”?

As Kostin explains in laying out his criteriea for screening for the “Future five”, the defining characteristic of the “current five” has been rapid sales growth. FB, AAPL, AMZN, MSFT and GOOGL have managed to sustain high revenue growth in the otherwise low growth environment of the last cycle. As GDP growth slowed following the global financial crisis, so did sales growth for many firms. The S&P 500 has posted a 4% sales CAGR since 2009 versus 7% between 1970 and 2009. During the past decade, FAAMG grew its aggregate top-line at a 20% CAGR. Furthermore, the ability of these stocks to grow sales independent of the broader economic circumstances has been brought into focus by COVID-19 and has reaffirmed their label as “secular growth” stocks.

To identify the potential “future five,” Goldman used the Rule of Ten criteria that screens for stocks with a track record of strong realized sales growth and expectations of continued superior revenue growth; this concept was introduced back in 2016 when Goldman first introduced our “Rule of Ten” which attempted to identify secular growth stocks based on the following criteria:

- Realized sales growth of at least 10% in each of the last two years;

- Expected sales growth of at least 10% in each of the next two years (now using consensus estimates).

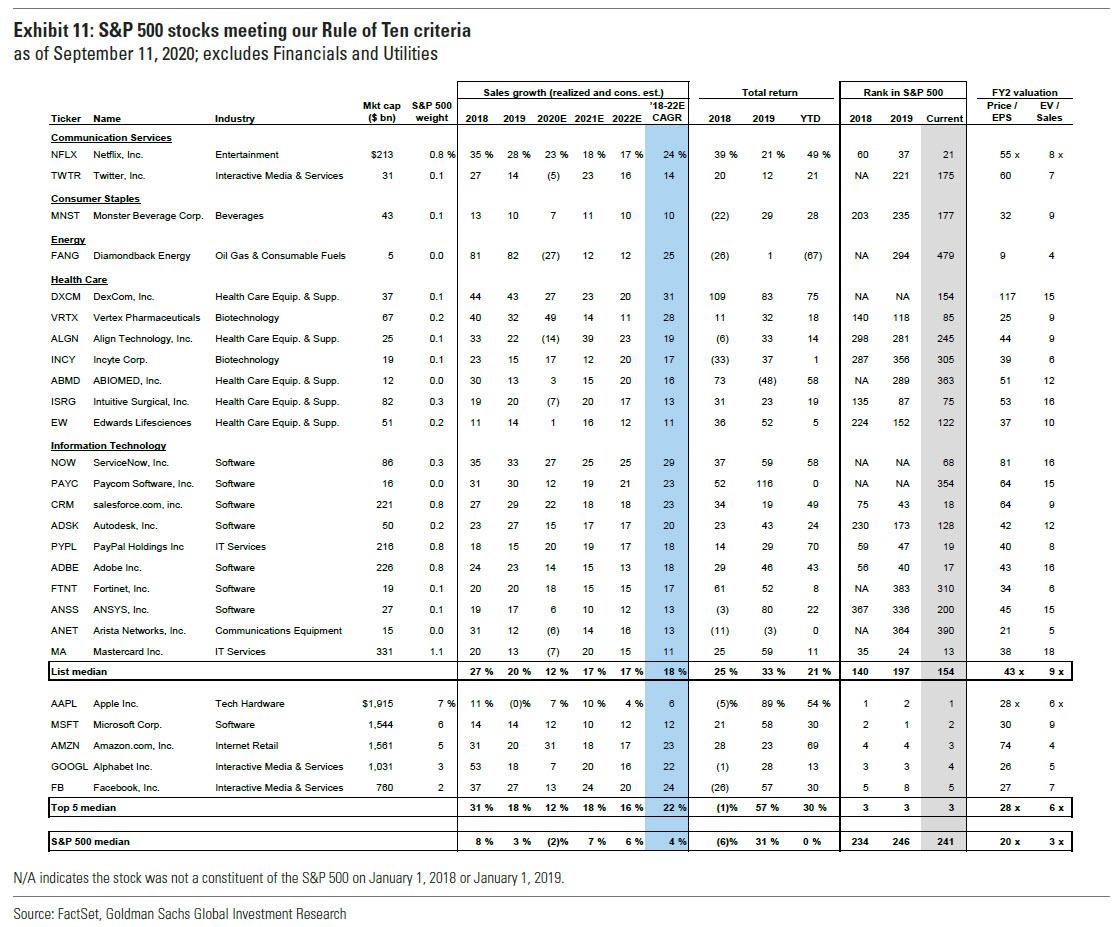

There are 21 S&P 500 stocks that meet these Rule of Ten criteria and these are listed below. Four of the “current five” (FB, AMZN, MSFT, GOOGL) meet the Rule of Ten. Naturally, these are excluded from Goldman’s final list as the objective is to identify stocks with high likelihood of climbing significantly in equity capitalization ranking and becoming the “future five.”

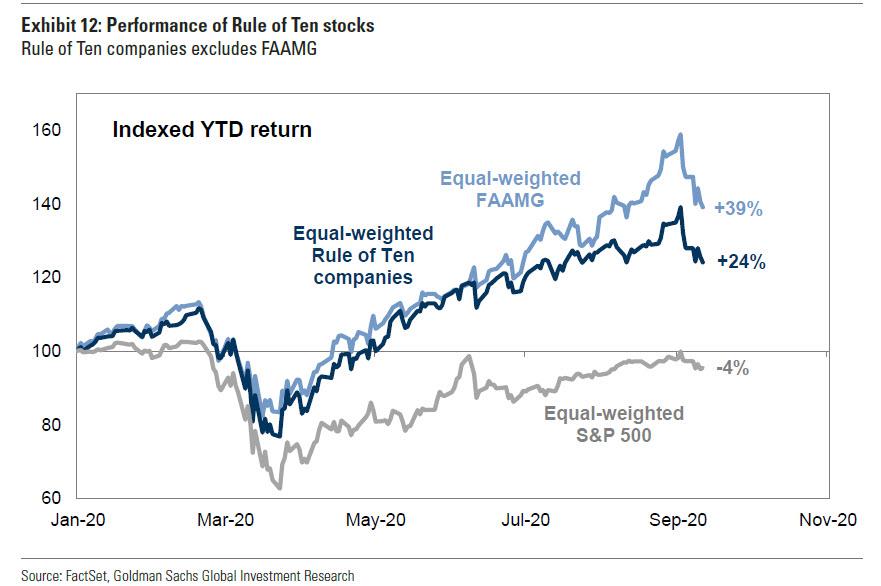

Some statistics: these 21 stocks are forecast to generate 18% annualized sales growth between 2018 and 2022, much faster than the median S&P 500 stock (4%) but less than FAAMG (22%). From a valuation perspective, the stocks trade at a P/E on 2021E EPS of 43x and an EV/sales multiple of 9x, well above FAAMG (28x and 6x, respectively) and the S&P 500 (20x and 3x). Not surprisingly the returns differ too: an equal-weighted basket of our Rule of Ten stocks has returned 24% YTD compared with a 39% return for FAAMG and -4% for the equal-weighted S&P 500. Daily returns YTD for our 21-stock list of Rule of Ten stocks also had a 0.91 correlation with the returns of FAAMG. Daily excess returns of our Rule of Ten stocks have had a 0.73 correlation to our Growth factor.

Presenting the “future five.”

Having narrowed down the list of FAAMG replacements to 21, Goldman then applies a second filter to further concentrate the basket, with Kostin writing that most of its Rule of Ten stocks can be broadly classified into five themes, which we expect will be increasingly important in the future:

- Computerization of health care: Technology has permeated all aspects of life, especially the health care industry. Rule of Ten stocks leveraged to this theme: ABMD, ALGN, DXCM, EW, ISRG.

- Digital transformation of business: “Software is eating the world,” Marc Andreessen famously quipped back in 2011. The integration of software platforms by businesses outside of the technology sector has been in process for years, but equity analysts expect this trend will accelerate. Rule of Ten stocks leveraged to this theme: ADSK, ADBE, ANSS.

- Workflow automation: Companies are increasingly using software to automate and optimize workplace tasks, such as HR, payroll processing, and IT and expense management. Rule of Ten stocks leveraged to this theme: CRM, NOW, PAYC.

- E-commerce and digital payments: The coronavirus has expedited shifts to e-commerce from in-person sales and to digital payments from cash. Rule of Ten stocks leveraged to this theme: MA, PYPL.

- Advancements in life sciences: Health care companies continue to discover treatments and cures for medical conditions that affect large portions of the population. Rule of Ten stocks leveraged to this theme: INCY, VRTX.

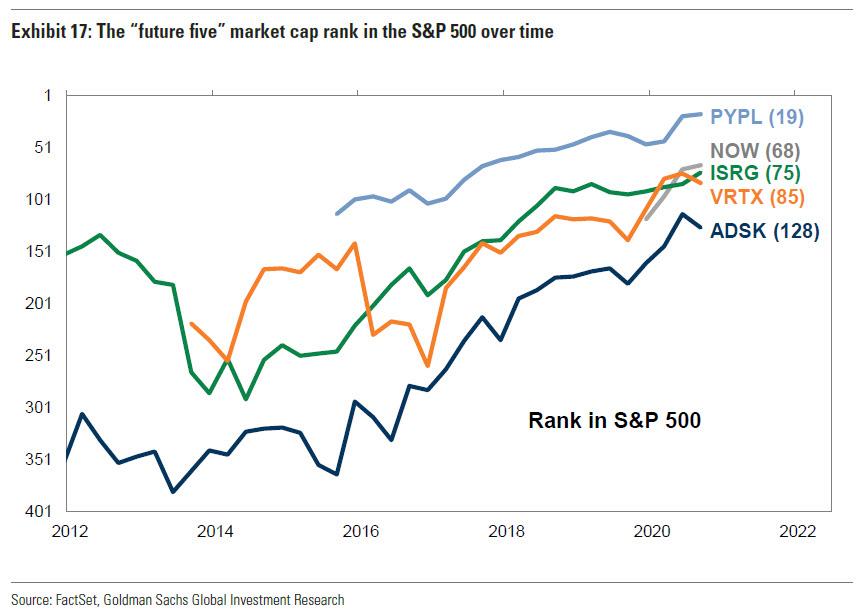

Finally, among those five themes, Goldman highlight potential “future five” stocks that the bank’s equity analysts believe are well-positioned and have compelling growth opportunities: VRTX, ADSK, PYPL, ISRG, NOW or VAPIN for short. During the past few years, these stocks have steadily climbed the S&P 500 equity capitalization ranking table.

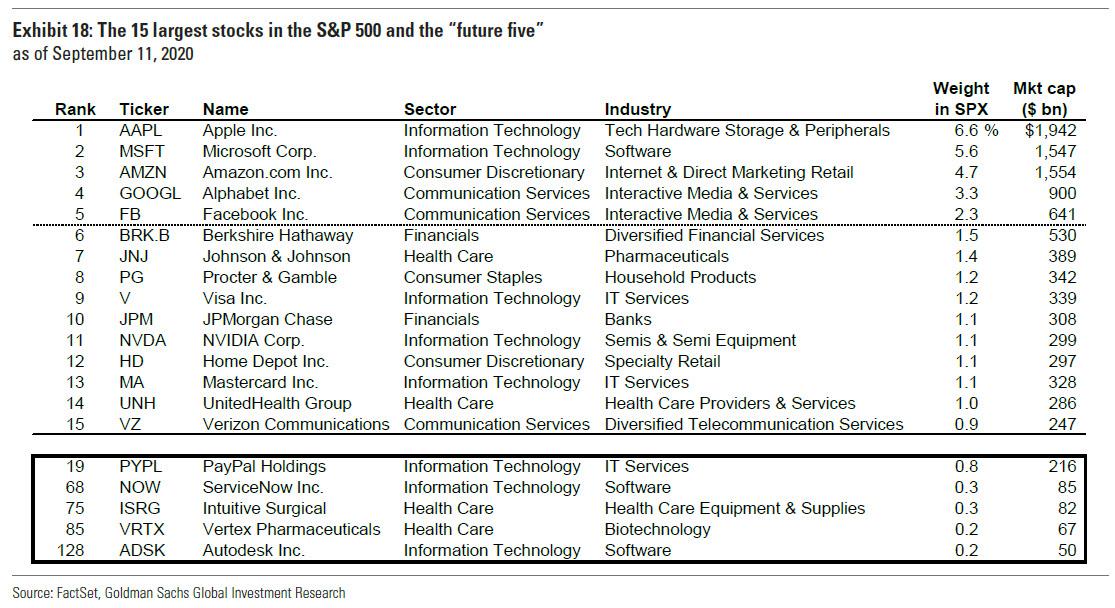

As expected, most of the future five are in the “second tier” in terms of size, with no stock ranking in the current top 15 of the S&P 500. All five stocks rank in the top 150 of the index, but only PYPL ranks in the top 20. While growth stocks have often moved up in the ranking during the past few years, several stocks in the current top 15 of the index have been consistently large for many years. For instance, Berkshire Hathaway, Johnson & Johnson, and JPMorgan have ranked in the top 15 in every month since 2013.

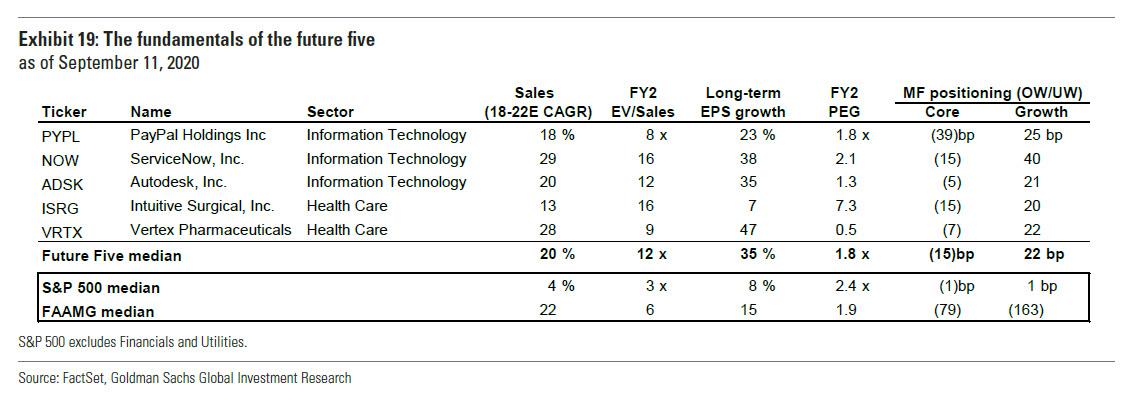

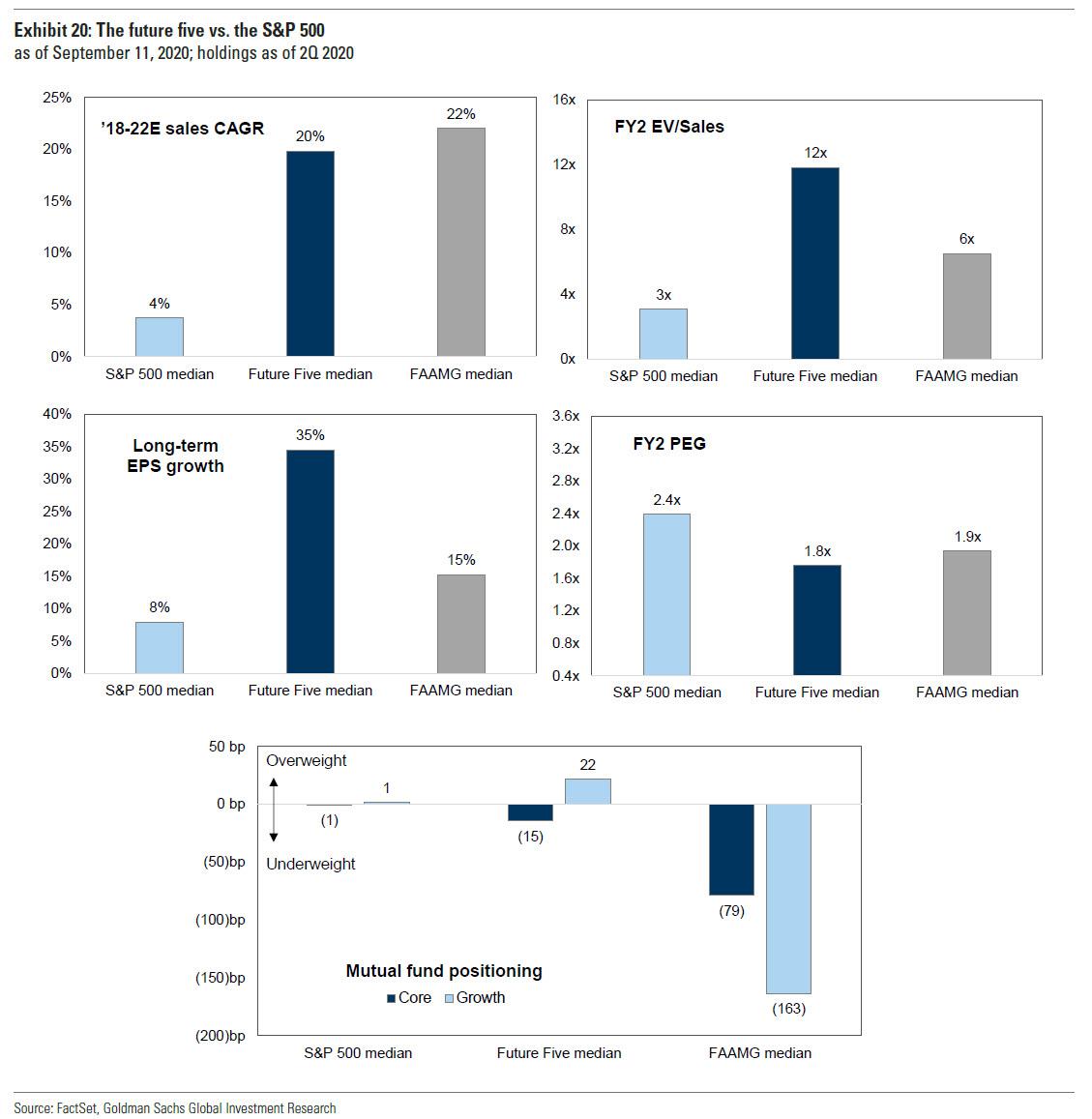

The future five offers 5x the sales growth of the S&P 500, and while carrying elevated absolute valuations, Kostin hedges this by noting their reasonable valuations relative to growth expectations. Consensus estimates that the median future five stock will have a sales CAGR of 20% from 2018 through 2022E (vs. 4% for S&P 500 and 22% for FAAMG). Additionally, consensus estimates put the long-term EPS growth rate for the median future five company at a 35%, compared with 15% for FAAMG and 8% for the S&P 500. This high rate of growth is partly reflected in high valuation: The median future five stock trades at 42x 2021E P/E multiple (vs. 20x for the S&P 500 and 28x for FAAMG), but 1.8x PEG ratio (vs. 2.4x for the S&P 500 and 1.9x for FAAMG). The average large-cap core fund is underweight the typical future five stock, but large-cap growth funds are modestly overweight them.

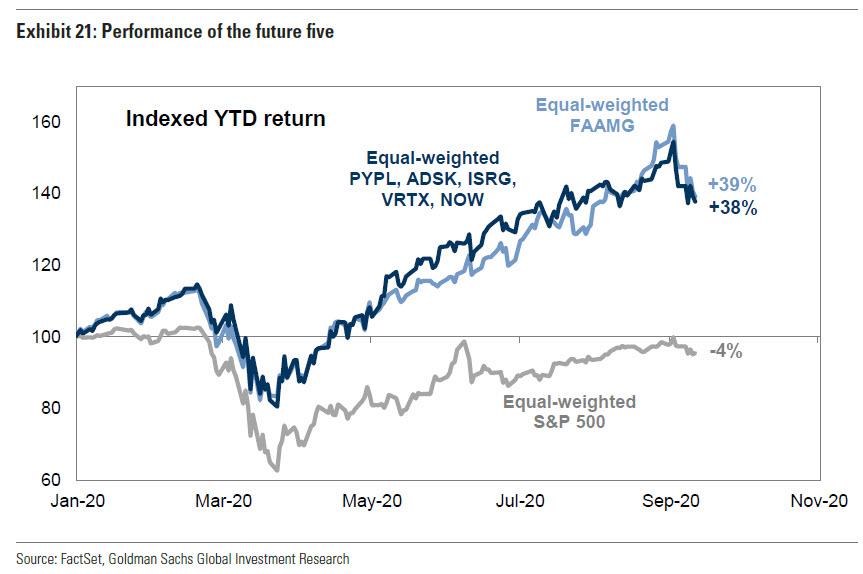

It appears that the market already had a sense that these “future five” would emerges as competitors to the FAAMGs, and an equal-weighted basket of the future five has returned 38% YTD compared with a 39% return for FAAMG. The future five have also had a 0.91 correlation with FAAMG YTD, meaning managers may view these stocks as a similar alternative to FAAMG ownership in the event that FAAMG’s large index weights and portfolio construction limitations have hindered their ability to own these stocks.

So now you know what Goldman is pitching to its clients as the next FAAMG basket. What is unclear is whether Goldman’s prop traders are already selling their accumulated holdings in this basket to clients, or if it is buying alongside them. Keeping an eye on the return of FAAMGs vs the “Future Five” will be an interesting exercise for the near future.

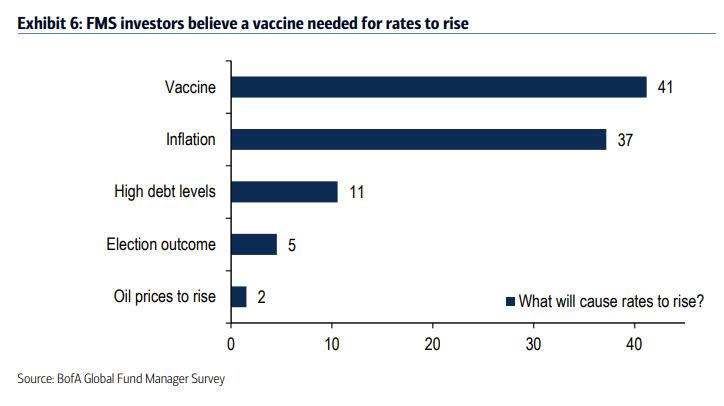

That said, keep in mind that this alternative basket is will work only so long as the deflationary conditions that boosted the original FAAMGs to all time highs persist. If and when higher rates emerge, a process which according to the latest BofA fund manager survey will be catalyzed by a vaccine for Covid, inflation or even higher debt levels…

… the massively overbought tech sector will suffer and both “current” and “future” five baskets will tumble.

In fact, one can argue that in a world where taking the opposite side of hedge funds and high net worth clients has been the most successful strategy in the past decade, shorting these “future five” may be the best hedge to a second tech crash, which many are warning is inevitable.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com