In Unprecedented Reversal, Nasdaq Shorts Hit Second Highest Ever

Tyler Durden

Sat, 09/26/2020 – 12:35

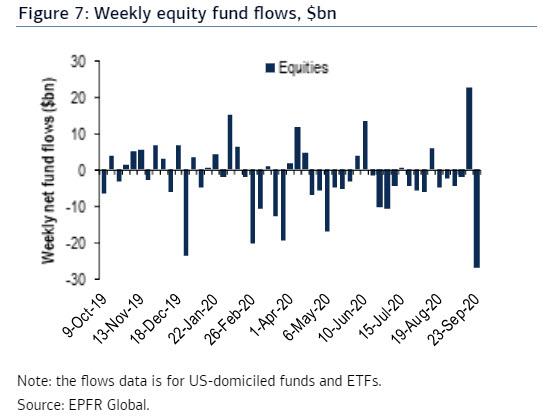

On Friday we pointed out that one week after one of the biggest inflows into stock funds on record – when retail traders furiously BTFD in hopes the market’s upward momentum would accelerate – speculators hit a brick wall and reversed furiously as stocks slumped, with US equity funds and ETFs reporting $26.87BN of outflows, the largest weekly outflow since December 2018 and the third largest outflow ever! In other this was the fastest and biggest sentiment reversal on record.

This record sentiment reversal was driven by despair-driven capitulation outflows from high beta and momentum names, as tech-focused ETFs suffered $1.23 billion worth of outflows, the largest since December 2018, when global stock markets tanked. September was also the first month of outflows for the tech sector since the March crash.

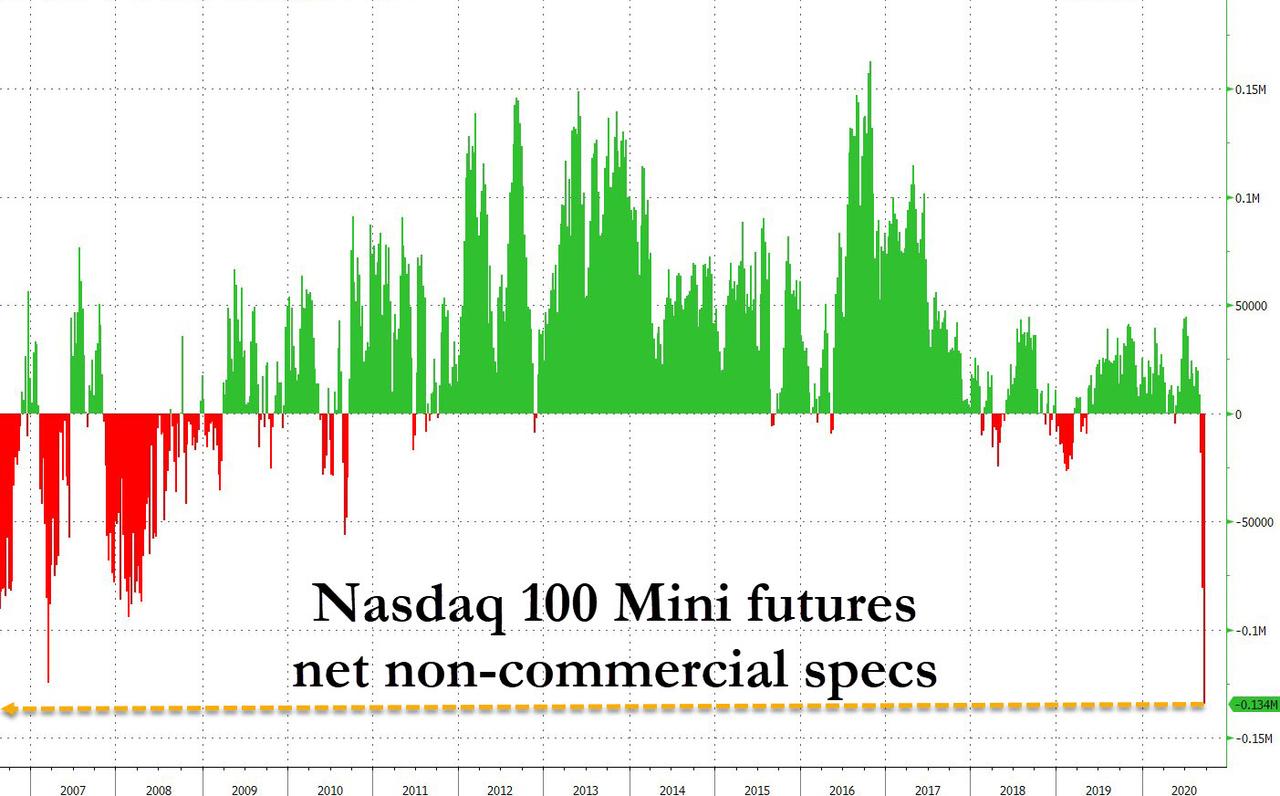

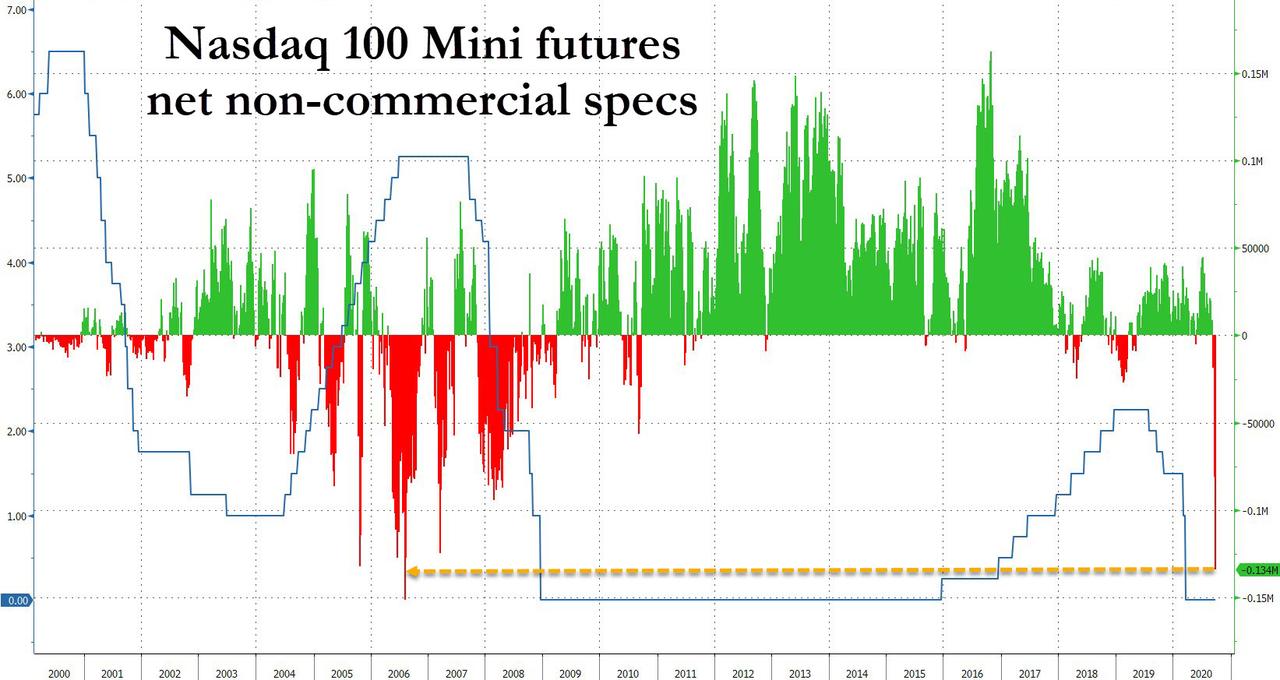

But nowhere has the sentiment shift been as clear as in Nasdaq 100 Mini futures, where after more than a year of bullish sentiment with just one tiny dip into bearish territory in May, speculators finally puked, sending the net non-commercial NQ futs to -134,311 contracts, surpassing the peak bearish sentiment during and after the financial crisis…

… and in fact the second highest on record, with just July 2006 more bearish. What happened back then? For the next generation of traders out there, that’s when Fed had just reached the peak of its rate-hike cycle (yes, there was a time when rates above 2% were possible), hammering the Nasdaq.

Back in 2006 the Fed responded by starting an easing cycle in 2007, and the resulting drop in rates from over 5% to 0% eventually allowed the Nasdaq to rebound and hit all time highs.

What is curious is that it took only a modest Nasdaq correction over the past month to send sentiment to the second most bearish on record. And unlike 2006, this time the Fed can’t cut rates any lower to reverse sentiment.

On the other hand, the Fed can and will do everything in its power to push sentiment even higher now that Powell has made it clear the Fed is all in the stock market as the primary wealth effect mechanism, in which case watch out once the near record short-squeeze in NQ futs begins: it can and will send the Nasdaq to all time highs faster than you can spell “Brrrrr.“

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com