Robinhood Raises Margin Requirements On “Widely Held Stocks” As Election Volatility Nears

Tyler Durden

Fri, 10/16/2020 – 08:29

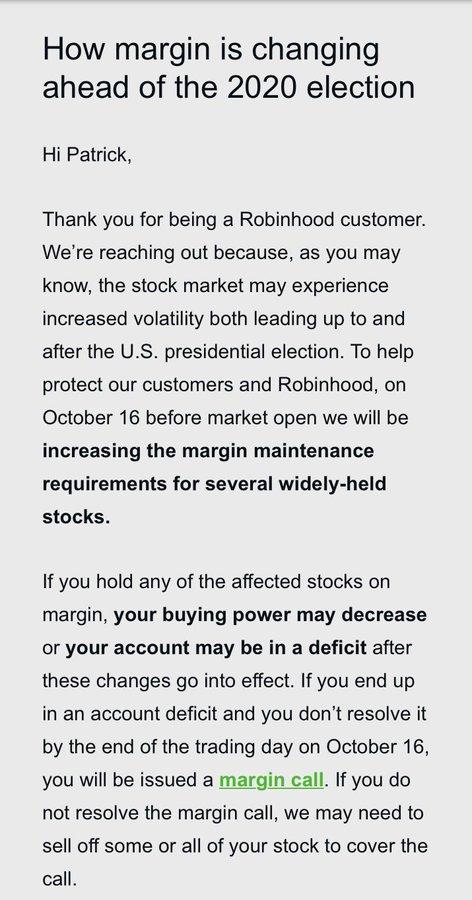

Just hours after the Robinhood reported a massive hack, an email surfaced on Twitter showing the company warning users about an imminent increase in “margin maintenance requirements for several widely-held stocks” which was to be implemented before the market open on Friday.

The warning, titled “How margin is changing ahead of the 2020 election,” was tweeted by Packy McCormick, a millennial daytrader, around 22:00 ET Thursday.

“If you hold any of the affected stocks on margin, your buying power may decrease or your account may be in a deficit after these changes go into effect. If you end up in an account deficit and you don’t resolve it by the end of the trading day on Oct. 16, you will be issued a margin call. If you do not resolve the margin call, we may need to sell off some or all of your stock to cover the call,” the warning continued.

Here’s the full message from Robinhood to some of its overleveraged newbie daytraders:

Robinhood users on Twitter were not pleased with the overnight warning, which gave many little notice to readjust their accounts.

One Twitter user remarked: “Love that they didn’t bother telling us which stocks.”

Another said: “Sending this at 9:30 pm the night before…plus changing MR due to a forecast they are making is ridiculous. Thank god I’m not on their platform.”

The increased margin requirements are being added as expected uncertainty surrounding the presidential elections on Nov. 3 has been showing up in the futures curve, particularly in the VIX term structure, which has developed a “hump” around the date of the election.

Notice the Nov-Oct VIX spread continues to rise as election uncertainly increases just weeks ahead of Nov. 3.

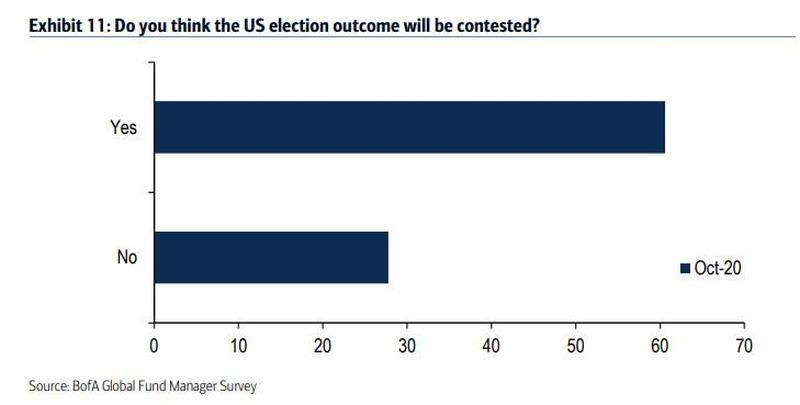

The latest Fund Manager Survey from BofA revealed that a vast majority of investors are concerned about a contested election, which would, as we’ve described, would produce periods of high volatility.

The trading platform has seen an explosion in active users this year amid an explosion in day trading activity, especially after the COVID-19 crash in markets, with drew in many retail traders conditioned to believe that “stocks only go up”.

The question we have for this morning, as the cash session nears: Will Robinhood margin calls lead to selling pressure for stocks?

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com